ACA Repeal Would Lavish Medicare Tax Cuts on 400 Highest-Income Households

Each Would Get Average Tax Cut of About $7 Million a Year

End Notes

[1] We have previously discussed the overall impact of the repeal of the ACA tax provisions in Chye-Ching Huang and Paul N. Van de Water, “Millionaires the Big Winners From Repealing the Affordable Care Act, New Data Show,” Center on Budget and Policy Priorities, December 15, 2016, https://www.cbpp.org/research/federal-tax/millionaires-the-big-winners-from-repealing-the-affordable-care-act-new-data.

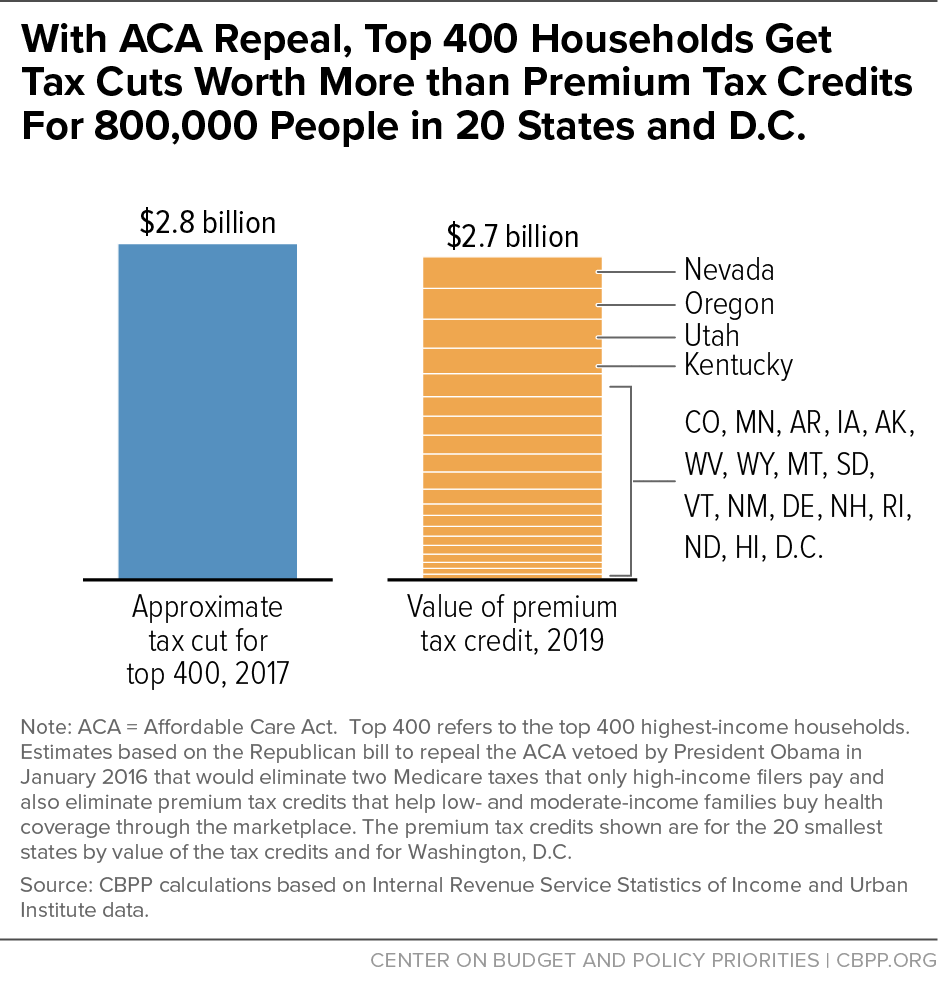

[2] The 20 smallest states by value of premium tax credits. Estimate based on the value of premium tax credits by state in 2019 from: Linda Blumberg, Matthew Buettgens, and John Holahan, “Implications of Partial Repeal of the ACA Through Reconciliation,” Urban Institute, December 6, 2016, http://www.urban.org/research/publication/implications-partial-repeal-aca-through-reconciliation.

[3] For more on the ACA Medicare taxes, see: Chye-Ching Huang, Chuck Marr, and Emily Horton, “Eliminating Two ACA Medicare Taxes Means Very Large Tax Cuts for High Earners and the Wealthy,” Center on Budget and Policy Priorities, updated January 11, 2017, https://www.cbpp.org/research/federal-tax/eliminating-two-aca-medicare-taxes-means-very-large-tax-cuts-for-high-earners.

