BEYOND THE NUMBERS

The House Appropriations Committee approved legislation Wednesday that would impose the biggest cut yet to the IRS after five years of damaging cuts. Nevertheless, House appropriators argue that its small ($75 million) bump in taxpayer services funding should enable the IRS to “stop making excuses” and improve taxpayer services. That ignores two basic facts:

-

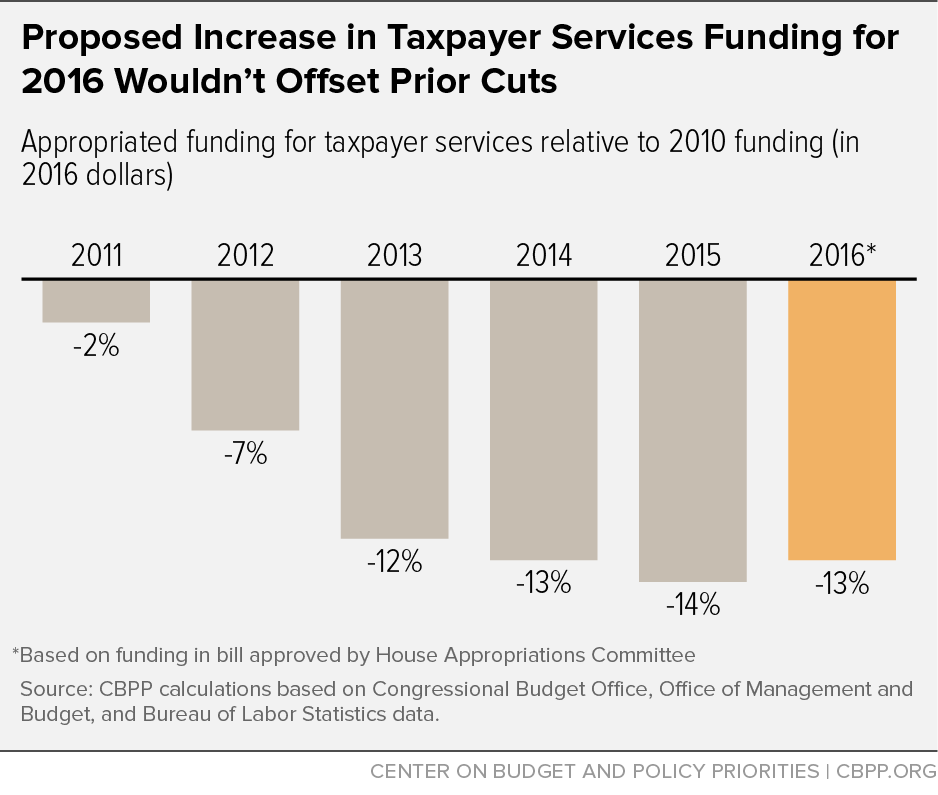

The small taxpayer services increase wouldn’t come close to offsetting previous cuts. The $75 million increase in 2016 relative to the current 2015 level would undo less than 10 percent of Congress’ cuts in taxpayer services since 2010, adjusted for inflation. Taxpayer services would still be about 13 percent below the inflation-adjusted 2010 level (see chart).

Those cuts have directly harmed taxpayer services, as the Treasury Inspector General for Tax Administration has reported. (Our recent report has more on the impact of the cuts.) The IRS answered fewer than half of taxpayer calls this tax filing season, and only after average wait times of about a half hour; taxpayers also waited in long lines outside IRS offices for help. The IRS needs a bigger funding increase for taxpayer services to prevent similar outcomes next year.

- The bill’s deep cuts in overall IRS funding will put immense pressure on the IRS’s other core functions. The bill, which would leave overall IRS funding 26 percent below the inflation-adjusted 2010 level, cuts more than $900 million relative to the 2015 level from other IRS areas already hit by earlier cuts, primarily tax enforcement and information technology. To fulfill its legal mandates and new responsibilities in these areas, which have suffered due to underfunding, the IRS has had to shift resources from answering taxpayers’ calls. The bill’s new cuts might prompt similar action next year.