- Home

- Trump Budget’s Deep Cuts To Block Grants...

Trump Budget’s Deep Cuts to Block Grants Underscore Danger of Block-Granting

President Trump’s 2018 budget aims some of its largest cuts at existing block grant programs. Meanwhile, the Administration and congressional Republicans are pursuing health legislation to repeal the Affordable Care Act (ACA) and convert Medicaid to a per capita cap or a block grant as well as considering proposals to block-grant other programs, putting funding for critical assistance for low- and moderate-income Americans at risk.

The Trump budget would cut overall funding for the 13 major housing, health, and social services block grants by one-third next year alone. It would eliminate six of the grants outright, including the Low Income Home Energy Assistance Program, the Community Development Block Grant, and the Social Services Block Grant. It would cut another five of the grants, including a 40 percent reduction in core funding for job training and a 26 percent cut for community mental health services. These cuts would undermine federal support for services that help 6 million low-income households pay winter heating bills, provide job training for unemployed workers, assist those with mental illnesses, and develop affordable housing.

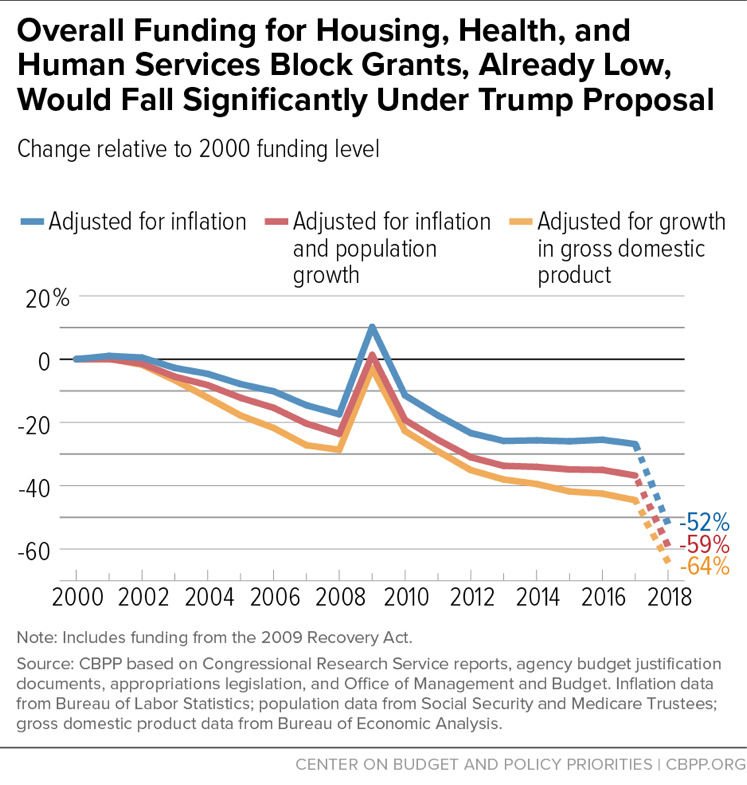

Once these grants have been created, their funding tends to substantially erode over time.These proposals are a dramatic acceleration of a longer-term trend. In recent decades, Republicans have advocated consolidating federal programs into broad, flexible block grants, but once these grants have been created, their funding tends to substantially erode over time. Between 2000 and 2017, overall funding for the 13 block grants fell by 27 percent on an inflation-adjusted basis. The Trump proposals would roughly double the inflation-adjusted cut since 2000, bringing it to 52 percent. The cuts are even deeper when one considers the growth of the U.S. population and economy in this nearly two-decade period. (See Figure 1.)

The proposed cuts reflect a paradox of block grants. While conservatives often argue for consolidating federal programs into broad block grants to give state and local governments more latitude and flexibility, that flexibility later becomes an argument for cutting or abolishing the grants due to asserted lack of accountability and performance measures. This history suggests that policymakers should exercise great caution in evaluating proposals to convert ongoing programs into block grants.

Most Block Grants Have Shrunk Over Time

The term “block grant” generally refers to funding distributed to state or local governments by formula and available for a range of activities related to some basic purpose, with considerable flexibility for the recipient governments to determine the specifics of how the funds are used.

Previous CBPP analyses have documented the tendency for block grant funding to decrease over time.[1] Those analyses looked at funding for the 13 major federal housing, health, and social services block grant programs, including ten “discretionary” (or annually appropriated) programs, two with “mandatory” funding provided directly in authorizing law, and one supported by both sources. The results were striking:

- Funding for the 13 block grants decreased by an average of 27 percent between 2000 and 2017, after adjustment for inflation.

