The Internal Revenue Service (IRS) provided inadequate taxpayer services this tax season, with the agency answering fewer than half of taxpayers’ phone calls and taxpayers waiting in long lines outside IRS offices for help.[1] Some have blamed the IRS for instigating this inadequate service; House Ways and Means Committee Republicans, for example, issued a report claiming that the IRS “deliberately cut spending for customer service.”[2] In reality, the poor taxpayer service reflects the cumulative effect of the deep cuts to the IRS budget that Congress has imposed since 2010, largely at the behest of House Republicans, who have sought even larger cuts than those enacted.[3]

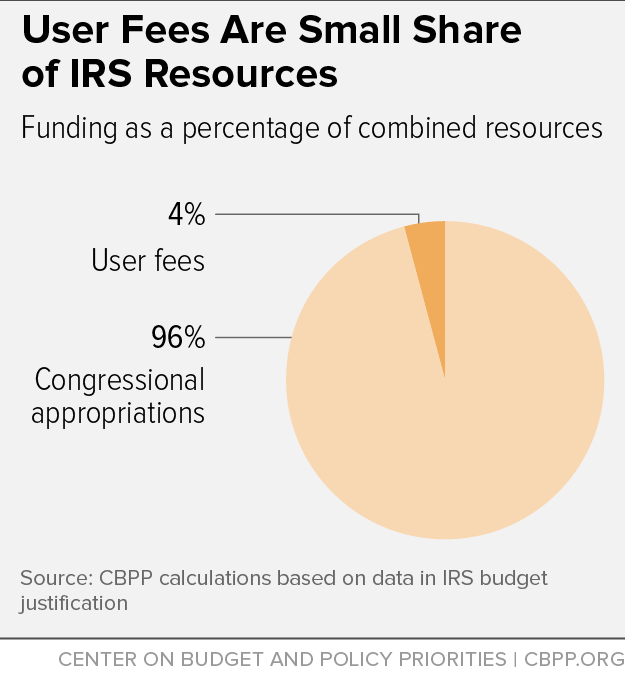

Congressional appropriations provide the vast majority of the IRS’s resources, and Congress has cut funding significantly since 2010 for each of the three main parts of the IRS budget: taxpayer services, operations support (primarily information technology or IT), and enforcement. The Ways and Means report, however, focuses on the IRS’s allocation of user fees, which amount to less than one-twentieth of the resources the IRS receives from appropriations. The IRS Commissioner has flexibility to devote those fees to the agency’s most pressing needs.

To meet its legal obligations, including new obligations related to health reform such as reconciling the estimated tax credits that taxpayers used to buy health insurance in the marketplace in 2014 with the credits they are ultimately eligible for based on their actual 2014 income, the IRS has consistently requested additional funds for IT. Congress has rebuffed those requests. This year, to address the continuing shortfall in IT funding, the IRS shifted some user fee funds from taxpayer services to operations support. The Ways and Means report attributes this year’s poor taxpayer service to this shift, ignoring both Congress’s much larger cuts in taxpayer services funding since 2010 and Congress’s underfunding of IT activities needed to ensure the IRS meets important legal requirements.

The IRS plays a fundamental role in government, collecting nearly all of the revenue that funds federal programs from national defense and the safety net to roads, science research, and education. It also supports our system of voluntary tax compliance by helping taxpayers comply with the tax code and enforcing the nation’s tax laws. Budget cuts since 2010 have compromised the IRS’s ability to fulfill these responsibilities, however, as a number of independent analysts — including the National Taxpayer Advocate, the Treasury Inspector General for Tax Administration, the IRS Oversight Board, and the Government Accountability Office — have concluded. This underfunding, not the IRS’s efforts to meet its multiple responsibilities despite reduced resources, is the fundamental source of today’s low levels of taxpayer service.

