- Home

- Introduction To The Federal Budget Proce...

Note: The COVID-19 recession and relief packages dramatically, but mostly temporarily, changed spending and revenue levels for fiscal years 2020 and 2021, and to a lesser extent 2022. We use recent budget projections by the Congressional Budget Office (CBO) for 2023 to illustrate the composition of the federal budget and taxes under more normal circumstances.

Policy Basics: Introduction to the Federal Budget Process

No single piece of legislation establishes the annual federal budget. Rather, Congress makes spending and tax decisions through a variety of legislative actions in ways that have evolved over more than two centuries.

The Constitution makes clear that Congress holds the power of the purse, giving it authority “to lay and collect Taxes, Duties, Imposts and Excises,” and specifying that “No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by law.” In short, federal taxing and spending requires legislation that is enacted into law.

Under the practices that have evolved, some tax and spending legislation is permanent — unless and until changed, which it often is. Other legislation covers multi-year periods, requiring periodic renewal. And many budget decisions are made year by year, through enactment of annual appropriations bills. In addition, the Congressional Budget Act of 1974 establishes an internal process — called a congressional budget resolution — for Congress to formulate and enforce an overall plan each year for acting on budget legislation, though Congress has increasingly chosen to ignore that process.

In this backgrounder, we address:

- the two basic categories of federal spending legislation — “mandatory” and “discretionary” — and how Congress handles them;

- the President’s annual budget request for Congress to enact tax and spending laws, which traditionally kicks off the annual budget process;

- the congressional budget resolution — how it is developed, what it contains, and what happens if there is no budget resolution, as is frequently the case;

- the enactment of budget legislation, including how the terms of the budget resolution are enforced and what happens when appropriations are delayed;

- budget “reconciliation,” an optional procedure used in some years to facilitate the passage of legislation amending tax or spending law;

- statutory budget-control measures, such as pay-as-you-go requirements; and

- the debt limit.

Basic Budget Spending and Revenue Categories

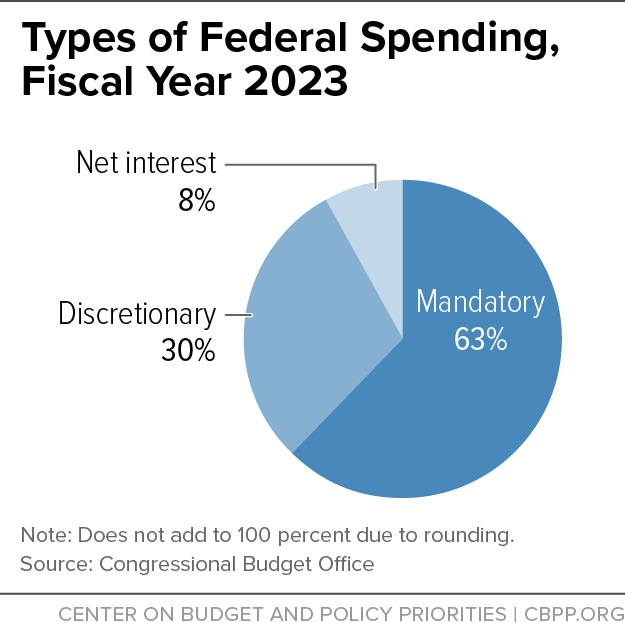

Spending. Federal spending is classified in two basic categories: mandatory and discretionary. About 63 percent of the federal budget is mandatory spending, 30 percent is discretionary spending, and the rest is interest payments on debt (see chart). These categories are not named for the relative importance or necessity of the programs involved; they refer to the relationship between the law that authorizes a program or activity and the law that determines the program’s spending.

