más allá de los números

States Look to Expand Opportunity by Boosting Capital Gains Taxes

Lawmakers in Connecticut, Minnesota, and Vermont are considering raising taxes on capital gains —profits from selling an asset that has gained value, such as stock, real estate, or artwork — while New Mexico this year scaled back a tax break for capital gains. Historically, wealthy (mainly white) individuals used their political power to shape state tax policies in ways that largely benefit them and their families; reforms like these can reduce wealth concentration and racial inequality and expand equality of opportunity.

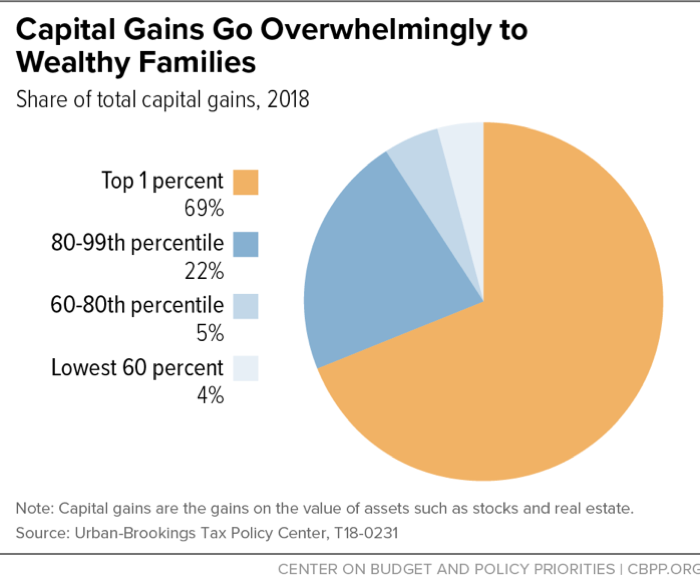

Because wealth is highly concentrated, so is capital gains income. Some 69 percent goes to the wealthiest 1 percent of taxpayers (see chart), and about 80 percent to the wealthiest 5 percent. Meanwhile, white families are three times likelier than families of color to be in the wealthiest 1 percent.

Most states tax capital gains income at the same rate as wage and salary income, but some states, including Vermont and New Mexico, provide special tax breaks. Among recent state actions on capital gains:

- In Connecticut, the legislative finance committee proposed a 2 percent surtax on capital gains for taxpayers with income over $500,000 (for single filers) and $1 million (for married filers).

- In Minnesota, House leaders proposed a 3 percent surtax on capital gains and dividend income for taxpayers with income over $500,000.

- In Vermont, a House-passed bill would shrink a capital gains tax break by cutting the amount of capital gains income that filers can exclude from their taxable income. The Senate has advanced a similar proposal. Reducing this tax break, which mostly benefits high-income taxpayers, would be an important first step towards fundamentally rethinking Vermont’s capital gains taxes.

- In New Mexico, the governor and legislature reduced, from 50 percent to 40, the share of capital gains that are tax-exempt from taxation as part of a historic package of tax reforms that they enacted in April.

Opponents argue that strengthening capital gains taxes discourages investment and stifles economic growth. But history shows there’s no connection between capital gains tax rates and economic growth. That’s particularly true at the state level: the companies, bonds, and other assets generating capital gains for a state’s residents could be located anywhere in the country or world, so any economic benefit wouldn’t necessarily go to the state providing the tax break.

States looking to create broadly shared prosperity should increase capital gains taxes — including by eliminating any tax breaks for this type of income — to support public investments in education, infrastructure, and other priorities that benefit the state as a whole. They should also explore expanding taxes on other types of wealth, like high-value properties and estates.