House Agriculture Committee Chair Glenn “GT” Thompson is expected to unveil his farm bill proposal within the next few weeks, including his proposals for reauthorizing the Supplemental Nutrition Assistance Program (SNAP), with committee markup slated for later in May. The proposal would reportedly freeze the cost of the Thrifty Food Plan (TFP), the basis for SNAP benefits, outside of inflation adjustments.[1] According to Thompson, the Congressional Budget Office (CBO) estimates this would result in a roughly $30 billion SNAP cut over the next decade, a cut that would affect every SNAP participant.[2] Over the longer term, the cuts would grow larger and SNAP benefits would become less adequate.

This proposal would limit the Department of Agriculture’s (USDA) authority to adjust the cost of the TFP to accurately reflect the cost of a frugal, healthy diet. USDA would be required to regularly undertake a rigorous and resource-intensive evaluation that would only ever result in a single pre-determined outcome: the cost of a healthy diet would remain unchanged, regardless of scientific evidence to the contrary.

The nation’s most important anti-hunger program, SNAP is highly effective at reducing hunger and poverty; SNAP participation is also linked to better outcomes for education, health, and economic security.[3] It is critical that the farm bill protect SNAP from harmful cuts and policy changes, including Chair Thompson’s proposal, that would weaken the program’s ability to meet its core mission.

More than 40 million people participate in SNAP each month. SNAP supports a broad range of people in low-income households, including children, parents, adults aged 60 and over, disabled people, veterans, and workers who are between jobs or paid too little to afford enough groceries. SNAP’s modest benefits are highly targeted to those with the greatest need: 92 percent of SNAP benefits go to households with income below the poverty line, and 54 percent go to households at or below half of the poverty line (about $12,900 for a family of three in 2024).[4]

Thompson’s proposal would return SNAP to the situation in place before 2021, when the cost of the TFP was adjusted only for inflation, resulting in SNAP benefits becoming increasingly inadequate over time. USDA had to assume that people purchased an extremely unrealistic set of foods in order to claim that SNAP benefits were nutritionally adequate.

With such inadequate benefits, millions of low-income households struggled to meet their food needs. Congress should not return to a policy that left many low-income families experiencing food insecurity and hardship. Instead, policymakers must ensure that SNAP benefits keep pace with the scientific evidence regarding the cost of a healthy, realistic diet.

The Thrifty Food Plan is a market basket of food, the cost of which represents the minimum amount of money USDA estimates a household needs to purchase a frugal but nutritious diet. This amount is then used to calculate the amount households receive in SNAP benefits. For about 50 years the cost of the TFP was only adjusted for food price inflation; USDA didn’t consider the numerous other factors affecting the cost of a healthy diet, such as changes in dietary guidance and food consumption patterns.

SNAP benefit levels became more and more inadequate over time as the TFP became increasingly out of alignment with the foods that people buy and the time they have to shop for and prepare food. The decision to let the cost rise only by inflation for decades resulted in absurd assumptions about how families would stretch this inadequate food budget. For example, the TFP assumed that the weekly diet of a family of four would include 12 pounds of potatoes, 25 pounds of milk, 20 pounds of orange juice, and 5 pounds of fresh oranges, but include very little of other commonly purchased but relatively more expensive staple foods. It also assumed that although households were increasingly balancing work and family, they would spend hours each day preparing meals (for example, hand-soaking beans rather than buying canned beans).[5]

Millions of low-income people struggled to afford an adequate diet as a result.[6]