[4] Note that the IRS and TPC estimates are not completely comparable because the IRS figures use adjusted gross income (AGI) as reported on tax returns, while TPC estimates use an “expanded cash income” measure that is based on AGI but includes a number of other sources of income, such as contributions to health insurance and retirement accounts. See: Tax Policy Center, “Income Measure Used in Distributional Analyses by the Tax Policy Center,” http://www.taxpolicycenter.org/resources/income-measure-used-distributional-analyses-tax-policy-center.

[5] By contrast, taxpayers with AGIs above $1 million derived about 40 percent of their income from these sources in 2014; taxpayers with AGIs between $50,000 and $75,000 received about 3 percent of their income from these sources. IRS Statistics of Income, Individual Statistical Tables by Size of Adjusted Gross Income, Table 1.4, https://www.irs.gov/uac/soi-tax-stats-individual-statistical-tables-by-size-of-adjusted-gross-income. The $96 billion in capital gains, dividends, and taxable interest income that went to the top 400 (just 0.0003 percent of households) represents about 9 percent of all capital gains, dividends, and taxable interest income that year.

[6] Although nearly all of the income of the top 400 filers exceeds the thresholds for the ACA Medicare taxes, their unearned income includes capital gains income from some types of partnership and S corporation income that is not subject to these taxes. This means that simply applying the tax rates for the ACA Medicare taxes to their income above the thresholds would overstate the tax cut they would receive from repealing the taxes. For this reason, we estimate the tax cut received by the top 400 taxpayers using IRS data on sources of income as well as data on the actual Medicare taxes paid by households with incomes of $10 million or more (of which the top 400 is a subset) in 2014.

As detailed below, we calculate that the unearned income of the top 400 represents 32 percent of the unearned income of those with incomes of $10 million or more and apply that 32 percent ratio to the $8.3 billion of Medicare taxes on unearned income paid by those with incomes of $10 million or more, in order to calculate the share of this tax that the top 400 pay. We do similar calculations for the 0.9 percent Hospital Insurance tax and combine the estimates to determine the total tax cut received by the top 400 from repealing these two Medicare tax provisions. The calculations are as follows:

$96 billion (total unearned income for top 400) / $302 billion (total unearned income for households with incomes of $10 million or more) = 32 percent share

32 percent * $8.3 billion (Medicare tax on unearned income paid by households with incomes of $10 million or more in 2014) = $2.6 billion total tax cut for top 400 from repealing the Medicare tax on unearned income, or $6.6 million average tax cut per household in the top 400

$31 billion (other income for top 400) / $207 billion (other income for households with incomes of $10 million or more) = 15 percent share

15 percent * $858 million (additional 0.9 percent Hospital Insurance tax paid by households with incomes of $10 million or more in 2014) = $129 million tax cut from repealing additional 0.9 percent Hospital Insurance tax, or $322,000 average tax cut per household in top 400

$2.6 billion + $129 million = $2.8 billion total Medicare tax cut, or $6.9 million each on average for the top 400

Source: CBPP calculations based on IRS Statistics of Income Tables 1.4 and 3.3.

[7] The 20 smallest states by value of premium tax credits. Estimate based on the value of premium tax credits by state in 2019 from: Linda Blumberg, Matthew Buettgens, and John Holahan, “Implications of Partial Repeal of the ACA Through Reconciliation,” Urban Institute, December 6, 2016, http://www.urban.org/research/publication/implications-partial-repeal-aca-through-reconciliation.

[8] $6.6 million (average income tax cut) / $244 million (average AGI less average federal income taxes paid) = 2.7 percent average increase in income after federal income taxes

[9] See Chuck Marr and Chye-Ching Huang, “House GOP “A Better Way” Tax Cuts Would Overwhelmingly Benefit Top 1 Percent While Sharply Expanding Deficits,” Center on Budget and Policy Priorities, September 16, 2016, https://www.cbpp.org/research/federal-tax/house-gop-a-better-way-tax-cuts-would-overwhelmingly-benefit-top-1-percent; and Robert Greenstein, Chye-Ching Huang, and Isaac Shapiro, “Revised Trump Tax Plan Heavily Tilted Toward Wealthiest, Tax Policy Center Analysis Shows,” Center on Budget and Policy Priorities, October 11, 2016, https://www.cbpp.org/research/federal-tax/revised-trump-tax-plan-heavily-tilted-toward-wealthiest-tax-policy-center.