Sabotage Watch: Tracking Efforts to Undermine the ACA

President Trump said that, politically, the best thing to do would be to let the Affordable Care Act (ACA) “explode.” This timeline tracked Trump Administration actions to sabotage the ACA by destabilizing private insurance markets or reversing the law’s historic gains in health coverage.

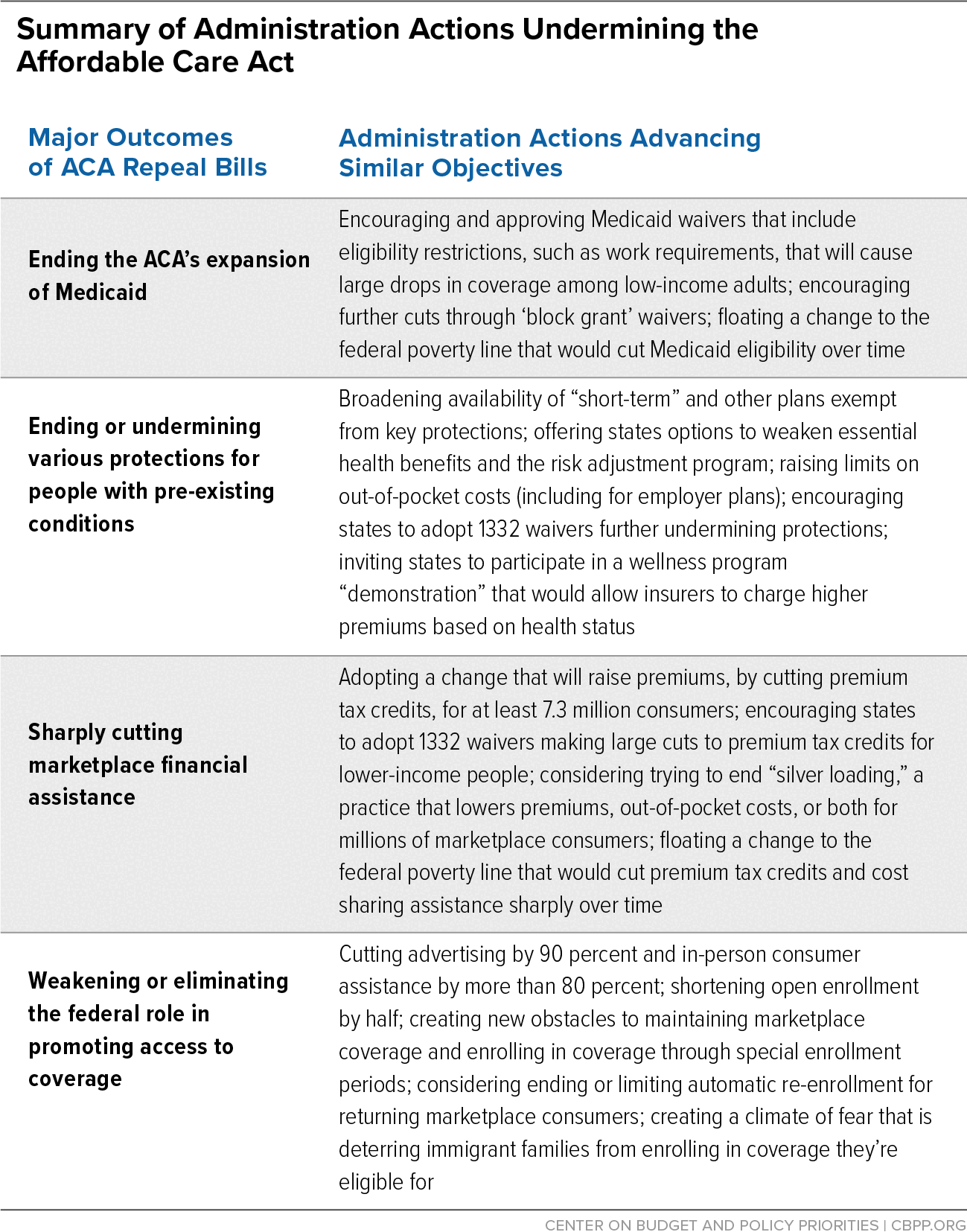

For a graphic summarizing administration actions against the Affordable Care Act, click here.

January 19 The Trump Administration finalizes a regulation that dramatically cuts funding for ACA marketplace operations and greenlights other ill-advised changes to the marketplace. The new rule encourages states to exit HealthCare.gov without creating a state-based substitute, allowing their residents to access marketplace coverage only through private brokers and insurers. This is the same backward-looking policy the Administration approved November 1 in Georgia’s unprecedented 1332 waiver, which is expected to cause tens of thousands of people to lose coverage. The Administration approved this policy and persisted in encouraging more states to adopt it even though “nearly all commenters” cautioned about its harmful impact on consumers.

The new rule also codifies in regulations earlier Administration guidance that attempts to weaken the statutory guardrails that prevent 1332 waivers from reducing coverage or making coverage less comprehensive or less affordable. And the new rule slashes the marketplace user fee paid by insurers by 25 percent. This cuts funding for core marketplace operations — including the HealthCare.gov website and call center — despite the need to revitalize outreach and enrollment assistance programs, especially given the pandemic.

January 15 Five days before leaving office, the Trump Administration approves requests by Texas and Florida to extend their states’ Medicaid demonstration projects through 2030. These extensions are very unusual: neither state’s demonstration was set to expire until 2022, and the Centers for Medicare & Medicaid Services extends the demonstrations for nearly a decade when federal law limits extensions to three years in most cases.

Moreover, the Department of Health and Human Services allows Texas to use a “fast track” process even though the state did not provide evidence showing that it met the required criteria, and also permits the state to forgo public notice and comment on its proposal. In asking to waive notice and comment requirements, Texas cited the COVID-19 public health emergency even though the state didn't propose making any changes to its current demonstration to help it or Texas providers respond to COVID-19.

Both states’ demonstrations include uncompensated care pools, which give providers funding to pay for care they provide to uninsured people, many of whom could be covered under the ACA’s Medicaid expansion. The Obama Administration’s uncompensated care pool policy, later reversed by the Trump Administration, prevented states that rejected the Medicaid expansion from receiving federal funds to reimburse providers for care they delivered to people who could have had comprehensive coverage under Medicaid. The Trump Administration is likely acting so quickly to extend the Florida and Texas demonstrations for ten years to make it more difficult for the Biden Administration to develop and apply its own policy on whether to pay for care delivered to people who could be eligible for Medicaid.

January 8 The Trump Administration finalizes the “Securing Updated and Necessary Statutory Evaluations Timely” (SUNSET) rule, under which most Department of Health and Human Services (HHS) regulations will automatically expire unless the department reviews them. (In general, rules will expire if not reviewed every ten years.)

HHS received over 500 public comments on the proposed SUNSET, yet finalized the rule in just over a month. The final rule is largely the same as proposed, with one notable exception – rules will need to be reviewed within five years of the final rule’s effective date, rather than two as proposed.

This rule will undermine Medicaid, Medicare, and the marketplaces, as well as other core functions of government, such as Food and Drug Administration operations, and will require substantial agency staff time to implement, diverting key resources from other priorities. If rules were to expire due to insufficient resources to review them, it could wreak havoc on HHS programs and harm the people who rely on them.

January 8 In the final days of the Trump Administration, the Centers for Medicare & Medicaid Services (CMS) approves the TennCare III demonstration, which puts an aggregate cap on federal funding for Tennessee’s Medicaid program (known as TennCare) for ten years. The demonstration project effectively creates a federal “slush fund” that the state can use to supplant state spending — with no benefit and some risks for Tennesseans needing Medicaid coverage. While CMS has not called the demonstration a “block grant,” the demonstration creates some of the same risks for beneficiaries as a block grant, especially the financial incentive it creates for the state to restrict access to care for Medicaid enrollees to maximize the federal funds available to the state to pay for programs previously funded solely by the state. CMS also approved Tennessee’s proposal to deny coverage for many Food and Drug Association-approved drugs — the first time a closed formulary has been permitted in Medicaid. CMS approved this proposal in spite of denying a very similar proposal from Massachusetts in 2018 on the basis that it did not conform with the requirements in federal law. This policy could deny Tennesseans access to needed medications.