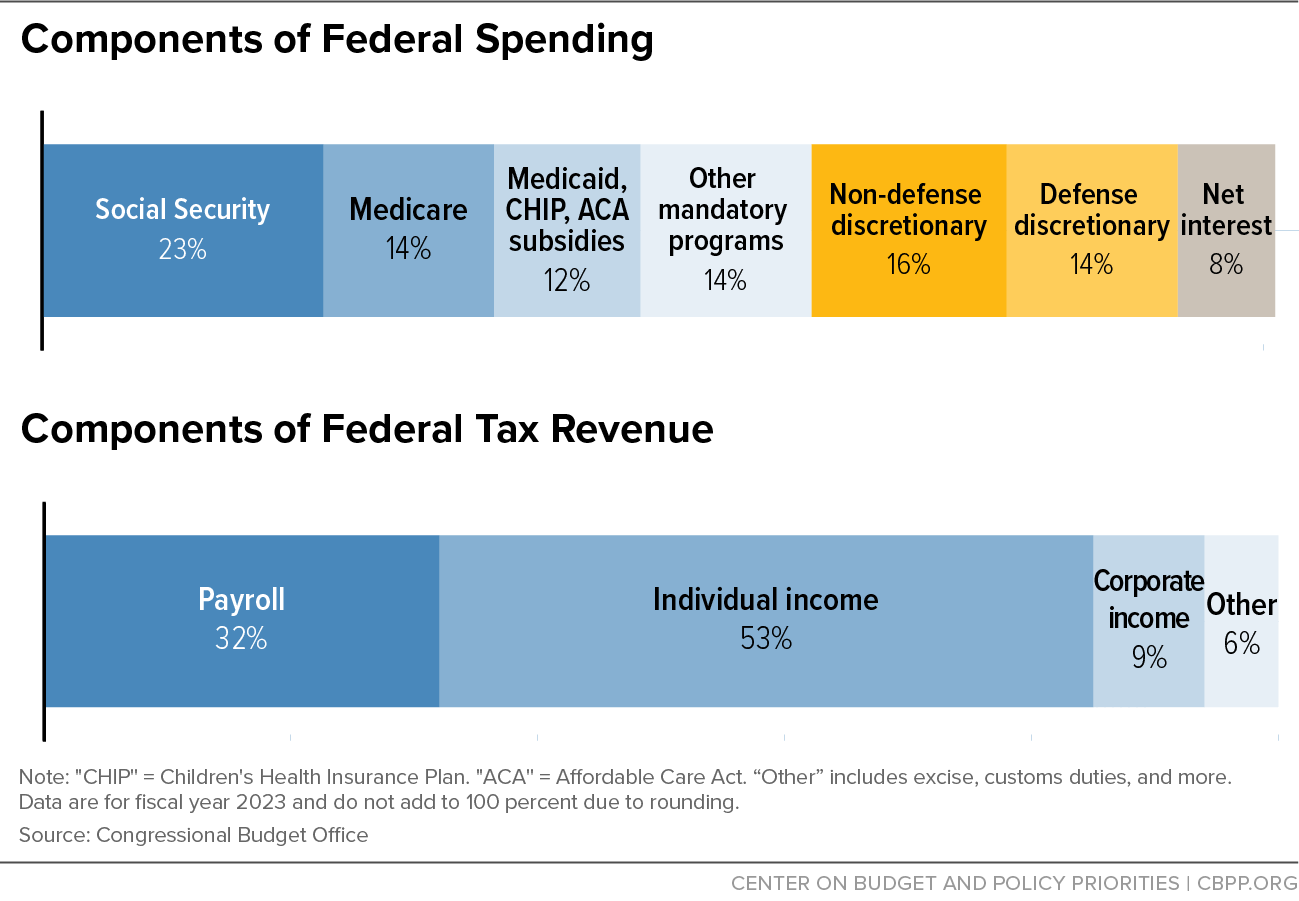

In the case of mandatory spending (sometimes also called “direct spending”), those two functions are combined. The law that authorizes a program and determines its purposes and rules also determines the funding. For many of these programs, the authorizing law provides that all who meet eligibility criteria can receive benefits determined by formula or benefits such as health care. Examples include Social Security, Medicare, Medicaid, federal military and civilian retirement, veterans’ disability compensation, the Supplemental Nutrition Assistance Program, or SNAP (formerly known as food stamps), and some farm price support programs (see chart below). These authorizing laws are written by the committees of jurisdiction over each such program. Examples include: SNAP, by the House Agriculture Committee and the Senate Committee on Agriculture, Nutrition, & Forestry; Medicaid, by the House Energy & Commerce Committee and the Senate Finance Committee; and veterans’ disability compensation, by the House and Senate Veterans’ Affairs Committees.