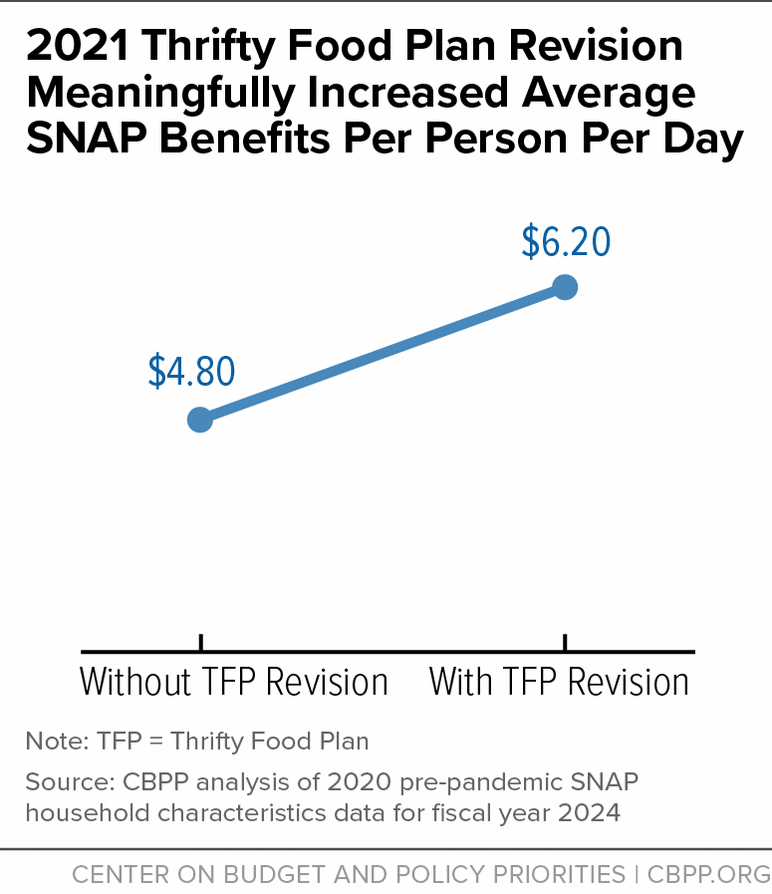

This changed following a provision in the bipartisan 2018 farm bill, which directed USDA to take into account factors other than inflation, and re-evaluate the TFP by 2022. USDA did so in 2021 and implemented the revised TFP at the beginning of fiscal year 2022, raising maximum SNAP benefits by 21 percent. This resulted in a $1.40 per-person, per-day increase in SNAP’s modest average benefits, to just $6.20 per person per day in 2024. (See Figure 1.)

This update lifts over 2 million SNAP participants above the poverty line, including more than 1 million children.[7] The impact of the 2021 TFP update in reducing poverty was strongest for Black and Hispanic individuals, researchers found, suggesting that this revision may help reduce long-standing inequities in rates of poverty and food insecurity.[8]

Similar updates are currently required every five years, so the next is scheduled for 2027. Future updates won’t have to make up for 50 years of failing to properly evaluate the cost of a healthy diet and, thus, will likely be much more modest in cost.

