Three major tax proposals now on the table — the repeal of the Affordable Care Act (ACA), the tax plan that President-elect Trump proposed as a candidate, and the House GOP’s “Better Way” tax plan spearheaded by Speaker Paul Ryan — fail the standard for tax policy set by Treasury Secretary nominee Steve Mnuchin that “there will be no absolute tax cut for the upper class.” In a lengthy CNBC interview shortly after his selection, Mnuchin stated:[1]

Any reductions we have in upper-income taxes will be offset by less deductions, so there will be no absolute tax cut for the upper class. There will be a big tax cut for the middle class, but any tax cuts we have for the upper class will be offset by less deductions that pay for it.

Put simply, the “Mnuchin test” means tax plans should emphasize helping the middle class and that any tax cuts for high-income households must be offset by cuts in their tax benefits elsewhere in the tax code.

However, according to Urban-Brookings Tax Policy Center (TPC) estimates:

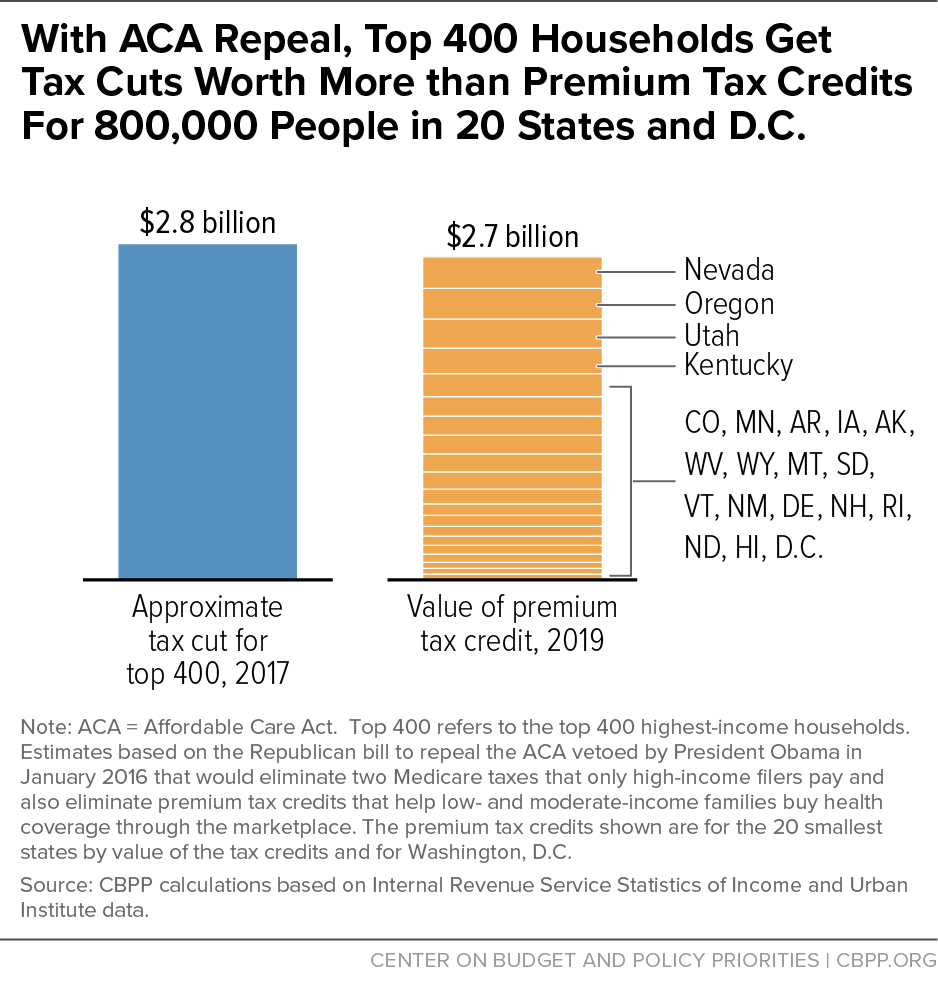

- Republican plans for ACA repeal, which are expected to follow the contours of the ACA repeal bill that President Obama vetoed in January 2016, would provide large tax cuts to the highest-income households. More than half of the benefits would flow to those with incomes over $1 million in 2025.[2] (CBPP estimates that the highest-income 400 households would receive tax cuts averaging about $7 million annually.) At the same time, eliminating the ACA’s premium tax credits would raise taxes on 7 million low- and moderate-income families who use those credits to purchase health insurance.[3]

