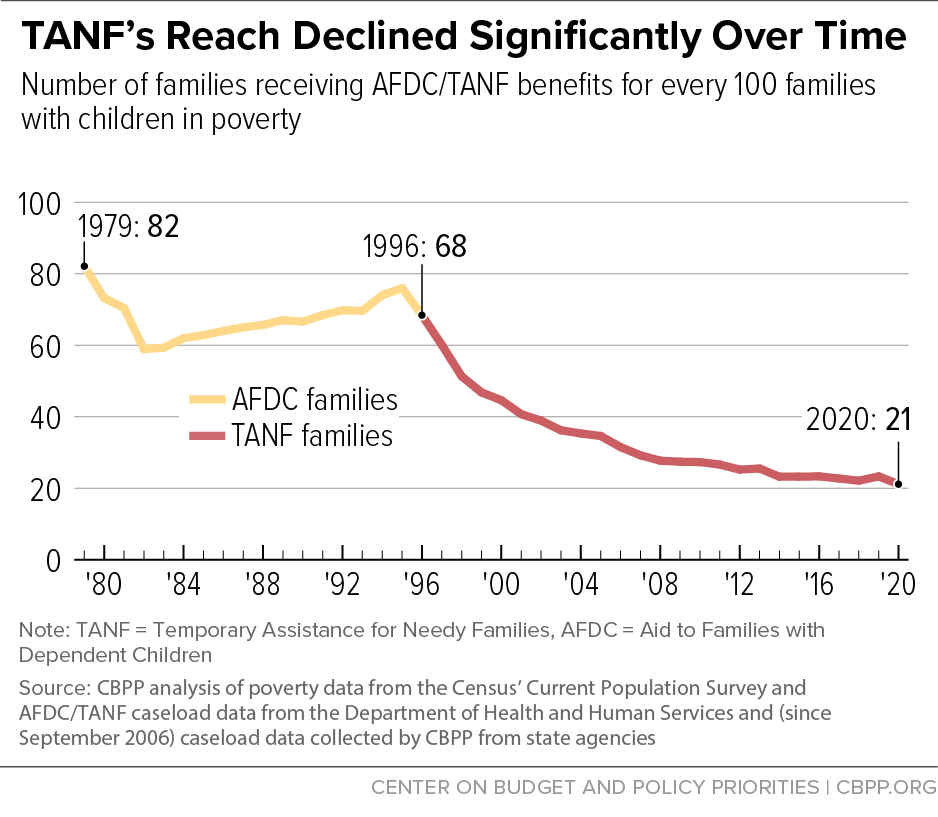

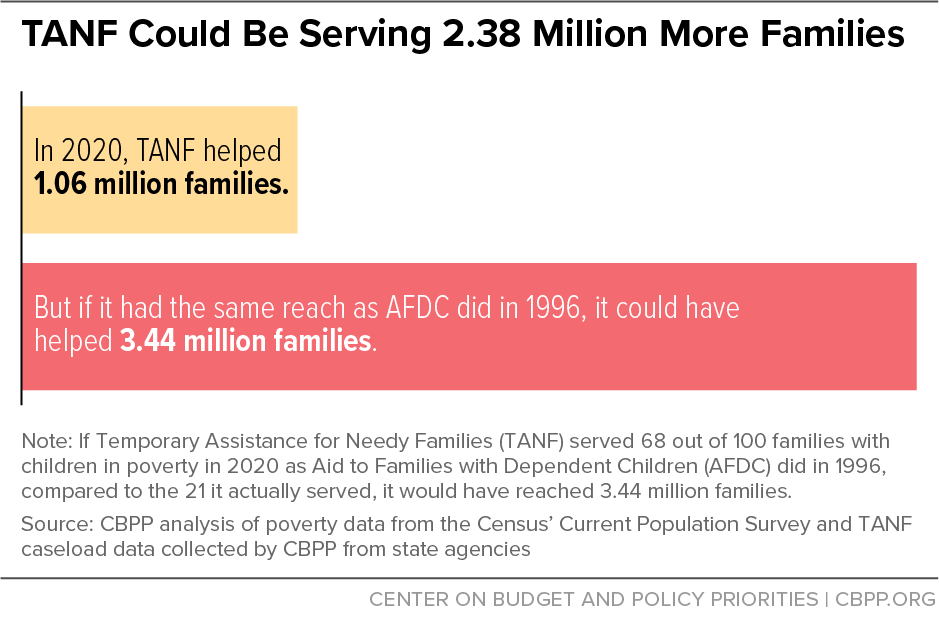

Families experiencing poverty need access to cash assistance to help them afford their basic needs and maintain stability, particularly during the ongoing COVID-19 pandemic. Families use assistance provided by the Temporary Assistance for Needy Families (TANF) program to pay for rent, utilities, diapers, food, transportation, and other necessities. Yet too few families struggling to make ends meet can access the program, and TANF’s history of racism means that it fails to reach many families in states where Black children are likelier to live. If TANF had the same reach in 2020 as its predecessor, Aid to Families with Dependent Child (AFDC), did in 1996, 2.38 million more families nationwide would have received cash assistance. Instead, in 2020, for every 100 families in poverty nationwide, only 21 received TANF cash assistance — down from 68 families in 1996. At an economically precarious time for families, this “TANF-to-poverty ratio” (TPR) is the lowest in the program’s history. (See Figure 1.)

This paper analyzes TANF caseload and poverty data from 2020, the most recent year available. The official U.S. poverty rate rose from 2019 to 2020 — the first rise in poverty after five years of decline — due to the COVID-19 pandemic and the resulting economic crisis.[1] Widespread hardship has created instability for millions of families with children, some of whom have turned to TANF, among other public programs, for relief.[2] But as this paper illustrates, TANF does not reach many families in need.[3] Access is worst for Black families, who have been especially hard hit by the pandemic’s impacts.[4] Further, though TANF caseloads grew in many states in 2020, the program’s benefit levels are extremely low in many states, falling far short of what families need to meet their basic needs.[5]

