- Home

- Trump Skinny Budget Will Be Short On Det...

Trump Skinny Budget Will Be Short on Details, But Troubling Fiscal Agenda Is Emerging

The “skinny budget” that the Trump Administration will release this week isn’t expected to include any information about the tax and entitlement changes it will propose in its full budget later this spring, in sharp contrast to prior Presidents’ initial budgets. The President’s emerging fiscal agenda, however, is increasingly clear. It features large increases in defense funding that are offset by cuts in a range of critical domestic priorities, substantial tax reductions for the wealthy, losses in health care for low- and moderate-income Americans, and potentially deep cuts in entitlement programs outside of Medicare and Social Security. More specifically, that agenda includes:

-

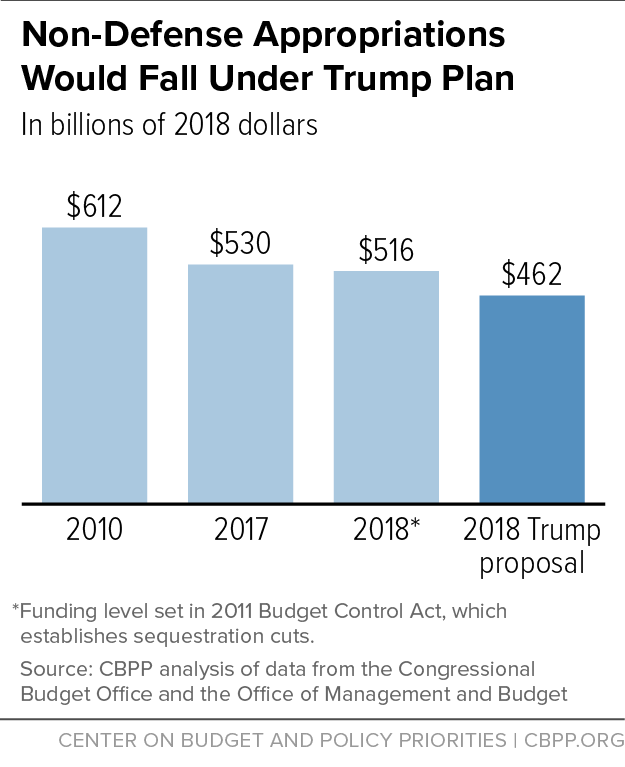

Cutting non-defense discretionary programs. The Administration has already announced that it will propose to reverse the $54 billion in defense sequestration cuts scheduled to take place in 2018 and, to offset the cost, deepen the already significant non-defense sequestration cuts by $54 billion. That would upend the bipartisan consensus in place since 2013 that the sequestration cuts are too deep in both defense and non-defense areas and that any sequestration relief should apply equally to defense and non-defense programs. Non-defense discretionary (NDD) programs — the budget category that funds such priorities as education and job training, research and development, workers’ safety, environmental protection, early childhood education, and Social Security field offices — have already been reduced significantly since 2010 due in large part to the Budget Control Act (BCA) and its tight annual limits on discretionary spending, with these cuts having been made deeper by sequestration. These cuts would have been even deeper if Congress had not reduced sequestration cuts for both defense and non-defense programs for each year since 2013 through a series of temporary measures, the last of which will expire at the end of 2017.

Under current law, NDD funding in fiscal year 2018 is scheduled to fall 16 percent below its 2010 level in inflation-adjusted terms; the Trump proposal would deepen that cut to 25 percent.

