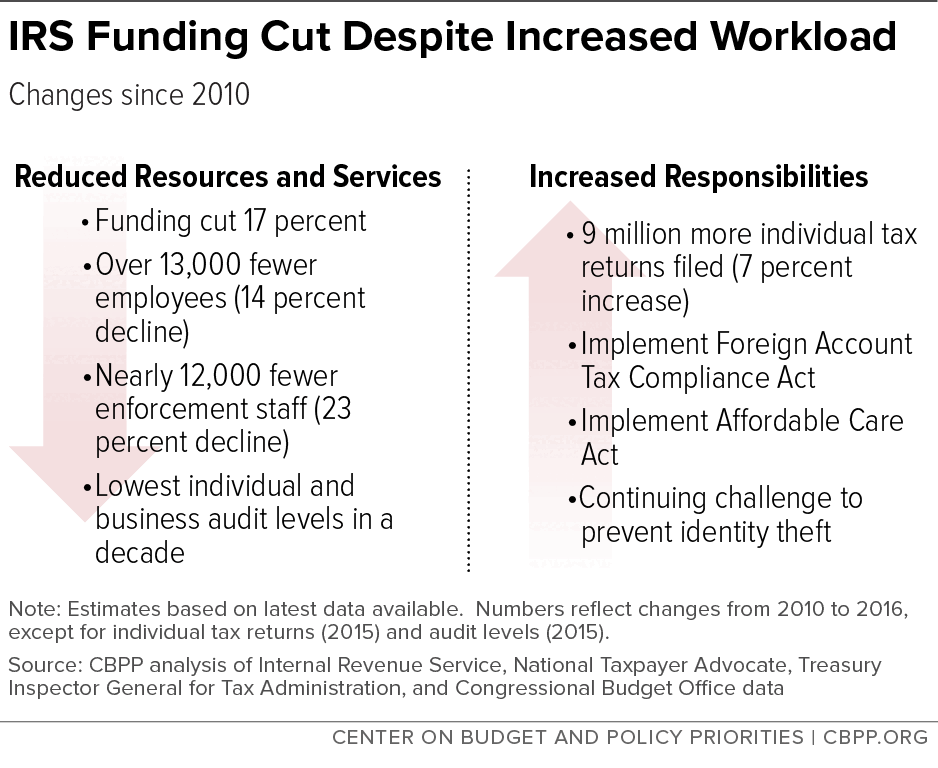

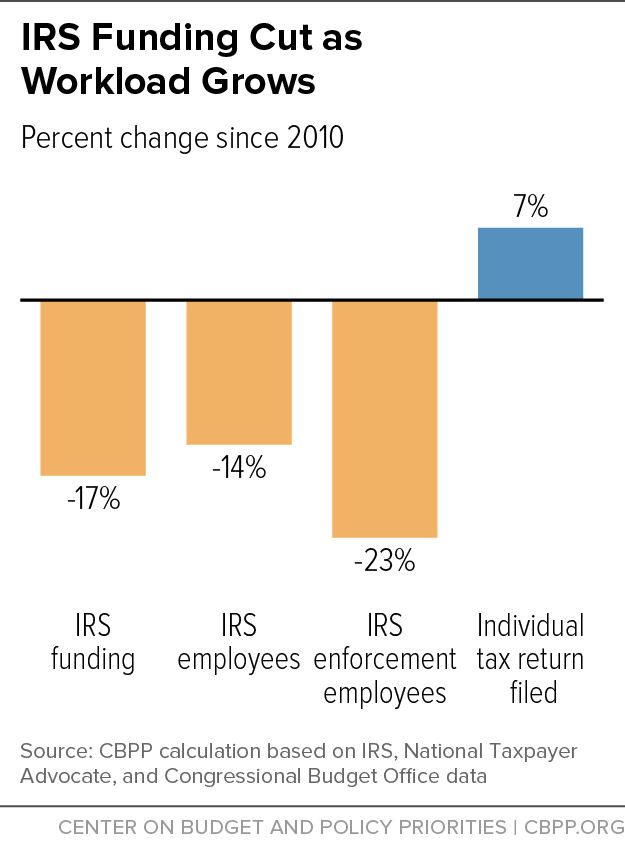

The Internal Revenue Service (IRS) budget has been cut by 17 percent since 2010, after adjusting for inflation, forcing the IRS to reduce its workforce, severely scale back employee training, and delay much-needed upgrades to information technology systems. These steps, in turn, have weakened the IRS’s ability to enforce the nation’s tax laws and serve taxpayers efficiently, as the National Taxpayer Advocate, the Treasury Inspector General for Tax Administration, the IRS Oversight Board, and the Government Accountability Office have all documented. As seven former IRS commissioners from both Republican and Democratic administrations have written: “Over the last fifty years, none of us has ever witnessed anything like what has happened to the IRS appropriations over the last five years and the impact these appropriations reductions are having on our tax system.”[2]

National Taxpayer Advocate Nina Olson recently highlighted an example underscoring the deep impact of the budget crisis on taxpayer service. Taxpayers whose returns the IRS’ Taxpayer Protection Program (TPP) flagged as potentially subject to identity theft need to contact the IRS by phone or online to get their returns processed. “All of these legitimate taxpayers were desperately attempting to free up their refunds,” she told Congress, “yet at one point during the filing season [in 2015] the level of service on the TPP line was below ten percent for three consecutive weeks — meaning more than 90 percent of calls were not answered!”[3]

