States’ Recent Tax-Cut Spree Creates Big Risks for Families and Communities

End Notes

[1] National Association of State Budget Officers (NASBO), “2022 State Expenditure Report,” November 2022, p. 15, https://www.nasbo.org/reports-data/state-expenditure-report.

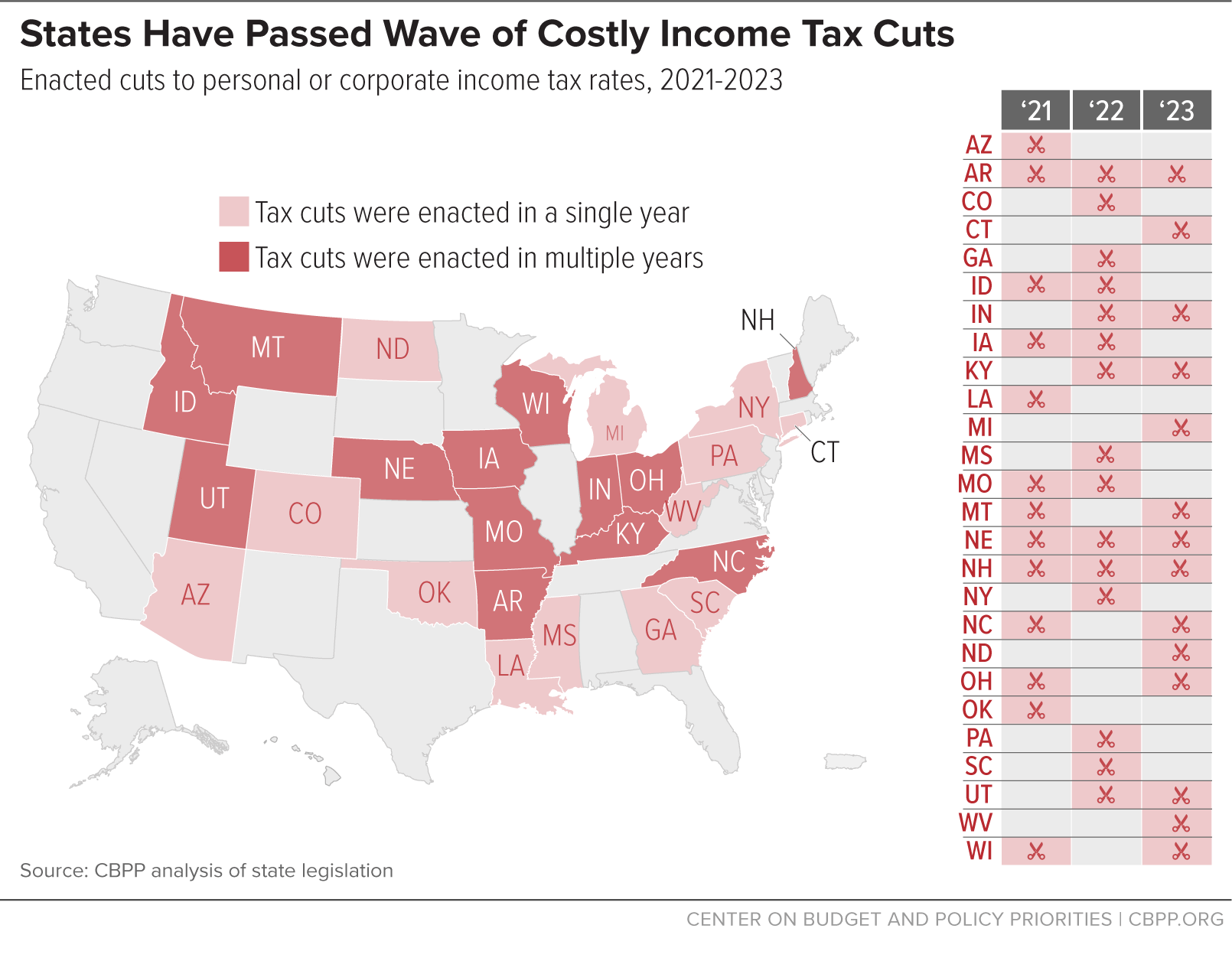

[2] Tax Policy Center, “Reviewing Three Years of State Tax Cuts,” July 2023, https://www.taxpolicycenter.org/taxvox/three-years-state-tax-cuts.

[3] Michael Leachman and Erica Williams, “States Can Learn From Great Recession, Adopt Forward-Looking, Antiracist Policies,” CBPP, February 11, 2021, https://www.cbpp.org/research/state-budget-and-tax/states-can-learn-from-great-recession-adopt-forward-looking.