December 15 The Trump Administration finalizes rules to make it easier for employers to keep offering pre-ACA plans that are exempt from important consumer protections, giving employers greater leeway to increase deductibles and other cost sharing for workers and their families while maintaining plans’ exempt status.

The rules change long-standing requirements for so-called grandfathered plans in the group market — those plans that existed prior to March 2010, when the ACA was enacted. While the ACA allowed these plans to continue without meeting all requirements in the new law, if the plans change too much, they lose grandfathered status. The expectation was that, over time, the grandfathered plans would naturally phase out and nearly everyone would have access to the ACA’s protections.

People enrolled in grandfathered employer plans may be deprived of the following ACA protections: preventive services with no patient cost sharing, the right to appeal insurers’ claims denials to a third-party reviewer, an annual limit on how much plan enrollees must pay each year in plan out-of-pocket costs, and, in some cases, coverage of the essential health benefits (which the ACA applied to small-group plans). The new rules mean that more people will likely go without these protections for longer periods of time.

November 25 The Trump Administration proposes a regulation that would weaken consumer protections and slash funding for ACA marketplace operations, among other harmful changes. If finalized, the new rule would Invite states to exit HealthCare.gov without creating a state-based marketplace, letting their residents access marketplace coverage only through private brokers and insurers. This is the same policy the Administration approved earlier in November in Georgia’s unprecedented 1332 waiver, which is expected to cause tens of thousands of people to lose coverage. The Administration is now encouraging more states to adopt the same harmful policy without even requiring a waiver.

The new rule would also codify in regulations earlier Administration guidance that attempts to weaken the statutory guardrails that prevent 1332 waivers from reducing coverage or making coverage less comprehensive or less affordable. Inserting this guidance into regulations would make it harder for the new Administration to promptly reverse it. And the new rule would slash the marketplace user fee paid by insurers by 25 percent, cutting funding for core marketplace operations – including the HealthCare.gov website and the call center – and making it more difficult for the new Administration to revitalize outreach and enrollment assistance programs.

November 13 The Trump Administration finalizes a regulation weakening important Medicaid managed care plan standards. Nationally over two-thirds of all Medicaid beneficiaries were enrolled in comprehensive managed care in 2018, and many states enroll beneficiaries who need long-term services and supports, in addition to large numbers of children and other adults, in managed care plans. Ensuring that states hold managed care plan to rigorous standards is therefore essential to Medicaid’s operation.

The new regulation amends a 2016 rule that streamlined and expanded the Centers for Medicare & Medicaid Services’ oversight of state managed care programs, including a requirement that states establish network adequacy standards based on the availability of providers (“time and distance” standards). The new rule expands states’ authority to define their own standards for network adequacy, rather than using a federal standard. This change will make it more difficult to assess whether beneficiaries have access to health care providers and compare access across states. The new rule also weakens requirements to provide accessible information for people with disabilities and those with limited English proficiency.

November 4 The Trump Administration proposes a rule called “Securing Updated and Necessary Statutory Evaluations Timely” (SUNSET), under which most Department of Health and Human Services (HHS) regulations would automatically expire unless they are reviewed by the agency. (In general, rules would expire if not reviewed every ten years.)

The proposed SUNSET rule would undermine Medicaid, Medicare, and the marketplaces, as well as other core functions of government, such as Food and Drug Administration operations. If finalized, it would require substantial agency staff time to implement, diverting key resources from responding to the COVID-19 crisis, other priorities, and day-to-day program administration. And if rules were allowed to expire due to insufficient resources to review them, it could wreak havoc on HHS programs and harm the people who rely on them.

November 1 The Trump Administration approves a waiver under section 1332 of the ACA to allow Georgia to exit the HealthCare.gov enrollment platform. If the waiver is implemented, Georgia residents will only be able to enroll in marketplace coverage through a private insurer or broker. In 2020, about half a million Georgians enrolled through HealthCare.gov; those residents would need to find a new way to enroll and many would likely become uninsured.

HealthCare.gov allows consumers to compare all available comprehensive plans side by side ― something few private insurance sellers do. Instead, consumers in Georgia will need to search out multiple individual agents and brokers, web brokers, and insurers to try to understand their options for comprehensive coverage. The waiver also makes it more likely that people will unwittingly enroll in short-term plans and other subpar coverage that isn’t guaranteed to cover all benefits and excludes coverage for pre-existing conditions, since those plans are more profitable for insurers and pay higher commissions to agents and brokers.

The Trump Administration approved the waiver unusually rapidly ― and on the first day of open enrollment for 2021 coverage ― even though only eight of the 1,826 public comments submitted on the proposal supported it. Not only did the Administration fail to take comments into consideration, but the waiver violates the ACA since it will cause many people to lose coverage, contrary to the statutory language of section 1332.

October 26 The Centers for Medicare & Medicaid Services (CMS) approves most of Indiana’s request to extend its Section 1115 Medicaid demonstration project (or “waiver”), called the Healthy Indiana Plan (HIP). Indiana’s waiver imposes significant premiums on people with very low incomes, locks some enrollees out of coverage if they fail to pay them, and takes away people’s coverage if they don’t meet a work requirement. Some provisions of the waiver, including the work requirement and lock-outs, are on hold due to a District of Columbia Circuit Court of Appeals ruling invalidating such policies, but the Administration is appealing that decision to the Supreme Court. CMS’ approval would let these policies go into effect if the Supreme Court reviews and reverses the circuit court decision. Moreover, in an unprecedented action, CMS approved most elements of the waiver for a ten-year period, instead of the usual three or five years, even though Indiana does not appear to have an approved evaluation design for HIP, nor is there any evaluation reported since 2016.

October 20 The Centers for Medicare & Medicaid Services (CMS) approves Nebraska’s Section 1115 Medicaid waiver proposal, letting the state withhold critical benefits from Medicaid expansion enrollees who don’t engage in qualifying work activities and complete a health assessment. Nebraska voters had approved a Medicaid expansion ballot initiative in November 2018, but the state waited 23 months — until October 2020 — to implement expansion, which will provide health coverage to approximately 90,000 low-income Nebraskans.

Under the waiver, which will take effect on April 1, 2021, expansion beneficiaries will get a “Basic” benefits package that doesn’t include coverage for dental and vision care and over-the-counter medications. In order to receive those benefits, beneficiaries must complete a health assessment and, beginning in 2022, demonstrate compliance with an 80-hour-a-month work requirement. These benefits are critical for the well-being of the expansion population. For example, poor oral health is twice as prevalent among non-elderly adults with incomes below the poverty line as for people with higher incomes, with a particularly high incidence among people of color. Poor oral health is associated with other physical health problems, such as diabetes, heart disease, and strokes, and can make it harder for people to maintain their employment and find work. Nebraska estimates that more than half of beneficiaries subject to the new rules will be unable to meet the requirements.

Public comments overwhelmingly opposed Nebraska’s waiver proposal: 425 comments were submitted during the federal comment period and all but one were against, according to CMS.

October 15 The Centers for Medicare & Medicaid Services approves Georgia’s Section 1115 Medicaid demonstration project, under which Georgia will require people with very low incomes to work and pay premiums to enroll in Medicaid. If Georgia expanded Medicaid rather than pursuing this waiver, these low-income people would not need to meet these pre-conditions, and an estimated 518,000 uninsured adults would be eligible for Medicaid immediately. Instead, just under 65,000 Georgians will enroll throughout the five-year demonstration, Georgia estimates. And many of these individuals may only have coverage for short periods, likely losing coverage due to the work requirement and premiums even if they manage to initially meet the conditions and enroll. Georgia is the second state to get permission to require work as a condition of coverage, following approval of South Carolina’s waiver putting similar conditions on covering parents. These approvals are a blatant attempt to get around the decision of the District of Columbia Circuit Court of Appeals that stopped the Administration from allowing states to cut off people’s coverage if they didn’t meet a work requirement, a decision the Administration is currently asking the Supreme Court to review.

October 2 The Trump Administration proposes a rule that would lead more eligible people to forgo health coverage such as Medicaid and the Children’s Health Insurance Program (CHIP) and help from other important public benefit programs. The rule would make it more difficult for people who have participated in such programs, including U.S. citizens, to “sponsor” their family members when they apply for lawful permanent resident (LPR) status in the United States.

