off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

In Case You Missed It...

| By

CBPP

This week at CBPP we focused on new Census Bureau data on poverty, income, and health coverage in 2014. We also covered the federal budget and taxes, health policy, housing, food assistance, Social Security, and income inequality.

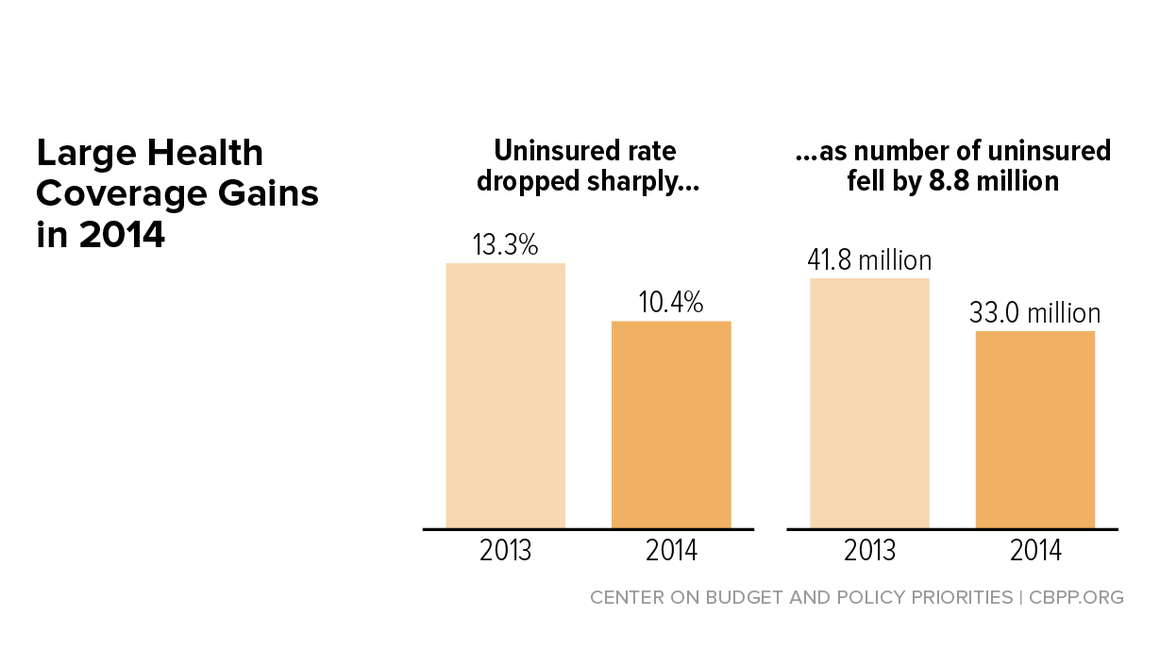

- On the Census data, we previewed the figures and then, after their release, Robert Greenstein issued a statement on the mixed Census findings. Matt Broaddus noted that the gains in health coverage in 2014 were historic but pointed out that states that have adopted health reform’s Medicaid expansion had a substantially lower uninsured rate in 2014 than states that haven’t. He and Edwin Park made a detailed examination of the health coverage figures. We explained that the safety net kept millions of people out of poverty last year, including 4.7 million due to SNAP (formerly food stamps) and about 10 million, including more than 5 million children, due to the Earned Income Tax Credit and Child Tax Credit. Alicia Mazzara noted that weak income growth hasn’t kept up with rising rents. Erica Williams found that poverty improved in few states. We rounded up our same-day Census analyses. Arloc Sherman and Isaac Shapiro addressed the American Community Survey’s data, which revealed a rise in incomes and a drop in poverty in 2014.

- On the federal budget and taxes, we issued new projections on the improved long-term budget outlook but urged policymakers not to ignore the remaining challenges. Chuck Marr explained why a House Republican push to permanently extend certain corporate tax breaks is misguided and praised legislation enabling the IRS to require all paid tax preparers to demonstrate basic competence. Richard Kogan pointed out the special rules Congress is applying to highway and transit funding, noting that its different approaches to paying for programs reflect its policy and ideological preferences rather than the application of standard budget rules. David Reich listed three reasons why a full-year continuing resolution would be problematic. Isaac Shapiro argued against cuts to the Bureau of Labor Statistics that would leave policymakers without crucial data. We updated our fact sheets showing the effects of the Earned Income Tax Credit and Child Tax Credit in each state.

- On health policy, Jesse Cross-Call explained how Michigan’s proposed Medicaid changes would threaten progress in expanding health coverage. Edwin Park cautioned against repealing limits on tax-advantaged health accounts.

- On housing, Will Fischer critiqued a proposed expansion of the “Moving to Work” demonstration, which could limit families’ housing choices. Ehren Dohler analyzed the alarming rise in homeless students.

- On food assistance, Robert Greenstein and Zoë Neuberger commended WIC’s cost-effective bidding process for infant formula.

- On Social Security, we explained in a paper and a blog post why the Netherlands’ disability insurance system would be a poor model for U.S. reform.

- On income inequality, Ben Spielberg cited a new study showing that unions boost economic opportunity.

Chart of the Week: Large Health Coverage Gains in 2014

Image

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Poverty, Wages Remain Stagnant Despite Economic Recovery

US News & World Report

September 16, 2015

Census: Uninsured Rate Plunged as Obamacare Took Hold in 2014

CQ Roll Call

September 16, 2015

Five myths about public housing

Washington Post

September 14, 2015

To Support Millions of Low-Wage Workers, Protect Tax Credits

Moms Rising

September 12, 2015

Stay up to date

Receive the latest news and reports from the Center