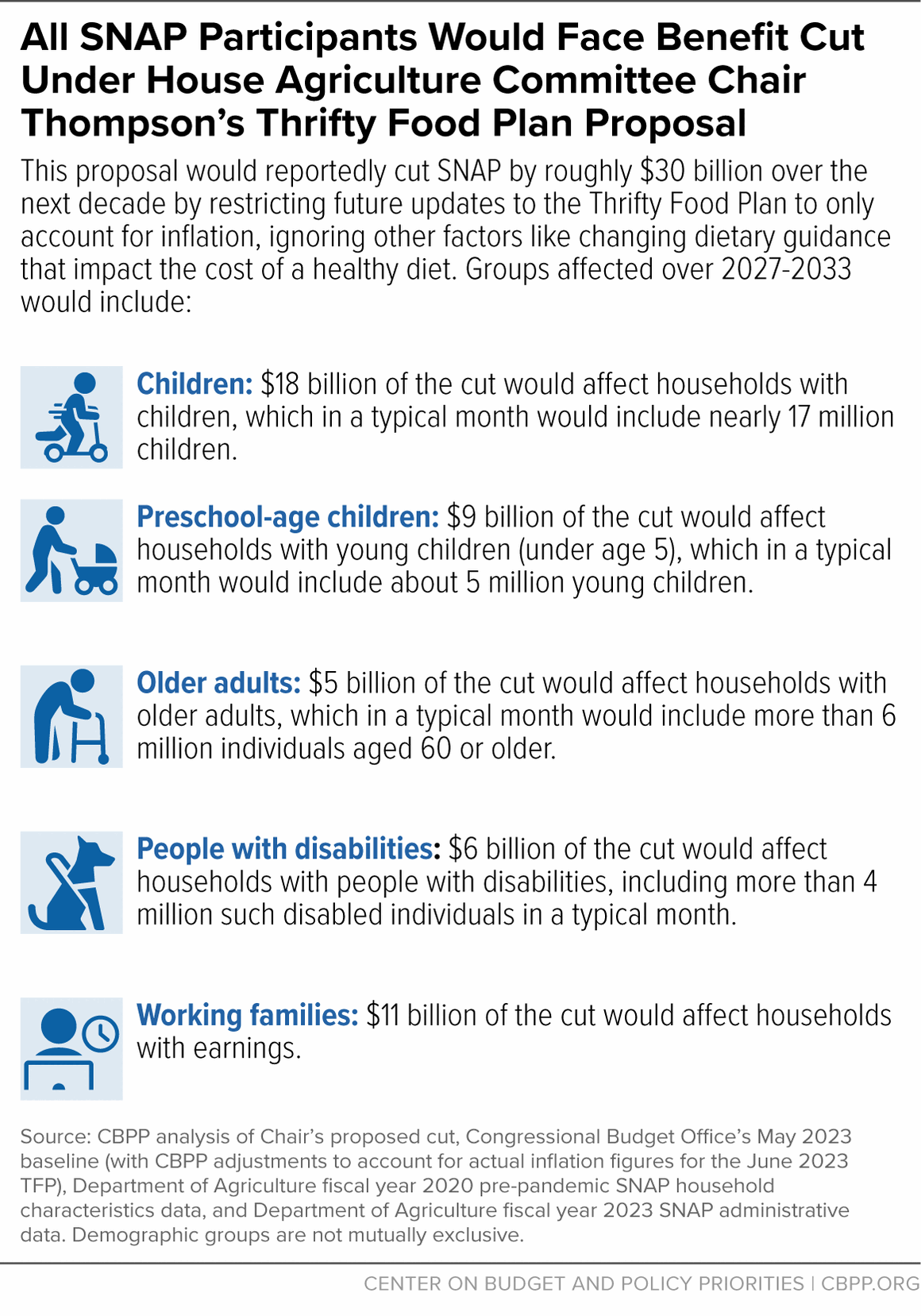

Chair Thompson has indicated that CBO estimates that his proposal to restrict future adjustments to the TFP to only account for inflation would cut roughly $30 billion from SNAP over the ten-year budget window.[9]Because the TFP underpins the SNAP benefit calculation for all participants, every SNAP participant in future years would receive less in benefits under this proposal compared to what the CBO estimates they would receive under current law.

If the total cut to SNAP and related nutrition programs under Thompson’s proposal is roughly $30 billion, the average per-person SNAP benefit would be roughly $7 less per month over the 2027–2031 period and $15 less per person per month in 2032 and 2033. SNAP benefits under CBO’s baseline will average only about $7 per person per day in 2027, rising to about $8 in 2032 and 2033. Thus, under CBO’s assumptions, the cut initially would be equal to a day’s worth of benefits each month. It would rise to almost two days’ worth by the end of the budget window.

But these cuts would be just the beginning. This change in permanent law would restrict future TFP adjustments to adjust for inflation only. That means that over time, SNAP benefits would likely fall further behind the cost of a healthy diet, as was the case before the 2021 update. (See Table 1 below for a state-by-state breakdown of CBO’s estimate of the cut.)

Using CBO’s assumptions, we estimate how the cut would affect various groups of SNAP participants over the 2027–2033 period.[10] (See Figure 2.)

- Children: $18 billion of the cut would affect households with children, which in a typical month would include nearly 17 million children.

- Preschool-age children: $9 billion of the cut would affect households with young children (under age 5), which in a typical month would include about 5 million young children.

- Older adults: $5 billion of the cut would affect households with older adults, which in a typical month would include more than 6 million individuals aged 60 or older.

- People with disabilities: $6 billion of the cut would affect households with people with disabilities, including more than 4 million such disabled individuals in a typical month.

- Working families: $11 billion of the cut would affect households with earnings.

In addition, people who participate in several other programs would experience a cut because those programs’ benefits or grant amounts also are tied to the Thrifty Food Plan.

- The Emergency Food Assistance Program, which provides food for food banks and food pantries to distribute to individuals and families, would be cut by more than $100 million over the 2027–2033 period;

- Puerto Rico’s Nutrition Assistance Program block grant would be cut by more than $700 million over the 2027–2033 period;

- The new Summer EBT program, which will provide grocery benefits to children in low-income families during the summer when schools are closed, would be cut by more than $500 million over the 2027–2033 period.