[4] Nicholas Johnson, “The State Tax Cuts of The 1990s, the Current Revenue Crisis, and Implications for State Services,” CBPP, November 18, 2002, https://www.cbpp.org/sites/default/files/archive/11-14-02sfp.pdf.

[5] NASBO, “The Fiscal Survey of States: Spring 2023,” 2023, p. 57, https://shorturl.at/svRX0.

[6] In some cases, such as Arkansas and Ohio, the most recent tax cuts stack on top of prior waves of cuts adopted over many years and sometimes decades. See Bruno Showers, “A Decade Of Tax Cuts For Arkansas’s Rich And Powerful,” Arkansas Advocates for Children and Families, July 7, 2022, https://www.aradvocates.org/a-decade-of-tax-cuts-for-arkansass-rich-and-powerful/; and Guillermo Bervejillo, “The great Ohio tax shift,” Policy Matters Ohio, February 10, 2022, https://www.policymattersohio.org/research-policy/quality-ohio/revenue-budget/tax-policy/the-great-ohio-tax-shift-2022.

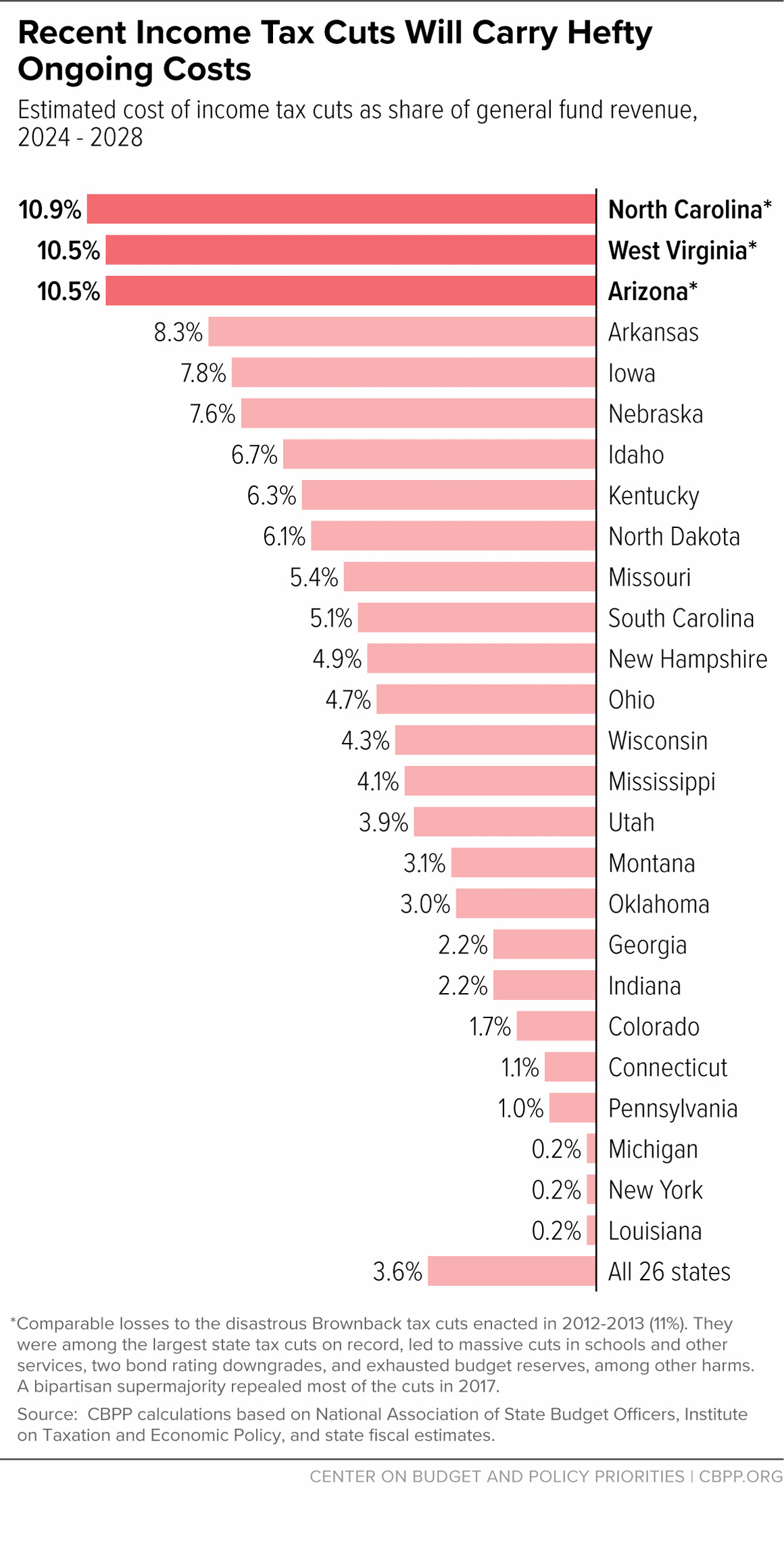

[7] In one state, Michigan, the revenue losses from reduced income tax rates will be temporary rather than permanent, because the state’s attorney general interpreted state law as only triggering a temporary, one-year tax cut for tax-year 2023, as opposed to a permanent rate reduction, as some have argued was the bill’s original intention. At the same time, revenue losses from some other state policy changes — in particular a costly expansion of the state’s tax exemption for seniors — will be permanent. “Michigan attorney general says income tax cut is temporary,” Associated Press, March 28, 2023, https://apnews.com/article/income-tax-cut-temporary-nessel-michigan-6a8e42a09153afbb8e094bc61dad5cec.

