BEYOND THE NUMBERS

Greenstein on the New Ryan Budget

CBPP President Robert Greenstein just issued a statement on House Budget Committee Chairman Paul Ryan’s new budget plan. Here’s the opening.

House Budget Committee Chairman Paul Ryan’s new “Path to Prosperity” is, sadly, anything but that for most Americans. Affluent Americans would do quite well. But for tens of millions of others, the Ryan plan is a path to more adversity.

The budget documents that Chairman Ryan issued today laud his budget for promoting “opportunity,” even as his budget slashes Pell Grants to help low- and moderate-income students afford college by more than $125 billion over ten years and cuts the part of the budget that funds education and job training (non-defense discretionary funding) far below the already low sequestration levels. The budget documents also claim to help the poor, even as the Ryan budget shreds key parts of the safety net; for example, it resurrects the draconian benefit cuts in SNAP (food stamps) that the House passed last fall and adds $125 billion of SNAP cuts on top of them.

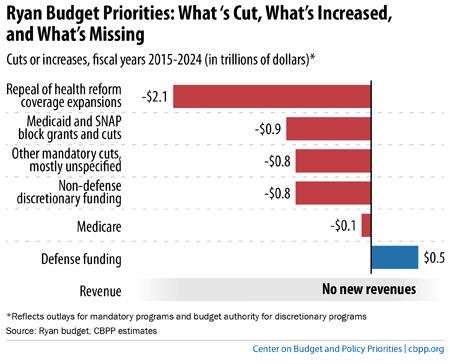

The budget also swells the ranks of the uninsured by at least 40 million people. It repeals the Affordable Care Act (ACA), taking coverage away from the millions of people who have just attained it, and cuts Medicaid by $732 billion (by 26 percent by 2024) on top of the cuts from repealing the ACA’s Medicaid expansion. Yet it offers no meaningful alternative to provide health coverage to the tens of millions of uninsured Americans.

Image

That’s only a partial list of its cuts. The budget cuts non-defense discretionary programs by $791 billion below the sequestration level, shrinking this part of the budget to less than half its share of the economy under President Reagan. These cuts are entirely unspecified, as are more than $500 billion of cuts in entitlement programs.

Meanwhile, the budget aims to cut the top individual tax rate and the corporate income tax rate to 25 percent, eliminate the Alternative Minimum Tax, and repeal the ACA’s revenue-raising provisions. These tax cuts would cost about $5 trillion over ten years, based on past analyses by the Urban-Brookings Tax Policy Center. Yet the Ryan plan doesn’t identify a single tax break to close or narrow to cover the lost $5 trillion, even though his budget assumes no revenue losses overall. And it ignores the hard fact that, in his recent tax reform plan, House Ways and Means Committee Chairman Dave Camp only lowered the top individual tax rate to 35 percent even after identifying scores of politically popular tax breaks to narrow or eliminate.

The Ryan budget is thus an exercise in obfuscation — failing to specify trillions of dollars that it would need in tax savings and budget cuts to make its numbers add up. No one should take seriously its claim to balance the budget in ten years.

It’s also an exercise in hypocrisy — claiming to boost opportunity and reduce poverty while flagrantly doing the reverse. Here’s just one example: Ryan has criticized some of the poor for not working enough and says that he wants to promote work and opportunity. But his budget eliminates Pell Grants entirely for low-income students who have families to support, must work, and are attending school less than half time on top of their jobs.