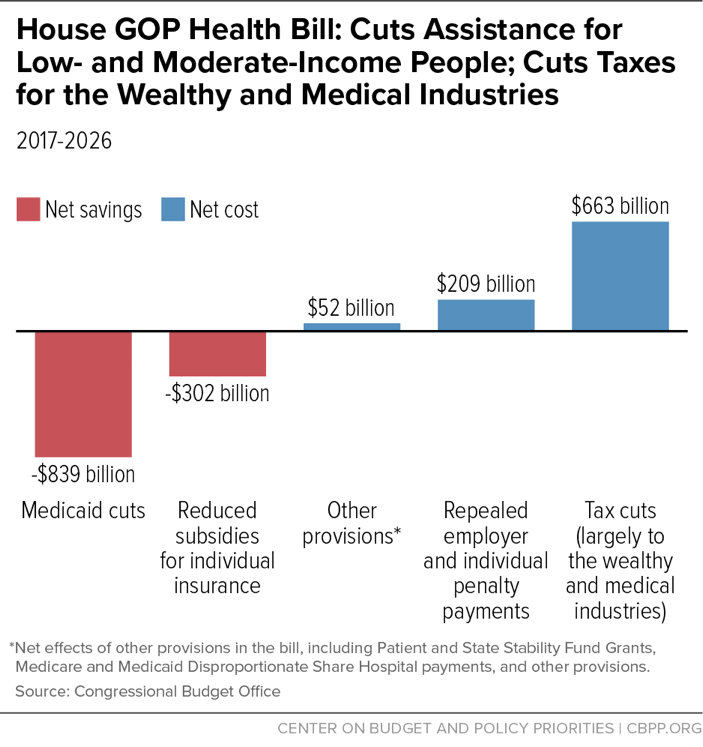

The House-passed bill to repeal and replace the Affordable Care Act (ACA) went through various changes in the House, but large tax cuts for the wealthy and corporations remained at its core throughout. The bill would eliminate ACA taxes on wealthy households and insurance and drug companies and greatly expand tax-sheltering opportunities for high-income people. These tax cuts (plus several smaller ones) would cost $660 billion over 2017 to 2026.[1] The bill would pay for them with cuts hitting low- and moderate income families: it would cut and radically restructure Medicaid, dramatically scale back premium tax credits that low- and moderate-income families use to purchase marketplace health coverage, and eliminate cost-sharing subsidies that lower out-of-pocket health costs.[2]

This structure — huge tax cuts for the rich and corporations paid for by cutting provisions that help millions to afford health coverage and care — means:

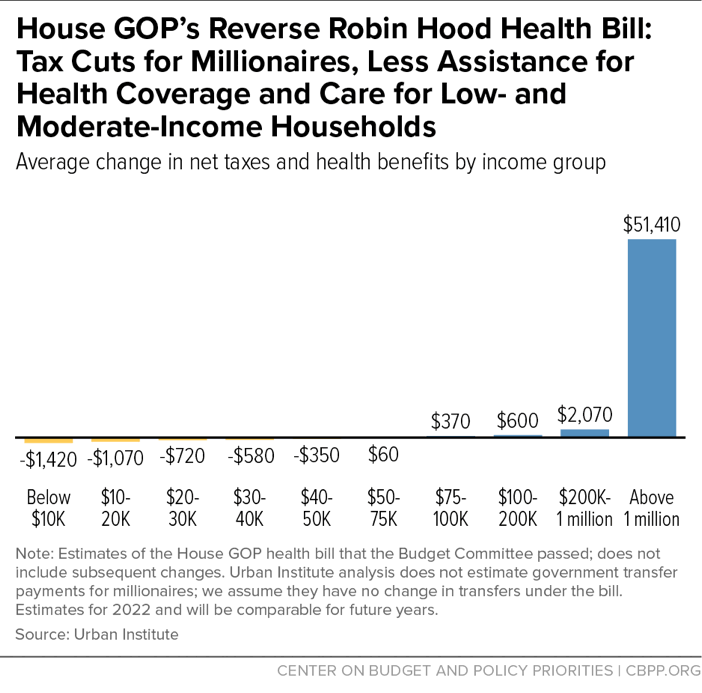

- The bill is the largest tax increase on low-and moderate-income people in recent decades, primarily due to its cuts to tax credits that help families afford health insurance premiums in the marketplace. For example, households with incomes between $20,000 and $50,000 would face an average tax increase of $170, in large part from cuts to their tax credits.[3]

