BEYOND THE NUMBERS

Bill for Inadequate Unemployment Insurance Taxes Now Coming Due in Many States

Businesses in 20 states must make the first payment tomorrow on about $35 billion that these states have borrowed from the federal government in recent years to help pay unemployment insurance (UI) benefits.

Most of this borrowing happened because many states kept the business taxes that fund UI benefits too low before the recession, leaving their UI reserves ill prepared for an economic slump.

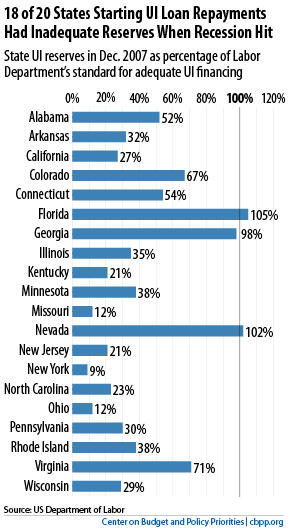

The U.S. Labor Department recommends that states have enough reserves to cover a year’s worth of UI benefits in a typical recession. When the recession hit in December 2007, 18 of the 20 states whose first loan repayments are due tomorrow didn’t meet that standard. Most weren’t even close: 13 of these states had less than half the needed reserves (see graph).

The only states among these 20 that had adequate reserves but still had to borrow from the federal government were Florida and Nevada, both of which were hit exceptionally hard by the bursting of the housing bubble and subsequent economic fallout.

After two years, states that have borrowed to pay UI benefits must start repaying the principal through higher federal UI taxes on their employers. (Employers ultimately pass on the cost of UI taxes to workers through lower wages.) The taxes keep going up each year until the loan is repaid.

In addition to the 20 states that start repayments tomorrow, Indiana, Michigan, and South Carolina started repayments in 2010 or 2011, while Arizona, Delaware, Kansas, and Vermont will need to make their first payments next year unless they repay their loans in full by November. Fifteen states didn’t take out any federal loans. (The state loans have nothing to do with the fully federally funded program providing UI benefits for workers whose state UI benefits expire, a program slated to expire at the end of February.)

States whose UI reserves proved inadequate in the last recession need to revisit their UI tax policies to ensure that they are better prepared for the next one. UI has played an important role in creating jobs and reducing poverty in the last few years; diminishing its power in future recessions would be a step in the wrong direction.