Food price inflation is only one factor influencing the cost of a healthy diet, as Congress recognized in revising the TFP process in the 2018 farm bill. The scientific and economic factors that determine the cost of a healthy, realistic diet evolve over time. If the evidence shows that the cost of such a diet has risen, SNAP benefits should adjust to reflect this.

But under Chair Thompson’s proposal, the cost of the TFP would be frozen, outside of inflation adjustments, regardless of the evidence. USDA would be required to regularly undertake an extensive scientific and economic evaluation to determine the cost of an inexpensive, nutritionally adequate diet, but this evaluation could only result in a single pre-determined outcome. While USDA would still be required to examine factors other than inflation in its evaluation, the TFP could not accurately reflect changes in food composition data, consumption patterns, or dietary guidance if they would increase its cost.

Contrary to Chair Thompson’s stated rationale, outlined in a recent op-ed, this change is not required to prevent a future administration from using the TFP revision process to “indiscriminately expand or decimate the benefit.”[11] The 2018 farm bill directed the Secretary of Agriculture to regularly reevaluate the TFP based on food prices, food composition data, consumption patterns, and dietary guidance. It does not give the Secretary free rein to ignore the government’s career nonpartisan nutrition and economics experts and set the value of the TFP arbitrarily.

Some critics have suggested that the 2021 TFP revision was improper and that restricting future updates is necessary to prevent another similarly sized increase in SNAP benefits. These concerns are misguided. The 2021 TFP revision was a “substantial improvement in transparency,” according to a 2023 letter from economists with expertise in SNAP and the TFP.[12]USDA’s experts rigorously documented its review of existing research, explained the methods and outcomes of the reevaluation in an extensive report, published data used in the TFP model on its website, and provided additional resources, including blogs and infographics.[13] Academic researchers have already reproduced the 2021 TFP using publicly available information from USDA.[14] Additionally, as noted above, future updates should be much smaller in size because they will not be making up for a half-century of deferred adjustments.

SNAP is our nation’s most effective and important anti-hunger program, and the top priority for any farm bill proposal must be to protect SNAP from damaging policies that would undermine its effectiveness and worsen hunger for low-income families, such as Chair Thompson’s expected TFP proposal. Rather than enacting such a policy, lawmakers could use the forthcoming farm bill to both protect and strengthen SNAP by rejecting harmful benefit cuts and ensuring that future TFP adjustments allow benefits to keep pace with the cost of a healthy diet based on factors such as the latest dietary guidance and food consumption patterns.

| TABLE 1 |

|---|

|

| Fiscal years 2027–2033, by state or jurisdiction, based on Congressional Budget Office assumptions |

|---|

| State | Total Estimated Cut (millions) |

|---|

| Alabama | $530 |

| Alaska | $50 |

| Arizona | $610 |

| Arkansas | $170 |

| California | $3,590 |

| Colorado | $380 |

| Connecticut | $280 |

| Delaware | $80 |

| District of Columbia | $100 |

| Florida | $2,110 |

| Georgia | $1,060 |

| Hawai’i | * |

| Idaho | $80 |

| Illinois | $1,380 |

| Indiana | $410 |

| Iowa | $170 |

| Kansas | $130 |

| Kentucky | $380 |

| Louisiana | $620 |

| Maine | $110 |

| Maryland | $450 |

| Massachusetts | $750 |

| Michigan | $970 |

| Minnesota | $320 |

| Mississippi | $260 |

| Missouri | $460 |

| Montana | $60 |

| Nebraska | $110 |

| Nevada | $330 |

| New Hampshire | $50 |

| New Jersey | $520 |

| New Mexico | $340 |

| New York | $2,020 |

| North Carolina | $1,060 |

| North Dakota | $30 |

| Ohio | $950 |

| Oklahoma | $470 |

| Oregon | $500 |

| Pennsylvania | $1,290 |

| Rhode Island | $100 |

| South Carolina | $400 |

| South Dakota | $50 |

| Tennessee | $520 |

| Texas | $2,290 |

| Utah | $110 |

| Vermont | $50 |

| Virginia | $580 |

| Washington | $610 |

| West Virginia | $200 |

| Wisconsin | $460 |

| Wyoming | $20 |

| Guam | $50 |

| Virgin Islands | $20 |