Other mandatory programs have specific funding amounts directly provided in the authorizing law. Examples include grants to states to support child care assistance, highway and transit assistance financed by the federal gas tax, and some of the funding for community health centers.

Changing mandatory programs requires amending the relevant authorizing law, to modify eligibility or benefits (up or down) or to adjust the funding levels set in authorizing law.

For discretionary spending, in contrast, the authorizing law that sets up the program, agency, or activity does not itself determine the funding level, which is instead set in annual appropriations legislation. For example, almost all defense spending is handled this way, along with the operating budgets of civilian agencies, medical care for veterans, grant programs such as for education and medical and scientific research, and some low-income assistance programs (such as for housing) that are not set up to necessarily serve everyone who is eligible.

Under current practice, annual funding for discretionary programs is under the jurisdiction of the House and Senate Appropriations Committees, which produce 12 appropriations bills, although some or all of those bills are often combined into omnibus packages. When a program that is traditionally funded through an annual appropriations bill instead receives some funding directly from an authorizing bill, then that funding is considered mandatory.

Revenues. On the revenue side of the budget (see chart above), taxes and fees are similar to mandatory spending in that they are generally governed by laws that remain in place until changed. But some tax policies are enacted on a temporary basis and expire if not extended. For example, most of the individual income tax cuts enacted in the 2017 tax law expire after 2025. Almost all revenue law is in the jurisdiction of the House Ways & Means Committee and the Senate Finance Committee.

Summary. Each year’s budget process in Congress requires, at a minimum, enactment of appropriations covering all discretionary programs. Congress is also likely to pass legislation affecting some mandatory spending, to renew programs if funding is expiring or to change eligibility, benefits, or funding, or to create new programs. It may also pass legislation changing tax law or extending expiring tax provisions. In addition, as described more below, Congress is supposed to adopt a budget resolution to guide its budgetary action for the year.

The President's Budget Request

The annual federal budget process traditionally starts when the President submits a detailed budget request for the coming fiscal year, which begins on October 1. (The request is supposed to come by the first Monday in February, but sometimes the submission is delayed, particularly when a new administration takes office or congressional action on the prior year’s budget has been delayed.) This budget request — developed through an interactive process between federal agencies and the President’s Office of Management and Budget that begins the previous spring (or earlier) — plays three important roles.

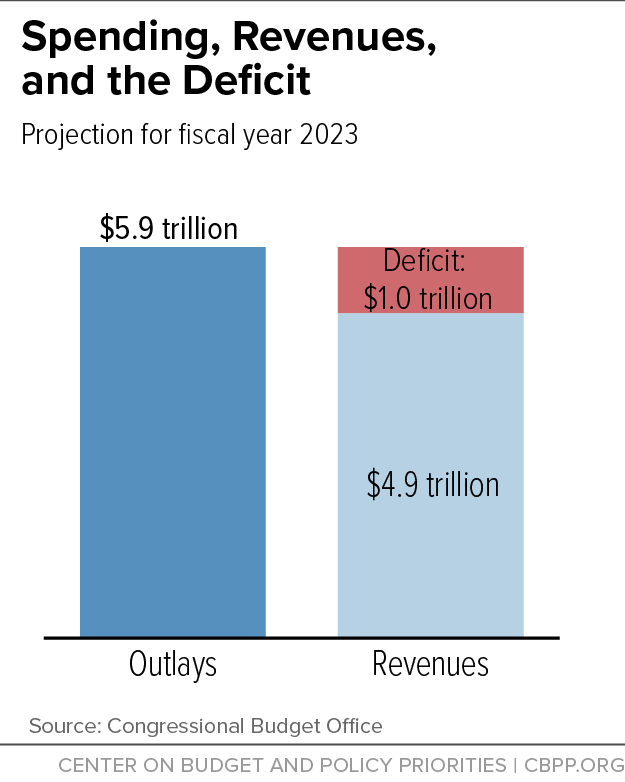

First, it tells Congress the President’s recommendation for overall federal fiscal policy: (a) how much money the federal government should spend on public purposes; (b) how much tax revenue it should collect; and (c) how much of a deficit (or surplus) it should run, which is the difference between (a) and (b). In most years, federal spending exceeds tax revenue and the resulting deficit is financed primarily through borrowing (see chart).