In response to criticism, Congress agreed to a small nominal increase in IRS funding for fiscal year 2016, though funding was essentially flat in inflation-adjusted terms. The year-end omnibus appropriations bill provided an additional $290 million to improve taxpayer services (in part by hiring seasonal employees), strengthen cybersecurity, and expand the agency’s ability to address identity theft.

Still, this small increase is not enough to make up for the deep funding cuts, and the resulting reductions in personnel, the IRS has experienced since 2010. IRS Commissioner John Koskinen testified that despite the modest boost, “the IRS is still under significant financial constraints,” and that he expects the permanent IRS workforce to continue shrinking this year.[4] At the same time, the IRS’ workload continues to increase (see Figure 1).

The President’s fiscal year 2017 budget offers a framework for reversing these harmful cuts, boosting IRS funding by about 9 percent over the 2016 level (or 7 percent, adjusted for inflation). The increased funding focuses on enforcement, taxpayer services, and information technology investments. But even with these additional resources, IRS funding would remain roughly 12 percent below the 2010 level, adjusted for inflation.

The IRS plays a fundamental role in our system of government by helping taxpayers comply with the tax code and ensuring that the nation’s tax laws are enforced fairly and credibly, as well as by collecting nearly all of the revenue that funds federal programs from national defense and the safety net to roads, science research, and education. Policymakers must provide the resources it needs to do these jobs effectively.

