President Biden’s budget, released before 2024 appropriations have been finalized, proposes annual appropriations for 2025 to fit within the tight caps set as part of last year’s debt ceiling agreement. Whether the 2025 non-defense appropriations cap, just 1 percent above the 2024 level (without accounting for inflation), is ultimately workable will no doubt be part of the 2025 appropriations debate once the dust settles on the 2024 process.

When making 2025 appropriations, policymakers will need to make careful choices, giving attention to investments that improve well-being and opportunity for people and communities in need or that address other pressing national priorities.

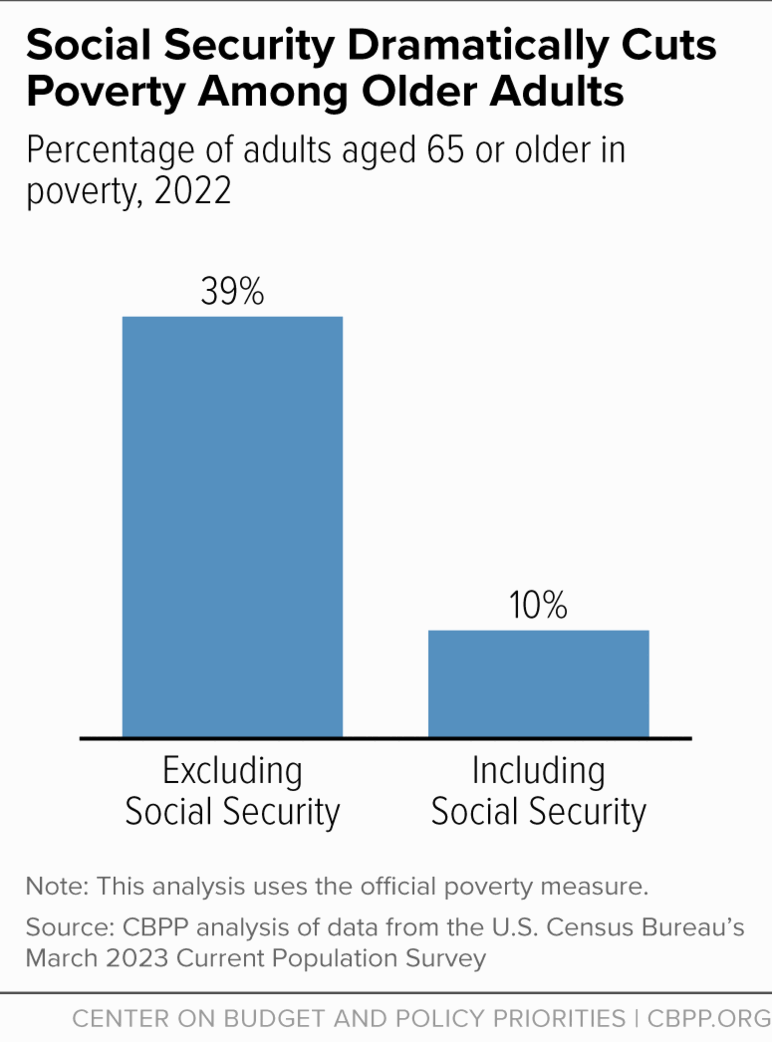

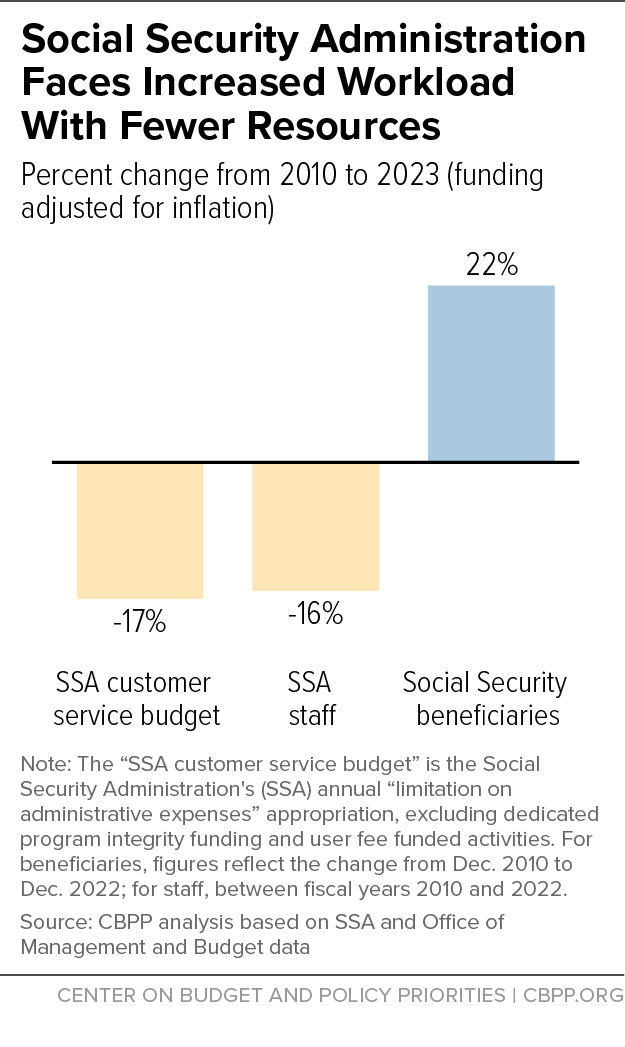

The President’s budget includes some of those investments. To give a few examples, it expands assistance to help families with low and moderate incomes meet the high cost of child care, provides sufficient funding for the WIC nutrition assistance program to serve all eligible families who apply, increases the budget of the Indian Health Service to carry out federal obligations to tribal nations, and provides more adequate customer service funding for the Social Security Administration.