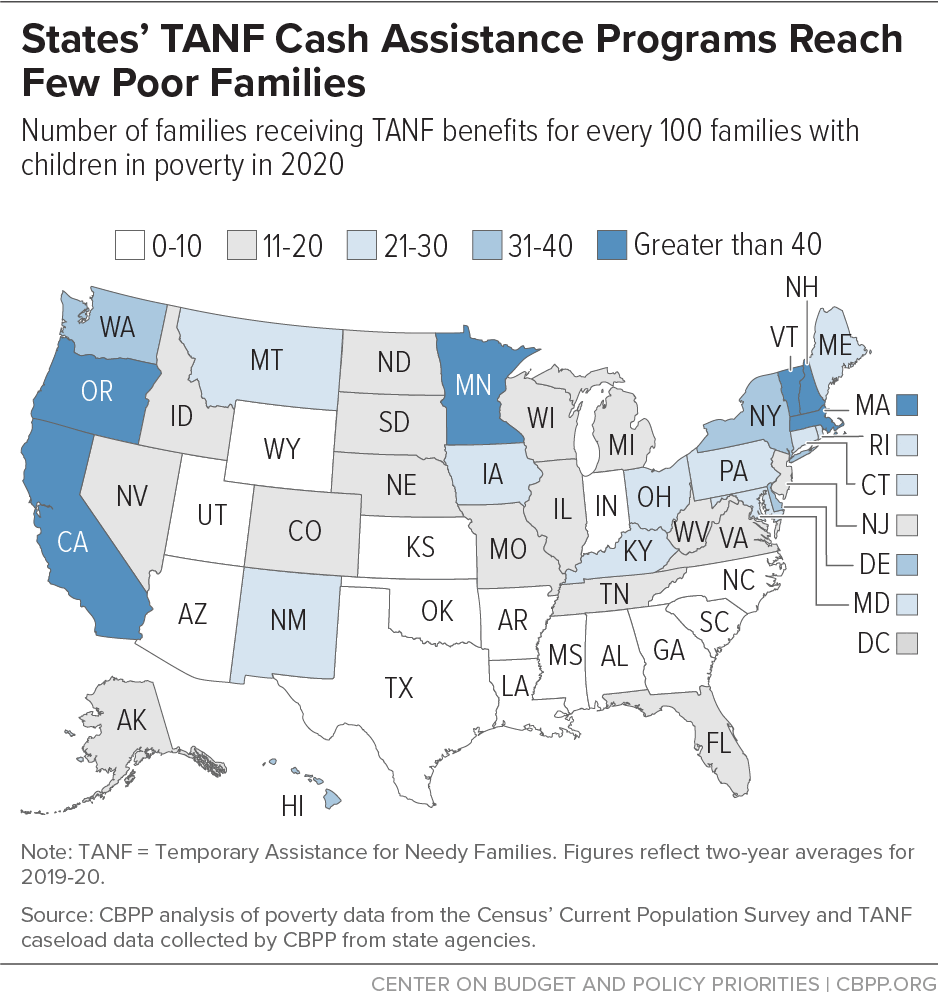

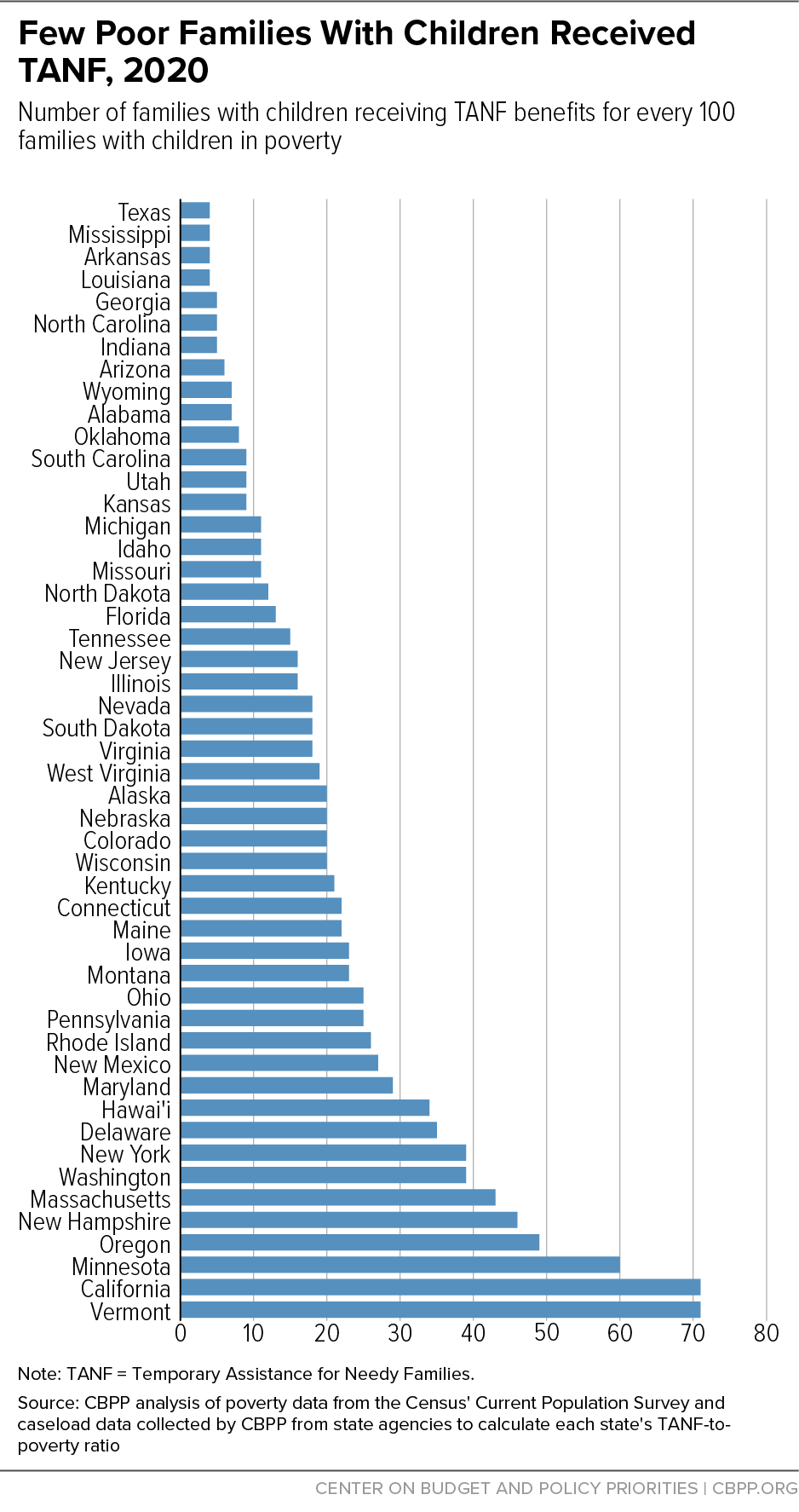

Access to TANF largely depends on where a family lives. There are no federal minimum eligibility standards and states have the power to erect barriers or create pathways to TANF cash assistance. This has led to wide variation among state TPRs, which range from 71 in California and Vermont to just 4 in Arkansas, Louisiana, Mississippi, and Texas (see Appendix B, Figure 1). In 14 states, for every 100 families living in poverty, 10 or fewer receive TANF cash assistance.