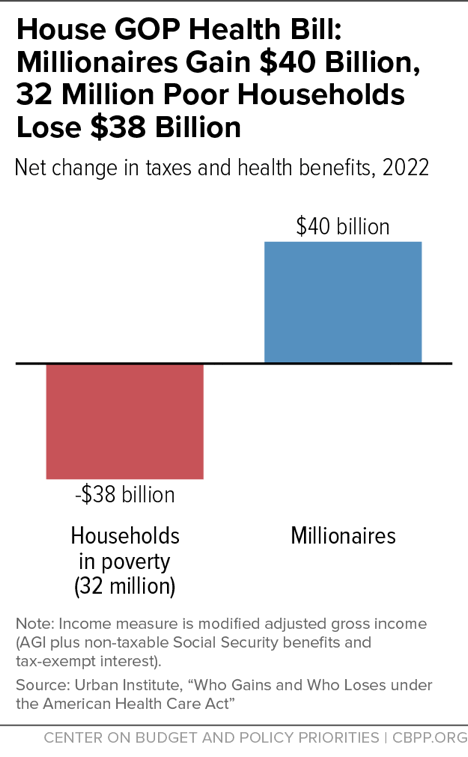

- Millionaires, however, would ultimately get tax cuts averaging more than $50,000 apiece each year. Millionaires would gain about $40 billion in tax cuts annually once all the bill’s tax cuts are in place — roughly equivalent to the $38 billion that 32 million households in poverty would lose, primarily from cuts to their tax credits and to Medicaid.[4] (See Figure 1.)

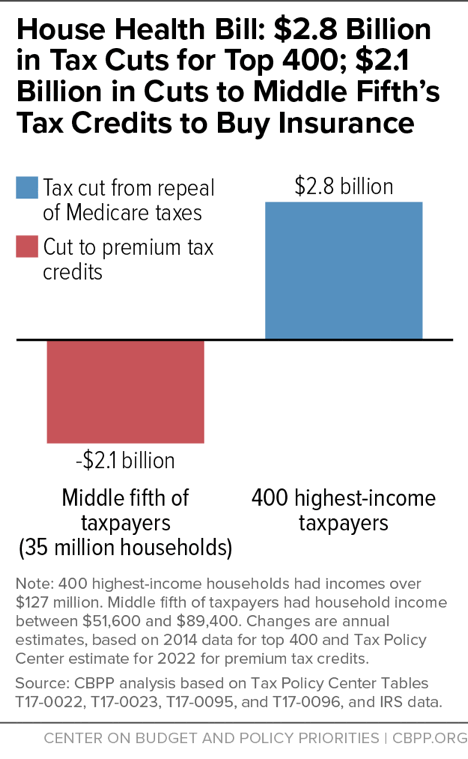

- The 400 highest-income families would ultimately get tax cuts averaging roughly $7 million each annually.[5] The bill would give roughly $2.8 billion in annual tax cuts to these households at the very top of the income scale, while cutting premium tax credits for households in the middle fifth of the income scale by $2.1 billion.

Unless the Senate vastly scales back the tax cuts for the wealthy and profitable corporations at the core of ACA repeal, the offsets required to pay for these tax cuts will harm the health and financial security of millions. Overall, the House bill would represent the largest transfer in modern U.S. history from low- and moderate-income people to the very wealthy. (See Figure 2.)

The House-passed bill would cut more than $1.1 trillion from Medicaid, the premium tax credits that help moderate-income people afford marketplace coverage, and the cost-sharing subsidies that help them obtain needed health care by reducing out-of-pocket medical costs. (See Figure 3.)