Second, the President’s budget lays out the administration’s relative priorities for federal programs — how much should be spent on defense, agriculture, education, health, and other areas. The budget is very specific, recommending funding levels for individual “budget accounts” — federal programs or small groups of programs. It typically outlines fiscal policy and budget priorities not only for the coming year but also for the subsequent nine years. The budget is accompanied by supporting volumes, including historical tables that report past budgetary results.

Third, the President’s budget typically includes some proposals to alter some mandatory programs and some aspects of revenue law, even if Congress is unlikely to consider those proposals. And it updates estimates of anticipated spending for ongoing mandatory programs and revenues even when no changes to these programs are proposed, so that budget totals — overall fiscal policy — is based on more recent information.

The Congressional Budget Resolution

Congress generally holds hearings to question administration officials about their requests and may then develop its own budget plan, called a “budget resolution.” The House and Senate Budget Committees draft and enforce the congressional budget resolution. Once the Budget Committees pass their budget resolutions, the resolutions go to the House and Senate floors, where they can be amended. The budget resolution for the year is adopted when the House and Senate pass the identical measure, either after negotiating a conference agreement or after one chamber passes the resolution adopted by the other.

The congressional budget resolution is a “concurrent” resolution, not an ordinary bill, and therefore does not go to the President to be signed or vetoed. It is also one of the few measures that cannot be filibustered in the Senate and so requires only a majority vote to pass (or be amended). Because it does not go to the President, a budget resolution cannot enact spending or tax law. Instead, it sets targets for congressional committees to propose legislation directly appropriating funds or changing spending and tax laws. It can also establish an expedited process for action on mandatory spending and tax changes, known as “reconciliation” (discussed more in a separate section below).

Congress is supposed to pass the budget resolution by April 15, which is 5½ months before the October 1 start of the fiscal year, but it often takes longer. In recent years, moreover, it has been common for Congress not to pass a budget resolution at all. Instead, the House and Senate may agree to “deeming resolutions” or statutory provisions that substitute for the budget resolution (see box, “What If There Is No Budget Resolution?”).

- How detailed is the budget resolution? Unlike the President’s budget, which is very detailed, the congressional budget resolution is a simple document. It consists of a set of numbers stating how much Congress should spend in each of 19 spending categories (known as budget “functions”) and how much total revenue the government should collect, for each of the next five years or more. (The Congressional Budget Act requires that the resolution cover a minimum of five years, though Congress now generally chooses ten.) The difference between the two totals — the spending ceiling and the revenue floor — represents the deficit (or surplus) expected for each year.

- How is the Social Security program treated? Since 1990, the budget resolution has been required by law to exclude the income and expenditures of the Social Security Trust Fund. The charts above show the total, or “unified,” budget but the congressional budget resolution omits Social Security spending and the corresponding revenue from the Social Security payroll tax.

How spending is defined: budget authority vs. outlays. The spending totals in the President’s budget and the budget resolution are stated in two ways: the total amount of “budget authority,” or funding, and the estimated level of expenditures, or “outlays.” Budget authority represents how much money Congress allows a federal agency to commit to spend; outlays are how much money flows out of the federal Treasury in a given year. For example, a bill that appropriated $50 million for building a bridge would provide $50 million in budget authority for the coming year, but the outlays might not reach $50 million until the following year or even later, when the planning and construction of the bridge has been completed.

Budget authority and outlays thus serve different purposes. Budget authority represents a limit on the new financial obligations federal agencies may incur (by signing contracts or making grants, for example), and is generally the focus of Congress’s budgetary decisions. Because outlays represent actual cash flow, they help determine the size of the overall deficit or surplus.

How committee spending limits are set: 302(a) allocations. The report that accompanies the budget resolution includes a table called the “302(a) allocation,” named for the section in the Congressional Budget Act. This table takes the spending totals that are laid out by function in the budget resolution and distributes them by congressional committee instead. The House and Senate tables are different from one another since committee jurisdictions vary somewhat between the two chambers.

In both the House and Senate, the Appropriations Committee receives a single 302(a) allocation for all of its programs. Each of the Appropriations Committees then decides how to distribute this funding among its 12 subcommittees to create 302(b) sub-allocations. Each committee with jurisdiction over mandatory programs receives a 302(a) allocation that represents a total dollar limit on all of the mandatory spending within its jurisdiction.