These geographic disparities reflect racial inequities in TANF: compared to white children, Latinx children are somewhat more likely, and Black children even more likely, to live in states with the lowest TPRs. The history of racism in cash assistance programs in the United States lives on in policies that impact access to TANF today, from strict work requirements and time limits to invasive behavioral requirements, exacerbating the barriers Black and Latinx families still face to economic stability.[6]

More income during early childhood can improve children’s futures, research continues to find.[7] But TANF’s limited reach means that when families hit hard times because they have lost a job, are fleeing domestic violence, or are facing a health or mental health crisis, they may have no access to cash assistance. Blocking families from assistance to meet their basic needs often puts them on a downward spiral, making it even harder to get back on their feet, and may have long-term negative consequences for children.

State and federal policymakers can change these trends. States should remove barriers to assistance and ease policies that cut off families who are still struggling. At the federal level, policymakers should hold states accountable for serving families experiencing poverty and provide the resources to help them do so.

Amid the nationwide hardship in 2020 that resulted from the pandemic, the number of families receiving TANF benefits increased in some states but stayed the same or fell in others over the course of the year. Nationally, the average monthly TANF caseload declined between 2019 and 2020, but that metric misses the rise and fall of the caseload during the year. In fact, caseloads rose at the beginning of the pandemic in early 2020 and fell by the end of the year. Some of this decline likely is attributed to the availability of pandemic federal unemployment benefits and other financial assistance, such as Economic Impact Payments.

Most states made temporary TANF policy changes at the start of the pandemic due to public health precautions, limited opportunities for residents to find work, and staff safety. These changes, which reduced the burden of applying for or maintaining benefits, ranged from extending eligibility recertifications and halting in-person interview requirements to suspending work requirements and providing expanded time limit exemptions. At the start of the pandemic, applications for TANF soared nationwide, from about 170,000 in February to 316,000 in April, then plummeted to 174,000 in July. Applications modestly rose over the remainder of the year, ending at 233,000 in December.

At the start of the pandemic, caseloads rose in 35 states. By the end of 2020, they had fallen in 34, though not all states with a drop had seen a rise earlier in the year. Caseloads remained higher than January and February 2020 in only 12 states. (See Figure 2.)

In some states, policy and administrative changes may have contributed to a sustained increased caseload. For example, Indiana suspended requirements that applicants complete job search activities before receiving benefits and redeterminations, and Maryland suspended work requirements and extended eligibility recertifications and verifications. Caseloads rose substantially in both states during the spring and stayed high for the rest of the year.

TANF would help many more families in poverty had it maintained AFDC’s reach in 1996. Instead, its reach has fallen dramatically. If TANF had maintained the same reach to families in poverty as AFDC had in 1996, 3.44 million families would have received TANF in 2020, about 2.38 million more than reported for that year. (See Figure 3.) In the average month in 2020, TANF reached the fewest number of families since TANF’s start, even as the number of families in poverty increased.

This pattern of reaching few families living in poverty has persisted. Before 2020, the TPR declined because TANF caseloads had fallen much more than the number of families experiencing poverty. In 2020, the TPR declined because the average monthly TANF caseload fell while the number of families in poverty increased.

We use the TANF-to-poverty ratio to examine changes over time in access to TANF by families experiencing poverty to help meet their basic needs. We calculate the ratio by dividing the number of TANF cash assistance cases by the number of families with children in poverty from the Census Bureau’s Current Population Survey (CPS). We use two-year averages for our state-level calculations to improve the reliability of the data. (See Appendix A for further details about our methodology.)

When this ratio falls, it means TANF is less responsive to need than in previous years. The TPR can fall because: (1) the number of families receiving cash assistance from TANF falls, without a corresponding drop in the number of families living in poverty; or (2) the number of families living in poverty rises, without a corresponding increase in the number of families receiving TANF benefits. The TPR declined between 2019 and 2020 because the number of families in poverty increased while the number of families receiving TANF benefits declined.

The TPR has both strengths and limitations. Its strengths include: (1) it provides a measure of access to TANF benefits that is consistent over time and across states; and (2) it uses readily available data, making it transparent and relatively current. Key limitations include: (1) it is less reliable in small states because of sample size limitations in the CPS; (2) the underreporting of income from public benefit programs in the CPS has worsened over time, making the official poverty estimates less accurate than they once were; (3) it is not able to capture systemic anomalies that may occur within a single year, such as how the effects of the pandemic impacted caseloads.

The national TANF-to-poverty ratio misses the extreme — and growing — variation among states. In 2020 the TPR ranged from 71 in California and Vermont to just 4 in Arkansas, Louisiana, Mississippi, and Texas. (See Figure 4.) (To improve the reliability of the state-level poverty data, we created two-year averages of the poverty numbers; we also converted the caseload data into two-year averages to calculate the TPRs. The years cited here are for the latter of the two years.)