Many individuals seeking LPR status must have sponsors (often close family members such as a spouse) who sign affidavits of support agreeing to provide financial support to the person they are sponsoring. The Trump rule would make it harder for a family member to fulfill the affidavit of support requirement if they had participated in any one of a long list of programs, including Medicaid or CHIP, at any point in the three years before their family member applied for LPR status. That would lead many people to forgo accessing benefits altogether out of fear that doing so would later thwart their family member’s chances to come to or stay in the country.

July 15 The Trump Administration proposes rules that would make it easier for employers to keep offering pre-ACA plans that are exempt from important consumer protections, giving employers greater leeway to increase deductibles and other cost sharing for workers and their families while maintaining plans’ exempt status.

The proposed rules would change long-standing requirements for so-called grandfathered plans in the group market — those plans that existed prior to March 2010, when the ACA was enacted. While the ACA allowed these plans to continue without meeting all requirements in the new law, if the plans change too much, then they lose grandfathered status. The expectation was that, over time, the grandfathered plans would naturally phase out and nearly everyone would have access to the ACA’s protections.

People enrolled in employer plans that are grandfathered may be deprived of the following ACA protections: preventive services with no patient cost sharing, the right to appeal insurers’ claims denials to a third-party reviewer, an annual limit on how much plan enrollees must pay each year in plan out-of-pocket costs, and, in some cases, coverage of the essential health benefits (which the ACA applied to small-group plans). The proposed rule means that more people will likely go without these protections for longer periods of time.

June 12 The Department of Health and Human Services releases a final rule gutting anti-discrimination protections for LGBTQ people, women, people with limited English proficiency, and people with disabilities.

Section 1557 of the Affordable Care Act prohibits health programs and facilities that receive federal funds (and federally administered health programs and activities) from discriminating based on race, color, national origin, age, disability, or sex. The new rule weakens protections in the existing rules, issued in 2016, that implement section 1557. Among other things, it eliminates specific nondiscrimination protections based on sex, gender identity, and association and removes requirements ensuring that people with limited English proficiency can get important information about their health care and coverage in languages other than English.

These changes could create confusion and fear, causing many people to delay seeking — or opt not to seek — medical attention or obtain health care coverage. Thus, they are reason for concern under any circumstances. But during a pandemic, it’s especially alarming that policy changes may prevent or delay people from seeking care or understanding their health coverage options, with particularly harmful impacts on groups, including immigrants, that are also experiencing disproportionate harm from COVID-19.

June 10 The Administration proposes increasing the tax advantages for two products — health care sharing ministries and direct primary care arrangements — that are sometimes marketed as an alternative to health insurance, though they provide far more limited benefits and lack the same consumer protections.

If finalized, the new tax incentives would almost certainly leave more people with large coverage gaps that they don’t understand, particularly if misleading marketing had convinced them that they were enrolling in comprehensive health insurance. Several states have taken action against one health care sharing ministry for misleading consumers and then leaving them with tens of thousands of dollars in unpaid medical bills.

Boosting these two arrangements would only expose more people to costly risks, while potentially raising premiums for health insurance that meets Affordable Care Act standards, by luring healthier people who cost less to cover out of ACA insurance risk pools.

April 1 The Trump Administration refuses to create a special enrollment period (SEP) to allow people to purchase insurance through HealthCare.gov, despite the COVID-19 health and economic crisis. State-based marketplaces in 12 states and the District of Columbia created SEPs to encourage people, particularly the newly unemployed, to enroll in comprehensive health insurance with income-based subsidies to make coverage more affordable. Current HealthCare.gov rules allow only people who’ve lost job-based coverage (or have certain other life changes) to enroll, leaving out millions of people ― disproportionately low-income people and people of color. The Administration has also failed to do outreach to let eligible people know they can access coverage through one of the existing SEPs.

January 31 The Trump Administration proposes a rule that could limit marketplace enrollees’ ability to automatically re-enroll in coverage with a premium that is fully paid for by their premium tax credit. Automatic re-enrollment is a key strategy to help eligible enrollees maintain coverage. The proposed change would have the biggest impact on the lowest-income enrollees since they are more likely to have a premium tax credit large enough to enroll in a plan without an additional premium. The proposed rule also continues the Administration’s change to a technical insurance formula that has increased premiums for 7.3 million marketplace consumers and has raised limits on out-of-pocket costs for millions more families with employer-sponsored coverage.

January 30 The Trump Administration issues guidance inviting states to seek demonstration projects that would radically overhaul Medicaid coverage for adults. Under the guidance, states could apply for demonstrations that would convert their Medicaid programs for adults into a form of block grant, with capped federal funding and new authorities to cut coverage and benefits.

The demonstrations would likely worsen many enrollees’ health by taking away coverage and reducing access to care. States that adopt these demonstrations could deny coverage for prescription drugs, impose higher copayments on people in poverty, and waive standards for managed care plans (which many states use to provide Medicaid coverage).

Moreover, capped federal funding would shift financial risk to states, with federal funding cuts most likely to occur when states can least absorb the cuts — such as during recessions, public health emergencies, and other times when states face both high demand for coverage and strain on other parts of their budgets. That would put pressure on states to use their new and existing authorities to cut coverage.

January 30 The Department of Homeland Security (DHS) announces it will begin implementing radical changes to “public charge” immigration policies on February 24. The changes will take effect nationwide except in Illinois, where a federal court has blocked them.

The new policy directs immigration officials to reject applications from individuals seeking to become permanent residents if they are judged more likely than not to receive in the future any of an extensive array of public benefits that are tied to need, including Medicaid. Actual receipt of such benefits by the person applying for an immigration status would also be viewed negatively when immigration officials make these assessments.

The policy changes are complicated. While most people who meet the eligibility requirements for benefits listed in the rule will not undergo public charge assessments, confusion or fear regarding the changes will likely lead many people to forgo needed health coverage and other benefits that help families make ends meet.

January 22 The Centers for Medicare & Medicaid Services approves Texas’ section 1115 Medicaid family planning waiver, which allows Texas to receive federal funding for a program that provides family planning coverage to women with incomes below 200 percent of the federal poverty line but restricts their choice of family planning providers. Today’s unprecedented approval comes despite research on Texas’ program (which previously was entirely state-funded) finding that restricting choice of providers reduces access to care, including life-saving preventive screenings.

January 10 The Department of Justice (DOJ) urges the Supreme Court to delay consideration of the lawsuit in which the Administration and 18 states are asking the courts to strike down the entire ACA. The states defending the law, led by California, asked the Court to hear the case on an expedited basis to resolve the uncertainty the lower courts have created for the 20 million people who would become uninsured, and the millions more who would lose protections against pre-existing condition exclusions and other benefits, if the law is ultimately overturned. Delaying, as DOJ urges, would prolong that uncertainty, potentially for years.

December 27 The Centers for Medicare & Medicaid Services (CMS) finalizes a rule reinterpreting the statutory ban against using premium tax credits to pay for certain abortion services, which could cause some people to lose coverage purely due to red tape. Before the rule, insurers typically itemized abortion coverage separately at the end of the payment process. But now they must send separate bills for health insurance premiums and the de minimis portion of the premium attributable to abortion coverage (often as little as $1), requiring enrollees to send two separate payments. Receiving two monthly bills is bound to confuse many of the 3 million consumers who could be affected. Failure to make one or the other payment could cause some to lose coverage, after a three-month grace period. CMS estimates the rule will raise costs — mostly administrative — for insurers, consumers, and health insurance marketplaces by nearly $1.5 billion over the next five years.

December 12 The Centers for Medicare & Medicaid Services approves two section 1115 Medicaid waivers that let South Carolina take coverage away from low-income parents who don’t meet an 80-hour-per-month work requirement. These approvals are unprecedented in two ways. First, they put South Carolina on the path to be the first state to implement work requirements just for parents (and taking health coverage away from low-income parents would likely harm their children as well). Second, they’re the first approved waivers requiring applicants to document compliance with the work requirement before they can get, or renew, coverage.

Today’s approval comes even as several states are reconsidering their Medicaid work requirements and evidence is mounting from Arkansas and New Hampshire that work requirements cause people — including working parents and people with serious health needs — to lose coverage, without increasing employment.