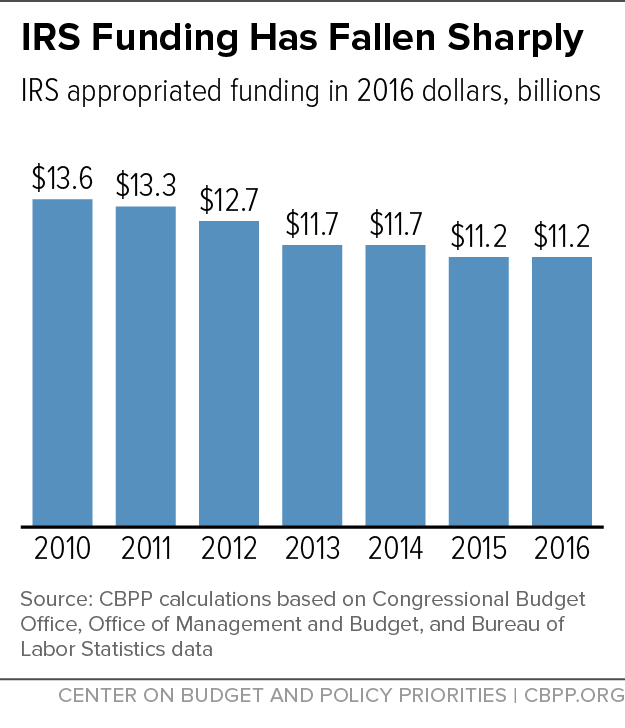

Since regaining a majority in the 2010 elections, House Republicans have targeted the IRS for sharp cuts. As Figure 2 shows, the agency’s inflation-adjusted funding has fallen sharply since 2010. Even though Congress and the Administration negotiated a small $290 million increase in 2016, it was barely enough to keep up with inflation. As a result, IRS funding is still 17 percent below the 2010 level, adjusted for inflation. Even in nominal terms — ignoring inflation — IRS funding this year is $900 million or 8 percent below its 2010 level.

To be sure, funding for non-defense appropriations has been under pressure in recent years, in large part due to the funding caps set in the 2011 Budget Control Act and subsequently lowered by sequestration. But the IRS has been targeted for particularly deep cuts, with inflation-adjusted cuts since 2010 that are 50 percent greater than the overall average cut in non-defense appropriations.

Cuts in Workforce and Training

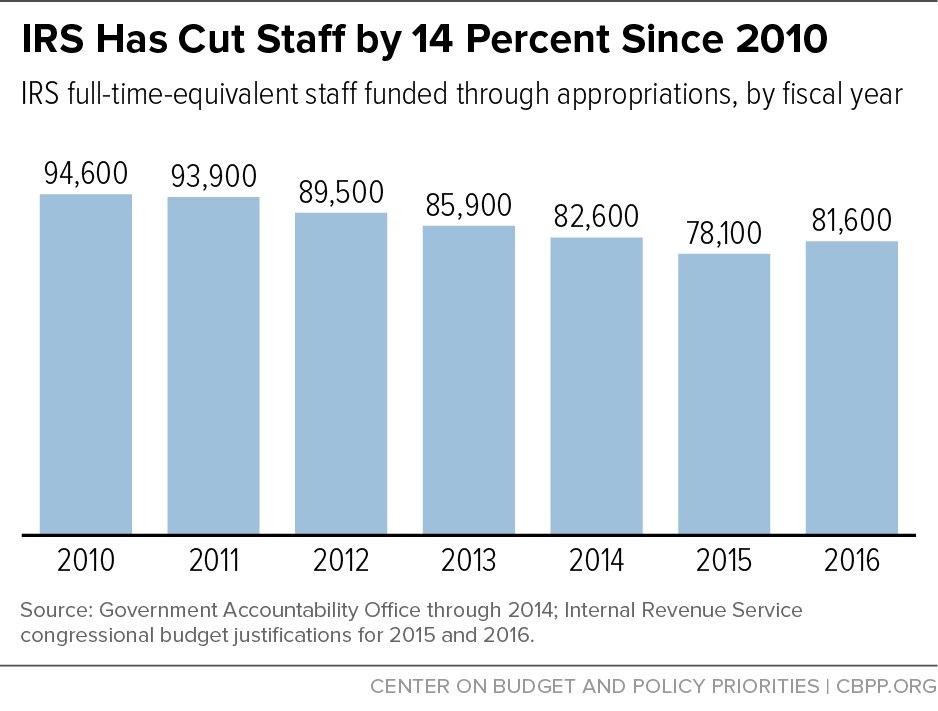

Three-quarters of the IRS budget goes to personnel, 85 percent of whom are directly involved in enforcing tax laws or providing taxpayer services.[5] Accordingly, in the face of low funding, the IRS has cut its workforce substantially — by about 13,000, or 14 percent, between 2010 and 2016 (see Figure 3). The modest 2016 funding increase allowed the agency to hire additional staff, including seasonal employees to assist with customer service during filing season. But the increase is insufficient to stop all the bleeding: Commissioner Koskinen expects the permanent IRS workforce to shrink, as it is unable to replace most employees leaving through attrition.[6] Importantly, the total number of enforcement employees continues to dwindle.