The spending totals in the budget resolution do not apply to “authorizing” legislation that merely establishes or changes rules for federal programs funded through the annual discretionary appropriations process. Unless it changes an entitlement program (such as Medicare or SNAP), authorizing legislation does not actually have a budgetary effect; the subsequent discretionary appropriation does, however.

- What is the revenue floor? The budget resolution’s revenue floor is a single figure covering all revenue (except Social Security payroll tax revenue).

The report accompanying the budget resolution often contains language describing the assumptions behind it, including how much it envisions certain programs being cut or increased, or how it envisions tax law being changed. These assumptions serve only as guidance to the other committees.

The budget resolution can also include temporary or permanent changes to the congressional budget process.

Enacting Budget Legislation

Following adoption of the budget resolution, Congress considers the annual appropriations bills, which fund discretionary programs for the coming fiscal year. Congress may also consider legislation to enact changes to mandatory spending or revenue levels within the spending limits and the revenue floor specified in the budget resolution and the accompanying 302(a) allocations. Mechanisms exist to enforce the terms of the budget resolution during the consideration of such legislation. Failure to enact appropriations bills by the start of the fiscal year requires Congress to take special steps to avoid the disruption of government services. A special mechanism known as “reconciliation” expedites the consideration of mandatory spending and tax legislation and is discussed in the next section.

Enforcing the Terms of the Budget Resolution

The main enforcement mechanism that prevents Congress from passing legislation that violates the terms of the budget resolution is the ability of a single member of the House or the Senate to raise a budget “point of order” on the floor to block such legislation. In some recent years, this point of order has not been particularly important in the House because it can be waived in the “rule” that sets the conditions under which each bill will be considered on the floor. Rules, which are resolutions that the House can adopt by a simple majority vote, are developed by the leadership-appointed Rules Committee.

However, the budget point of order is important in the Senate, where any legislation that exceeds a committee's spending allocation — or cuts taxes below the level allowed in the budget resolution (the revenue floor) — is vulnerable to a budget point of order on the Senate floor that requires 60 votes to waive. If the point of order is not waived, the consideration of the bill on the Senate floor ends.

What If There Is No Budget Resolution?

Congress has seldom completed action on the budget resolution by the April 15 target date specified in the Congressional Budget Act of 1974. Moreover, while Congress agreed to a budget resolution for each of the first 23 years the Budget Act was in effect (1976 through 1998), it failed to complete action on a resolution for the majority of years between 1999 and 2022. (Nor has it yet adopted a budget resolution for fiscal year 2023.) In the absence of a new budget resolution, the spending limits and revenue floor in the prior budget resolution automatically continue for the remaining years of that budget resolution.

But because the prior budget resolution had established a 302(a) allocation for the Appropriations Committees for only the prior year, those committees will have no official funding target for the coming year. Without that funding target, each of the 12 appropriations bills will be subject to a point of order. To avoid this and other potential procedural problems stemming from not having a new budget resolution in place, the House and Senate may agree to separate budget targets — often with a considerable delay — which they “deem” to be a substitute for the budget resolution. Such deeming resolutions might cover only a new appropriations target (so that the prior multi-year revenue floor and spending targets for other committees remain in effect). Or they might set a new revenue floor and new targets for the other committees.

Congress has sometimes taken a different approach, establishing a “Congressional Budget” in statute as an alternative to the concurrent budget resolution, including setting new appropriations targets for discretionary programs. For instance, Congress did this in a series of “bipartisan budget acts” (enacted in 2013, 2015, 2018, and 2019) that reflected the outcome of negotiations to raise the funding limits on defense and non-defense appropriations created by the 2011 Budget Control Act. Because deeming resolutions and the statutory approach taken in the bipartisan budget acts substitute for regular budget resolutions, they effectuate the same budgetary points of order.