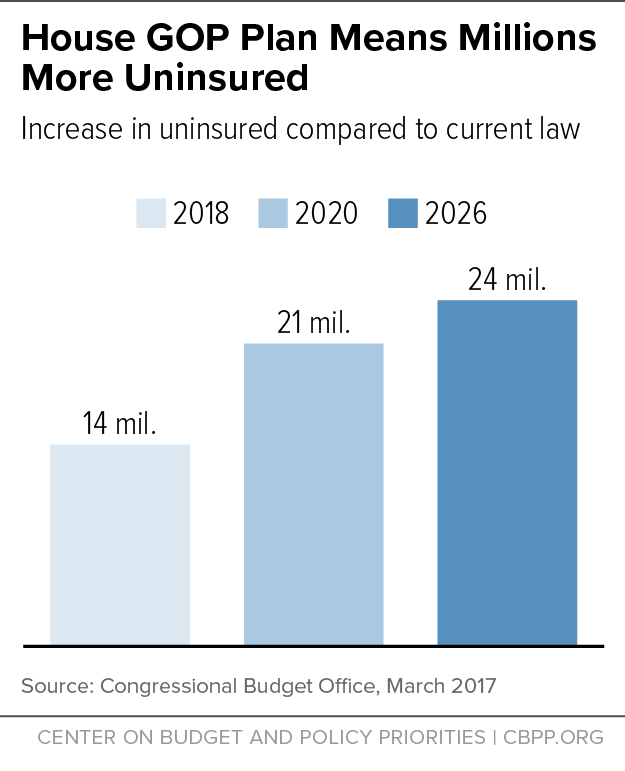

- Cutting health care while providing tax cuts to the wealthy. The President supports the House Republican legislation to “repeal and replace” the Affordable Care Act (ACA), which would cause 24 million people to lose coverage by 2026 by effectively ending the ACA’s Medicaid expansion over time, capping per-beneficiary federal funding for Medicaid, and making private health insurance coverage less affordable for moderate-income and older people (see Figure 1) — and would use much of the savings thereby extracted from low- and moderate-income people to pay for large tax cuts tilted heavily toward the wealthy.

- Providing additional large, regressive tax cuts. The President says he plans to propose very large (he uses the term “massive”) additional tax cuts on top of those in the House Republican health legislation. Those tax cuts likely will be accompanied by unrealistic claims that their costs will be financed in substantial part by faster economic growth which will generate vast amounts of additional tax revenue. Based on the President’s past proposals, these tax cuts almost surely will be dramatically skewed toward the most well-off.

- Potentially cutting other safety net programs deeply. With revenues, Social Security, and Medicare off the table as sources of deficit reduction, and with NDD cuts offsetting the proposed defense increase, entitlements outside of the retirement and health programs — including core programs for low- and moderate-income Americans such as SNAP (formerly known as food stamps) — could face deep cuts.

This agenda will hurt the very people who the President said during the campaign are a priority for his Administration.Taken together, this agenda will hurt the very people who the President said during the campaign are a priority for his Administration: low- and middle-income families that have struggled with stagnant or declining incomes, while providing large new tax cuts for those at the top, who have enjoyed substantial income gains in recent decades.

This agenda would mirror the broad outlines of House Republican budgets over the last several years, which sought to achieve $5 trillion to $6 trillion in deficit reduction over the course of a decade while raising no new revenue, not touching Social Security, securing modest Medicare savings, and increasing defense spending. These budgets secured about two-thirds of their savings from programs (including both entitlement programs and annually appropriated programs) that serve low- and moderate-income families and individuals.

A Budget This Skinny Is Unusual

A new administration typically publishes a document in its initial weeks that outlines its overall approach to fiscal policy — including revenues, entitlements, and discretionary programs — and the impact its policies would have on budget deficits, projected both for the next year and over the course of multiple years. The document typically stresses the new administration’s most important policy proposals.

While we don’t know yet exactly what information the Trump Administration will provide in its “skinny budget,” it has made clear that it will focus on discretionary spending, and perhaps just for 2018. Such spending accounts for about one-third of the federal budget. Thus, the skinny budget will likely omit far more spending than it includes and may provide no information about the Administration’s proposals for tax cuts, health care, and entitlements or how its fiscal policies would affect deficits in the years ahead.

That limited information will hinder analysis of Administration and congressional proposals (including changes to health programs), which are best assessed in the context of an overall budget plan projected over a multi-year period so they can judge policy trade-offs — tax cuts versus lower deficits, entitlements versus NDD funding, and the like.

Despite providing far more budget information than the Trump skinny budget, the initial budgets of at least the prior five administrations were released earlier — in February — than the Trump initial budget. Even if one assumes that an administration only starts working on its budget after its Office of Management and Budget Director has been confirmed (which is not typically the case), the Trump Administration has taken roughly the same amount of time to prepare its skinny budget as most past administrations, but still is expected to provide far less information.