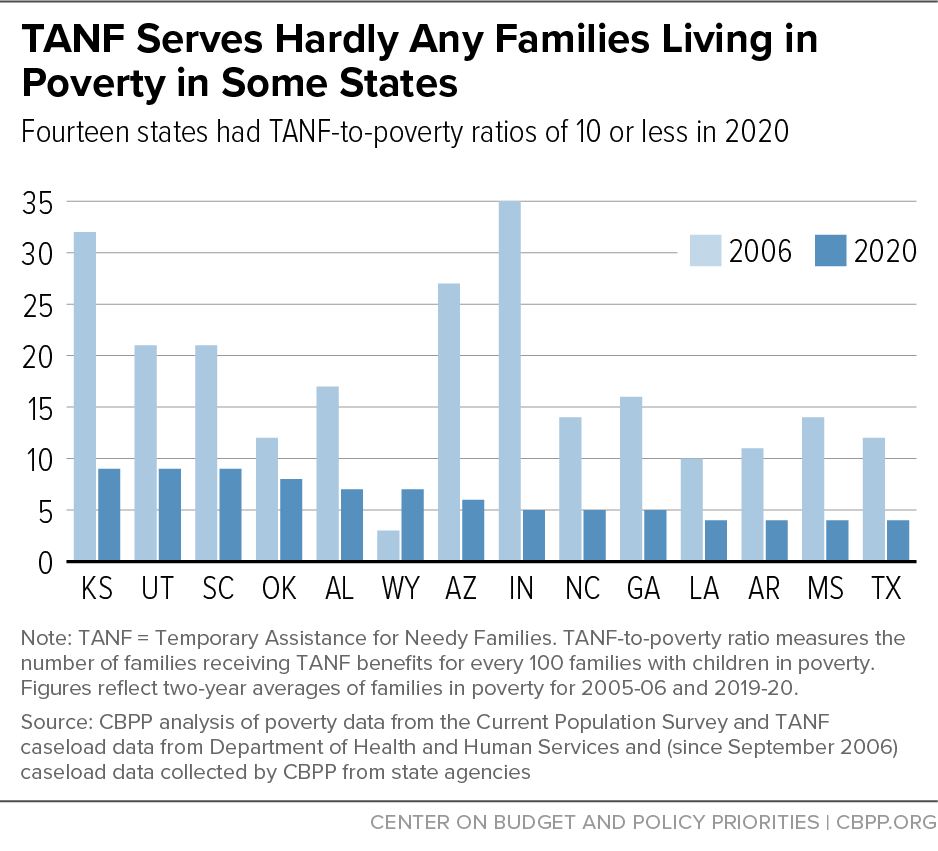

The TPR fell in most states between 2006 (the last time TANF was reauthorized) and 2020 for several reasons: state responses to federal policy changes when TANF was reauthorized and in response to the pandemic, adoption of more restrictive policies as part of a broader attack on economic security programs, and policy changes to restrict access and reduce costs during the Great Recession of 2007-2009, among other factors. (See Appendix B, Table 1.) The TPR dropped by 10 or more points in 25 states over this period; in 14 of those states, it dropped by 20 points or more.

Though TPRs have fallen both nationally and in every state since 1996, some states’ TPRs have risen in recent years. In 2020, the TPR increased in 15 states from the prior year. TANF caseloads increased in eight of these states in 2020: Illinois, Maine, Maryland, Massachusetts, Minnesota, Nebraska, New Mexico, and Washington. In the seven other states, the TPR rose because the number of families in poverty fell more than caseloads.

An especially troubling trend is the number of states with TPRs of 10 or less. In 2006, only three states (Idaho, Louisiana, and Wyoming) had such low ratios, and in 1996, none did. In 2020, 14 states had TPRs of 10 or less: Alabama, Arizona, Arkansas, Georgia, Indiana, Kansas, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Texas, Utah, and Wyoming. Three of these states have had especially large drops in their TPRs since 2006: Indiana (29 points), Kansas (23 points), and Arizona (21 points). All have made significant policy or administrative changes that have made it harder for families to receive benefits. (See Figure 5.) In 2020, more than one-third (37 percent) of families with children in poverty lived in states with TPRs of 10 or less.

A history of racist policies that aimed to limit Black mothers’ access to family cash assistance programs continues to contribute to racial disparities in access to TANF today.[8] Forty-one percent of the nation’s Black children live in states with TPRs of 10 or less, compared to 34 percent of Latinx children and 29 percent of white children.[9] Nationally, therefore, Black children are less likely than white children and somewhat less likely than Latinx children to have access to TANF assistance when their families fall into crisis. Moreover, if Black families do manage to receive TANF cash benefits, they are likelier to live in states with the lowest benefit levels, which do little to help families meet their basic needs.[10]

Disparate access has persisted over decades: averaged together, the 14 states with the lowest TPRs today consistently had ratios lower than the national average every year between 1979, the earliest year of our state analysis, and 2020. Individually, a few of these states had ratios above the national average for some years, but generally, they had lower ratios than the national average even before TANF was implemented (see Appendix B, Table 4).

From its roots, the public cash assistance system has excluded Black families in need.[11] In the early 20th century, supporting people in need was typically the responsibility of private organizations, which had full discretion to exclude individuals based on race, nationality, or religion. Some of the earliest public cash assistance programs, mothers’ pension programs, provided small benefits to widows and their children. Yet many mothers’ pension programs refused to serve Black women or other women of color; in 1931 only 3 percent of mothers’ pension program recipients were Black or “non-white.”[12]

In 1935, as part of that year’s Social Security Act, the United States established the first federal cash aid program for children, Aid to Dependent Children (ADC), which provided federal support to states for family cash assistance programs. The Southern congressional delegation (a crucial bloc in both chambers) successfully insisted on provisions that gave control of the program to state and local officials, thus protecting the white supremacist socioeconomic order of the Jim Crow South from the perceived threat of an expanded federal government.[13]

One way Southern officials tried to keep Black mothers available for work was to simply reject or ignore their applications for aid.[14] Even if a Black family’s application was accepted, officials could coerce them to work by deliberately paying out lower benefits or with so-called “farm policies” where benefits were lowered or cut off during the planting or harvesting seasons to force parents and children as young as 7 into the fields for extremely low wages. In Louisiana and Arkansas, for example, benefits would be lowered or halted completely regardless of whether the family had secured such employment during planting or harvesting seasons.[15]

States also restricted access to benefits for Black families through “suitable home” policies; 23 states passed such laws between the late 1940s and the early 1960s.[16] Though they appeared throughout the country, the most punitive of these policies were in the South, where most Black people lived, and they often targeted Black families. In 1960, Louisiana legislators passed two laws with a suitable home definition that cut off more than 6,000 families in the span of three months; 95 percent of the children in those families were Black. Later that year about half of the families who were cut off had their reapplications rejected or did not reapply. Some of the families who did not reapply did not know they could.[17]

“Man-in-the-house”[18] rules also disproportionally affected Black women.[19] Caseworkers often cut off families with little evidence of a romantic relationship or whether the partner was providing support to the family. After Georgia enacted a policy package in 1952 that included a man-in-the-house provision, the growth of Black families on the state’s ADC rolls slowed for several years.[20]