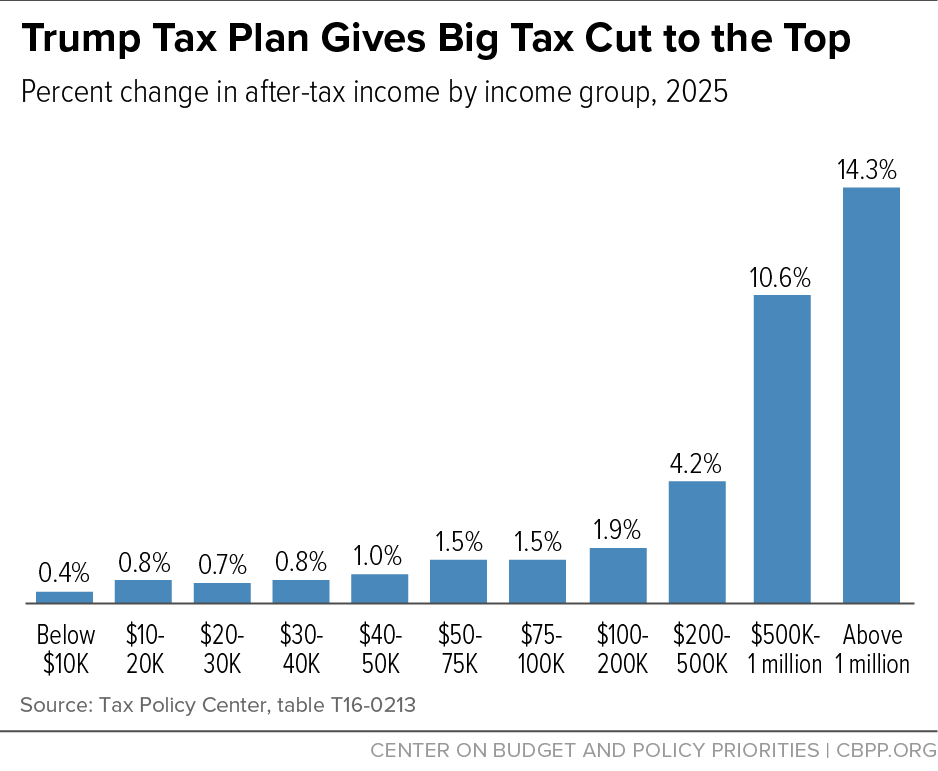

- The Trump tax plan would deliver a $387,000 average tax cut in 2025 for people with incomes over $1 million. Millionaires’ after-tax incomes would rise by 14 percent, dwarfing the gains of low- and middle-income households. People making between $40,000 and $50,000 would receive a tax cut of $500 on average, or just 1 percent of their after-tax income.[4]