Increasing Defense and Cutting Non-Defense Priorities

The President’s plan to boost defense by $54 billion in 2018 and offset the cost by cutting the same amount from NDD programs marks a stark departure from the bipartisan agreement over the past five years that the BCA’s annual caps on both defense and non-defense discretionary spending, as further reduced by “sequestration,” were too low to meet national needs. In each year since 2013, President Obama and Congress agreed to ease those cuts by substituting alternate deficit-reduction measures. Now, the new Administration wants to fully eliminate sequestration for defense while piling on deeper cuts in NDD programs on top of those that sequestration triggers.

NDD funding supports a wide range of important public services and investments. It is the main budget area that invests in the nation’s future productivity, supporting education, basic research, job training, and infrastructure. It also supports such priorities as providing housing and child care assistance to low- and moderate-income families, protecting against infectious diseases, enforcing laws that protect workers and consumers, safeguarding the environment, and caring for national parks and other public lands. A significant share of this funding comes in the form of grants to state and local governments.[1]

Under current law, 2018 will be the eighth straight year of austerity in NDD appropriations. The 2018 cap is scheduled to fall by almost $3 billion relative to the prior year’s cap, reflecting the imposition — for the first time — of full sequestration cuts, because the most recent bipartisan sequestration-relief agreement expires after 2017. Cumulatively, this cut will bring the non-defense cap 16 percent below the comparable 2010 level, after adjusting for inflation. Relative to the size of the economy, 2018 non-defense spending is already projected to equal the lowest level on record (3.1 percent of gross domestic product, or GDP), with records going back to 1962.

Under these circumstances, policymakers should extend sequestration relief to 2018 to help reduce the pressures of rising costs for these services and better meet high-priority needs. Sequestration relief is needed, for example, to accommodate a $3 billion increase for veterans’ medical care in 2018 that policymakers have already enacted, as well as the costs of preparing for the 2020 Census, maintaining housing assistance as rents rise, and reversing the deterioration of customer service at the Social Security Administration and the Internal Revenue Service.[2] Sequestration relief would also allow progress in various important areas with large unmet needs, such as: extending child care assistance to some of the five out of six low-income working families who are eligible but unserved; helping fund some of the highest-priority needs for repairs and upgrades to drinking water and water treatment infrastructure; reducing the backlog of needed maintenance at national parks and Indian schools; or ensuring that more struggling workers have access to job training so they can avoid falling behind in today’s changing labor market.

Instead, the Administration proposes $54 billion in new cuts, bringing 2018 NDD appropriations $57 billion below the 2017 level even before adjusting for inflation. (See Figure 2.) In fact, if the enacted increase for the Department of Veterans’ Affairs remains in place and Department of Homeland Security funding is held constant at the 2016 level, the Trump proposal will require an average 15 percent funding cut for all other NDD programs and activities, as compared to the 2017 levels. The cumulative cut since 2010 in those agencies would be about one-third in inflation-adjusted terms.

And the reductions could be even larger, because the Administration has made clear that it wants to greatly increase Homeland Security funding, rather than leave it constant, in order to finance deportations, detention facilities, more immigration enforcement agents, and a border wall.

Based on news reports, the Administration is considering specific cuts in NDD programs that would prove very damaging, such as deep cuts to housing assistance for low- and modest-income families and to the Environmental Protection Agency, and an end to the Legal Services Corporation, which provides civil legal assistance to low-income people. The Administration’s NDD target would be a major retreat from the federal government’s role in investing in the nation’s economic future and helping to address national problems.

The Administration’s Tax and Entitlement Agenda

Taxes

Speaking to congressional Republicans on March 7, President Trump said he will push for a massive tax cut, declaring, “It’s gonna be a big tax cut, the biggest since Reagan, maybe bigger than Reagan.”[3] That’s consistent with both his campaign rhetoric and the tax plan he announced in September 2016. The President also has emphasized the need to focus on working and middle-class families, though the two tax plans he released during the campaign were sharply inconsistent with that promise.