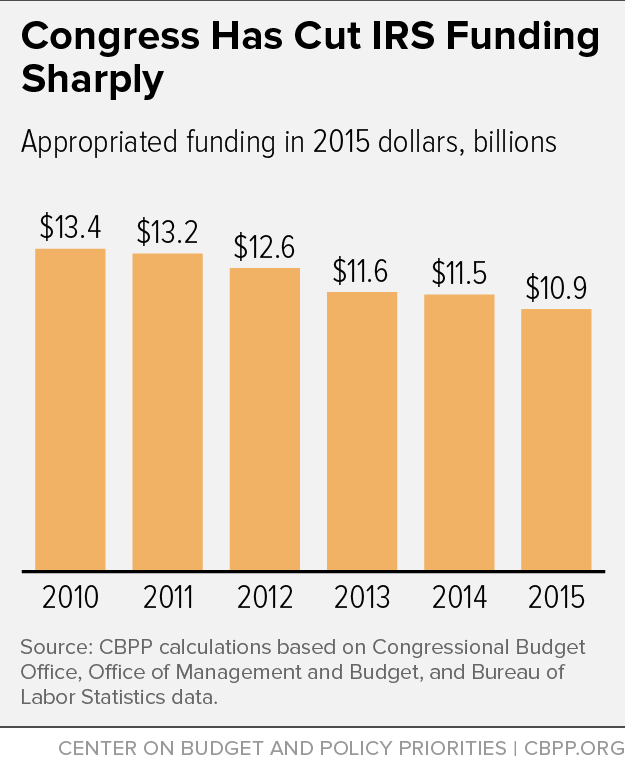

Congress has cut IRS funding by roughly one-fifth since 2010, after adjusting for inflation, even as the agency’s responsibilities have grown significantly.[4] (See Figure 1.)

For 2015, the House passed even deeper cuts than those ultimately enacted, calling for shrinking the IRS budget from the 2014 enacted level of $11.5 billion to $9.8 billion (or $1.1 billion less than the final appropriation of $10.9 billion).[5] The House will likely push for additional cuts in 2016: the House Appropriations Committee’s 2016 funding allocation for the Financial Services and General Government appropriations bill, roughly half of which goes to the IRS each year, is $1.3 billion (6.1 percent) below its 2015 enacted level.[6]

The cuts enacted to date have seriously weakened the IRS. Because three-quarters of its budget goes for personnel, the IRS has had to sharply reduce its workforce. As a result, taxpayer services have been degraded, and individual and business audit rates have fallen to their lowest levels in a decade. (See box.) Reductions in taxpayer service and enforcement make it harder for honest taxpayers to comply with the tax code and easier for people not to pay the taxes they owe, threatening to weaken the system of voluntary compliance that is the cornerstone of our tax system.

In addition, the cuts have prevented the IRS from upgrading its outdated IT systems — some of which, as IRS Commissioner John Koskinen notes, “were running when John F. Kennedy was president.”[7] He concludes, “This compromises the stability and reliability of our information systems, and leaves us open to more system failures and potential security breaches.”[8] The cuts also hindered the IRS’s preparation for implementing two major new laws that require substantial IT investments: health reform and the Foreign Account Tax Compliance Act (FATCA).

The IRS is charged with administering health reform’s premium tax credits, which help millions of near-poor and middle-income taxpayers afford coverage in the insurance marketplaces that were launched in 2014. The IRS also must administer health reform’s “individual mandate,” determining whether people who don’t buy health insurance during the year are subject to a penalty. Further, starting in the 2015 tax year, the IRS must process data related to the “employer mandate” (the requirement that large employers offer their workers coverage or pay a penalty), including data from nearly all insurers, employers subsidizing health insurance, and insured individuals. As the Treasury Inspector General for Tax Administration warned two years ago, health reform “contains an extensive array of tax law changes that, absent added funding, will present budgetary challenges for the IRS in coming years.”[9]

Under FATCA, which seeks to reduce illegal tax evasion by requiring filers and financial institutions to report more information to the IRS about assets held in offshore accounts, the IRS is charged with collecting and analyzing the additional information and conducting enforcement activities where warranted. More than 150,000 financial institutions in 112 countries have already registered under FATCA.[10]