The ADC (renamed AFDC in 1962) caseload grew through the 1960s and 1970s and, despite states’ efforts to limit Black families’ participation in the program, their numbers grew as well.[21] To ensure that Black families could access assistance, the National Welfare Rights Organization (NWRO), led by Black mothers and their allies, sought to end discriminatory practices. They educated parents about AFDC policy and advocated for more benefits to families.[22] NWRO also partnered with legal aid lawyers to push for greater enforcement of federal eligibility standards.[23] Their efforts led to several Supreme Court decisions that contributed to ending some of the most harmful state eligibility rules. In particular, the ruling in King v. Smith invalidated man-in-the-house policies and precluded states from adding eligibility restrictions on participants.[24]

During that period, an increased federal role in AFDC helped the program reach more families in poverty. The program boosted the federal contribution to state programs and expanded eligibility in other ways, such as extending the child age of eligibility to 18 and allowing children with two parents in the home, one of whom was unemployed, to participate in the program. Between 1961 and 1979, the number of families on AFDC nearly tripled and the number of Black families on the program more than tripled.[25] The AFDC-to-poverty ratio grew in the 1970s and remained around or above 60 between 1979 until AFDC ended in 1996. (See Appendix B, Table 2.) Despite gains made in the 1960s and 1970s, the access to and adequacy of benefits under AFDC remained limited.

During this time, policymakers increased their attention on mothers’ work effort while participating in AFDC. In 1967, the Work Incentive Program (WIN) required states to establish work and training programs; it later required participants to register for a work program. In 1988, the Job Opportunities and Basic Skills Training program replaced WIN and required states to engage mothers with children over the age of 3 in work and work-preparation activities.[26] Still, under the AFDC law, states could only reduce benefits by removing the needs of a parent and could not terminate or deny benefits to the entire family. Then, under a proliferation of waivers in the 1990s, states were allowed to bypass federal eligibility restrictions and began implementing policies to cut the whole family off if a parent did not meet work requirements.[27]

Further ground has been lost under TANF. With its creation in 1996, the federal government eliminated federal minimum eligibility standards, granting states broad flexibility with respect to eligibility requirements and sanctions. States have taken advantage of this considerable freedom to implement policies that restrict access to the program, including upfront work requirements, full-family sanctions, time limits, family caps, drug testing requirements, and felony drug bans, among others. The 1996 law set a lifetime limit of 60 months on receipt of federally funded benefits, and many states have opted for even shorter time limits, cutting thousands of families off from benefits.[28] And further, TANF created financial incentives for states to reduce caseloads.[29] These changes have led to a decline in the TPR nearly every year since TANF’s start.

Leading policymakers have continued to advance proposals to restrict access to benefits based on racist stereotypes: in 2014, then-House Budget Committee Chairman Paul Ryan argued that work requirements were needed in TANF because people in “inner cities” do not value work, referring through coded language to Black people.[30]

These changes disproportionately impact Black families. For example, research consistently finds that African American recipients are significantly more likely to be sanctioned than white recipients.[31] Black and Indigenous families were likelier than other families to be cut off due to time limit changes, research in Washington State found.[32] And research finds that all else equal, states with larger African American populations have less generous and more restrictive TANF policies.[33] These policies impact everyone, regardless of race: today, states that historically denied Black families have simply opted to help few families at all.[34]

The decline in access to TANF benefits has left many of the families experiencing the deepest poverty without resources to meet their basic needs. TANF does far worse than AFDC did in lifting families out of deep poverty (incomes below half of the poverty line). In the decade following the creation of TANF, deep poverty actually rose, largely among the families impacted by the law, with the greatest impact on Black and Latinx children, when using an assessment of poverty that includes more forms of income from public benefits than the official poverty measure.[35]

Today, TANF benefits alone are insufficient to help families move out of poverty in any state, and are sufficient to keep families out of deep poverty in only New Hampshire.[36] While AFDC helped more than 2.9 million children out of deep poverty in 1995, TANF helped only 260,000 children out of deep poverty in 2017, one analysis found.[37] In 1995, only three states had more families living in deep poverty than receiving AFDC. By 2020, most states had more families living in deep poverty than receiving TANF.

Income support programs can improve children’s academic, health, and economic outcomes, the National Academies of Sciences’ report on reducing childhood poverty finds.[38] Even relatively small amounts of income make a difference. Among families with incomes below $25,000, children whose families received a $3,000 annual income boost when the children were under age 6 earned 17 percent more as adults and worked 135 more hours per year after age 25 than otherwise-similar children whose families didn’t receive the income boost, research finds.[39] More recently, a major study found that cash assistance directly improves infant brain development associated with higher language, cognitive scores, and better social skills.[40] These research studies suggest that TANF policy changes that cut families’ income, such as harsher sanctions, shorter time limits, or significantly reduced benefits, could harm young children now and in the future.

Federal policymakers have not increased the TANF block grant since its inception; as a result, it has lost nearly 40 percent of its value due to inflation. That fixed block grant funding and erosion, combined with TANF’s nearly unfettered state flexibility, narrowly defined work requirements, and time limits, have created a system in which very few families in need receive cash assistance or help preparing for success in today’s labor market. The lack of minimum federal standards has allowed states to enact extremely restrictive eligibility policies, leaving the families with the greatest needs — including, disproportionately, Black families — unable to cover the basic essentials through either employment or cash assistance.

Other anti-poverty programs cannot fill TANF’s role. Even though the Earned Income Tax Credit and Child Tax Credit increase families’ incomes and reduce poverty, they do not provide families with enough income to meet their basic needs. Other cash assistance programs, such as Unemployment Insurance and Supplemental Security Income, have eligibility standards that make them unavailable to the wider share of families who fall on hard times and need cash to meet their basic needs. Many families not receiving TANF benefits may receive food assistance from SNAP (formerly food stamps), but SNAP benefits cannot help families pay rent or buy personal hygiene items or diapers or clothes for their children.[41]

While the temporary pandemic measures helped alleviate severe hardship for many families, TANF is overdue for significant, permanent improvements.[42] State and federal policy changes should focus on serving more families who need assistance, alleviating the program’s deep racial disparities, and ensuring that adequate resources are available to achieve these goals.

