BEYOND THE NUMBERS

Struggling to balance their budgets in the face of record revenue declines and rising needs, states have been making tough choices about raising taxes and slashing services ranging from education to public safety. Many states, however, are making these painful changes while leaving a huge share of the budget — up to half in some states — off the table.

States spend tens, possibly hundreds, of billions of dollars every year through “tax expenditures,” spending programs that are delivered through the tax code in the form of tax credits, deductions, exclusions, and so on. Since they are written into the tax code rather than re-evaluated and funded every year like direct spending programs, they often outlive their usefulness or outgrow their expected costs.

In many states, policymakers and voters can’t scrutinize this spending effectively because basic information about the state’s tax expenditures — their intended purpose, their cost, or whom they benefit — simply isn’t available.

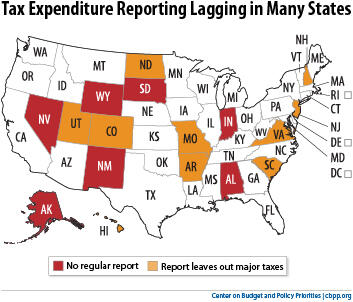

As our newly updated report explains, states can address this lack of transparency by regularly publishing a high-quality “tax expenditure report.” Forty-three states and the District of Columbia produce some form of regular tax expenditure report, but almost every state report omits essential information. (Some even leave out the cost of many tax expenditures.) Seven states produce no regular report at all, and several more omit some major taxes (see map).

To achieve transparency, encourage accountability, and save states money, a tax expenditure report should include the following features:

- It should be published regularly, incorporated into the budget process, and available on the Web.

- It should include tax expenditures related to all taxes, including those with lower costs and those that benefit few taxpayers.

- It should provide the tax expenditure’s current and future costs to allow comparison with other proposed spending. It also should specify who benefits from the tax expenditure.

- It should set out the purpose of the tax expenditure, evaluate the extent to which it accomplishes that purpose, and analyze the distribution of benefits by income level and size of business.

Even states with high-quality tax expenditure reports sometimes fail to use them at budget time, so other reforms are needed to integrate tax expenditures into the budget process. For example, because tax expenditures typically last indefinitely, with no legislative oversight or public review, lawmakers should set “sunset” dates on many of them. This forces the legislature to choose between allowing a tax expenditure to expire and extending it (perhaps with some changes) through the normal legislative process. In other words, it helps states save money — an especially compelling benefit in these difficult times.