[8] All told, ten states (Arkansas, Georgia, Indiana, Iowa, Mississippi, Nebraska, New Hampshire, North Carolina, Pennsylvania, and South Carolina) enacted phased-in income tax cuts from 2021 through 2023, and six (Georgia, Kentucky, Louisiana, Missouri, North Carolina, and West Virginia) adopted a tax-cut trigger.

[9] State’s fiscal note, with CBPP projections based on inflation and additional rate reductions for 2028-2030. Pennsylvania House Appropriations Committee, “2022/23 Budget-in-Depth,” July 20, 2022, https://www.houseappropriations.com/Topic/BudgetYears/720.

[10] Wesley Tharpe, “Growing Trend to Phase in or Trigger State Tax Cuts Is Irresponsible, Skirts Accountability,” CBPP, March 8, 2023, https://www.cbpp.org/blog/growing-trend-to-phase-in-or-trigger-state-tax-cuts-is-irresponsible-skirts-accountability.

[11] A triggered tax cut will now take effect, dropping that state’s flat personal income tax rate from 4.25 percent to 4.05 percent this year, at an estimated cost of $650 million in the 2024 budget year. “Michigan taxpayers to receive income tax reduction next year,” Associated Press, March 29, 2023, https://apnews.com/article/michigan-income-tax-cut-a684efabf8d68c69f498601b0de672f1.