Under his September tax plan, which included $6.2 trillion in tax cuts over the next decade, households with annual incomes over $1 million would ultimately receive average annual tax cuts of $387,000 apiece, boosting their after-tax incomes by 14.3 percent, according to the Tax Policy Center. In contrast, those making between $40,000 and $50,000 would see their after-tax incomes rise by $500, or 1 percent, on average.[4]

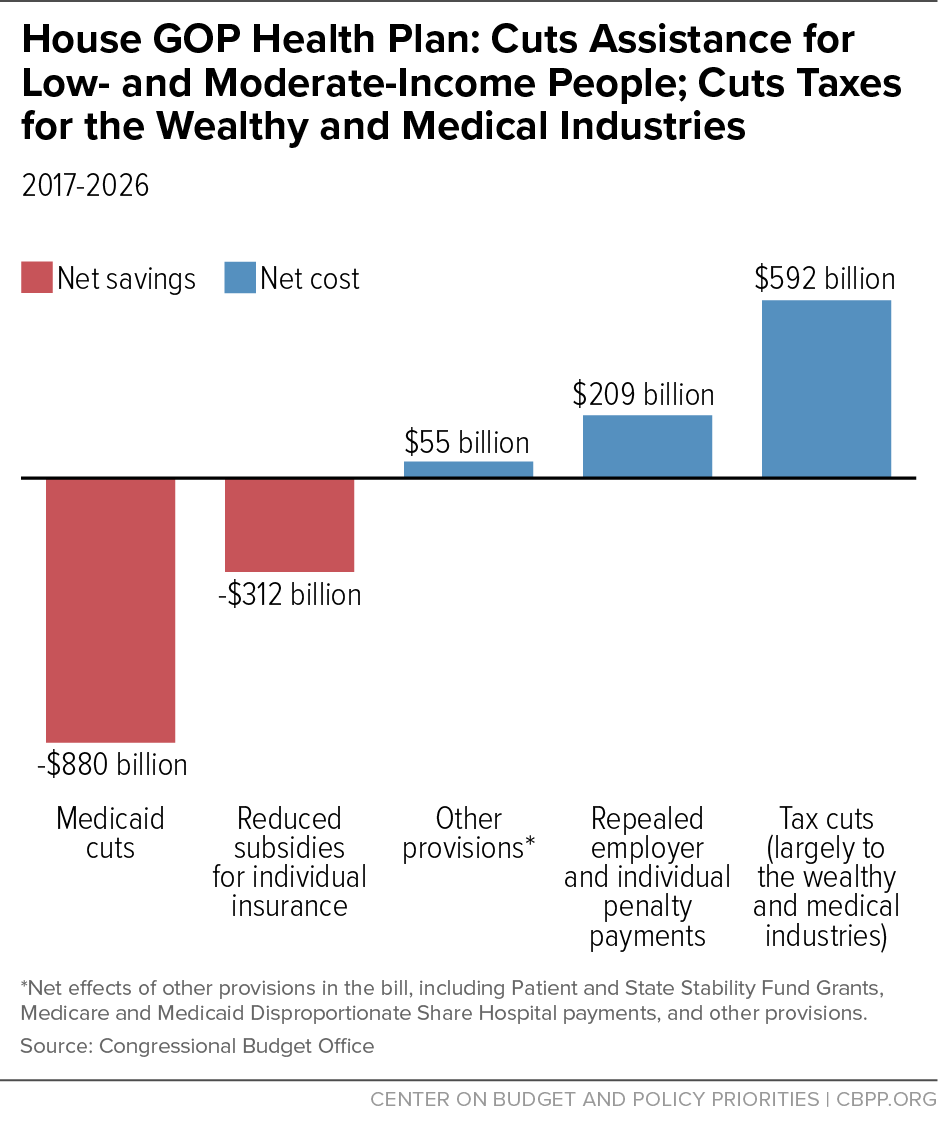

To be sure, the actual tax proposal the President releases or supports in the coming months could be different, and Treasury Secretary Steven Mnuchin stated shortly after his nomination: “Any reductions we have in upper-income taxes will be offset by less deductions, so there will be no absolute tax cut for the upper class.”[5] The ACA repeal bill presents the first test of this “Mnuchin Rule.” Yet Secretary Mnuchin inexplicably has argued that the legislation should be exempted from his standard even though it includes a large tax cut for wealthy individuals, as well as for insurance and drug companies. Two of the largest tax cuts in the bill would benefit only couples with incomes above $250,000 (and individuals with incomes over $200,000) — and would give tax cuts to millionaires that average about $50,000 in 2025.[6] Meanwhile, the bill shrinks tax credits that help low- and moderate-income people afford health insurance, while also scaling back the ACA’s Medicaid expansion and capping per-beneficiary funding, causing 24 million people to lose coverage in 2026, according to the Congressional Budget Office.[7] (See Figure 3.)

