BEYOND THE NUMBERS

House Republicans have targeted the IRS for deep cuts since 2010, to the detriment of honest taxpayers and the benefit of tax cheats. This week, the House Appropriations Committee can reverse course by restoring much-needed IRS funding and rejecting its subcommittee’s proposal to cut even more.

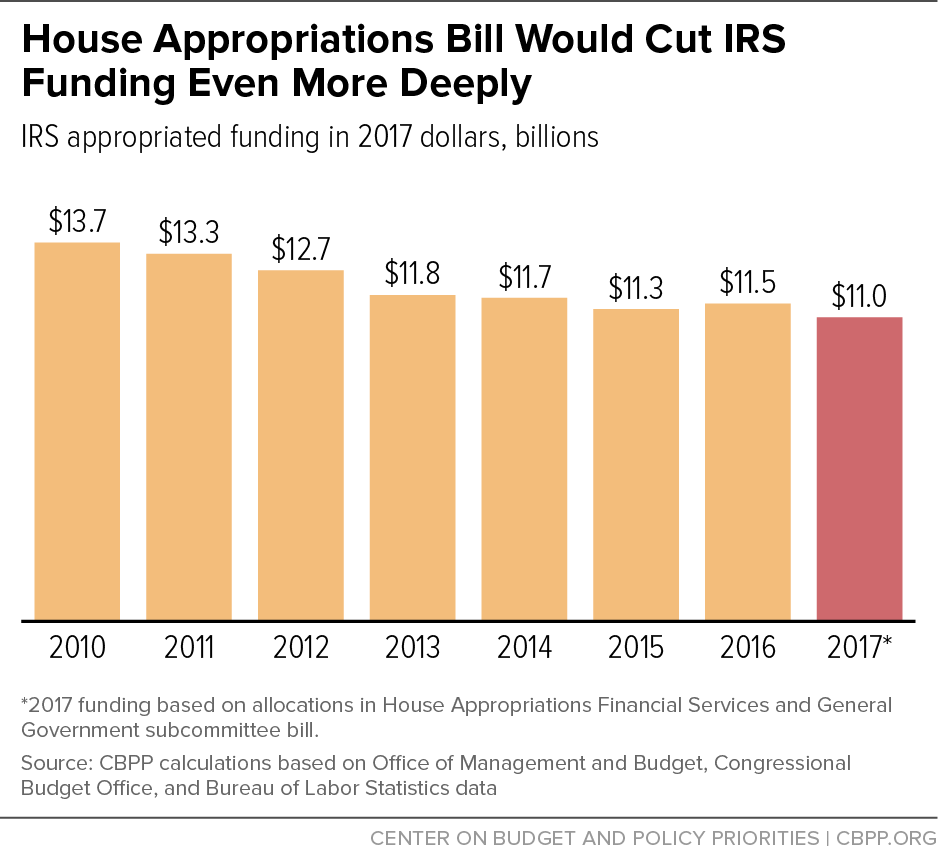

Behind a misguided House GOP push, policymakers have cut the IRS budget by 16 percent since 2010, after adjusting for inflation. As a result, honest taxpayers have a harder time reaching someone at the IRS by phone to answer questions on how to file their taxes. Conversely, tax cheats have a much lower chance of getting caught as the IRS conducts fewer audits.

The subcommittee provides $11 billion in 2017 for the IRS — $236 million below last year’s level (or roughly $500 million less in inflation-adjusted dollars — see chart), claiming that would provide enough funding for the agency to perform its core duties. That claim is wrong. But the subcommittee correctly acknowledges the need for more money, saying that its bill “provides an additional $290 million to improve service to taxpayers — such as phone call and correspondence response times — fraud prevention, and cybersecurity.”

In reality, there aren’t any “additional” funds; the $290 million for customer service was an increase in 2016 that this bill would merely carry into 2017, and the bill would cut the total IRS budget. But the subcommittee’s recognition that the IRS needs more money to address taxpayer customer service, tax fraud, and cybersecurity is a welcome admission. The full committee should build on it and begin to restore the funding that it cut in recent years.