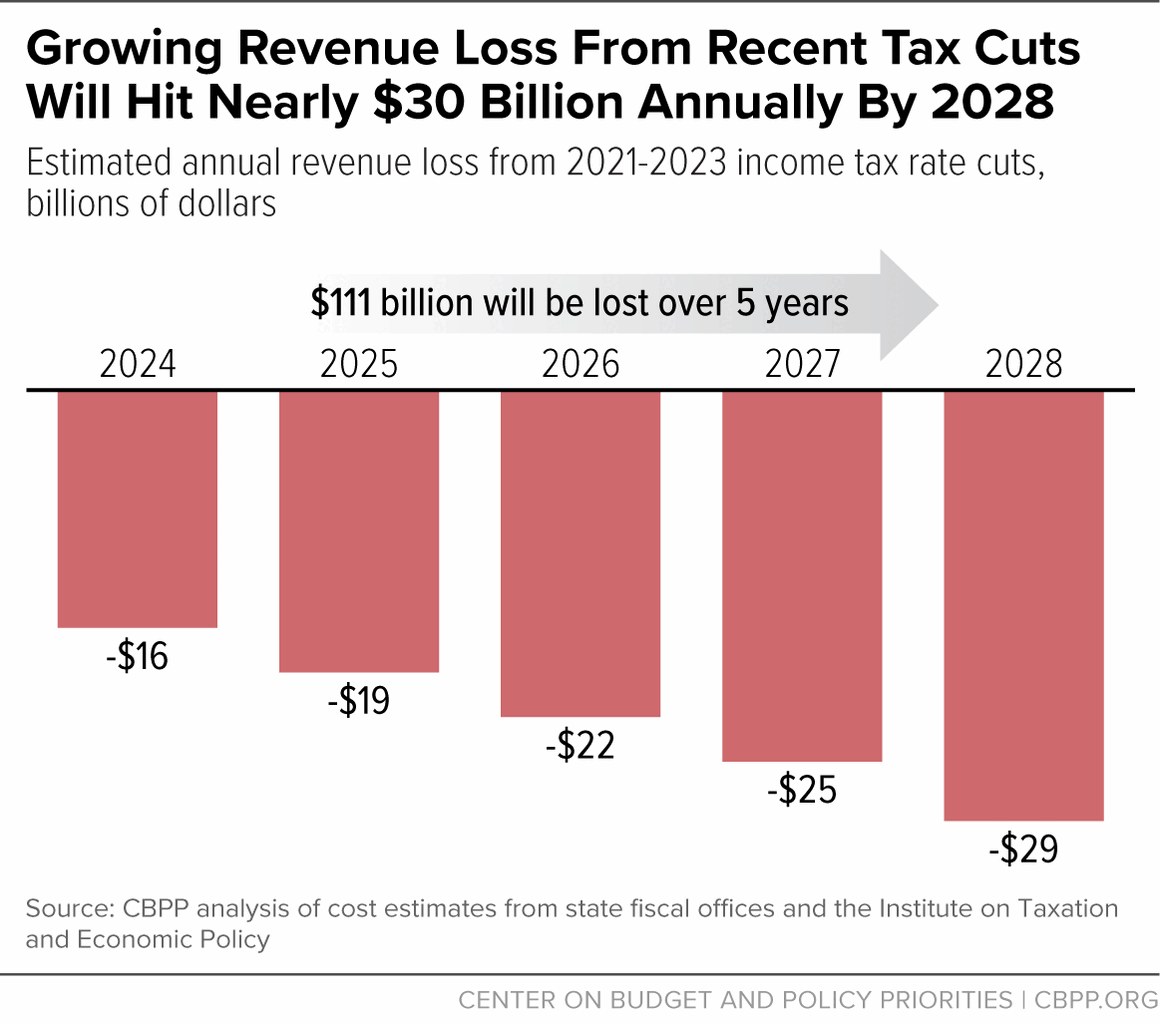

[12] CBPP, “Fiscal Recovery Fund Spending by States, U.S. Territories,” updated December 2022, https://www.cbpp.org/research/state-budget-and-tax/resource-lists/fiscal-recovery-funds-in-the-american-rescue-plan. See also Rebecca Thiess, Justin Theal, and Kate Watkins, “Pandemic Aid Lifts Federal Share of State Budgets to New Highs,” Pew, August 28, 2023, https://www.pewtrusts.org/en/research-and-analysis/articles/2023/08/28/pandemic-aid-lifts-federal-share-of-state-budgets-to-new-highs.