November 18 The Centers for Medicare & Medicaid Services issues a proposed Medicaid rule significantly restricting how states finance their required share of Medicaid expenditures. Most states do so through a combination of three sources: general revenue, taxes on providers (often called provider assessments), and funds transferred from or certified by state and local government health care providers (called intergovernmental transfers and certified public expenditures, respectively). The rule would force many states to curtail their use of the second and the third of these sources. If states couldn’t substitute other funds from general revenue or elsewhere, they would have to cut benefits and eligibility as well as provider payments, particularly payments to hospitals and nursing homes. The complexity of the rule and a lack of relevant data make it impossible to calculate the rule’s national or state-by-state impact. In fact, the required regulatory impact analysis for the rule states that the fiscal impact on Medicaid is “unknown.”

October 4 President Trump issues a proclamation requiring certain people seeking to lawfully immigrate to the United States to prove they have health insurance, can quickly get health insurance, or have the means to pay for any reasonably anticipated medical expenses. This health coverage mandate can’t be met through enrollment in ACA subsidized marketplace plans or Medicaid. It can be met, however, through enrollment in non-ACA compliant plans such as short-term plans, which are allowed to deny coverage or charge higher premiums based on pre-existing conditions and can exclude essential health benefits, leaving people enrolled in these plans exposed to substantial and unaffordable out-of-pocket expenses. The policy, which will take effect on November 3, days after the start of the ACA marketplace open enrollment period, will both close off lawful immigration pathways to people with low incomes or pre-existing health conditions and add to the climate of fear, deterring immigrant families from enrolling in comprehensive ACA coverage — and perhaps driving them towards enrolling in skimpy health plans.

September 30 In another action that erodes protections for people with pre-existing conditions, the Administration invites states to let individual market insurers vary premiums and cost sharing based on health outcomes. Specifically, new guidance establishes a demonstration project under which up to ten states can apply to establish “health-continent wellness programs.” These programs would let insurers vary premiums and cost sharing by as much as 30 percent based on whether enrollees meet designated health outcomes — effectively a return to charging sick people more than healthy people.

August 30 The Department of Health and Human Services (HHS) announces that only 34 groups will receive navigator funding in 31 states where the federal government runs the ACA marketplace. Many states will have large areas without navigators and a few states will have no navigator program at all.

In the announcement of navigator awards, HHS references a program change made earlier in the year that shifted the provision of vital post-enrollment assistance services from required duties to “permissible” duties, noting that this change will allow groups more “flexibility” over how they allocate their grant funding. The announcement does not address the Administration’s drastic cuts to navigator program funding of over 80 percent since 2016, which have caused the navigator groups’ struggle to meet consumers’ enrollment and post-enrollment needs.

August 12 The Department of Homeland Security finalizes a rule that will make extensive and deeply troubling changes to the nation’s “public charge” policies. Under the final rule, immigration officials can reject applications from individuals who seek to remain in or enter the country if they have received — or are judged more likely than not to receive in the future — any of an extensive array of public benefits that are tied to need, including Medicaid coverage for most adults. There is evidence that families, fearing immigration-related consequences, elected to forgo key public benefit programs even before the rule was finalized. The final rule will sow even more fear in immigrant communities and likely cause immigrants and their family members who are legally in the United States to forgo needed health coverage even though they likely will never go through a public charge assessment. The rule’s changes to the definition of public charge, which expand the list of benefits considered in a public charge determination and add new criteria that could lead someone to be declared a public charge, is scheduled to take effect on October 15, but several court challenges have been filed.

August 1 As part of an executive order to “improv[e]… transparency in American healthcare,” the Trump Administration proposes increasing the tax advantages for two products — health care sharing ministries and direct primary care arrangements — that are sometimes marketed or used by consumers as an alternative to health insurance, even though they provide far more limited benefits and don’t provide the same consumer protections.

The executive order calls for the Treasury Secretary to propose regulations that would define expenses related to “certain types of arrangements, potentially including direct primary care arrangements and health care sharing ministries,” as eligible for certain tax breaks under the tax code. Far from improving transparency, new tax incentives for these arrangements would almost certainly leave more people with large coverage gaps that they don’t understand, particularly when misleading marketing convinces them that they’re enrolling in comprehensive health insurance. Several states have taken action against one health care sharing ministry for misleading consumers and then leaving them with tens of thousands of dollars in unpaid medical bills.

Boosting these two arrangements would only expose more people to costly risks, while potentially raising premiums for health insurance that meets ACA standards, by luring healthier people who cost less to cover out of ACA insurance risk pools.

June 13 The Trump Administration finalizes a rule on health reimbursement arrangements (HRAs) that will likely lead employers to shift millions of workers from traditional employer-sponsored group health plans to individual coverage with a limited employer contribution. Under the rule, employers can forgo offering coverage and instead contribute money to a tax-free account for employees, who would then use it to help buy their own coverage. The complexity of enrolling in an individual plan (compared to employer coverage) could lead to more employees losing coverage and will make employees more susceptible to broker schemes that enroll them in skimpy plans instead of comprehensive coverage.

Employers with sicker workers are likelier to take up this option, which could raise premiums for everyone in the marketplace. It comes at a cost to taxpayers of $51 billion over ten years — resources that could have been used to make existing forms of coverage more affordable.

May 24 The Trump Administration proposes weakening federal rules that protect LGBTQ people, women, people with limited English proficiency, and others from discrimination in health care settings and programs. If the rule is implemented as proposed, more people would likely avoid seeking medical attention, fail to get health care coverage, not understand their benefits, or not get coverage of benefits they need.

Section 1557 of the Affordable Care Act prohibits health programs and facilities that receive federal funds (and federally administered health programs and activities) from discriminating based on race, color, national origin, age, disability, or sex. The proposed rules would roll back major provisions of existing rules (issued in 2016) that implement section 1557. Among other things, they would eliminate specific nondiscrimination protections based on sex, gender identity, and association and remove requirements ensuring that people can get significant communications about their health care and coverage in languages other than English.

The Administration also proposes to narrow the scope of section 1557 so that protections against discrimination would apply to fewer Department of Health and Human Services programs and to fewer health products that insurers offer. The proposed rules will be open for a 60-day comment period.

May 23 Adding to the atmosphere of fear deterring immigrant families from accessing needed services such as health coverage, President Trump directs agencies, including the Department of Health and Human Services, to review policies related to certain immigrants who have sponsors and receive benefits such as Medicaid and the Children’s Health Insurance Program. Agencies are asked to identify their policies on attributing sponsors’ income when calculating financial eligibility for sponsored immigrants and on holding sponsors accountable if people they sponsor use certain benefit programs. Many immigrants who have sponsors subject to these policies are not eligible for public benefit programs and those who are eligible already participate at low rates because of concerns related to their immigration status. Nonetheless, the new review of policies will likely deter additional people from participating and increase the number of eligible people who go without needed services such as health coverage and food assistance.

May 6 The Office of Management and Budget (OMB) releases a notice seeking comment on a proposal that would reduce eligibility for Medicaid and cut premium tax credits for millions of people by changing how the official poverty line is adjusted each year. More specifically, OMB is floating a proposal to update the poverty line using a lower measure of inflation (the “chained CPI”). That would make the poverty line lower than it otherwise would be, reducing eligibility for health coverage programs as well as for nutrition programs and certain other forms of assistance. The impact of the proposal would be small at first, but would increase each year it was in effect. The Administration is advancing this proposal to weaken coverage and other safety net programs even as tens of millions people remain uninsured or struggle to afford coverage, and despite evidence that the poverty line is already below what is actually needed to raise a family.

April 18 The Centers for Medicare and Medicaid Services (CMS) finalizes a rule that raises premiums for 7.3 million people who purchase subsidized coverage in the ACA marketplace and is expected to cause 70,000 to drop insurance coverage. The change will also increase limits on total out-of-pocket costs for millions of people, including many with employer coverage, meaning families that experience costly illnesses or injuries could face an additional $400 a year in medical bills. The Administration finalized the policy even though, as the final rule itself notes, “all commenters on this topic expressed opposition to or concerns about the proposed change.”

The rule scales back the scope of navigator duties so that important consumer assistance functions, like helping applicants appeal eligibility denials, are now considered “optional.” It also eliminates certain training requirements, like training on basic health insurance concepts, the benefits of enrolling in the marketplace, and providing culturally and linguistically appropriate services.