Budget points of order can be raised if appropriations bills (or amendments to them) do not fit within the 302(a) allocation given to the Appropriations Committee and the committee-determined 302(b) sub-allocations for the coming fiscal year. Similarly, entitlement bills (or any amendments offered to them) must not exceed the budget resolution's 302(a) allocation for the applicable committee and tax legislation must not cause revenue to fall below the revenue floor, in the first year and over the total multi-year period covered by the budget resolution. The cost of a tax or entitlement bill is determined (or “scored”) by the Budget Committees, nearly always by relying on estimates provided by the nonpartisan Congressional Budget Office (CBO). CBO measures the cost of tax or entitlement legislation against a budgetary “baseline” that projects mandatory spending and tax receipts under current law.

What If Appropriations Bills Are Not Passed on Time?

If Congress does not complete action on an appropriations bill before the start of the fiscal year on October 1 — which has been the case in each fiscal year since 1997, and in 40 of the last 43 years — it must approve, and the President must sign, a continuing resolution (CR) to provide stopgap funding for affected agencies and programs. If Congress doesn’t pass or the President does not sign a CR (due to disagreements over its contents), agencies and programs that require annual appropriations but have not received them must largely shut down operations.

For example, a dispute between President Trump and congressional Democrats over border wall funding led to a 35-day shutdown of federal agencies within nine different departments starting December 22, 2018. A dispute between President Obama and congressional Republicans over the funding of health reform legislation led to a 16-day shutdown of ordinary government operations beginning October 1, 2013. And a dispute between President Clinton and congressional Republicans in the winter of 1995-96 resulted in a 21-day shutdown of substantial portions of the federal government.

The Budget "Reconciliation" Process

The budget “reconciliation” process is an optional, special procedure outlined in the Congressional Budget Act to expedite the consideration of spending and tax legislation. This procedure was originally envisioned as a deficit-reduction tool, to force committees to produce spending cuts or tax increases called for in the budget resolution; 16 such deficit-reducing reconciliation bills have been enacted, including the Inflation Reduction Act of 2022. However, it has been used to increase the deficit on several occasions, notably to enact tax cuts three times during the George W. Bush Administration and again under the Trump Administration in 2017, and to enact a COVID-19 relief bill under the Biden Administration in 2021. Although the reconciliation process is optional, its procedural advantages (see below) are sufficiently great that Congress has increasingly used it to enact major spending and tax changes. In recent decades, the most likely reason for Congress to proceed with a budget resolution at all is to trigger the reconciliation process; if a reconciliation bill is not envisioned, Congress is likely to forgo a budget resolution entirely.

- How does Congress start the reconciliation process? To start a reconciliation process, the House and Senate must adopt a budget resolution that includes a “reconciliation directive” instructing one or more committees to produce legislation by a specific date that meets certain spending or tax targets, though the target may instead be a directive to “change the (projected) deficit” by a specified amount. If a committee fails to produce this legislation, the Budget Committee chair generally has the right to offer floor amendments to meet the reconciliation target for the committee; this threat usually results in compliance with the directive.

- What is a “reconciliation bill” and what are its procedural advantages? Once the committees produce legislation consistent with the reconciliation directive, the Budget Committee packages all of these measures together into a single “reconciliation bill” that goes to the floor. Under the rules guiding reconciliation, the bill is not subject to a filibuster and debate is limited to 20 hours; amendments are also more circumscribed. As a result, the Senate can consider and pass a reconciliation bill fairly quickly relative to other controversial legislation, which is subject to a filibuster and requires a three-fifths majority vote to proceed.

- What type of spending is subject to reconciliation? Historically, spending changes in reconciliation bills have been limited to mandatory programs. But on some occasions, especially in 2021, additional funding for discretionary programs has been directly provided by the committees with authorizing jurisdiction over those programs, bypassing the Appropriations Committees. Consequently, the House and Senate committees that have received reconciliation instructions have always been a) the tax committees (House Ways & Means and Senate Finance); b) authorizing committees, with jurisdiction over mandatory spending programs; and c) authorizing committees rather than the Appropriations Committees, even when direct funding changes to otherwise discretionary programs have been envisioned.