Households with incomes below $50,000 would lose an average of about $850 in higher taxes and cuts to their health coverage and care due to these changes, the Tax Policy Center (TPC) and Urban Institute estimate.[6] Households with incomes between $20,000 and $50,000 would face tax increases of $170, primarily from the loss of their premium tax credits.[7] Low- and middle-income families would lose even more than these calculations suggest, because various elements of the bill would raise consumers’ pre-credit premiums and out-of-pocket costs and create other health and financial hardships.[8]

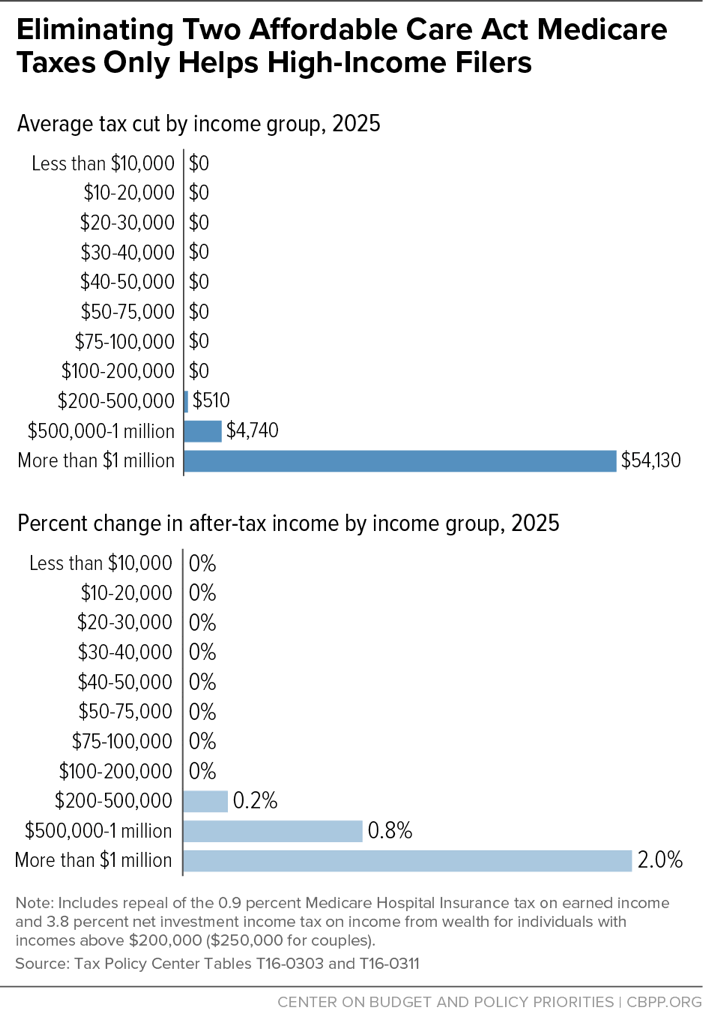

The House GOP bill would dedicate most of the savings from cutting health coverage and care to a series of tax cuts heavily tilted to high-income Americans and corporations. First, it would repeal the ACA’s two so-called Medicare taxes: the additional 0.9 percent Hospital Insurance (HI) payroll tax on high-income people and the 3.8 percent tax on unearned income. These taxes fall only on individuals with incomes above $200,000 ($250,000 for married couples). (See Figure 4.)

The bill would repeal the additional HI tax starting in 2023 and repeal the tax on unearned income starting in 2017, for a total cost of $231 billion over ten years, the Joint Committee on Taxation (JCT) estimates.[9] If these taxes were repealed, high-income taxpayers would no longer face Medicare taxes on all their income — unlike low- and moderate-income earners — and the disparity between the top tax rates on income from earnings and income from wealth would widen.[10]

- The 400 highest-income taxpayers would ultimately get annual tax cuts averaging about $7 million each, we estimate.[11] These taxpayers, whose annual incomes average more than $300 million, would receive tax cuts totaling about $2.8 billion a year once the tax cuts are fully in effect. At the same time, the bill would cut premium tax credits for households in the middle fifth of the income distribution by $2.1 billion (see Figure 5).