For example, states should:

- Remove barriers to access for those seeking cash assistance. States have too many requirements that create challenges for people applying to TANF while in crisis. States should remove requirements like applicant job search and other hurdles that make it harder to get assistance and should take steps to make applying for benefits more accessible. States should also eliminate burdensome requirements on families such as school attendance and immunization requirements.

- Stop cutting off families who are struggling to meet their basic needs. Two of the main causes of TANF’s dramatic caseload decline are full-family sanctions that end benefits to the entire family and arbitrary time limits. As noted above, families cut off by sanctions and time limits are more likely to have greater barriers to employment and to be families of color. States should ensure that their programs have adequate protections for families with significant barriers to work before imposing sanctions and time limits. Children should continue to receive benefits if the state imposes a sanction or a family reaches a time limit.

- Lift income thresholds and asset tests for applicants. In many states, eligible TANF applicants must be so destitute that few families in poverty even qualify. States should lift income thresholds and eliminate asset tests to broaden eligibility to more families.

Additionally, federal policymakers should:

- Hold states accountable to serving families in need. States focus on what they are incentivized to do. To expand TANF’s reach, Congress should remove incentives that encourage states not to assist families and should create a state accountability measure that focuses on serving families in need (such as the TPR). States that fail to meet a specified standard could be required to spend additional resources on cash assistance or work activities.

- Require states to direct a specified share of federal and state resources to families receiving cash assistance. TANF’s purposes are broad, which has given states the flexibility to spread program funds throughout their budgets and allowed them to shift resources away from assistance to families. To better target resources, Congress should require states to spend a specific share of their state and federal TANF funds on basic assistance.

- Provide more resources for states to provide cash assistance. The TANF block grant is worth 40 percent less than when it was created in 1996. Without additional funds, states are unlikely to adopt policies that would reach more families as this would increase the costs of providing cash assistance to families. With a fixed block grant, providing cash to more families means taking money away from other activities that use TANF funds. Any additional funds should be restricted to TANF’s core purposes: cash assistance, employment assistance, and work supports.

Appendix A: Methodology and Source Notes

In this analysis, AFDC/TANF caseload data from January 1979 through August 2006 were collected from the U.S. Department of Health and Human Services (HHS). Beginning in September 2006, this analysis uses caseload data collected directly from the states rather than the official data reported by HHS, as the state data more consistently reflect the number of families with children receiving cash assistance in each state over time.

These state data differ from the official HHS TANF data in two important ways. First, they include cases from solely state-funded programs. In most instances, these families had been in state TANF programs but were shifted to a solely state-funded program on or after October 2006, when the Deficit Reduction Act of 2005 (DRA) took effect, because states anticipated these families would not be able to meet TANF work participation requirements and thus would lower the state’s work participation rate. These cases are not included in the data reported to HHS as no TANF or state maintenance-of-effort (MOE) funds are used. While these families are not counted in the HHS TANF caseload numbers, they generally are seen as part of the state’s cash assistance program and continue to receive the same or comparable benefits as when they were on TANF.

Second, unlike the HHS data, the state data exclude cases in worker supplement programs, through which states provide modest TANF- or MOE-funded cash payments to working families. States generally created these programs after the passage of the DRA. Because these supplements make additional families eligible (or make current recipients eligible for a longer period of time), they increase the TANF or MOE caseloads that states report to HHS. Often, states provide a very small cash grant to these families — as little as $8 to $10 per month. The main purpose of these small grants is to raise the percentage of TANF families who are meeting their work participation requirement, thereby helping states meet their work participation requirement.

Including solely state-funded programs and excluding worker supplement programs in the caseload data used for our analysis provides us with a more consistent trend of the number of families receiving cash assistance in each state over time.

The number of families with children in poverty was calculated using Current Population Survey (CPS) data and the official Census poverty thresholds. We counted related subfamilies and primary families in a single household as one family but counted and determined the poverty status of unrelated subfamilies separately. “Deep poverty” refers to families with incomes below half the poverty line, which in 2020 was about $11,000 for a family of three. Two years of CPS data were merged to improve reliability for state estimates.

Ratios are calculated by dividing the number of TANF cases (based on administrative data from HHS or, since late 2006, data collected from states by CBPP) by the number of families with children in poverty (CPS data). We use two-year averages for these calculations to improve reliability.

These ratios should not be interpreted as the percentage of families with children in poverty served by TANF because the number of families receiving TANF is not a perfect subset of the number of families in poverty. A family above poverty could receive TANF benefits, for example: some families may be poor in the months they receive TANF but have higher incomes for the rest of the year; states may encourage work by continuing partial TANF benefits for certain families with earnings slightly above the poverty line; and in some households, large extended families may contain more than one eligible TANF case unit. For these reasons, it’s possible for a state to have more than 100 TANF families for every 100 families with children in poverty.

Using the Alabama ratio as an example, the data should be described as follows: In 1995, for every 100 Alabama families with children in poverty, AFDC served 34 families. In 2020, 7 families participated in TANF for every 100 families with children in poverty.

In Alaska and Hawai’i, the TANF-to-poverty ratio was above 100 in 1994-95 because the HHS poverty guidelines used in determining program eligibility in these two states are significantly higher than the Census poverty thresholds used in determining the number of poor families. (This is not true for any of the other 48 states. HHS poverty thresholds are set higher in Alaska and Hawai’i to allow for higher costs of living in these two states but do not vary elsewhere. The Census Bureau’s poverty thresholds do not vary for any state.)