What constraints does the “Byrd Rule” impose on reconciliation? While reconciliation enables Congress to make changes to spending and tax legislation by majority vote, it faces one major constraint: the “Byrd Rule,” named after the late Senator Robert Byrd of West Virginia. This Senate rule provides a point of order against any provision of (or amendment to) a reconciliation bill that is deemed “extraneous” to the purpose of amending spending or tax law. If a point of order is raised under the Byrd Rule, the offending provision is automatically stripped from the bill unless at least 60 senators vote to waive the rule. This makes it difficult, for example, to include any policy changes in a reconciliation bill unless they have direct fiscal implications — and those fiscal effects must be more than “merely incidental” to the non-budgetary aspects of the provision. Under this rule, changes in the authorization of discretionary appropriations — which will be funded in later appropriations bills rather than directly funded in the reconciliation bill — are not allowed. Nor, for example, are changes to civil rights or employment law or even the budget process. Changes to Social Security also are not permitted under the Byrd Rule, even if they are budgetary.

In addition, the Byrd Rule bars any spending increases or tax cuts that cost money beyond the five (or more usually ten) years covered by the reconciliation directive, unless other provisions in the bill fully offset these "outside-the-window" costs. For a more thorough discussion of the Byrd Rule, including an explanation of why “merely incidental” budgetary effects does not mean “small” budgetary effects, see the link at the end of this Policy Basics, Introduction to Budget “Reconciliation.”

Statutory Budget-Control Mechanisms

In addition to the limits established in the annual budget process under the Congressional Budget Act, Congress has often operated under statutory budget-control mechanisms intended to prevent tax and mandatory spending legislation from increasing the deficit or that constrain discretionary spending.

- PAYGO. Under the 2010 Statutory Pay-As-You Go (PAYGO) Act, any legislative changes to taxes or mandatory spending that increase projected deficits must be “offset” or paid for by other changes to taxes or mandatory spending that reduce deficits by an equivalent amount. (The House and Senate each enforce the PAYGO principle though similar internal rules, independent of the Congressional Budget Act, although those rules can be waived by majority vote in the House and by the vote of 60 senators.)

- Discretionary funding caps. The 1990 Budget Enforcement Act (BEA) and the 2011 Budget Control Act (BCA) each imposed temporary, legally enforceable limits or “caps” on the level of discretionary appropriations. In each case, the limits were amended from time to make them less restrictive. The BEA limits expired after 2002 and the BCA limits expired after 2021.

Both PAYGO and discretionary funding caps are enforced by “sequestration” — across-the-board cuts in specified programs. For instance, violation of PAYGO would trigger across-the-board cuts in selected mandatory programs at the end of each session of Congress to restore the balance between the costs and savings of previously enacted mandatory spending or revenue changes. But Congress has frequently set aside the Statutory PAYGO Act by exempting costs from its sequestration rules; as a result, there has never been a sequestration under Statutory PAYGO. Similarly, appropriations that exceed the discretionary funding caps would trigger across-the-board cuts in appropriated programs to eliminate the overage. The only significant sequestration occurred in 2013, to comply with the funding limits set by the 2011 Budget Control Act (which went into effect after Congress had already enacted appropriations for 2013).

The Debt Limit

Budgeting involves legislation that raises revenue and funds programs. If revenue is not sufficient to cover the resulting spending (and to cover other financial transactions), the Treasury borrows as needed. Separately, however, a fixed dollar limit exists on Treasury borrowing. When the debt limit is reached, it will conflict with underlying budgetary law. That is, the government is required by law to pay contractors who have fulfilled their contracts, pay its employees, cover Medicare costs, make compensation payments to disabled veterans, pay interest on its outstanding debt, and so on — yet the Treasury will be prohibited from borrowing to do so. Congress invariably resolves this conflict of laws by raising the debt limit to a new dollar level or suspending the debt limit for a specified period, rather than by forcing the Treasury to illegally default on contracts and violate the nation’s budgetary laws. But consideration of legislation to raise the debt limit may be acrimonious and time-consuming, and the threat of a possible government default may dampen the economy until the debt limit is raised or suspended.

Conclusion

The norm of applying the rules and procedures of the Congressional Budget Act on an annual basis has largely broken down. For the last decade or more, Congress has rarely followed the Act’s orderly process. Deadlines are routinely missed. Perhaps most importantly, Congress has sought to adopt a budget resolution mainly when it has chosen to create a reconciliation bill, which is not subject to a Senate filibuster. Nevertheless, the Act’s rules and procedures can still shape and influence consideration of fiscal policy in Congress, and to a significant degree the reconciliation process is used to enact major legislation.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.