BEYOND THE NUMBERS

In Case You Missed It...

This week on Off the Charts, we focused on the federal budget and taxes, health care, state budgets and taxes, the economy, and the safety net.

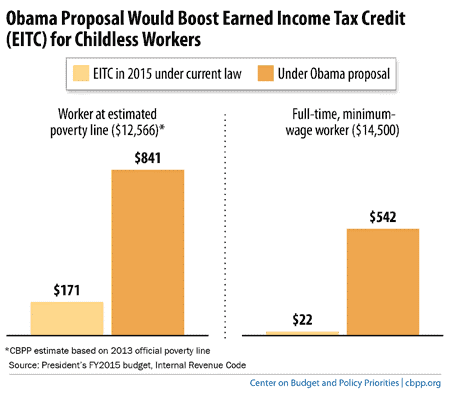

- On the federal budget and taxes, we highlighted Robert Greenstein’s statement on the President’s 2015 budget and excerpted his PBS “NewsHour” interview on the need to strengthen both the Earned Income Tax Credit (EITC) and the minimum wage. Nathaniel Frentz pointed to our new state-by-state fact sheets on the impact of the EITC and Child Tax Credit (CTC). Chuck Marr explained that the President’s budget would extend the EITC’s pro-work success to childless workers. He also analyzed the treatment of “tax extenders” in House Ways and Means Chair Dave Camp’s tax reform plan.

- On health care, Paul Van de Water highlighted a new Congressional Budget Office report showing that raising the threshold for full-time work under health reform to 40 hours would negatively affect workers. Edwin Park explained that delaying health reform’s penalty for lacking health coverage would mean more uninsured and higher premiums. He also revisited the Medicare Part D myth in light of the program’s lower-than-expected costs in its first five years.

- On state budgets and taxes, Elizabeth McNichol highlighted a new report by the Economic Analysis and Research Network showing that states need to help address income inequality.

- On the economy, Chad Stone noted that the February employment report marks the fourth anniversary of the start of the private-sector jobs recovery, but the job market is still far from full strength.

- On the safety net, we pointed to Sharon Parrott’s commentary on House Budget Committee Chair Paul Ryan’s new report on safety net programs and poverty.

In other news, Chad Stone issued a statement on the February jobs report, Robert Greenstein issued a statement on the President’s budget, and Sharon Parrott issued a commentary on Chairman Ryan’s poverty report. We issued papers on keys elements of the President’s budget, how strengthening the EITC for childless workers promotes work and reduces poverty, falling SNAP costs, and how the EITC encourages children’s success at school. We also issued state-by-state fact sheets on the EITC and CTC.

In addition, we paid tribute to the late Richard W. Boone, who conceived of and provided the funding to launch the Center on Budget and Policy Priorities in 1981.

CBPP’s Chart of the Week:

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Things to Praise and Pan in Camp's Tax Plan

U.S. News and World Report

March 6, 2014

Washington is Ignoring Obama's Budget. You Shouldn't.

New Republic

March 6, 2014

Where Unemployment Insurance Benefits Stand in Your State

Fiscal Times

March 4, 2014

Does the president’s budget present solutions for closing the economic gap?

PBS “NewsHour”

March 4, 2014

Camp Roadmap to Paying for Extenders

Huffington Post

March 5, 2014

Mr. Ryan’s Small Ideas on Poverty

New York Times

March 3, 2014

Obama Budget Would Expand Low-Income Tax Break

New York Times

March 3, 2014