| Appendix Table 1 |

| State |

1995-96 |

2005-

06 |

2015-

16 |

2016-

17 |

2017-

18 |

2018-

19 |

2019- 20 |

Ratio Change

'05-06 to '19-20 |

| Alabama |

32 |

17 |

10 |

9 |

8 |

8 |

7 |

-10 |

| Alaska |

132 |

32 |

27 |

20 |

20 |

22 |

20 |

-13 |

| Arizona |

42 |

27 |

6 |

6 |

6 |

6 |

6 |

-21 |

| Arkansas |

33 |

11 |

5 |

5 |

5 |

4 |

4 |

-7 |

| California |

101 |

66 |

66 |

65 |

68 |

70 |

71 |

4 |

| Colorado |

66 |

18 |

26 |

34 |

34 |

23 |

20 |

2 |

| Connecticut |

82 |

48 |

23 |

21 |

22 |

27 |

22 |

-26 |

| Delaware |

99 |

45 |

38 |

36 |

39 |

44 |

35 |

-10 |

| Florida |

55 |

20 |

12 |

13 |

12 |

13 |

13 |

-7 |

| Georgia |

82 |

16 |

5 |

6 |

5 |

5 |

5 |

-11 |

| Hawai’i |

108 |

71 |

38 |

38 |

34 |

35 |

34 |

-37 |

| Idaho |

32 |

8 |

7 |

8 |

8 |

9 |

11 |

3 |

| Illinois |

87 |

17 |

17 |

14 |

15 |

14 |

16 |

-1 |

| Indiana |

61 |

35 |

7 |

7 |

6 |

5 |

5 |

-29 |

| Iowa |

64 |

40 |

22 |

21 |

21 |

19 |

23 |

-17 |

| Kansas |

52 |

32 |

10 |

8 |

8 |

10 |

9 |

-23 |

| Kentucky |

55 |

29 |

20 |

24 |

21 |

21 |

21 |

-8 |

| Louisiana |

48 |

10 |

4 |

4 |

4 |

4 |

4 |

-6 |

| Maine |

91 |

52 |

22 |

19 |

18 |

19 |

22 |

-29 |

| Maryland |

97 |

32 |

30 |

39 |

33 |

25 |

29 |

-4 |

| Massachusetts |

81 |

46 |

38 |

38 |

34 |

40 |

43 |

-3 |

| Michigan |

88 |

40 |

14 |

12 |

11 |

11 |

11 |

-29 |

| Minnesota |

93 |

51 |

57 |

47 |

41 |

47 |

60 |

9 |

| Mississippi |

39 |

14 |

7 |

6 |

6 |

4 |

4 |

-11 |

| Missouri |

118 |

38 |

19 |

14 |

13 |

11 |

11 |

-26 |

| Montana |

41 |

21 |

17 |

26 |

33 |

25 |

23 |

2 |

| Nebraska |

54 |

52 |

20 |

21 |

18 |

17 |

20 |

-32 |

| Nevada |

71 |

20 |

22 |

22 |

19 |

20 |

18 |

-2 |

| New Hampshire |

100 |

62 |

25 |

28 |

30 |

46 |

46 |

-16 |

| New Jersey |

108 |

42 |

20 |

19 |

15 |

16 |

16 |

-26 |

| New Mexico |

44 |

32 |

22 |

21 |

21 |

24 |

27 |

-5 |

| New York |

79 |

41 |

43 |

42 |

42 |

42 |

39 |

-2 |

| North Carolina |

74 |

14 |

7 |

7 |

6 |

7 |

5 |

-9 |

| North Dakota |

48 |

23 |

8 |

9 |

10 |

13 |

12 |

-11 |

| Ohio |

89 |

33 |

22 |

24 |

25 |

25 |

25 |

-8 |

| Oklahoma |

41 |

12 |

8 |

9 |

9 |

10 |

8 |

-3 |

| Oregon |

50 |

26 |

37 |

35 |

40 |

48 |

49 |

23 |

| Pennsylvania |

87 |

45 |

30 |

28 |

25 |

26 |

25 |

-20 |

| Rhode Island |

113 |

64 |

35 |

29 |

35 |

35 |

26 |

-38 |

| South Carolina |

40 |

21 |

11 |

10 |

10 |

10 |

9 |

-12 |

| South Dakota |

42 |

22 |

17 |

20 |

23 |

20 |

18 |

-4 |

| Tennessee |

67 |

51 |

23 |

23 |

22 |

18 |

15 |

-36 |

| Texas |

47 |

12 |

4 |

4 |

4 |

4 |

4 |

-9 |

| Utah |

59 |

21 |

9 |

9 |

10 |

11 |

9 |

-12 |

| Vermont |

80 |

79 |

47 |

55 |

50 |

49 |

71 |

-7 |

| Virginia |

56 |

31 |

19 |

18 |

16 |

15 |

18 |

-13 |

| Washington |

76 |

63 |

25 |

26 |

29 |

34 |

39 |

-24 |

| West Virginia |

68 |

27 |

16 |

17 |

16 |

18 |

19 |

-8 |

| Wisconsin |

81 |

23 |

20 |

20 |

23 |

23 |

20 |

-3 |

| Wyoming |

45 |

3 |

5 |

6 |

6 |

7 |

7 |

4 |

| APPENDIX TABLE 2 |

| |

Number of families with

children in poverty |

Yearly average of number of families on AFDC/TANF |

Ratio |

| 1979 |

4,222,769 |

3,465,254 |

82 |

| 1983 |

6,115,748 |

3,628,418 |

59 |

| 1987 |

5,720,798 |

3,718,937 |

65 |

| 1991 |

6,479,558 |

4,433,843 |

68 |

| 1996 |

6,400,950 |

4,380,430 |

68 |

| 2001 |

5,310,009 |

2,162,291 |

41 |

| 2006 |

6,042,035 |

1,902,442 |

31 |

| 2010 |

7,263,610 |

1,979,893 |

27 |

| 2011 |

7,373,607 |

1,963,324 |

27 |

| 2012 |

7,334,765 |

1,847,761 |

25 |

| 2013 |

6,940,399 |

1,747,820 |

25 |

| 2014 |

7,068,069 |

1,643,205 |

23 |

| 2015 |

6,477,753 |

1,502,236 |

23 |

| 2016 |

5,874,839 |

1,372,302 |

23 |

| 2017 |

5,568,320 |

1,263,805 |

23 |

| 2018 |

5,231,333 |

1,157,087 |

22 |

| 2019 |

4,568,131 |

1,064,133 |

23 |

| 2020 |

5,025,600 |

1,060,447 |

21 |

| Appendix Table 3 |

| State |

2006 |

2010 |

2015 |

2019 |

2020 |

Percent Change,

2006-2020 |

| Alabama |

19,358 |

22,363 |

13,083 |

7,467 |

7,131 |

-63% |

| Alaska |

3,538 |

3,478 |

3,141 |

2,401 |

2,259 |