March 29 The Centers for Medicare & Medicaid Services (CMS) issues its initial approval of Utah’s Medicaid waiver expanding coverage to some low-income adults but rejecting a full expansion that would have covered tens of thousands more. The waiver approval is the latest step in a rollback of the ballot initiative that Utah voters approved in November 2018 instructing the state to adopt the ACA’s Medicaid expansion and extend Medicaid coverage to 150,000 Utahns. The first step in the rollback came in February 2019, when the Utah legislature repealed the voter-approved expansion and directed the state to pursue a series of waivers that would provide less coverage than the voter initiative would have.

The approved waiver is the second step in the rollback. Under the waiver, CMS gave Utah unprecedented authority to arbitrarily cap enrollment based solely on state funding decisions, and it also approved the state’s proposal to take coverage away from people not meeting job training and search requirements. The third step will come later this year when CMS will make a decision on Utah’s requests to receive the ACA’s higher matching rate for federal funding without fully expanding Medicaid to people with incomes up to 138 percent of the poverty line (an approach that CMS has repeatedly refused to approve, including under the Trump Administration), and impose a per capita cap on funding for expansion enrollees, meaning that the federal government would only provide funding up to a pre-determined per-person limit.

March 25 In a two-sentence letter, the Department of Justice (DOJ) asks the U.S. Court of Appeals for the Fifth Circuit to invalidate the entire Affordable Care Act (ACA). This would cause millions of people to lose health coverage and make coverage worse or less affordable for millions more, including up to 130 million people with pre-existing conditions.

In December a federal district court judge sided with a partisan group of state attorneys general and struck down the entire ACA in an opinion that even conservative legal experts called “embarrassingly bad.” The DOJ had already declined to defend the constitutionality of the law and urged the district court to end the ACA’s protections for people with pre-existing conditions but stopped short of seeking to nullify the entire law.

In the near term, the Trump Administration’s new offensive against the ACA will likely cause confusion, uncertainty, and anxiety for people who depend on the ACA for access to health coverage and care. If the Administration prevails in court, the outcome would be far worse.

March 15 The Centers for Medicare & Medicaid Services approves a waiver proposal from Ohio that would let the state take Medicaid coverage away from people who aren’t working or engaged in qualifying work activities for 80 hours a month — despite the evidence from Arkansas that it will lead thousands of residents to lose coverage. Some 93 percent of comments submitted during Ohio’s comment period opposed the waiver (with only 4 percent in support), scheduled to take effect on January 1, 2021. Ohio estimates that 18,000 people will lose their Medicaid coverage because they are unable to meet the work requirement, but this estimate is likely too low, and many who should be exempt will likely lose coverage due to difficulty navigating the appraisal process and falling through the cracks.

Ohio says its goals are to “promote economic stability and financial independence” and “improve health outcomes.” The reality is that since the state adopted the Medicaid expansion in 2014 it has made tremendous progress toward these objectives without a work requirement, including reported declines in unmet health needs and improved access to mental health services and treatment for chronic health conditions. And 75 percent of those who were unemployed and looking for work said having Medicaid made their job search easier; half of those already employed said Medicaid made it easier to stay working.

January 18 With approval from the Centers for Medicare and Medicaid Services in hand, Arizona appears poised to move forward with policies that will reduce coverage, make it harder for people to access affordable care, and increase financial hardship. Arizona’s waiver lets the state take away Medicaid coverage from people who aren’t working or engaged in qualifying work activities for 80 hours per month — despite mounting evidence from Arkansas that it will lead thousands of residents to lose coverage, including working people and people with serious health needs. The waiver also lets the state halt payments to hospitals and other safety net providers for retroactive coverage, an important provision that protects beneficiaries against medical debt and ensures the financial stability of Arizona’s safety net.

January 17 The Centers for Medicare and Medicaid Services (CMS) proposes changes to a technical insurance formula that would leave the large majority of people who purchase subsidized marketplace coverage under the Affordable Care Act — at least 7.3 million marketplace consumers — paying higher premiums. The change would also lead 100,000 people to drop marketplace coverage each year, by the Administration’s own estimates. It would also raise limits on total out-of-pocket costs for millions of people, including many with employer coverage, leaving families that experience costly illnesses or injuries facing an additional $400 per year in medical bills and hitting people with pre-existing conditions especially hard.

CMS also suggests it may make other damaging changes in the future, by eliminating two practices known as silver loading and auto-reenrollment. Silver loading was insurers’ response to the Trump Administration’s 2017 decision to stop making cost-sharing reduction (CSR) payments to insurers. Insurers increased their premiums for silver plans to account for the cost of providing CSRs (in the form of lower deductibles and other cost-sharing charges) to roughly 6 million low- and moderate-income people. Prohibiting silver loading would further increase consumers’ premiums and possibly cause insurers to reconsider participating in the marketplace. Eliminating auto-reenrollment, a practice that automatically puts people who are covered by a marketplace plan at year’s end into a plan for the next year, would also reduce marketplace enrollment and leave more consumers uninsured.

December 21 The Centers for Medicare & Medicaid Services (CMS) approves Michigan’s Medicaid waiver proposal, clearing the state to move forward with a new policy to take Medicaid coverage away from people who aren’t working or engaged in qualifying work activities for 80 hours a month. Michigan’s waiver is scheduled to take effect on January 1, 2020. As many as 183,000 people, or 27 percent of Michiganders covered under the state’s Medicaid expansion, will lose their coverage over a one-year period, according to a February 2019 analysis by Manatt Health. That’s consistent with evidence from Arkansas showing that such a policy will lead thousands of residents to lose coverage.

CMS approved Michigan’s waiver despite ample evidence showing Medicaid expansion has improved the health of low-income Michiganders and made it easier for them to maintain employment and look for work. For example, nearly 48 percent of enrollees surveyed reported improvements in their physical health since enrolling in the program. And over half of non-working adults reported that Medicaid makes it easier to look for work, while nearly 70 percent of working adults said Medicaid made it easier to work or made them better at their jobs.

December 14 A day before the end of open enrollment, a U.S. District Court judge in Texas issues an opinion striking down the entire Affordable Care Act (ACA) in an action brought by 20 states’ attorneys general. The Department of Justice had declined to defend the constitutionality of the law and instead urged the court to invalidate the ACA’s protections for people with pre-existing conditions; the judge’s opinion goes further and strikes down the entire law.

Judge Reed O’Connor’s decision doesn’t include an injunction ordering the Administration to stop enforcing the law, and the White House has affirmed that the ACA remains the law of the land pending appeal. And legal experts across the political spectrum, including some who opposed the ACA and supported previous legal challenges to the law, have called the case “absurd” and the decision “embarrassingly bad” and said it “makes a mockery of the rule of law and basic principles of democracy.” Even some committed opponents of the ACA have predicted the decision will be overturned on appeal.

If the decision were implemented, it would cause millions of people to lose health coverage and make coverage worse or less affordable for millions more. In the meantime, it is likely to result in confusion, uncertainty, and anxiety for people who depend on the ACA for access to health coverage and care.

November 30 With approval from the Centers for Medicare & Medicaid Services in hand, New Hampshire appears poised to move forward with a new policy to take away Medicaid coverage from people who aren’t working or engaged in qualifying work activities for 100 hours per month — despite mounting evidence from Arkansas that it will lead thousands of residents to lose coverage, including working people and people with serious health needs. New Hampshire’s policy is even harsher than Arkansas’, as its 100-hour threshold exceeds the 80 hours that Arkansas requires, and it applies to more adults — those up to age 64 versus 49 in Arkansas as well as parents of children age 6 and older. New Hampshire’s policy also makes it much harder for beneficiaries to maintain their coverage if they need more than one month to make up missed hours from a previous month.

November 29 The Centers for Medicare & Medicaid Services (CMS) releases several “waiver concepts” that invite states to “break away” from federal health care protections and standards – specifically by reviving many of the ideas that were proposed (but failed) during efforts in 2017 to repeal the Affordable Care Act (ACA). CMS encourages states to restructure and redirect funding that would otherwise be used for ACA subsidies for low- and moderate-income people. One prominent suggestion: a flat tax credit based only on age, instead of the current ACA premium credit structure that also takes income into account. In addition, CMS encourages states to let financial assistance be used for “different types of health insurance plans” that are not available through ACA marketplaces — including those, such as short-term plans, that don’t provide the ACA’s protections for people with pre-existing conditions and that offer much skimpier coverage.