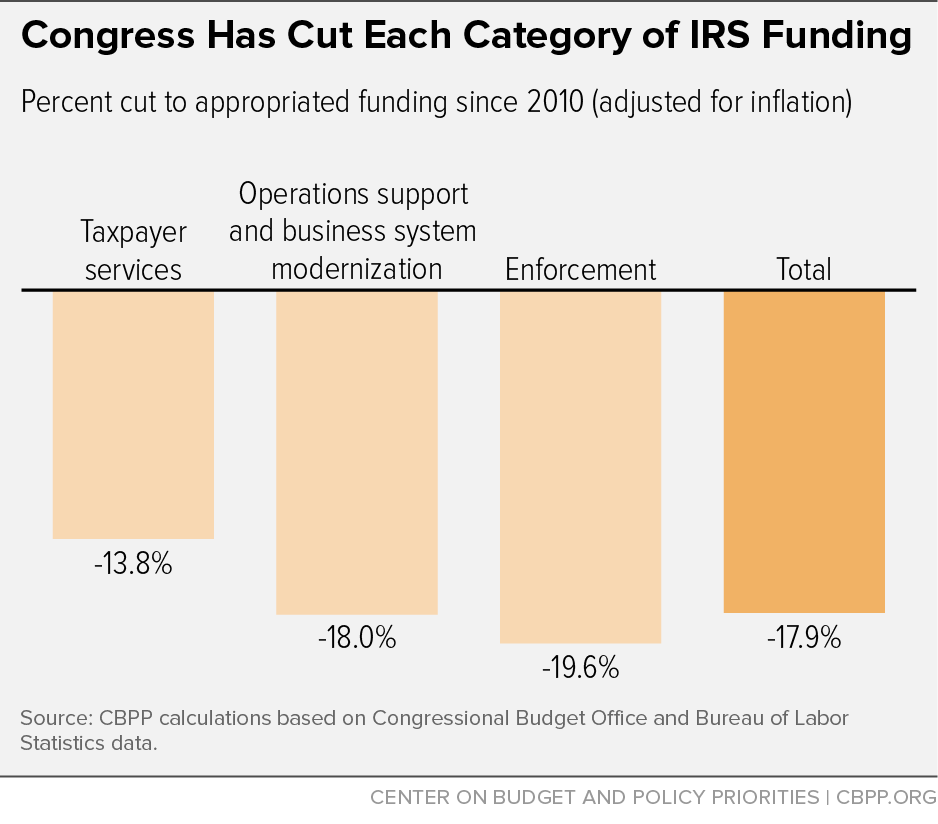

The three main categories in the IRS budget — taxpayer services, operations support, and enforcement — reflect the IRS’s main responsibilities of facilitating the filing of tax returns, processing them, and collecting outstanding taxes. Congress sets specific amounts for each of these categories in the appropriations bill. As Figure 2 shows, policymakers have cut all three deeply since 2010.

The cuts came despite the IRS’s new responsibilities in 2015 to implement health reform and FATCA. The IRS requested over $300 million in 2015 specifically for IT support for health reform.[11] This funding was needed to set up computer systems needed for the first time this filing season to reconcile estimates of the premium tax credit used to purchase health insurance with the actual credit amount, which is based on a person’s year-end income, for the millions of individuals who received subsidies in 2014. The IRS also needed new IT investments to begin processing data this year related to reporting requirements for the employer mandate, scheduled to take effect in the 2015 tax year. In addition, the IRS needed added personnel and IT resources to collect and analyze the large amounts of data that FATCA generates, as 2015 is the first year many banks begin reporting accounts to the IRS.

Congress provided no new funding in 2015 for the IRS for these purposes. In fact, Congress cut overall funding for IRS operations support by more than $160 million in 2015. Congress also cut funding for enforcement by more than $160 million in 2015.

Given the new cuts to already inadequate funding levels for IT, the IRS sought to fulfill its legal obligations by shifting some of the user fees it collects from taxpayer services into operations support. The Ways and Means Republicans’ report harshly criticized the move, claiming that the IRS “decided to make drastic cuts to taxpayer assistance. Instead of prioritizing customer service or boosting its enforcement budget, the IRS spent the bulk of its user-fee receipts on other priorities.” The report also blamed the funding shift for the decline in taxpayer service this year, noting that Congress held funding for taxpayer services steady in 2015 at the 2014 level (though funding declined after adjusting for inflation).