- Millionaires would get tax cuts averaging more than $50,000 each in 2025, when the tax cuts are fully phased in.[12] Repealing these two taxes would boost the after-tax incomes of households with incomes over $1 million by 2.0 percent, TPC estimates.[13] (See Figure 4.) The repeal of these two taxes represents the overwhelming bulk of the bill’s total tax cuts for millionaires, which average about $57,000 apiece in 2025.

- Repealing the 0.9 percent additional HI tax would weaken Medicare’s finances. The revenues from the tax go to Medicare’s Hospital Insurance trust fund, so repeal would undermine Medicare’s financing and hasten the insolvency of the trust fund. (Other provisions of the bill would weaken the trust fund further.)[14]

Expanding Tax Sheltering Opportunities for Wealthy Through Health Savings Accounts

Another high-income tax cut in the House GOP plan would make health savings accounts (HSAs), which do nothing to help the uninsured afford coverage but offer wealthy people lucrative tax-sheltering opportunities, even more valuable for the wealthy.

HSAs offer generous tax subsidies for people with high-deductible health plans to save for out-of-pocket health care expenses. They primarily benefit higher-income people, who can most afford to save for health care expenses and are most likely to contribute to HSAs. Further, high-income people receive the biggest tax benefit for each dollar contributed to an HSA because they face the highest marginal tax rates. These factors explain why 70 percent of HSA contributions come from households with incomes over $100,000 and why filers with higher incomes make bigger average contributions.[15] More than 15 percent of filers with incomes above $200,000 make HSA contributions, which average almost $5,000 yearly among those who contribute. In contrast, fewer than 5 percent of filers with incomes below $50,000 make contributions, which average less than $1,500 yearly among those who contribute.[16]

The House bill would tilt HSAs’ tax benefits even further toward people at the top, primarily by roughly doubling the maximum annual contribution. Only people wealthy enough to “max out” their contributions under the current limit would benefit.

The bill’s HSA expansions would cost $19 billion over 2017-2026, JCT estimates. The cost would likely grow significantly over time because much of the cost associated with HSAs occurs when people make tax-free withdrawals from the accounts in retirement — in lieu of sources that are taxable — to pay for medical and long-term care.

Cutting Taxes on Insurance and Drug Companies

The House bill would also repeal the ACA’s taxes on insurance companies, drug companies, and medical device manufacturers starting in 2017, reducing federal revenues by $193 billion over 2017 to 2026, JCT estimates:

- Repealing the tax on insurers and cutting taxes for insurers with high-paid executives. The bill would eliminate the fee on insurers that helps pay for the ACA’s coverage expansions. This would cost $145 billion over ten years, JCT estimates. The biggest insurers would receive the biggest tax cuts. The bill would also cut taxes for insurers with high-paid executives by allowing insurers to deduct up to an additional $500,000 from their taxes for executives who are paid over $500,000 each year, while weakening the ACA’s restrictions on those deductions. JCT estimates this would cost $0.5 billion over ten years.

- Cutting taxes paid by drug companies. Eliminating a tax levied on drug companies would cost $29 billion over 2017 to 2026, JCT estimates. Manufacturers and importers of brand-name prescription drugs pay this fee based on their brand-name drug sales to government health programs. Wealthy shareholders and other investors, who own the bulk of stock and other investments, likely would ultimately enjoy the benefit of this tax cut as company profits expand.

- Repealing the medical device tax. The House bill would repeal the ACA’s 2.3-percent excise tax on the sale of any taxable medical device by a manufacturer or importer. The tax is intended to ensure that the medical device industry, which benefits from higher sales due to improved health coverage under the ACA, contributes to health reform provisions that allow millions of Americans to afford that coverage. Repeal would cost $20 billion over ten years, JCT estimates.