As youth across the country mobilize today on “Kick Butts Day” to raise awareness of tobacco’s dangers, it’s worth calling attention to President Obama’s proposal to raise the federal tobacco tax to pay for expanded early childhood education, which he first introduced last year and included again in his 2015 budget. As we have explained, the plan would cut the number of premature deaths due to smoking and raise an estimated $78 billion over ten years to improve access to high-quality pre-kindergarten programs.

Here are three reasons why the proposal deserves Congress’s support:

-

Cigarette smoking is the leading cause of preventable disease in the United States. It accounts for about 443,000 deaths each year, or about 20 percent of all deaths — some 50,000 of them from secondhand smoke.

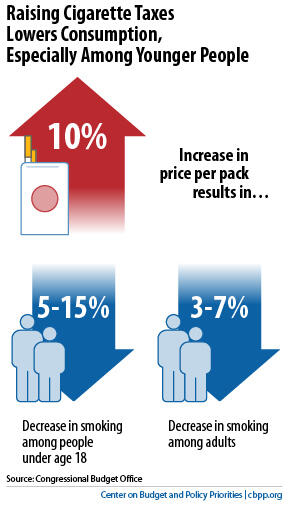

- Tobacco taxes are a proven strategy to reduce smoking, especially among younger people, and extend lives. As the graph shows, a 10 percent rise in cigarette prices will reduce smoking by 5-15 percent among people under age 18 and by 3-7 percent among adults, the Congressional Budget Office estimates. Cutting consumption among young people is especially important: four in five adult smokers started before they were 18.

- The impact of the tobacco tax is less regressive than many people believe. Some opponents argue that raising tobacco taxes would unfairly affect low-income people since they have higher smoking rates. But low-income people would also benefit more from the health improvements from cutting consumption, since they smoke more and are more likely than better-off people to stop smoking (or not start) if tobacco taxes rise. Lower-income families would also benefit more from the expanded access to early childhood education that these tax revenues would finance.