In addition, the President’s infrastructure plan may turn out to largely be another tax cut to high-income individuals and corporations, with limited impact in getting needed infrastructure improvements made. That’s because the only infrastructure proposal the President or his advisors have offered to date consists of tax credits that would mainly reward private developers for bankrolling for-profit projects that, in many cases, they would have undertaken anyway.[8]

The Administration may try to obscure the full cost of its tax cuts by adopting highly unrealistic estimates of the impact that its tax (and other) policies would have on economic growth, in order to greatly reduce the seeming effect of its tax proposals on budget deficits. Overstating likely economic growth by a percentage point per year would lead to a decrease in deficit projections of about $3 trillion.[9] In the absence of budget gimmicks — or deep cuts in entitlement programs to offset the revenue losses — the Trump tax cuts would likely boost future deficits considerably.

Entitlements Outside Social Security and Medicare

Because the Administration clearly won’t propose a tax increase, spending cuts will bear the full burden of any deficit reduction it pursues. And since the President has said he will protect Social Security and Medicare from cuts and will use NDD cuts to finance his defense increase, that leaves only about 26 percent of federal spending (outside of interest payments) to tap for deficit reduction. About three-quarters of that 26 percent of the budget consists of programs providing support for low- and moderate-income Americans.

A significant portion of those supports for low- and moderate-income Americans reflects health care through Medicaid and the ACA’s refundable tax credits that help families purchase private coverage. (Refundable tax credits show up in the budget as entitlement spending.) The House Republican health legislation would cut Medicaid substantially over time and sharply reduce these tax credits for low- and moderate-income Americans. And it would use much of those savings to finance tax cuts mainly benefiting higher-income households by repealing most of the ACA’s revenue-raising measures. The House bill does achieve some deficit reduction, because its cuts in Medicaid and subsidies for low- and moderate-income households are larger than the sizable tax cuts it also includes.[10]

If the Administration wants to achieve deficit reduction outside of these health programs (though the Administration and Congress also could cut health programs even more deeply going forward), it could be left to look for sizable savings in other entitlement programs. These non-heath programs include SNAP, which provides basic nutrition assistance to low-income households; the Supplemental Security Income program, which provides income assistance to poor seniors and adults and children with serious disabilities; assistance to college students through Pell Grants and favorable student-loan repayment terms; the Temporary Assistance for Needy Families (TANF) program,[11] which provides funding to states for income assistance, work programs, child care and other supports for low-income families with children; and refundable tax credits — principally the Earned Income Tax Credit (EITC) and the refundable portion of the Child Tax Credit — that supplement the earnings of low-income working families. Cuts in any of these areas could deepen poverty, reduce help to working families with low earnings, and lead to significant increased hardship.

The President has repeatedly talked about the need to help Americans whom the economy has left behind. This includes many families that receive benefits to supplement earnings from low-wage work or during periods when they’re between jobs. For example, about two-thirds of Americans with incomes between 100 percent and 300 percent of the poverty line — or between $19,100 and $57,300 for a family of three — live in a family in which someone receives aid from a means-tested benefit program or the EITC or the refundable Child Tax Credit. (This analysis does not take into account tax credits received under the ACA.)[12]

Conclusion

That the Administration’s “skinny budget” is providing little detail about the broad framework of its fiscal policy is troubling. While obscuring its long-term agenda for spending and taxes, and the effects on deficits, the Administration nevertheless is pressing Congress to enact dramatic changes in health care and taxes.