The IRS Oversight Board, an independent body that Congress created to provide long-term guidance to the IRS, explained in 2014 how these cuts are affecting the IRS workforce:

The workforce has decreased over the last four years due to a longstanding combination of attrition and a hiring freeze. As the result of the hiring freeze, new employees replace outgoing employees at a rate of one to five. This means a current IRS employee will see five coworkers leave, some of them the most experienced and well trained, before one new employee is eventually hired to cope with a growing workload. This puts enormous stress on new employees arriving at understaffed offices and those who remain as they shoulder the burden of the work left behind until a new employee arrives to help.[7]

National Taxpayer Advocate Olson summed up the consequences of the shrinking workforce, saying: “I do not see any substitute for sufficient personnel if the IRS is to provide high-quality taxpayer service.”[8]

The cuts since 2010 have significantly weakened taxpayer services. As the Government Accountability Office (GAO) found last year, “A reduced budget and increased workload has contributed to performance declines across the agency, including serious concerns about service to taxpayers during filing season.”[9]

Last year’s tax filing season was particularly “abysmal,” according to IRS Commissioner Koskinen. In 2010, about three-quarters of calls to the IRS were answered, with an average wait time of 11 minutes.[10] During last year’s filing season, only 37 percent of calls were answered, with an average wait of 23 minutes. This means that more than 60 percent of calls were not answered at all.[11] Relatedly, the number of “courtesy disconnects,” when taxpayer calls are dropped because the IRS’s switchboard is overloaded, grew dramatically to about 8.8 million this year, up from 544,000 in 2014.[12] The IRS also answered only “basic” tax questions this filing season, and it no longer helps low-income, disabled, or elderly taxpayers prepare returns. Outside of tax season, the IRS no longer answers any questions.

Similarly, while the IRS conducts important business with taxpayers through the mail (including individual examinations and clarifications on how much tax a filer owes), it has failed to respond in a timely manner to significant amounts of correspondence in recent years due to inadequate funding.[13]

These cuts threaten low-income and other vulnerable taxpayers in particular, as these populations are more likely to need personal assistance to comply with their tax obligations. [14]

Taxpayers caught up in identity theft issues faced particular frustration last year. The IRS must aggressively combat identity theft but must also have the resources to limit the inconvenience of taxpayers whose identities have been stolen or who have be incorrectly been captured by IRS screening filters. Taxpayers caught up as a “false positive” must contact the IRS and verify who they are to unlock the processing of their return and any refund. Yet during the 2015 filing season, the Taxpayer Protection Program line that affected taxpayers were directed to call answered only 17 percent of calls. During some weeks, more than 90 percent of these calls went unanswered.[15]

The dismal state of taxpayer services last year helped convince Congress to boost IRS funding modestly for 2016. About $178 million of the added $290 million is going to taxpayer services, according to Commissioner Koskinen, including the hiring of seasonal employees to provide phone and correspondence service during the 2016 tax filing season. He also projected that the phone answer rate would be in the mid-60 percent range during filing season this year.[16] It’s essential that this positive trend continue and that Congress commit itself to restoring the IRS’s budget so that it can provide the service that honest taxpayers deserve.