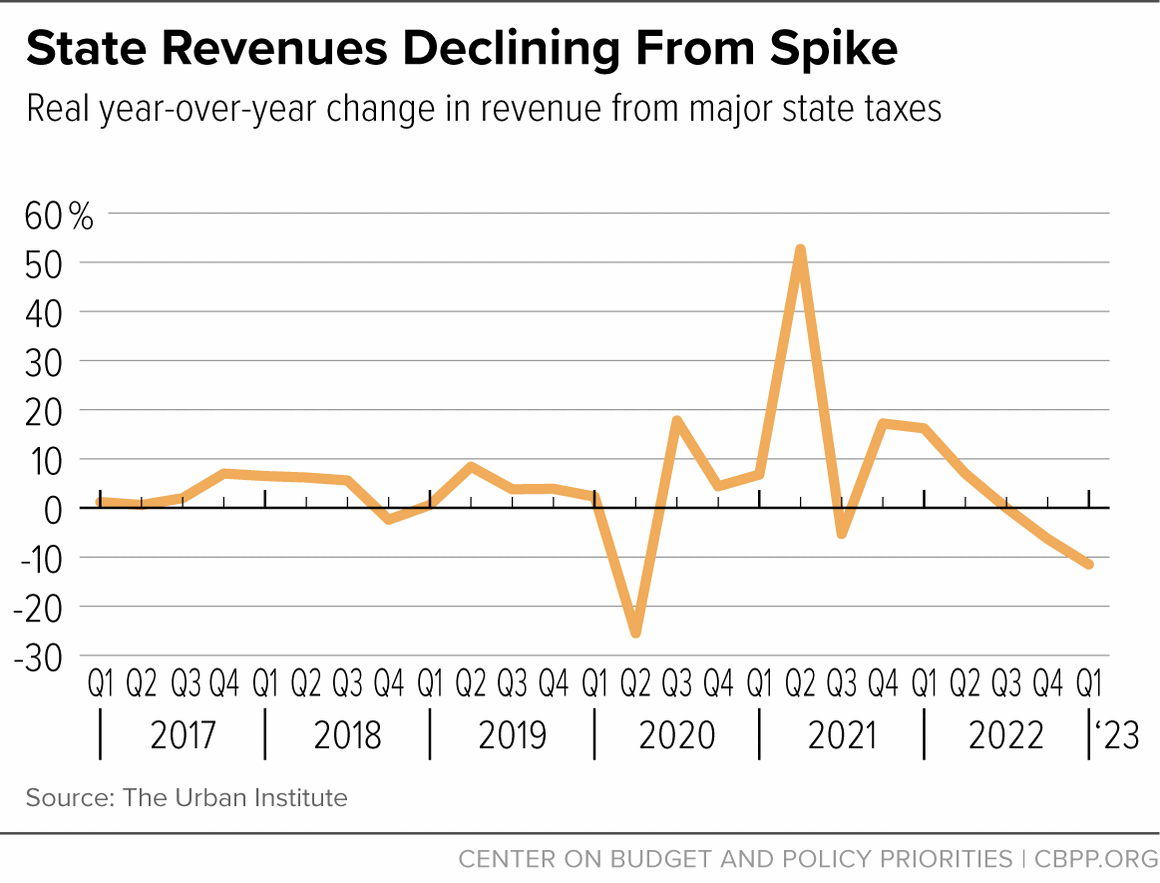

[13] NASBO Spring 2023 Fiscal Survey of States reports that, nationwide, states anticipate general fund revenues to fall in nominal terms by 0.7 percent in fiscal year 2024, compared to an essentially flat 0.3 percent decline in fiscal year 2023 and increases of 16.3 percent in 2022 and 16.6 percent in 2023. See page 45. https://shorturl.at/svRX0.

[14] Lucy Dadayan, “Navigating Fiscal Uncertainty: Weak State Revenue Forecasts for Fiscal Year 2024,” Tax Policy Center, August 4, 2023, https://www.taxpolicycenter.org/taxvox/navigating-fiscal-uncertainty-weak-state-revenue-forecasts-fiscal-year-2024.

[15] Lucy Dadayan, “State Tax Revenues Declined in the First Quarter of 2023,” Urban Institute, August 2023, p. 39, https://www.urban.org/sites/default/files/2023-08/STER_2023Q1.pdf.

[16] Such an outcome has been the norm in North Carolina for years, since the state launched a series of personal and corporate income tax cuts starting in 2013. For example, the number of open teaching positions there more than tripled from 2018 to 2023 (from 1,555 to 5,091), due largely to inadequate state funding. See Patrick McHugh, “NC schools are struggling to survive while rich people and corporations keep getting tax cuts,” North Carolina Budget and Tax Center, February 23, 2023, https://ncbudget.org/nc-schools-are-struggling-to-survive-while-rich-people-and-corporations-keep-getting-tax-cuts/.

[17] Bruno Showers, “Cuts To Top Tax Rate Endanger Services And Chiefly Benefit The Wealthy,” Arkansas Advocates for Children, March 31, 2023, https://www.aradvocates.org/cuts-to-top-tax-rate-endanger-services-and-chiefly-benefit-the-wealthy/.

[18] Jason Bailey and Pam Thomas, “State Budget Changes in 2023 Session Increase Future Risk,” Kentucky Center for Economic Policy, March 31, 2023, https://kypolicy.org/2023-kentucky-state-budget-changes/.

[19] OpenSky Policy Institute, “Medicaid renewals starting up for first time since pandemic,” April 13, 2023, https://www.openskypolicy.org/medicaid-renewals-starting-up-for-first-time-since-pandemic.

[20] Kelly Allen, “Erosion of State Funding for Higher Education Explains Most of WVU’s Budget Crisis,” West Virginia Center on Budget and Policy, June 7, 2023, https://wvpolicy.org/erosion-of-state-funding-for-higher-education-explains-most-of-wvus-budget-crisis/.

[21] Sean O’Leary, “How Much Would It Cost to End Child Poverty in West Virginia?” West Virginia Center on Budget and Policy, April 17, 2019, https://wvpolicy.org/how-much-would-it-cost-to-end-child-poverty-in-west-virginia/.

