BEYOND THE NUMBERS

Deep cuts to the Internal Revenue Service (IRS) budget over the past five years have resulted in “truly an abysmal level of service” to taxpayers, IRS Commissioner John Koskinen noted in a speech yesterday. That’s one more reminder why, as our updated paper explains, policymakers should give the IRS the funds it needs to do its job effectively.

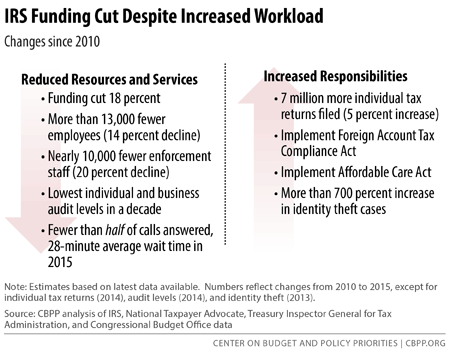

Policymakers have cut the IRS budget by 18 percent since 2010, adjusted for inflation. These cuts — coming at the same time that the IRS’ responsibilities have grown — have forced the agency to significantly cut its workforce and scale back employee training (see chart). These steps, in turn, compromise taxpayer service and erode enforcement activities. Taxpayers are feeling the impact during this tax filing season.

Funding cuts are hurting honest taxpayers as they try to file their taxes: the IRS isn’t answering more than half of its calls. Even if taxpayers reach an agent, they must wait on hold an average of about a half hour, and the IRS is answering only “basic” tax questions, despite the tax code’s complexity. National Taxpayer Advocate Nina Olson sounded a similar alarm in recent testimony, stating “I do not think it is hyperbolic to say we are facing a crisis in taxpayer service.”

Funding cuts also reward tax cheats by weakening the IRS’ ability to curb tax fraud, tax evasion, and other illegal activities. The IRS estimates that individual and business audit rates have fallen to their lowest levels in a decade, and they may continue to fall amid budget cuts. As Koskinen noted, these cuts are “penny wise and pound foolish.” Audit and collection activities raise additional revenue, so cutting the IRS enforcement budget actually increases the budget deficit. Each additional $1 spent on IRS enforcement yields $6 or more of additional revenue from collecting taxes owed under current law, according to the Treasury Department.

Further, because the U.S. tax system relies on taxpayers to report their income and pay the appropriate tax, it depends on a high degree of trust between taxpayers and government that has lasted many, many decades. The declines in taxpayer services and enforcement resulting from budget cuts weaken that trust and could corrode compliance over time. Treasury estimates that increased enforcement funding produces indirect revenue savings at least three times the direct impact by encouraging compliance.

The IRS plays a fundamental role in our system of government by helping taxpayers comply with the tax code and ensuring that tax laws are enforced fairly and credibly. But budget cuts have led to inadequate levels of taxpayer service and enforcement, harming honest taxpayers while rewarding tax cheats.