These ideas would lead to dramatic cuts in subsidies for people who currently receive them, inadequate coverage, and the unraveling of the markets where people with pre-existing conditions are protected. While states still must show they’ll meet guardrails under section 1332 “state innovation” waivers (related to the number of people covered, affordability, comprehensiveness, and deficit neutrality), CMS is sending the overall message with its new waiver concepts that the Administration wants states to craft proposals that make a sharp turn away from the ACA.

November 20 The Department of Health and Human Services (HHS) re-approves Kentucky’s Medicaid waiver after a federal district court struck down an almost identical earlier version. The waiver would take coverage away from beneficiaries who don’t meet a work requirement, pay premiums, or report changes or renew their coverage on time, causing tens of thousands of people to lose coverage, according to Kentucky’s own estimates. The early experience in Arkansas, which implemented its work requirement in June, shows the danger ahead in Kentucky: over 12,000 Arkansas Medicaid beneficiaries have already lost Medicaid coverage and have likely become uninsured. Kentucky’s work requirement is even more stringent than Arkansas’ and applies to far more beneficiaries. The new approval letter fails to show how the waiver could possibly advance Medicaid’s objectives — setting the stage for further action in court.

October 31 The Department of Health and Human Services (HHS) approves Wisconsin’s Medicaid waiver, which will allow the state to take coverage away from people with incomes below the poverty line if they don’t pay $8 monthly premiums, meet a work requirement, or complete a health risk assessment. Wisconsin is the first state allowed to take Medicaid coverage away from people with incomes as low as 50 percent of the poverty line – or about $500 per month for an adult without dependents – if they don’t pay monthly premiums.

October 29 The Departments of Treasury, Labor, and Health and Human Services propose a regulation that would encourage employers to shift workers from traditional employer-sponsored group health plans to individual coverage with a limited employer contribution. Health reimbursement arrangements (HRAs) are individual accounts employers can fund tax-free; to unlock the account, an employee would need to enroll in individual market coverage.

This shift from group to individual plans can negatively affect employees and people who rely on the individual insurance market. Some employees offered HRAs may find individual market coverage difficult to understand compared to the simplicity of enrolling in a group plan, fail to complete enrollment, and end up uninsured. Employers with sicker workforces will be the most motivated to end traditional coverage and dump employees in the individual market, raising costs for coverage there. According to the Administration’s own estimates, this rule would result in nearly 7 million fewer people having traditional group coverage by 2028.

October 22 The Trump Administration releases new guidance that drastically changes how the federal government will evaluate states’ proposals for so-called section 1332 waivers, opening the door to waiver proposals that could slash financial help for low-income people and undermine the markets where people can access coverage regardless of their pre-existing conditions. The waivers, which were part of the Affordable Care Act (ACA), let states modify how they implement key elements of the ACA provided they meet four guardrails related to coverage, affordability, comprehensiveness, and deficit neutrality.

In the new guidance, the Administration makes sweeping changes to these guardrails. It says it’s willing to approve waivers as long as a comparable number of people have some form of coverage — even if that coverage is through substandard plans with limited benefits — and as long as affordable and comprehensive coverage remains available in the state — even if people aren’t actually enrolled in such coverage. The Administration’s guidance gives states more leeway to curb protections and raise out-of-pocket costs for people with high-cost health needs, putting the ACA’s progress in this area at risk.

October 10 The Department of Homeland Security proposes a rule that would radically change “public charge” policies. If finalized, the rule would direct immigration officials to reject applications from individuals who seek lawful permanent resident status, or seek to enter the United States, if they have received — or are judged likely to receive in the future — any of an extensive array of benefits tied to need, including Medicaid. Though the rule has not been finalized, nor does it include marketplace subsidies as a program that would be viewed negatively in a public charge determination, the policy is complex and confusing and has stoked fear among immigrant families. As a result, many individuals eligible for programs such as Medicaid and marketplace coverage are deciding not to sign up.

October 2 New federal rules take effect that let a parallel market for skimpy plans operate alongside the Affordable Care Act’s (ACA) market for comprehensive individual health insurance. The rules allow short-term plans exempt from the ACA’s pre-existing condition protections and benefit standards to last for up to one year, compared to three months under prior rules, and to be renewed. While a number of states have taken action to block short-term plans, in most places, consumers are exposed to new risks. Healthy people who enroll in these plans may face benefit gaps and be exposed to catastrophic costs if they get sick and need care. And because short-term plans will likely offer lower premiums to healthy people (because the plans include reduced benefits), they will lure healthy enrollees away from the individual and small-group markets, leaving behind a group that’s costlier to insure. This dynamic, known as adverse selection, will raise premiums for traditional, more comprehensive health coverage and undermine ACA protections for people with pre-existing conditions.

September 12 The Department of Health and Human Services (HHS) announces that only 39 groups will receive navigator funding in the 34 states where the federal government runs the Affordable Care Act (ACA) marketplace. Many states will have large areas with no navigators and a few states will have no navigator program at all.

Moreover, HHS is encouraging navigators to inform people about the availability of skimpy plans such as short-term plans and association health plans, which are exempt from many ACA consumer protections that shield people — particularly those with pre-existing conditions — from high out-of-pocket costs and substandard benefits.

August 23 Data that the Trump Administration used to make funding decisions for the navigator program last year were “problematic for multiple reasons,” the Government Accountability Office (GAO) finds. (See our explanation.) GAO also notes that HHS’ failure to set enrollment targets for the marketplace reduced its ability to monitor the agency’s performance and make informed decisions about allocating resources.

August 1 The Trump Administration releases rules to expand the use of short-term health plans as an alternative to plans that meet more stringent standards under the Affordable Care Act (ACA). Short-term plans, which have been limited to no more than three months, will now be able to last for up to one year, mimicking regular health insurance even though short-term plans do not have to meet most standards and consumer protections that apply to regular health insurance. For example, short-term plans do not have to cover the ACA’s essential health benefits and frequently do not include maternity services, prescription drugs, mental health care, and substance use disorder treatment. Short-term plans can deny coverage or charge higher prices to people with pre-existing conditions, and they typically do not cover medical services related to a pre-existing condition.

Expanding short-term plans will let a parallel market for skimpy plans operate alongside the market for comprehensive individual health insurance, exposing consumers to new risks and raising premiums for people seeking comprehensive coverage, especially middle-income consumers with pre-existing conditions. The only good news: states have the authority to set their own limits and protections for short-term plans.

July 10 The Centers for Medicare & Medicaid Services (CMS) slashes funding for consumer enrollment assistance and outreach through the navigator program to just $10 million for the 34 states whose Affordable Care Act marketplaces are facilitated by the federal government. Combined with the large cut last year, navigator funding has now fallen more than 80 percent from its 2016 level.

In addition, the funding announcement opens the door to other significant changes that may leave consumers in some states without access to in-person, marketplace-funded assistance. In a particularly troubling change, it encourages navigators to promote limited-benefit coverage options, “such as association health plans, short-term, limited-duration insurance, and health reimbursement arrangements.” As we’ve explained, such plans can leave consumers exposed to significant financial risk if they become ill or injured, and the proliferation of such plans will result in higher costs for people needing comprehensive coverage.

Taken together, these actions and dramatic funding cuts will lead to fewer people getting the impartial assistance they need to enroll in and maintain coverage.

July 7 The Centers for Medicare & Medicaid Services (CMS) announces that Affordable Care Act risk adjustment transfers for 2017 may be delayed. Risk adjustment is a federal program that transfers revenues from insurers that enroll a healthier-than-average group of consumers to those that enroll a sicker-than-average group. By doing so, risk adjustment reduces the incentives for insurers to design plans to avoid attracting people with pre-existing conditions and other serious health needs.

CMS’s announcement has created uncertainty and confusion, with insurers unsure how long transfers might be delayed. This disruption is unnecessary: while CMS linked its decision to an adverse New Mexico federal district court ruling regarding the risk adjustment program, legal experts have concluded that CMS had — and continues to have — options to avoid disrupting or delaying transfers.

