BEYOND THE NUMBERS

Claims That Letting the High-Income Bush Tax Cuts Expire Would Harm Small Businesses Are Vastly Exaggerated

House Speaker John Boehner referred this week to the proposal to let President Bush’s tax cuts on income over $250,000 expire on schedule as a “small business tax hike” that would have “disastrous consequences.”

Neither part of that charge holds up, as we explain in a new analysis. For starters, the frequently cited claim that letting the high-income tax cuts expire would seriously harm small businesses relies on a highly exaggerated definition of “business” that treats any filer with any pass-through income as a business owner. (A pass-through entity passes its profits through to its owners, who pay tax on them at the individual rate.)

Under that definition, professors who occasionally get paid for giving a speech or doing some consulting, lawyers and accountants whose firms are organized as partnerships, and corporate executives who get paid to sit on other firms’ boards of directors are treated as small business owners. The definition is so broad, in fact, that under it, both President Obama and Governor Romney would count as small business owners — as would 237 of the nation’s 400 wealthiest people.

Under a much more reasonable definition set out in a recent Treasury Department study, it’s clear that allowing the upper-income Bush tax cuts to expire on schedule would prevent a windfall for the highest-income Americans in the face of unsustainable budget deficits. The study shows that allowing the top two marginal tax rates to return to pre-2001 levels would affect only 2.5 percent of small business owners.

What’s more, history refutes the doomsday claims. The arguments against allowing the high-end tax cuts to expire on schedule echo those made against President Clinton’s proposed 1993 tax increases, which set marginal rates at the levels to which they are set to return when the Bush rate cuts expire.

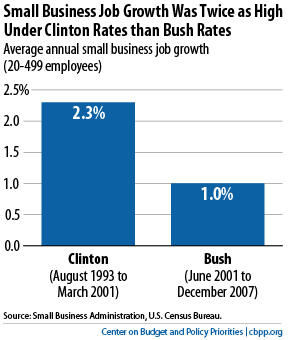

Critics claimed at the time that those tax increases would seriously harm economic growth. As it turned out, job creation and economic growth proved significantly stronger following the 1993 tax increases than following the 2001 Bush tax cuts. Further, small businesses created jobs at twice the rate during the Clinton years than they did under the Bush tax code (see graph).