BEYOND THE NUMBERS

In a sentiment with which we wholeheartedly agree, seven former IRS commissioners — from both Republican and Democratic Administrations — expressed concern over IRS budget cuts in a letter this week to House and Senate Appropriations Committee leaders.

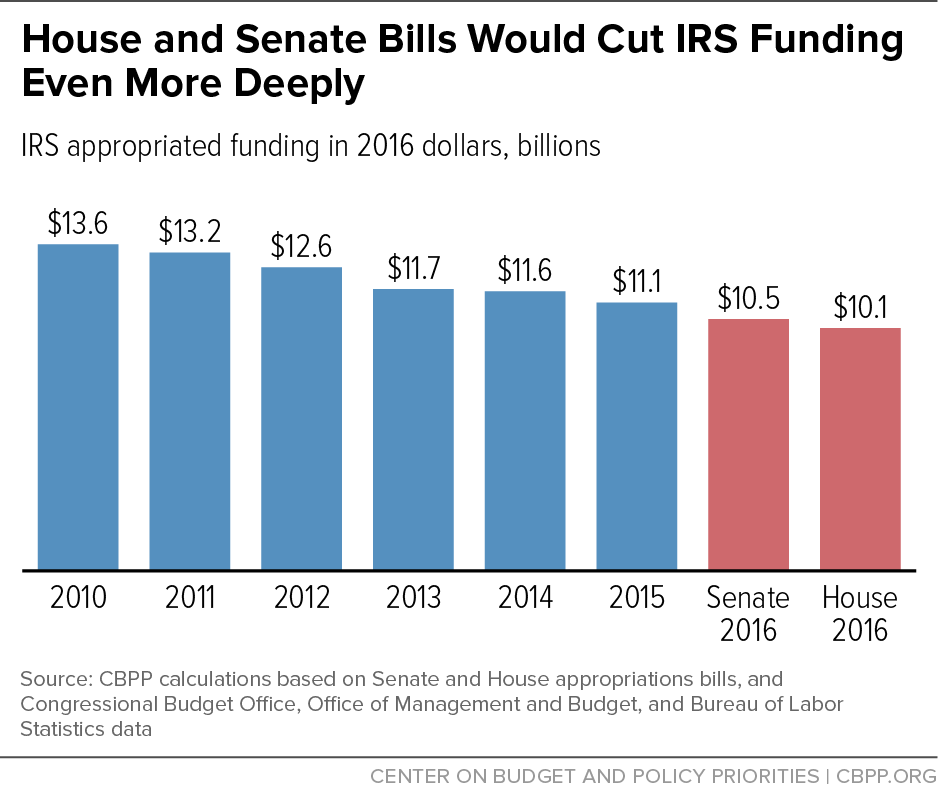

The agency’s budget, which has been cut by 18 percent since 2010, stands to lose even more under the House and Senate appropriations bills. “Over the last fifty years, none of us has ever witnessed anything like what has happened to the IRS appropriations over the last five years and the impact these appropriations reductions are having on our tax system,” the commissioners wrote.

As we’ve written, the last five years of IRS cuts have compromised taxpayer service and weakened enforcement. They’ve forced the agency to cut its workforce, severely scale back employee training, and delay much-needed upgrades to information technology systems. These steps, in turn, have weakened the IRS’s ability to enforce the nation’s tax laws and serve taxpayers efficiently, as the National Taxpayer Advocate, the Treasury Inspector General for Tax Administration, the IRS Oversight Board, the Government Accountability Office — and now these former IRS commissioners — all have documented.

The House and Senate 2016 appropriations bills would further damage IRS funding: the House bill would cut it by $838 million and the Senate bill would cut it by $470 million, relative to 2015 (see chart). Adjusted for inflation, these cuts would reduce IRS funding to 26 percent and 23 percent below its 2010 level, respectively, bringing it to its lowest level since 1990. These bills’ deep cuts in funding — on top of the years of cuts already enacted — would put intense pressure on IRS core functions, weakening enforcement and jeopardizing the IRS’s ability to fulfill its legal mandates.

Noting the damage that previous cuts have caused, the commissioners urged appropriators to increase the IRS budget. “We fail to understand how it makes any logical sense to continue to reduce, rather than increase the IRS budget for FY 2016 in order to optimize the IRS’ ability to provide taxpayer service and to enforce the tax laws to increase revenue collections.”

The IRS plays a fundamental role in government, collecting nearly all of the revenue that funds federal programs. We agree with the former commissioners: if policymakers want the IRS to fulfill its essential mission effectively, they need to restore the agency’s funding, not cut it more.