BEYOND THE NUMBERS

A new Congressional Budget Office (CBO) report on major individual tax expenditures (the deductions, exclusions, and credits embedded in the tax code) shows why they are ripe for reform — a point that we have made as well. Tax expenditures are:

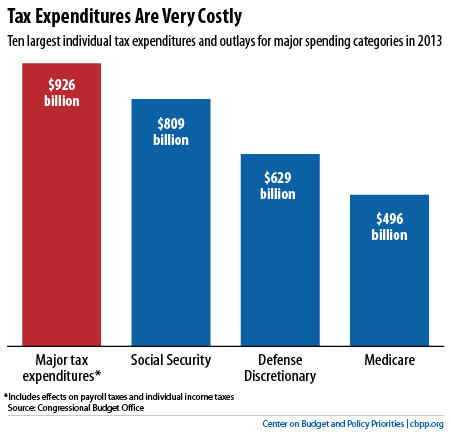

1) Costly. Combined, the ten biggest individual tax expenditures cost more in lost federal revenues each year than defense, Medicare, or Social Security, as the first graph shows.

2) Often inefficient. Tax expenditures can distort the allocation of resources. CBO notes, for example, that the mortgage interest deduction can convince people to “purchase more expensive homes, investing too much in housing and too little elsewhere relative to what they would do if all investments were treated equally.” In addition, tax expenditures sometimes pay people to do something they would have done anyway. For example, tax incentives for retirement saving may lead some people to simply “reallocate existing savings from accounts that are not tax-preferred to retirement accounts, rather than add to their savings.”

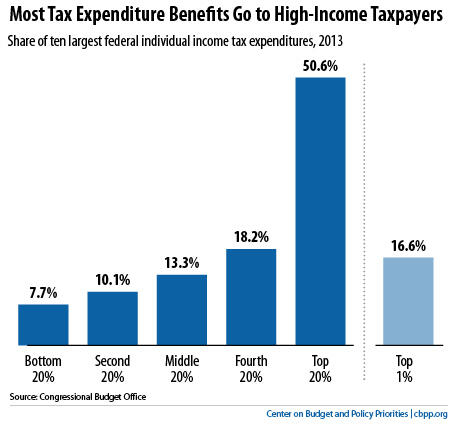

3) Tilted to high-income people. The value of many tax expenditures is tied to a taxpayer’s tax rate, so it rises as his or her income rises. These tax expenditures thus are “upside down” — they deliver the biggest subsidies to the people who least need a subsidy to do whatever the tax break is designed to encourage (see second graph).

I’d add a fourth reason why tax expenditures are ripe for reform: both sides have proposed tax expenditure reform as a core part of a long-term deficit reduction agreement.

President Obama proposes capping the value of large tax expenditures at 28 percent. House Speaker John Boehner proposed cutting tax expenditures by nearly $1 trillion over ten years at the end of last year. January’s “fiscal cliff” agreement raised much less revenue than the Boehner proposal ($561 billion over the same period) and didn’t include any tax expenditure limits.

As CBO’s new report highlights, tax expenditure reform remains a key piece of unfinished fiscal business.