- Over this period, all but three of the 13 grants decreased in inflation-adjusted terms, and five fell by one-third or more.

- When adjusted for population growth as well as inflation, the average decrease between 2000 and 2017 was 37 percent. All but one of the 13 grants decreased, and seven decreased by more than one-third.

Trump’s Budget Would Greatly Accelerate the Decline

The Trump budget targets most of these block grants for deep cuts or elimination (see Table 1). Looking at the increase or decrease between 2017 and 2018,[2] in unadjusted dollars, of the 13 grant programs:

- six would be eliminated entirely;

- five would be cut;

- one would be held level; and

- one would increase.

The combined effect is that the overall funding of these block grants would drop by 33 percent in the first year of the Trump budget. Relative to 2000, the cut in block grant funding overall would be 52 percent after adjustment for inflation and 59 percent after adjustment for both inflation and population growth.

The block grants bear a disproportionate share of the massive cuts President Trump has proposed to programs funded through annual appropriations. The 11 grants included in our analysis that are funded wholly or partly through discretionary appropriations represent about 3 percent of all non-defense discretionary funding in 2017 but are subject to 17 percent of the Trump budget’s cuts to that funding for 2018.[3]

| TABLE 1 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Trump Budget Would Eliminate Six Major Block Grants and Cut Overall Funding for Major Block Grants by One-Third in 2018 Funding in millions of dollars (not adjusted for inflation) |

|||||||||

| Program | Funding enacted for 2017 | Funding in 2018, under Trump plan | Percent change | ||||||

| Temporary Assistance for Needy Families (TANF) block grant | $16,574 | $14,968 | -10% | ||||||

| Child Care and Development Fund | 5,773 | 5,678 | -2% | ||||||

| Child Care Entitlements to States | 2,917 | 2,917 | 0% | ||||||

| Child Care and Development Block Grant | 2,856 | 2,761 | -3% | ||||||

| Low Income Home Energy Assistance Program | 3,390 | 0 | -100% | ||||||

| Community Development Block Grant | 3,000 | 0 | -100% | ||||||

| Job Training Formula Grants to States (Youth, Adult, and Dislocated Workers) | 2,710 | 1,630 | -40% | ||||||

| Substance Abuse Prevention and Treatment Block Grant | 1,858 | 1,855 | 0% | ||||||

| Social Services Block Grant | 1,583 | 0 | -100% | ||||||

| HOME Investment Partnerships Program | 950 | 0 | -100% | ||||||

| Community Services Block Grant | 715 | 0 | -100% | ||||||

| Native American Housing Block Grant | 648 | 598 | -8% | ||||||

| Maternal and Child Health Block Grant | 551 | 580 | 5% | ||||||

| Community Mental Health Services Block Grant | 563 | 416 | -26% | ||||||

| Preventive Health and Health Services Block Grant | 160 | 0 | -100% | ||||||

| Total | $38,317 | $25,716 | -33% | ||||||

| Discretionary programs | 17,245 | 7,839 | -55% | ||||||

| Mandatory programs | 21,074 | 17,877 | -15% | ||||||

The Trump budget would eliminate six housing, health, and social services block grants:

- The Low Income Home Energy Assistance Program, which helps more than 6 million low-income households pay heating bills, including seniors, people with disabilities, and families with young children.

- The Community Development Block Grant, which supports housing, community facilities, economic development, and social service projects, mainly for low- and moderate-income residents.

- The Social Services Block Grant, which provides a flexible source of funds to states to support social services for vulnerable children, families, and seniors, such as child care assistance, foster care, child protective services, and services for people with disabilities.

- The HOME Investment Partnership Program, which helps develop and preserve affordable rental housing and repair homes of low-income homeowners.

- The Community Services Block Grant, which provides anti-poverty services through local non-profit and public agencies.

- The Preventive Health and Health Services Block Grant, which provides funds to states to address their priorities in disease prevention, infectious disease control, and other public health needs.

Other major changes in the budget that would affect block grants include:

- Core grants to states for job training and employment services would be cut by 40 percent, despite the widely recognized need for strengthened efforts to help workers acquire the skills they need for well-paying jobs in today’s economy.[4] The resulting 2018 funding would be 65 percent below the 2000 level after adjustment for inflation.