These claims ignore the fact that Congress provides the vast majority of IRS resources — user fees represent less than one-twentieth of the IRS’s combined resources (see Figure 3) — and that Congress has cut taxpayer services funding by more than twice as much since 2010 as the amount of user-fee funds that the IRS shifted. As a result of these cuts, taxpayer service worsened between 2010 and 2014, with the share of taxpayers’ calls being answered falling from 74 to 64 percent and average wait times for callers rising from 11 to 20 minutes, before worsening further in 2015.[12] In addition, appropriations now support over 3,000 fewer full-time equivalent employees for taxpayer services than in 2010, an 11 percent reduction.[13] The cumulative effects of these cuts made in previous years hurt taxpayer services this filing season, even if appropriated funding did not decline between 2014 and 2015.

Further, the report doesn’t acknowledge that congressional underfunding of IT, and failure to provide resources to implement health reform, compelled the IRS to shift user fee funding in the first place. While it argues that the IRS chose to prioritize implementing health reform over “core responsibilities like taxpayer assistance,” health reform is the law of the land, and the IRS has a legal obligation to fulfill its responsibilities under that law, such as ensuring that taxpayers receive the tax credits to which they are entitled and collecting overpayments.

Also, the report’s narrow focus on the taxpayer services budget category ignores the fact that operations support is crucial to serving taxpayers. For example, having an IT system able to process tax returns for filers receiving health insurance subsidies certainly helped taxpayers.

To be sure, the IRS’s shift of user fees out of taxpayer services may have contributed to somewhat lower levels of taxpayer service this filing season. But any effects of this shift were more pronounced because Congress’s cuts to taxpayer services left the IRS with reduced base funding for this category. Repeated cuts in IRS funding in recent years compelled the agency this year to choose which urgent needs to fill with the few resources it controls itself. The tradeoff — for instance, between answering more phone inquiries in a timely fashion and ensuring that tax returns with premium credits can be processed — was not of the IRS’s making.

Congress provides nearly all of the IRS’s funding and has cut the agency’s budget by nearly a fifth since 2010. Criticizing the IRS for “deliberately” weakening taxpayer services when it seeks to fulfill its legal obligations despite those cuts is unfair and misleading, especially since House Republicans have sought even deeper cuts in taxpayer services and other areas and will likely push for additional cuts for next year. The evidence demonstrates that the IRS needs more resources, not fewer, in each of the major budget categories under which it carries out its essential tasks.

Another criticism in the Ways and Means report — that the IRS has not “prioritized” enforcing the nation’s tax laws — is just as misleading as the report’s claims regarding taxpayer services, and for the same reason. Congress has cut enforcement funding significantly in recent years; in fact, it has cut enforcement more than any other IRS budget category. Moreover, the House passed an appropriations bill for 2015 that would have cut enforcement even more than the appropriation ultimately enacted.

These cuts have badly damaged enforcement efforts:

- The number of IRS staff devoted to enforcement has dropped by 20 percent since 2010.

- The annual audit rate for individual taxpayers is now below 1 percent, the lowest in a decade. The IRS audited 1.2 million taxpayers in 2014 — 150,000 fewer than in 2013 and over 300,000 below 2010.

- Audits of corporations fell by 6 percent last year, reaching their lowest level since 2006.

Weakening IRS enforcement ultimately hurts the entire budget and increases deficits. The Treasury estimates that every dollar invested in IRS tax enforcement activities above current levels yields $6 or more in increased revenue collections. Increased enforcement funding also boosts revenue indirectly by deterring tax evasion; Treasury estimates that this indirect revenue impact is at least three times the direct impact. As Commissioner Koskinen summarized, “Essentially, the government is losing billions to achieve budget savings of a few hundred million dollars.”

For citations and further information, see Marr, Friedman, and DeBot, 2015.