BEYOND THE NUMBERS

Recent high-profile news investigations have emphasized how wealthy people can avoid paying taxes in ways that most ordinary wage-earners can’t: ProPublica’s analysis of tax records showed that many of the wealthiest U.S. residents pay little to no income tax, and the investigation of the Pandora Papers showed how many wealthy people hide money in offshore accounts to avoid taxation. While the federal government should improve its taxation of wealth, states don’t have to wait for federal policymakers. This year several states strengthened their taxes on wealth or high incomes or closed loopholes that primarily benefit corporations and wealthy individuals, raising revenue that can support an antiracist, equitable response to the pandemic that centers the needs of the people hit hardest by the pandemic and its economic effects.

State actions include:

- Colorado eliminated or reformed more than a dozen tax loopholes for corporations and the wealthy and redirected much of the savings — several hundred million dollars per year — to help families make ends meet and contribute to the economic recovery, such as by expanding the Earned Income Tax Credit (EITC) and funding the state’s Child Tax Credit.

- The District of Columbia made its income tax more progressive by raising revenue from the highest earners, which it will use to boost wages for early childhood educators, provide additional affordable housing supports, and expand the EITC. These measures will make D.C.’s tax code more racially equitable.

- Maine eliminated an ineffective and expensive corporate loophole, the Foreign Derived Intangible Income deduction. This will provide the state almost $9 million annually.

- New York raised over $4.3 billion in revenue annually by temporarily raising the top personal income tax rate and corporate franchise tax rate and by decoupling from misguided federal tax breaks for “Opportunity Zones.”

- Rhode Island increased its tax on the transfer of high-value property by placing an additional tax on the portion of property sold worth over $800,000. Revenue will go to creating and maintaining affordable housing in the state.

- Washington State created a 7 percent tax on capital gains above $250,000 per year to help support child care, early learning, and public schools. The measure — which is expected to raise more than $500 million annually, almost exclusively from the wealthiest 1 percent of households — will boost the state economy.

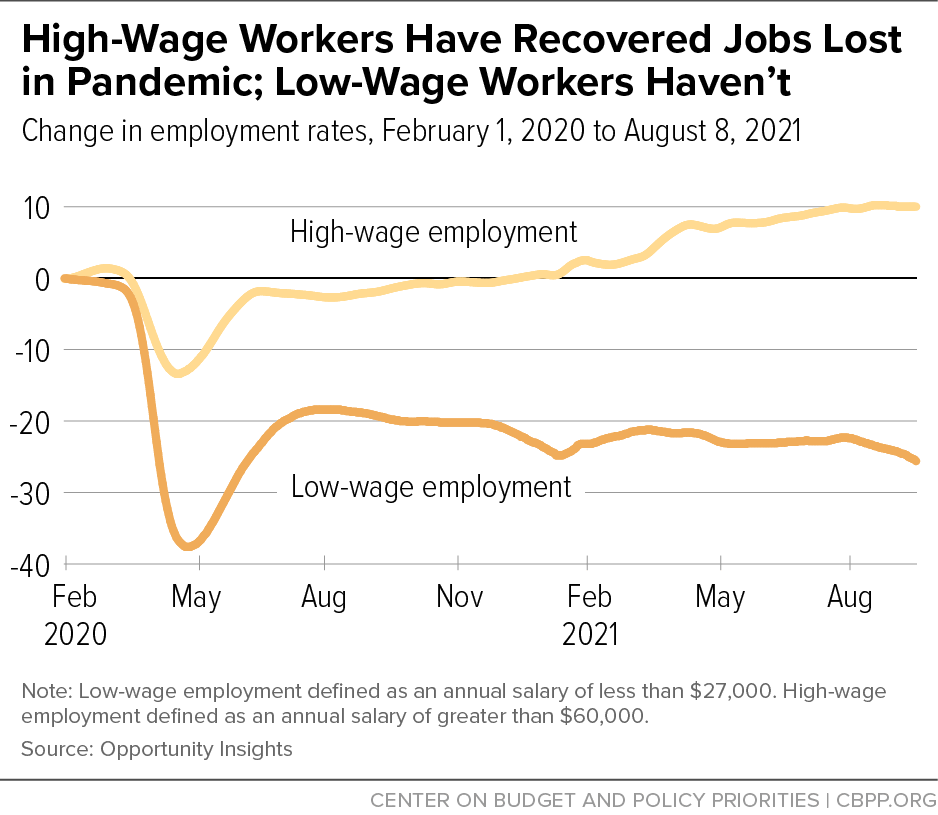

Families’ access to wealth has largely determined how the pandemic has affected them, with wealthier and higher-paid families more likely to avoid the worst health and economic effects. This divergence reflects both racial and class inequities, especially since wealthy families are disproportionately white. For example, high earners have been much less likely to lose their jobs than other workers due to COVID-19. Between January 2020 and August 2021, the employment rate fell by more than 25 percent for people earning less than $27,000 but rose by 10 percent for people earning over $60,000, according to Opportunity Insights. (See chart.) And millions still report (through the Census Bureau’s Household Pulse Survey) that their household isn’t getting enough to eat or isn’t caught up on rent, with households of color likelier to report greater hardship. This reflects longstanding inequities — often stemming from structural racism — in education, employment, housing, and health care that the current crisis has aggravated.

By taxing wealth and high incomes, states can raise much-needed revenue to help address these inequities. Federal aid provided through the CARES Act and American Rescue Plan is crucial for states to make transformative investments in a stronger and more equitable future, but it’s temporary. Also, states’ needs for increased revenue will extend beyond that federal support. Taxing wealth is particularly appropriate given that generators of income and wealth for people at the top have continued to rise during the pandemic, such as the stock market and home values (especially for high-value homes).

States can choose from a number of options to tax wealth and high incomes, including increasing income taxes for the highest-income people, increasing capital gains taxes, increasing taxes on the sale or purchase of expensive homes, and enacting or expanding estate and inheritance taxes. More states should consider these and similar measures to enable a more broadly shared recovery and make meaningful progress on reducing long-term inequities.