But because of the caps, the budget’s funding increases are generally quite small, in some cases providing less than what’s needed just to keep up with inflation. For example, the two largest federal programs assisting K-12 education (“Title I” Education for the Disadvantaged and IDEA grants for special education) each receive increases of roughly 1 percent over the two years from 2023 through 2025.

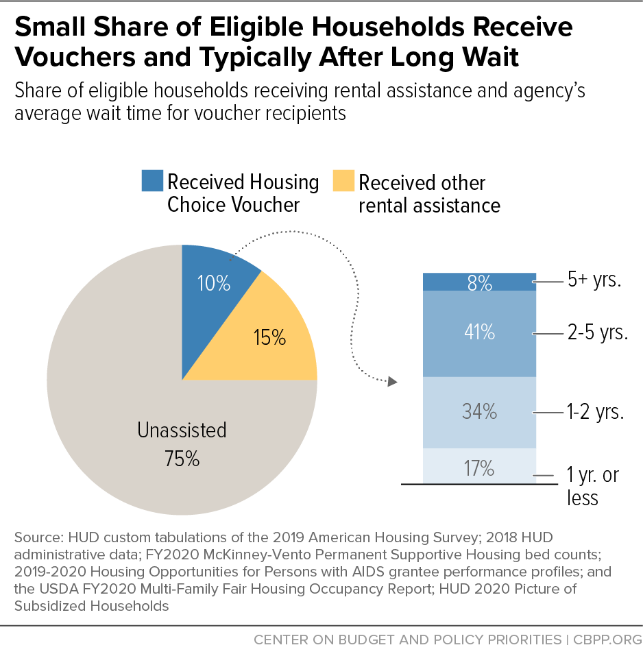

The budget also includes cuts in areas that are otherwise a priority for the Administration. For example, while it makes important investments in housing supply and affordability using mandatory funds (not funds subject to the annual appropriations process), the HUD budget includes some notable cuts that will undermine communities’ ability to address affordable housing needs. While it calls for increased funding for Housing Choice Vouchers, the largest rental assistance program, that funding will likely be too little to avert cuts in the number of households receiving assistance.

Crafting workable funding bills under these caps for 2025 will be extremely challenging. Even under the best of circumstances, many needs will go unmet — a reason for Congress to reevaluate these funding levels for next year.