CMS’s decision does not implicate the 2019 risk adjustment program: in finalizing 2019 marketplace rules, CMS addressed the legal issues the New Mexico court case raised. Nonetheless, the Administration’s decision has raised concerns about whether it signals an intent to interfere with the risk adjustment program going forward. As such, the announcement adds to insurers’ concerns about future policy actions, concerns that are likely causing them to increase 2019 individual market premiums more than they otherwise would.

June 19 The Labor Department finalizes rule changes expected to increase enrollment in association health plans (AHPs), coverage offered by trade and professional associations. Under the new rules, these associations could sell coverage to small businesses and self-employed individuals without meeting key Affordable Care Act (ACA) standards that would otherwise apply to plans sold to these customers. These include requirements to cover essential health benefits, prohibitions against charging higher premiums based on factors such as gender or occupation, and limits on charging higher premiums to older people.

Under the new rules, AHPs likely will be structured and marketed to attract younger and healthier people and firms with younger and healthier workforces, pulling them out of the ACA-compliant individual and small-group insurance markets and leaving older, sicker, and costlier risk pools behind. And because the AHP changes take effect starting this fall, the plans could result in 2019 premium increases and confuse consumers if they hit the market at the same time as the ACA open enrollment period.

June 7 The Department of Justice (DOJ) files a brief declining to defend the constitutionality of the Affordable Care Act (ACA) in an action brought by 20 states’ attorneys general. In Texas v. United States, the states assert that the entire ACA must be struck down because the Supreme Court’s 2012 decision in National Federation of Independent Business v. Sebelius upheld the coverage requirement under Congress’s taxing power and the 2017 tax law zeroed out that tax penalty.

DOJ agrees with their argument but stops short of saying the entire law must be overturned. Rather, the Trump Administration asks the court to strike down two critical consumer protections: the provision that bars insurers from denying coverage to people with pre-existing conditions (guaranteed issue) and the prohibition on charging higher premiums to people because of their health status (community rating). The Administration claims, wrongly, that these provisions are inextricably linked to the mandate and must be thrown out if the mandate is found to be unconstitutional, ignoring Congress’s decision in December to repeal the penalty but not other portions of the law.

Allowing insurers to again use pre-existing condition exclusions puts coverage at risk for 133 million people who could be charged more, denied coverage for certain diagnoses, or blocked from individual market coverage altogether because they have certain health conditions. Eliminating these provisions could also allow insurers to charge higher premiums to women, older people, and people in certain occupations. The attorneys general of 16 states and the District of Columbia have intervened in the case to defend the law.

April 9 The Centers for Medicare & Medicaid Services (CMS) finalizes health care rule changes for the individual market that will weaken benefit standards, likely harming people with pre-existing conditions; raise new barriers for people who want to enroll in health coverage; and reduce accountability for insurers and transparency for consumers. Among the most significant provisions of the wide-ranging rule: it lets states and insurers scale back benefits, weakens risk adjustment, creates new enrollment barriers, reduces consumer access to assistance with eligibility and enrollment, reduces transparency of insurance premium setting, and weakens the standard that individual market insurers must spend at least 80 percent of premiums on medical care and improving health care quality.

February 20 The Trump Administration proposes rules to expand the use of short-term health plans as an alternative to plans that meet more stringent standards under the Affordable Care Act. This would let a parallel market for skimpy plans operate alongside the market for comprehensive individual health insurance, exposing consumers to new risks and raising premiums for people seeking comprehensive coverage, especially middle-income consumers with pre-existing conditions. A rise in enrollment in short-term plans would also expose more consumers to coverage gaps and higher costs.

February 1 The Department of Health and Human Services (HHS) approves Indiana’s Medicaid waiver, allowing it to impose a work requirement on Medicaid beneficiaries as part of its three-year waiver renewal. HHS extended Indiana’s waiver, known as HIP, even though the state’s own evaluation shows that the waiver, with its premiums and coverage lockouts, has made it harder for eligible Hoosiers to get coverage and care. Adding a work requirement will exacerbate HIP’s shortcomings and cause additional beneficiaries to lose coverage.

January 19 The Centers for Medicare & Medicaid Services (CMS) rescinds guidance it issued in April 2016 reaffirming Medicaid’s “free choice of provider” provision, which allows beneficiaries to receive family planning services from all qualified providers of such services. CMS’ reversal raises concerns that states will be allowed to restrict women covered by Medicaid from choosing certain health care providers like Planned Parenthood.

January 12 The Department of Health and Human Services approves Kentucky’s Medicaid waiver, making Kentucky the first state to require Medicaid beneficiaries to work or participate in work-related activities as a condition of Medicaid eligibility. Kentucky’s waiver includes other harmful provisions that will jeopardize coverage for hundreds of thousands low-income Kentuckians, such as premiums; six-month coverage lock-outs for failing to pay premiums, renew coverage on time, or report changes affecting eligibility; and delays in the effective date of coverage.

January 11 In a sharp reversal of long-standing federal policy, the Centers for Medicare & Medicaid Services (CMS) issues guidance allowing states to block some low-income adults from getting Medicaid coverage if they’re not working or participating in work-related activities. CMS attempts to justify its new policy with the spurious claim that tying health insurance coverage to work will improve Medicaid beneficiaries’ health and economic well-being, because people who work are healthier.

January 5 The Trump Administration proposes a new rule to dramatically broaden enrollment in association health plans (AHPs), coverage offered by trade and professional associations. If finalized, the rule would likely devastate small-group insurance markets and could hurt the individual insurance market, while putting people who enroll in AHPs at significant risk, particularly those who have a pre-existing medical condition or develop costly health needs.

The rule proposes allowing AHPs that enroll small businesses and self-employed people to be treated as large employers. This would exempt the AHPs from a number of consumer protections that otherwise apply in the small-group and individual insurance markets, including the Affordable Care Act’s (ACA) requirement to cover essential health benefits, the prohibition against charging higher premiums based on factors like people’s gender or occupation, and the limits on charging higher premiums to older people.

Because the rule would subject AHPs to substantially weaker standards than ACA-compliant plans in the small-group and individual markets, they could — and likely would — be structured and marketed to attract younger and healthier people, thus pulling them out of the ACA-compliant small-group market and leaving older, sicker, and costlier risk pools behind. Enrollees who need comprehensive coverage, or those with pre-existing conditions and with incomes too high to qualify for subsidies, would face rising premiums and large gaps in coverage.

December 22 President Trump signs into law major tax legislation that repeals the ACA’s individual mandate beginning in 2019. (The individual mandate requires most people to either have coverage or pay a penalty.) Without the mandate, fewer healthy people will sign up for coverage, increasing average health care costs in the individual market and causing premiums to rise by 10 percent, according to Congressional Budget Office (CBO) estimates.

CBO also estimates that mandate repeal will cause 13 million people to become uninsured, increasing the non-elderly uninsured rate by almost 50 percent. Because of these coverages losses, federal funding for marketplace subsidies and Medicaid will fall substantially, generating savings of $314 billion, according to Joint Committee on Taxation estimates. The tax legislation uses these savings to help pay for making its corporate rate cuts permanent, providing tax cuts averaging nearly $100,000 to the top 0.1 percent of households (those with incomes over $3.1 million in 2017).

November 1 The Trump Administration reduces email outreach for the marketplace open enrollment period. Although the HealthCare.gov database has email addresses for about 20 million consumers — those currently or previously enrolled or who have expressed interest in HealthCare.gov coverage — the Department of Health and Human Services (HHS) will only reach out to current enrollees.

When announcing its plan to slash its outreach budget by 90 percent, the Administration said that it would focus its open enrollment advertising and outreach activities on email, digital media, and text messaging. Yet HHS isn’t emailing millions of people who need information about open enrollment and coverage.

October 26 STAT News reports that Centers for Medicare & Medicaid Services (CMS) Administrator Seema Verma said during an appearance in Cleveland that CMS will give states an “unprecedented level of flexibility” in requesting waivers of federal Medicaid rules. This will likely undermine the intent of Medicaid waivers — namely, to enable states to test new approaches to providing care to beneficiaries — and instead end up harming beneficiaries.

Verma also criticized the Affordable Care Act’s (ACA) expansion of Medicaid to millions of low-income adults, saying that “the policies that are in the Medicaid program are not designed for an able-bodied individual” and that the Trump Administration seeks to keep such individuals in the private insurance market, where they would not be “dependent on public assistance.”