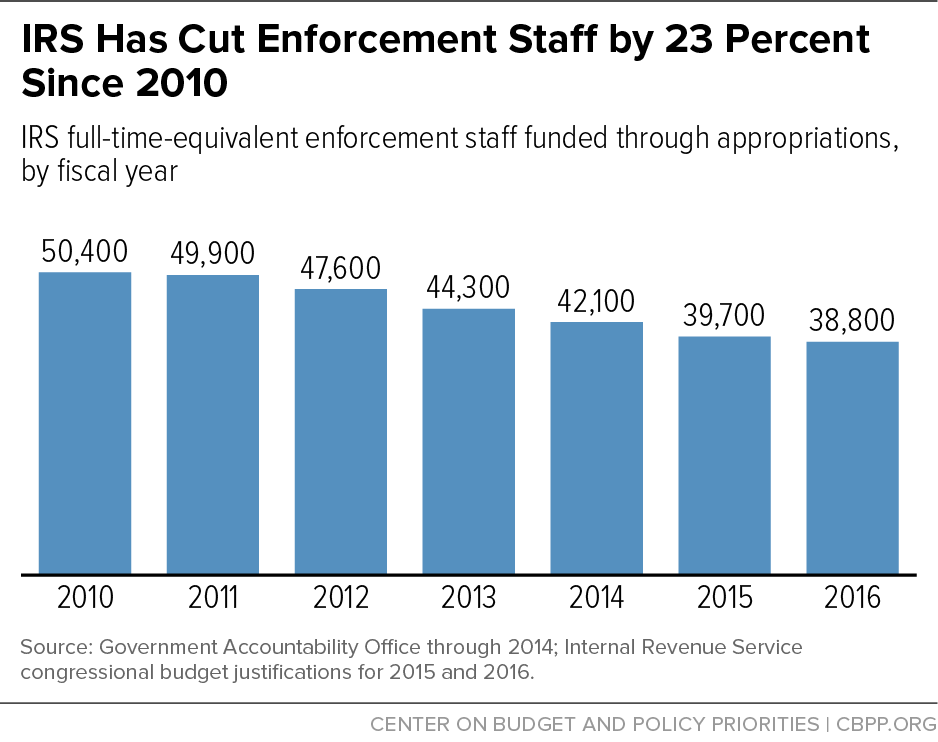

Since 2010, the number of IRS staff devoted to enforcing tax laws has dropped from over 50,000 to below 39,000, a decline of 23 percent.[17] (See Figure 4.) Among other things, the cuts have put pressure on the IRS’s Criminal Investigations Division (CI), which plays a crucial role in enforcement by investigating potentially criminal tax code violations. This division’s activities not only sanction tax evaders but also provide a strong incentive for voluntary compliance. However, the number of these agents continues to fall as resources shrink. As former IRS Criminal Investigation chief Mark Matthews recently put it, “The inevitable result of CI budget declines is a decline in CI’s core product — criminal cases and convictions.”[18]

As a result of cuts, the IRS is conducting fewer audits overall and fewer audits of high-income taxpayers and businesses. In 2010, it audited 1.1 percent of individual returns; in 2015, it audited only 0.8 percent, the lowest level in a decade.[19] The IRS audited 1.2 million taxpayers in 2015 — 13,700 fewer than in 2014 and over 350,000 below 2010.[20] This represents a 22 percent drop. Audits recovered about 30 percent ($30 billion) less in revenue in the past five years than in the prior five years.

Enforcement has suffered in part in spite of evidence that various IRS enforcement efforts save many times what they cost. The Treasury estimates, for example, that every additional $1 invested in IRS tax enforcement beyond current levels would yield $4 in increased revenue.[21] As Commissioner Koskinen summarized, “Essentially, the government is losing billions to achieve budget savings of a few hundred million dollars.”[22]

The IRS needs state-of-the-art information technology (IT) to perform its core functions of collecting taxes and enforcing the nation’s tax laws while countering sophisticated identity thieves and tax evaders and addressing taxpayers’ privacy concerns. The IRS lags behind in this area. For example, some IRS computers still run on an operating system that is so outdated Microsoft no longer services it; the IRS had to spend scarce funds to set up custom support.[23] Commissioner Koskinen notes that the IRS uses “applications that were running when John F. Kennedy was President.”[24] He concludes, “We’re falling behind in upgrading hardware infrastructure and software. This compromises the stability and reliability of our information systems, and leaves us open to more system failures and potential security breaches.”[25]

GAO has reported that budget constraints have contributed to delays in two essential IT projects: Information Reporting and Documentation Matching, designed to match documents such as 1099-K forms with individual tax returns to help track down underreported income; and the Return Review Program (RRP), designed to replace the outmoded Electronic Fraud Detection System, the IRS’s main system for detecting fraudulent returns.[26] Part of the IRS effort to prevent identity thieves from obtaining tax refunds fraudulently, the RRP is meant to allow the IRS to more quickly and flexibly adjust its fraud detection filters to stay ahead of would-be identity thieves.[27]