-39% |

| Arizona |

38,634 |

28,492 |

11,087 |

6,467 |

7,432 |

-83% |

| Arkansas |

8,161 |

7,462 |

3,895 |

2,150 |

2,075 |

-75% |

| California |

480,132 |

575,090 |

520,787 |

371,095 |

354,700 |

-26% |

| Colorado |

13,862 |

14,065 |

17,843 |

15,860 |

15,410 |

7% |

| Connecticut |

21,365 |

19,181 |

14,951 |

10,346 |

8,975 |

-57% |

| Delaware |

5,576 |

6,306 |

5,355 |

3,955 |

3,950 |

-30% |

| Florida |

51,428 |

57,614 |

48,535 |

39,821 |

42,447 |

-26% |

| Georgia |

29,338 |

20,387 |

13,095 |

9,214 |

8,384 |

-74% |

| Hawai’i |

9,310 |

9,628 |

7,531 |

4,200 |

5,683 |

-50% |

| Idaho |

1,789 |

1,789 |

1,889 |

2,081 |

1,939 |

10% |

| Illinois |

35,906 |

32,210 |

43,543 |

21,051 |

25,363 |

-38% |

| Indiana |

43,668 |

34,984 |

8,885 |

5,460 |

7,217 |

-86% |

| Iowa |

19,720 |

17,365 |

10,985 |

7,161 |

7,065 |

-66% |

| Kansas |

16,639 |

13,914 |

5,482 |

3,557 |

3,827 |

-78% |

| Kentucky |

32,470 |

30,483 |

24,490 |

16,911 |

15,129 |

-52% |

| Louisiana |

11,266 |

11,013 |

5,491 |

4,671 |

4,040 |

-67% |

| Maine |

11,979 |

14,716 |

5,968 |

3,895 |

4,109 |

-66% |

| Maryland |

22,986 |

27,802 |

23,097 |

16,615 |

22,612 |

-20% |

| Massachusetts |

46,686 |

50,673 |

37,119 |

29,792 |

30,384 |

-37% |

| Michigan |

84,387 |

80,340 |

26,947 |

15,360 |

18,637 |

-79% |

| Minnesota |

30,224 |

33,626 |

28,557 |

24,932 |

28,018 |

-14% |

| Mississippi |

12,797 |

11,985 |

6,628 |

3,215 |

2,334 |

-80% |

| Missouri |

43,777 |

41,999 |

27,225 |

9,387 |

9,295 |

-79% |

| Montana |

3,642 |

3,707 |

2,981 |

3,351 |

2,823 |

-23% |

| Nebraska |

12,473 |

8,732 |

5,845 |

4,871 |

5,011 |

-61% |

| Nevada |

7,030 |

11,897 |

11,041 |

8,359 |

7,806 |

10% |

| New Hampshire |

6,096 |

6,520 |

3,066 |

3,829 |

3,698 |

-39% |

| New Jersey |

41,879 |

39,560 |

28,238 |

10,918 |

11,306 |

-74% |

| New Mexico |

15,785 |

20,633 |

13,176 |

10,468 |

11,600 |

-34% |

| New York |

171,662 |

158,081 |

152,297 |

117,440 |

117,094 |

-34% |

| North Carolina |

29,631 |

25,143 |

16,545 |

12,343 |

11,285 |

-62% |

| North Dakota |

2,669 |

1,876 |

1,096 |

915 |

954 |

-66% |

| Ohio |

79,285 |

100,655 |

58,918 |

50,321 |

52,138 |

-36% |

| Oklahoma |

10,092 |

9,635 |

7,262 |

5,904 |

5,672 |

-46% |

| Oregon |

18,281 |

28,314 |

27,249 |

20,737 |

19,657 |

8% |

| Pennsylvania |

94,577 |

86,080 |

70,576 |

41,032 |

35,015 |

-60% |

| Rhode Island |

12,153 |

7,175 |

4,669 |

3,936 |

3,089 |

-72% |

| South Carolina |

17,637 |

20,513 |

11,875 |

9,128 |

8,820 |

-50% |

| South Dakota |

2,852 |

3,212 |

2,994 |

2,895 |

2,741 |

0% |

| Tennessee |

68,106 |

62,355 |

35,986 |

19,201 |

16,478 |

-74% |

| Texas |

68,100 |

49,387 |

27,553 |

18,822 |

17,602 |

-76% |

| Utah |

6,843 |

7,069 |

3,878 |

3,163 |

2,795 |

-62% |

| Vermont |

4,757 |

5,751 |

4,701 |

3,558 |

3,432 |

-28% |

| Virginia |

33,959 |

37,543 |

25,966 |

16,676 |

16,561 |

-53% |

| Washington |

54,556 |

66,895 |

32,606 |

25,133 |

28,975 |

-52% |

| West Virginia |

11,058 |

11,193 |

8,091 |

6,619 |

6,165 |

-46% |

| Wisconsin |

18,149 |

23,710 |

21,502 |

14,182 |

15,245 |

-23% |

| Wyoming |

304 |

353 |

384 |

503 |

498 |

62% |

| U.S. |

1,902,442 |

1,979,893 |

1,502,236 |

1,064,133 |

1,059,078 |

-44% |

| APPENDIX TABLE 4 |

| |

1978-79 |

1982-83 |

1986-87 |

1990-91 |

1995-96 |

2019-20 |

| Alabama |

49 |

40 |

29 |

35 |

32 |

7 |

| Arizona |

51 |

37 |

37 |

64 |

42 |

6 |

| Arkansas |

39 |

32 |

26 |

38 |

33 |

4 |

| Georgia |

60 |

51 |

52 |

59 |

82 |

5 |

| Indiana |

56 |

38 |

47 |

34 |

61 |

5 |

| Kansas |

78 |

53 |

68 |

52 |

52 |

9 |

| Louisiana |

58 |

41 |

44 |

57 |

48 |

4 |

| Mississippi |

71 |

49 |

53 |

48 |

39 |

4 |

| North Carolina |

55 |

40 |

47 |

65 |

74 |

5 |

| Oklahoma |

64 |

32 |

36 |

48 |

41 |

8 |

| South Carolina |

64 |

42 |

52 |

46 |

40 |

9 |

| Texas |

31 |

24 |

32 |

45 |

47 |

4 |

| Utah |

69 |

35 |

46 |

53 |

59 |

9 |

| Wyoming |

50 |

29 |

43 |

60 |

45 |

7 |

| 14-state average |

55 |

38 |

42 |

48 |

48 |

6 |

| National APR/TPR |

82 |

59 |

65 |

68 |

68 |

21 |