[22] “Flat Tax Exacerbates Inequalities for Households of Color,” Arizona Center for Economic Progress, May 26, 2021, https://azeconcenter.org/flat-tax-exacerbates-inequalities-for-households-of-color/.

[23] Showers, 2023.

[24] Rose Bender, “State Tax Reform Worsens Racial Equity,” Montana Budget and Policy Center, October 2021, https://montanabudget.org/report/statetax_reform_worsensequity.

[25] Kelly Allen, “Senate Compromise Tax Plan Looks Much Like Their Initial Plan,” West Virginia Center on Budget and Policy, February 25, 2023, https://wvpolicy.org/senate-compromise-tax-plan-looks-much-like-their-initial-plan/.

[26] Michael Leachman et al., “Advancing Racial Equity With State Tax Policy,” CBPP, November 15, 2018, https://www.cbpp.org/research/state-budget-and-tax/advancing-racial-equity-with-state-tax-policy.

[27] Eli Byerly-Duke and Carl Davis, “The Pitfalls of Flat Income Taxes,” ITEP, January 17, 2023, https://itep.org/the-pitfalls-of-flat-income-taxes/.

[28] Daniel C. Vock, “Kids Eat Free! States Push to Make School Meals Available to All,” Route Fifty, March 15, 2023, https://www.route-fifty.com/health-human-services/2023/03/kids-eat-free-states-push-make-school-meals-available-all/384030/.

[29] Julie Zauzmer Weil and Michael Brice-Saddler, “D.C. Council votes to raise taxes on the rich,” Washington Post, July 20, 2021, https://www.washingtonpost.com/local/dc-politics/dc-council-tax-increase-budget/2021/07/20/36f483d4-e8e7-11eb-97a0-a09d10181e36_story.html.

[30] Marco Guzman, “Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’,” ITEP, November 9, 2022, https://itep.org/massachusetts-voters-score-win-for-tax-fairness-with-fair-share-amendment/.

[31] Jason Wright, “Your Fair Share Dollars at Work: Critical Investments and Hard Choices,” MassBudget, August 15, 2023, https://massbudget.org/2023/08/15/your-fair-share-dollars-at-work-critical-investments-and-hard-choices/.

[32] Peter Callaghan and Walker Orenstein, “‘Transformational’ and also ‘bonkers:’ Minnesota Legislature ends its session of historic spending, policy changes,” MinnPost, May 23, 2023, https://www.minnpost.com/state-government/2023/05/transformational-and-also-bonkers-minnesota-legislature-ends-its-session-of-historic-spending-policy-changes/.

[33] Michael Leachman X thread, May 24, 2023, https://twitter.com/leachma2/status/1661364661424386048.

[34] Matt Gardner, “Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance,” ITEP, July 7, 2023, https://itep.org/minnesotas-corporate-tax-reform-2023-gilti/.

[35] Washington State Budget and Policy Center, “Huge victory for tax justice,” March 24, 2023, https://budgetandpolicy.org/schmudget/huge-victory-for-tax-justice/.

[36] So far, according to state officials, 3,190 people have paid a total of $849 million — nearly twice what was originally expected over that span. See Danny Westneat, “WA’s wealthiest are richer than even the tax collectors guessed,” Seattle Times, May 27, 2023, https://www.seattletimes.com/seattle-news/politics/was-wealthiest-are-richer-than-even-the-tax-collectors-guessed/.

[37] Erica Breunlin, “Voters approve Prop. FF, clearing way for new school meals program funded by cutting tax breaks for the wealthy,” Colorado Sun, November 8, 2022, https://coloradosun.com/2022/11/08/colorado-proposition-ff-results-school-meals/.

[38] Peter Hirschfeld, “Vermont child care funding boost, payroll tax become law as Legislature overrides governor’s veto,” Vermont Public, June 20, 2023, https://www.vermontpublic.org/local-news/2023-06-20/vermont-child-care-funding-boost-payroll-tax-becomes-law-as-legislature-overrides-governors-veto.

[39] Wesley Tharpe, “States Should Protect or Raise Revenue as Uncertainty Looms,” CBPP, January 18, 2023, https://www.cbpp.org/blog/states-should-protect-or-raise-revenue-as-uncertainty-looms.

[40] Institute on Taxation and Economic Policy, “ITEP Microsimulation Tax Model Overview,” https://itep.org/itep-tax-model/.

[41] NASBO, “2022 State Expenditure Report.”

[42] CBPP analysis of 2013-2022 state personal income data from the Bureau of Economic Analysis, https://www.bea.gov/itable/regional-gdp-and-personal-income.