Identity theft continues to present a major challenge for the IRS, making IT investments all the more critical. The seven former IRS commissioners warned that “increasing incidents of identity theft and refund fraud are being perpetrated against our tax system by large crime syndicates around the world.”[28] And last year GAO added “tax refund fraud due to identity theft” to its list of areas of government operation that are especially vulnerable to fraud, waste, and abuse.[29]

In a recent Tax Notes article, former long-serving IRS officials commented that “fighting identity theft is increasingly challenging for the IRS, as thieves continue to develop more sophisticated ways of stealing person and business information.” [30] While the IRS has implemented new strategies to combat identity theft, the means that identity thieves use are constantly evolving. IRS Commissioner Koskinen put the issue in budgetary terms when he testified that, despite additional funds in 2016 for cybersecurity and identity theft, the agency “needs to continue investing in resources and tools to stay ahead of criminals.”[31]

Restoring IRS funding to a more adequate level is important both to reverse the decline in taxpayer service and enable the agency to handle its growing responsibilities in areas such as identity theft and health reform.

Health reform “contains an extensive array of tax law changes that, absent added funding, will present budgetary challenges for the IRS in coming years,” the Treasury Inspector General for Tax Administration reports.[32] Most importantly, the IRS administers the premium tax credits to help millions of near-poor and middle-income taxpayers afford coverage in the health insurance marketplaces as well as assistance with health insurance deductibles and co-payments for taxpayers with modest incomes. The IRS also administers health reform’s “individual mandate,” determining whether people who don’t buy health insurance during the year are subject to a penalty. But Congress has failed to provide the IRS with any funds to implement health reform, forcing the agency to divert funds from other areas, such as IT.[33]

Another major new set of IRS responsibilities concerns the Foreign Account Tax Compliance Act (FATCA). Enacted in 2010, FATCA seeks to reduce illegal tax evasion by requiring filers and financial institutions to report more information to the IRS about assets held in offshore accounts. More than 150,000 financial institutions in 112 countries have already registered under FATCA.[34] The IRS needs added personnel and IT resources to collect and analyze the large amounts of information that FATCA will generate and to conduct enforcement activities where warranted.[35]

Yet Congress has rejected requests for new funding for these new responsibilities, instead cutting the IRS’s budget as noted.[36]

In addition, the number of tax filers continues growing. The number of individual income tax returns has grown by more than 9 million (7 percent) since 2010.[37] (See Figure 5.) In 2015, IRS funding was no higher than in 1998 after adjusting for inflation, but the number of returns filed was 30 million (23 percent) higher.[38]

Congress authorized a modest nominal increase in IRS funding for fiscal year 2016, though funding was flat in inflation-adjusted terms. The bigger picture remains that IRS funding has been cut by nearly one-fifth since 2010, despite Congress’s enactment of new responsibilities for the agency and growing identity-theft attacks on the tax administration system. There is an urgent need for Congress to quickly and substantially build on the small funding step for 2016.

The Administration has requested $12.3 billion in IRS funding for fiscal year 2017, a 7 percent increase (after adjusting for inflation), though it would still leave the IRS 12 percent below 2010 funding levels. The added funding would support specific initiatives such as:

- Answering 70 percent of calls to the agency throughout the year;

- Providing additional staffing and technology to help prevent fraud related to identity theft and assist taxpayers innocently caught up in it;

- Addressing the recent defunding of tax enforcement and reversing the decline in audits; and

- Implementing health reform, and reducing the need for the IRS to divert resources from other areas.[39]

Collecting taxes is one of government’s most essential functions, yet budget cuts in recent years have made it harder for the IRS to enforce tax laws, and implementing new laws such as health reform and FATCA has added to the agency’s responsibilities. Policymakers should give the IRS sufficient resources to carry out its mission. In particular, policymakers who profess to be concerned about the nation’s fiscal course should provide the IRS with the funding it needs to administer the nation’s tax laws and collect taxes due under the laws of the land.