BEYOND THE NUMBERS

Congressional Budgets Would Ultimately Cut Programs for Low- or Moderate-Income People by About 40 Percent

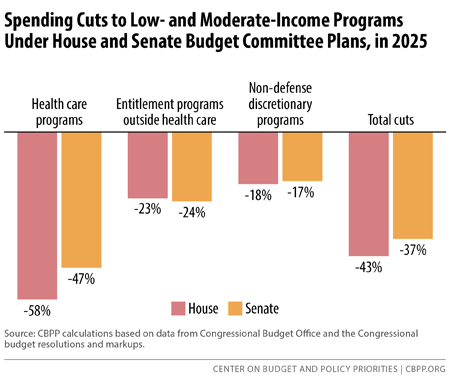

As we’ve explained, more than two-thirds of cuts in the budget plans that the House and Senate will vote on this week come from low- and moderate-income programs, even though they represent less than one-quarter of federal program costs. Now, let’s examine how deep those cuts would be.

In dollar terms, the plans before the House and Senate would cut low- and moderate-income programs by $3.7 trillion and $3.2 trillion, respectively, over the next decade. The cuts would be large throughout this period but would grow over time.

In 2025, in fact, the House and Senate plans would shrink low- and moderate-income programs by 43 percent and 37 percent, respectively. Such deep cuts would produce a dramatically weaker safety net, driving millions of people into poverty and denying or weakening health coverage for tens of millions more.

In vivid contrast, the plans wouldn’t raise any additional revenues, such as by limiting tax expenditures (deductions, exclusions, credits, and other preferences), which primarily benefit high-income households and which cost the nation more than $1 trillion a year.

As the graph shows, in 2025:

- Health care assistance for low- and moderate-income people would fall by more than half (58 percent) under the House plan and by nearly half (47 percent) under the Senate plan. The cuts reflect the plans’ repeal of health reform and additional deep cuts to Medicaid.

- Entitlement programs outside health care serving low- and moderate-income people, such as SNAP (formerly food stamps), would fall by 23 percent under the House plan and 24 percent under the Senate plan.

- Non-defense discretionary programs serving low- and moderate-income people, such as housing assistance and Head Start, would fall by a little less than one-fifth under each plan. These cuts would come on top of the cuts required under the 2011 Budget Control Act, which are already sending non-defense discretionary spending to historically low levels as a share of the economy.

Outside the health arena, the plans generally don’t specify the cuts to particular programs. But as our previous analysis explains, it’s clear that low- and moderate-income programs, such as basic food and education assistance as well as tax credits for working families, would be hit hard.