Verma’s statements raise concerns that the Administration may seek to use waivers to do what congressional Republicans’ ACA repeal efforts failed to do: cut health coverage and benefits.

October 25 The Department of Health and Human Services’ Office of Inspector General releases a report explaining how the Trump Administration’s actions terminating marketplace outreach, which we described in our Sabotage Watch entry on January 26, 2017, led to $1.1 million in unrecoverable costs.

October 12 President Trump signs an executive order that could destabilize the health insurance markets where millions of individuals and small businesses get their coverage and undermine protections for people with pre-existing health conditions. The order directs relevant agencies to consider ways for more people to buy health coverage that’s exempt from many standards of the Affordable Care Act — such as the requirement that health plans cover a package of “essential health benefits” including maternity care and mental health treatment and the prohibition against charging people different premiums based on their health status.

The Trump Administration announces that it will stop making cost-sharing reduction (CSR) payments to insurers, which help lower deductibles and other out-of-pocket health care costs for roughly 6 million low- and moderate-income people. This action will raise costs for consumers and further disrupt health insurance markets. The Congressional Budget Office has estimated that ending the CSR payments will raise the number of insured people by 1 million in 2018, increase marketplace premiums by 20 percent, and cause insurers to pull out of the marketplace, leaving some consumers with no marketplace plans. And far from saving the federal government money, ending CSR payments will increase the federal deficit by $194 billion over the next ten years.

October 6 The Trump Administration announces that it is allowing employers to opt out of covering contraception based on a moral or religious objection. Previous policy ensured that employees had access to birth control even if their employer had a religious objection, giving 62 million women access to birth control without co-payments. The change could threaten many women’s access to essential contraceptive care. Moreover, the Trump Administration is taking an inappropriate short cut to put this change into effect immediately by releasing the change as an “interim final” rule, a process that is typically used when there is a public health crisis or other emergency need for a rule to take effect right away.

September 27 The Department of Health and Human Services (HHS) responds to criticism of its decision to prohibit HHS regional staff from attending marketplace open enrollment events by lashing out with false claims that the ACA has failed and is harming people.

September 25 The Department of Health and Human Services (HHS) stops staff from its regional offices from participating in marketplace enrollment events. In past years, regional office staff played an important role in outreach and other events promoting enrollment, such as the education sessions the Mississippi Health Advocacy Program conducted throughout the state. HHS staff were scheduled to participate in next week’s sessions as in past years, but with very little notice, they told event organizers they couldn’t attend due to HHS restrictions on regional staff attending open enrollment events.

September 22 Centers for Medicare & Medicaid Services (CMS) informs navigator groups it could take up to 30 days to review and approve their revised proposals and budgets to reflect the major budget cuts it has made, and that the groups’ funding won’t be guaranteed until final CMS approval. The Ohio Association of Foodbanks — which had its award reduced to 71 percent of what it anticipated — announces it will no longer pursue navigator funding due to the limited funding levels and continued uncertainty, leaving a huge gap for Ohioans who need help enrolling in the marketplace.

Consumers won’t be able to complete HealthCare.gov applications on all but one Sunday morning during the upcoming 45-day enrollment period due to system maintenance, CMS announces. While downtimes due to system maintenance have occurred in the past, regularly taking the system off line on Sunday mornings — especially during open enrollment — has never happened. Sunday mornings are popular times for assistance groups to help people enroll at community events, including faith-based gatherings.

September 20 The Trump Administration sends navigator groups their new target budgets for consumer outreach and enrollment assistance. Many groups face steep cuts and are being forced to make difficult decisions such as cutting services to hard-to-reach rural communities. Centers for Medicare & Medicaid Services (CMS) officials continue to point to poor performance in enrollment as justification for the cuts, though relying on enrollment numbers is a flawed measure of navigator effectiveness that doesn’t reflect their full value. Furthermore, as groups received notification of their new award amounts, some groups that met or exceeded enrollment targets for the 2017 coverage year received deep cuts, calling into question how CMS used data sources and methods to make cuts.

September 8 Navigator groups that conduct consumer outreach and provide marketplace enrollment assistance haven’t received federal funding for the next year, even though their budget year started September 1. The lack of clarity about navigator funding continues more than a week after the Trump Administration announced it would slash funding for the organizations. Without funding or assurances that funding — if and when it is finally awarded — can be used retroactively for expenses incurred starting September 1, navigator groups have been forced to make drastic cuts that would severely undermine their outreach efforts for the open enrollment period that starts on November 1. Some groups are already cutting highly trained staff whom they could lose permanently if they find other jobs. And groups have begun canceling outreach activities, which are especially critical in this year’s shortened open enrollment period.

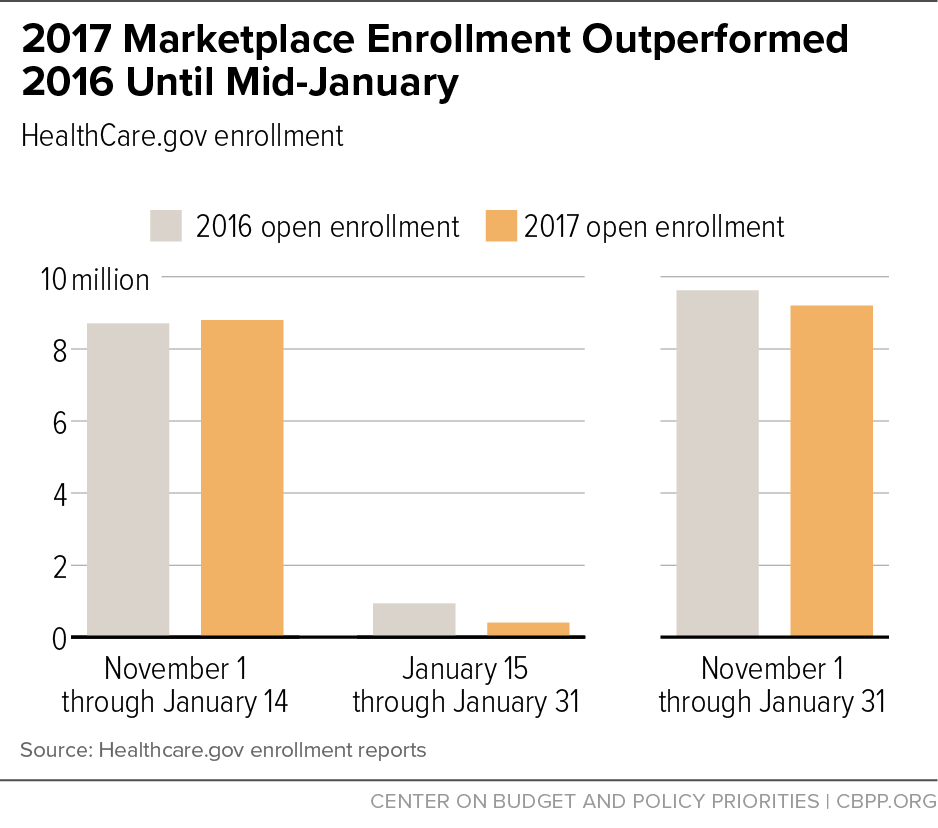

August 31 Just two months before the start of open enrollment, the Trump Administration announces it will slash funding for marketplace outreach (by at least 90 percent) and consumer enrollment assistance through the navigator programs (by about 40 percent). Without a robust awareness campaign, many people will be unaware of the availability of affordable coverage options and will remain uninsured. Bipartisan efforts to stabilize the marketplaces are developing, but the Administration’s cuts will make that goal far more challenging.

August 15 Beginning in 2013, the Obama Administration successfully engaged a diverse set of partners to spread the word about coverage available in the marketplaces and Medicaid. The Administration enlisted “gig economy” companies like Lyft and Uber, faith-based organizations like the United Methodist Church, and medical groups like the American Congress of Obstetricians and Gynecologists in efforts to raise awareness and boost enrollment. Former HHS officials have described these partnerships as key to advancing enrollment especially among diverse, young, and healthy people. But this year, there’s no sign that the Trump Administration has reached out to these groups. Ending these partnerships will likely depress enrollment in the coming open enrollment period.