What we already know about Administration priorities paints a disturbing picture. NDD programs, already hit hard in recent years, will face substantial additional cuts that would further undercut a broad swath of public services and investments. Health insurance coverage will end or shrink substantially for tens of millions of Americans, including those whom the President says he wants to help. And basic assistance that helps low- and moderate-income households make ends meet and supplements their low wages also may be on the chopping block. Meanwhile, one group seems sure to be big winners: people with very high incomes, who would benefit from the very large tax cuts already moving forward as part of the House health legislation, as well as from the very large additional tax cuts the Administration is expected to propose in the coming weeks.

ACA Repeal, Trump Tax Plan, and Ryan’s “Better Way” Tax Plan All Fail Mnuchin Test

End Notes

[1] Iris J. Lav and Michael Leachman, “At Risk: Federal Grants to State and Local Governments,” Center on Budget and Policy Priorities, March 13, 2017, https://www.cbpp.org/research/state-budget-and-tax/at-risk-federal-grants-to-state-and-local-governments.

[2] Douglas Rice, “Substantial Funding Boost Needed to Renew Housing Vouchers in 2017,” CBPP, updated January 25, 2017, https://www.cbpp.org/research/housing/substantial-funding-boost-needed-to-renew-housing-vouchers-in-2017. Based on available data on relevant rent and income trends, we anticipate that the inflation adjustment needed in 2018 will be similar to 2017.

[3] CQ Newsmaker Transcript, “President Donald Trump Delivers Remarks at Meeting with House Deputy Whip Team,” March 7, 2017.

[4] Chuck Marr and Chye-Ching Huang, “ACA Repeal, Trump Tax Plan, and Ryan’s ‘Better Way’ Tax Plan All Fail Mnuchin Test,” CBPP, January 18, 2017, https://www.cbpp.org/research/federal-tax/aca-repeal-trump-tax-plan-and-ryans-better-way-tax-plan-all-fail-mnuchin-test.

[5] Ibid.

[6] Chye-Ching Huang, “House Republicans’ ACA Repeal Plan Would Mean Big Tax Cuts for Wealthy, Insurers, Drug Companies,” CBPP, March 8, 2017, https://www.cbpp.org/research/federal-tax/house-republicans-aca-repeal-plan-would-mean-big-tax-cuts-for-wealthy-insurers.

[7] Congressional Budget Office, March 13, 2017, https://www.cbo.gov/sites/default/files/115th-congress-2017-2018/costestimate/americanhealthcareact_0.pdf.

[8] Chye-Ching Huang et al., “Trump Infrastructure Plan: Far Less Than the Claimed $1 Trillion in New Projects,” CBPP, December 2, 2016, https://www.cbpp.org/research/federal-budget/trump-infrastructure-plan-far-less-than-the-claimed-1-trillion-in-new.

[9] Chad Stone, “Alternative Math for Growth,” U.S. News and World Report, March 2, 2017, https://www.usnews.com/opinion/economic-intelligence/articles/2017-03-02/donald-trumps-economic-growth-forecasts-for-his-budget-are-unrealistic.

[10] Chye-Ching Huang, “House Republicans’ ACA Repeal Plan Would Mean Big Tax Cuts for Wealthy, Insurers, Drug Companies,” CBPP, March 8, 2017, https://www.cbpp.org/research/federal-tax/house-republicans-aca-repeal-plan-would-mean-big-tax-cuts-for-wealthy-insurers.

[11] While families do not have an entitlement to TANF benefits, TANF is funded on the entitlement side of the budget and states are entitled to funding under the program.

[12] CBPP analysis of Census Bureau data from the 2014 March Current Population Survey with corrections for underreported benefits from the U.S. Department of Health and Human Services/Urban Institute TRIM model. Poverty thresholds reflect 2016, the most recent year for which poverty thresholds are available from the Census Bureau. See also, “Poverty Reduction Programs Help Adults Lacking College Degrees the Most,” by Isaac Shapiro, Danilo Trisi, and Raheem Chaudhry, CBPP, February 16, 2017, https://www.cbpp.org/research/poverty-and-inequality/poverty-reduction-programs-help-adults-lacking-college-degrees-the.

More from the Authors

Areas of Expertise

Recent Work:

Areas of Expertise