BEYOND THE NUMBERS

Unless Congress acts soon to replenish Social Security’s Disability Insurance (DI) trust fund, beneficiaries will face a 20 percent benefit cut. Such a cut to DI’s already modest benefits would be devastating.

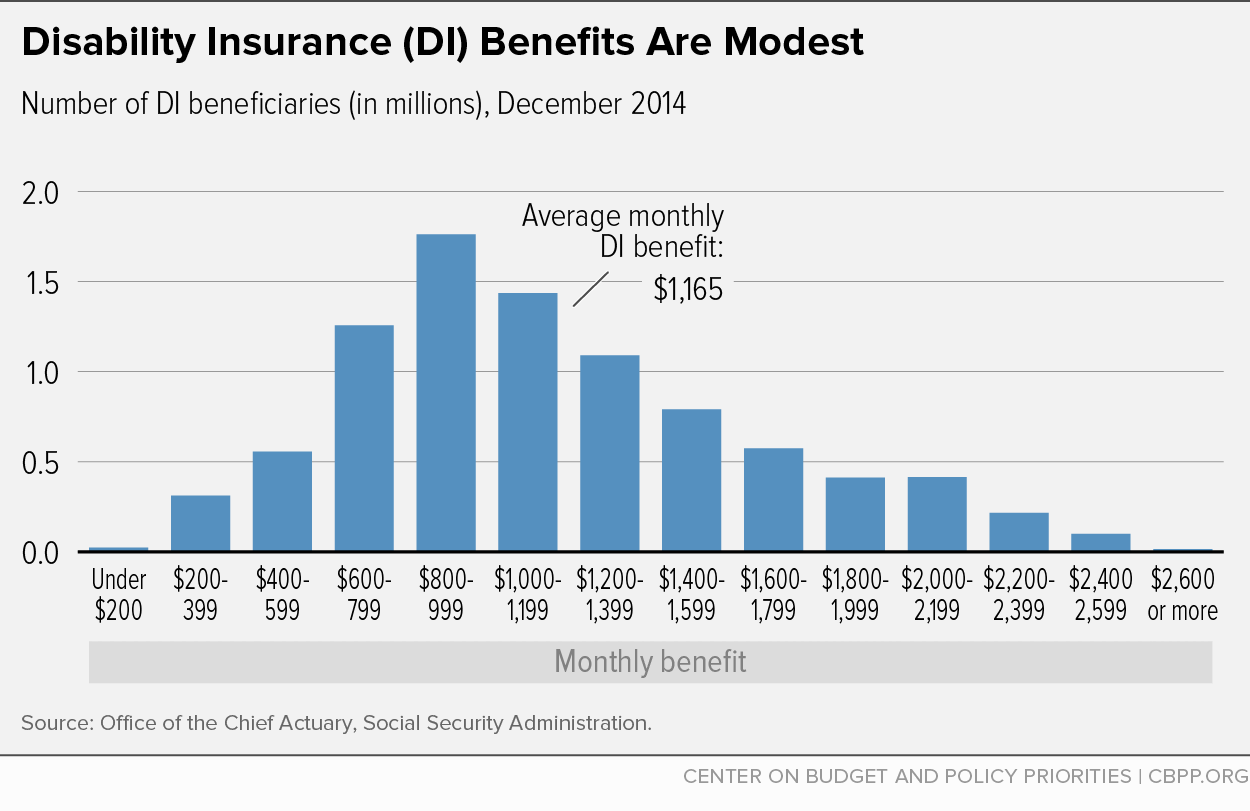

An average disabled worker receives $1,165 each month, less than the average Social Security retired worker or aged survivor. (See chart.) Annually, that’s only a little over the poverty line.

To receive disability benefits, workers must prove that they have such a severe impairment that they can’t support themselves and their families. They must also have a solid work history. The DI criteria are stringent: Most workers who apply don’t qualify.

Becoming disabled significantly reduces a worker’s overall standard of living, decreasing both income and spending on necessities such as food and housing. Though DI helps, it replaces only some of a worker’s lost earnings. In fact, for a typical disabled worker, benefits replace less than half of average pre-disability earnings.

Without DI, the poverty rate among disabled workers would reach nearly 50 percent. Even with disability benefits, about one in five disabled workers is poor. Poverty rates are particularly high for beneficiaries who are women, under 50, unmarried, African American, or Hispanic. In fact, poverty rates among disability beneficiaries are roughly twice as high as others their age.

The DI trust fund will likely be depleted by late 2016. Congress must act before then, ideally by boosting the DI share of Social Security’s payroll tax — as it has done many times in the past, on a bipartisan basis.

DI is essential for American workers and their families — not only for those who rely on its modest benefits, but also for the more than 150 million workers who have earned DI protection. Cutting DI benefits by about one-fifth — as would happen if Congress failed to shore up the DI trust fund — is unacceptable.