- Temporary Assistance for Needy Families (TANF) would be cut by 10 percent in 2018 and by a total of $16 billion over ten years.[5] (Because TANF is funded though ongoing authorizing law, the budget specifies numbers for the next ten years.) States use these funds to provide limited amounts of basic cash assistance as well as services to poor families with children, including employment services and job training. In 2017, TANF funding is already 30 percent below 2000 in inflation-adjusted terms.

- Grants to states for mental health services such as outpatient treatment, rehabilitation, crisis stabilization, and case management would be cut 26 percent below the 2017 level.

- Native American Housing Block Grants, the main source of funding to address serious shortages of adequate housing on Indian lands, would be cut by 8 percent; and the annually appropriated portion of child care assistance block grants would be cut by 3 percent or $95 million.[6]

The Paradox of Block Grants

The Trump budget illustrates a basic paradox of block grants. Conservatives often argue that combining more tightly targeted programs into broader block grants will be beneficial by giving state and local governments more flexibility. But that very flexibility later becomes an argument for cutting or eliminating the block grant.

Block grants’ broad purposes and diminished restrictions mean that state and local governments can use the funds in diffuse ways, making their impact harder to assess and giving rise to arguments that a given block grant lacks specific performance measures and concrete evidence of effectiveness.[7] Broad purposes can also make support more diffuse, leaving the block grant programs vulnerable to cuts in order to free up resources for policymakers’ other priorities.

The Trump budget may be repeating this pattern. Even as it would cut and eliminate existing block grants, it proposes creating a new $500 million block grant, to be run by the Centers for Disease Control and Prevention (CDC), called the “America’s Health Grant.” This would replace several existing CDC grant programs aimed at preventing or reducing specific health problems such as heart disease, stroke, diabetes, and tobacco use. The budget uses increased state flexibility as its justification for the proposal. The history of block grants suggests, however, that this new block grant would shrink over time, just as many of its predecessors have.

Other new block grants may be on the horizon. For example, the House has passed legislation to repeal the ACA, endorsed by the President, that would impose a per capita cap on Medicaid (a capped funding structure with similarities to a block grant except it provides a fixed amount of federal funding on a per-beneficiary basis) or, at state option, a block grant for children and/or non-disabled, non-elderly adults. And the emerging Senate health bill is expected to include something similar. Other proposals include converting various other low-income programs into block grants.

The historical record, as well as the Trump Administration’s recommendations to cut — or entirely abolish — a number of existing human services block grants suggest policymakers should regard proposals to block-grant major low-income assistance programs with trepidation.

Block-Granting Low-Income Programs Leads to Large Funding Declines Over Time, History Shows

End Notes

[1] David Reich et al., “Block-Granting Low-Income Programs Leads to Large Funding Declines Over Time, History Shows,” Center on Budget and Policy Priorities (CBPP), February 22, 2017, https://www.cbpp.org/research/federal-budget/block-granting-low-income-programs-leads-to-large-funding-declines-over-time.

[2] These cuts or increases are measured from the final appropriations enacted for 2017. The Trump Administration’s budget instead uses for its comparisons the temporary continuing resolution in effect until 2017 appropriations were finalized. On that basis, the child care block grant is held level rather than cut.

[3] In percentage terms, the Trump budget would cut spending on non-defense discretionary programs by 11 percent in 2018, while it would cut discretionary block grant programs by 55 percent.

[4] For more information, see Sharon Parrott, “Contrary to Rhetoric, Trump Budget Would Make It Harder for Many to Climb Economic Ladder,” CBPP, May 31, 2017, https://www.cbpp.org/research/federal-budget/contrary-to-rhetoric-trump-budget-would-make-it-harder-for-many-to-climb.

[5] These amounts reflect only the basic payments to states and territories and do not include the TANF contingency fund, which is not a block grant. For more, see Tazra Mitchell, “President Trump’s Budget Cuts TANF Despite Stated Goal to Reduce Poverty, Boost Work,” CBPP, May 24, 2017, https://www.cbpp.org/blog/president-trumps-budget-cuts-tanf-despite-stated-goal-to-reduce-poverty-boost-work.

[6] This program also receives mandatory funding, which would be held constant at the 2017 level under the Trump budget.

[7] For an example of how the flexibility used to justify creating block grants eventually became an argument for abolishing a block grant, see Richard Kogan, “House GOP Effort to Kill Social Services Block Grant Should Be Cautionary Tale,” CBPP, April 8, 2016, https://www.cbpp.org/blog/house-gop-effort-to-kill-social-services-block-grant-should-be-cautionary-tale.

More from the Authors

Areas of Expertise