BEYOND THE NUMBERS

An American Action Forum event today to promote “dynamic scoring” for tax and spending legislation unintentionally illustrates what Chye-Ching Huang and I explain in a newly updated paper: estimates of the macroeconomic effects of policy changes — which is what dynamic scoring would include — are highly uncertain and subject to manipulation, so they shouldn’t be part of official cost estimates.

In reasonably balanced remarks, Senator Orrin Hatch (R-UT) said that “we should not expect dynamic scoring to produce outsized miracles from either the supply side or the demand side.”

But Tax Foundation President Scott Hodge, in giving his organization’s estimates of the effects of several tax proposals, promised just such miracles. According to Hodge, cutting the corporate income tax rate or allowing full expensing of investments (that is, allowing firms to deduct the investments’ full cost from their taxable income up front, rather than depreciating it over the investments’ lifetime) would more than pay for itself by boosting economic growth and, in turn, tax revenues.

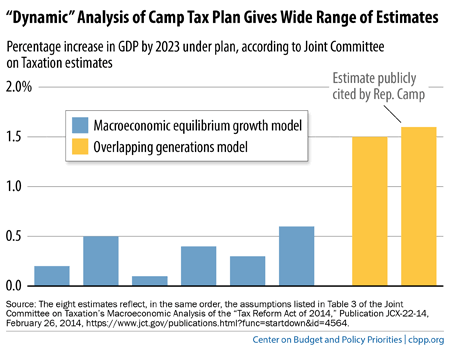

That’s highly implausible. But it shows how advocates can manipulate assumptions or cherry-pick dynamic-scoring estimates to buttress their agenda. Ways and Means Committee Chairman Dave Camp (R-MI) did the same thing when he cited only the most optimistic of many “dynamic” estimates in touting the benefits of his tax reform proposal, as our paper and the graph below show.