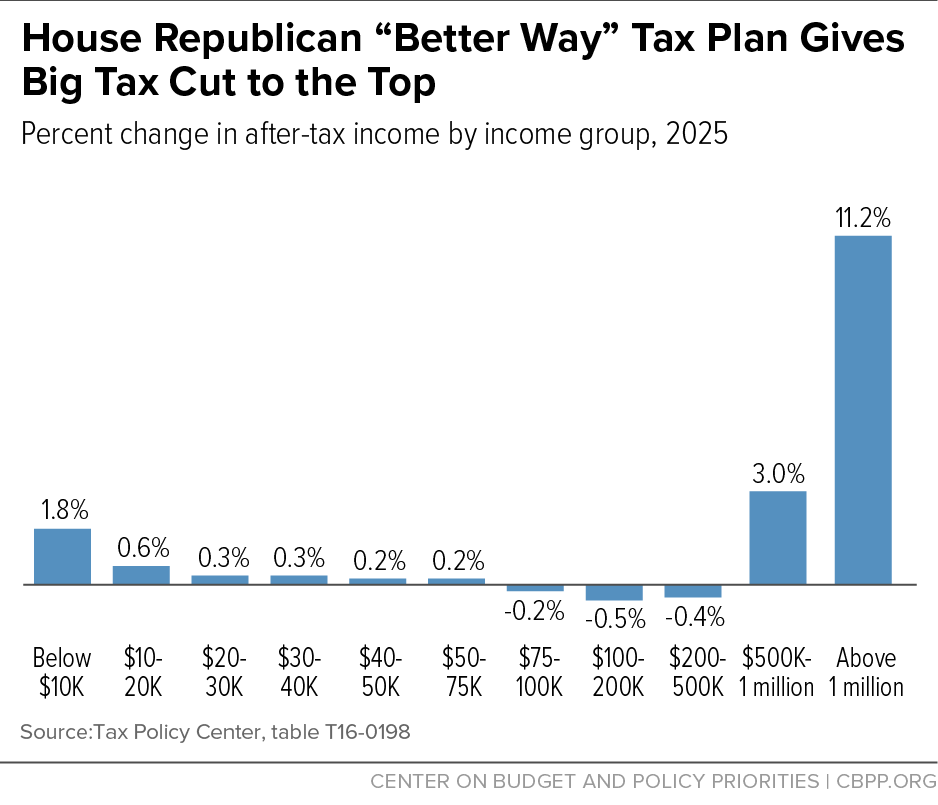

- The House GOP tax plan would deliver tax cuts averaging $302,000 apiece to people with incomes over $1 million in 2025, raising their after-tax incomes by more than 11 percent. By contrast, the bottom 80 percent of Americans wouldn’t see their after-tax incomes rise or fall by more than one-half of 1 percent.[5]

Let’s take a closer look at each of these three proposals.

Republican lawmakers’ planned bill to repeal the ACA is expected to resemble the repeal bill that President Obama vetoed in January 2016. This approach would cut taxes for the richest people in the country while eliminating premium tax credits for low- and moderate-income people that help them buy health coverage in the health insurance marketplace and thereby afford to go to the doctor.

Households with incomes above $1 million would receive tax cuts averaging $57,000 apiece in 2025, reaping 53 percent of the net tax cuts.[6] The bulk of the tax cuts for high-income filers would come from eliminating two ACA Medicare taxes that fall only on high-income filers: the additional Medicare Hospital Insurance tax of 0.9 percent on earnings over $250,000 a year ($200,000 for single filers) and the Medicare tax of 3.8 percent on the unearned income of households above the $250,000 and $200,000 thresholds.

- Households with incomes above $1 million would receive 80 percent of the windfall from eliminating these two taxes, TPC estimates. [7]

- The top 400 households, who had average incomes of $318 million in 2014, would receive about $7 million apiece, on average, CBPP estimates based on IRS data.[8]

Not only would the highest-income households receive large tax cuts, in clear violation of the Mnuchin test, but people making between $40,000 and $50,000 would face an average tax increase of $100, in large part from the elimination of the premium tax credit.[9] Seven million low- and moderate-income families would lose premium tax credits worth an average of $5,700 in 2025.[10]

The total tax cuts for the Top 400 as a group just from repealing the ACA’s two Medicare tax provisions would exceed all of the premium tax credits for 813,000 low- and moderate-income people in the 20 smallest states and Washington, D.C. (see Figure 1).

Developed and then revised during the campaign, the Trump tax plan would provide a massive tax cut for the wealthiest people in the country. It would cut the top income tax rate, the top corporate tax rate, and the capital gains and dividends rate. It would also create a special, lower top rate for income from business partnerships and other “pass-through” entities and eliminate the estate tax on large inheritances. For people at the top of the income scale, these tax cuts would overwhelm the tax increases from the plan’s limits on itemized deductions and other tax-expenditure reforms.[11] People with incomes above $1 million would get a tax cut averaging $387,000 in 2025, raising their after-tax incomes by 14 percent, TPC estimates.[12]

The gains for the highest-income households would dwarf those of less-affluent households. (See Figure 2.) Those making between $40,000 and $50,000 would see their after-tax incomes rise by 1 percent or $500, on average. The total tax cuts for people with incomes below $100,000 would be only about one-fifth as big as the tax cuts for millionaires.[13]

The House Republican leadership’s “Better Way” tax plan, released last June,[14] would lower the top individual rate, capital gains and dividends rate, and corporate rate, carve out a special, low rate for partnerships and other “pass-through” entities, and eliminate the estate tax, enabling the wealthy to pass down massive inheritances tax-free. It also would raise the standard deduction and eliminate the personal exemption, effectively folding it into a larger Child Tax Credit. While the charitable and mortgage interest deductions would remain, the state and local tax deduction and various other itemized deductions would disappear.

Overall, the plan is heavily lopsided: its major tax-cut provisions are targeted narrowly at the very top of the income and wealth scales, and it provides very modest tax cuts, at best, to low- and moderate-income people, TPC estimates show:[15]

- People with incomes above $1 million would receive tax cuts averaging $302,000 in 2025, raising their after-tax incomes by 11 percent. (See Figure 3.) As a group, they would receive fully 96 percent of the total tax cuts.

- People making between $40,000 and $50,000 would receive just $120, on average, and people with incomes somewhat above that level would experience a modest average tax increase.