off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Social Security Disability Insurance (DI) turns 60 today. Workers contribute to Social Security to protect against the financial risks of old age, ill health, and death of a breadwinner. The 1956 amendments, approved by large bipartisan majorities in Congress and signed into law by President Eisenhower, added disability protections to the Social Security Act, providing earned benefits for workers who can no longer support themselves through work due to severe impairments.

Here are six key facts about DI — and you can learn more from our newly updated policy basic:

- DI is a crucial part of Social Security. Together with retirement and survivors insurance, DI is part of the Social Security program that Americans know and love. Social Security’s programs share key features, such as the tax base, benefit formula, and cost-of-living adjustments. Most DI beneficiaries are near Social Security’s early retirement age of 62, and they automatically begin to receive retirement benefits rather than DI benefits when they reach the full retirement age, now 66.

- Workers earn DI benefits — and most beneficiaries have strong work histories. To qualify for DI, workers must not only prove that they have a severe enough impairment that they can’t support themselves and their families; they must also have a solid work history. The large majority of DI beneficiaries have extensive work histories; the average beneficiary worked for 22 years and earned middle-class wages before becoming disabled.

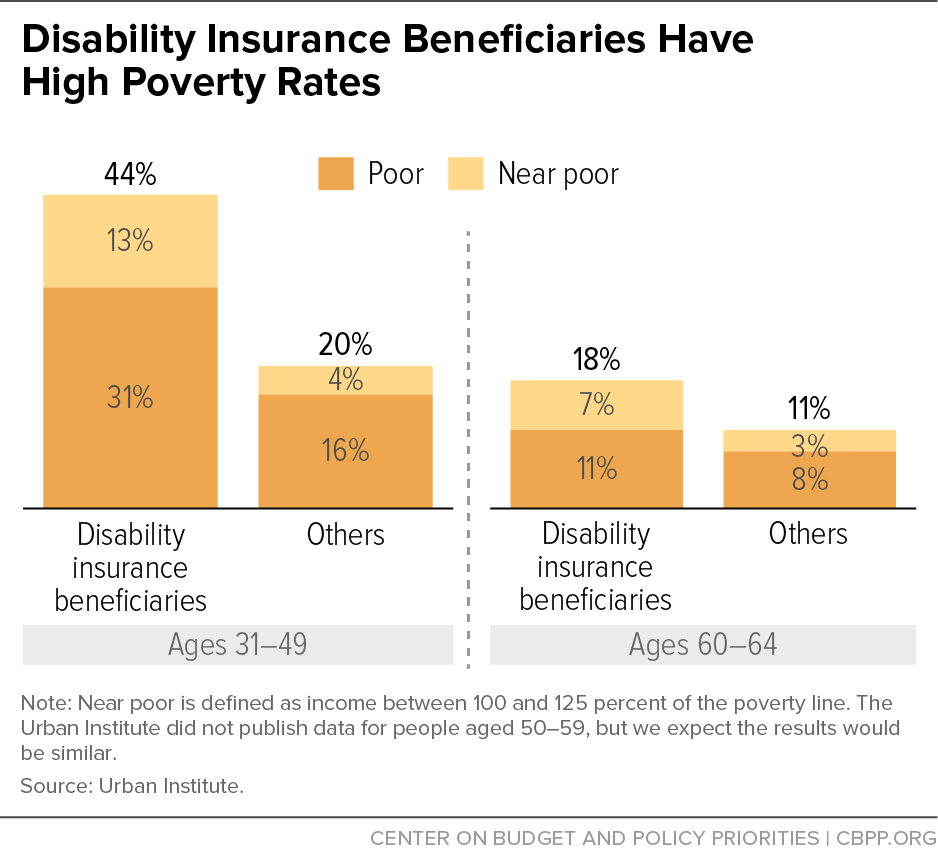

- DI provides a lifeline for workers experiencing great hardship. For a typical disabled worker, benefits replace less than half of average pre-disability earnings. Without DI, the poverty rate among disabled workers would reach nearly 50 percent. Even with disability benefits, about one in five disabled workers is poor (see chart).

- DI contains significant work incentives. All DI beneficiaries can earn up to $1,130 a month (in 2016) with no loss in benefits — which could double the income of a beneficiary receiving the average benefit of $1,165. Beneficiaries may earn unlimited amounts without jeopardizing their benefits while they test their ability to return to work during a nine-month trial work period and three-month grace period.

- The 2015 bipartisan budget deal improved DI solvency. To prevent the DI trust fund’s imminent exhaustion, the 2015 bipartisan budget agreement extended DI solvency through 2023 by reallocating payroll taxes between the DI trust fund and Social Security’s Old-Age and Survivors Insurance trust fund. Policymakers will have to revisit DI solvency within the next seven years — ideally as part of a comprehensive package to address Social Security’s solvency.

- DI costs have leveled off. Though DI faces a long-term financing gap, its costs have stabilized as the economy continues to mend and baby boomers who receive DI move to Social Security’s retirement program.

Topics:

Stay up to date

Receive the latest news and reports from the Center