BEYOND THE NUMBERS

The Congressional Budget Office (CBO) will release its newest long-term budget outlook today and, if it’s like last year’s, you should keep two points in mind. First, CBO generally presents two scenarios: an “extended baseline” and an “alternative fiscal scenario” (AFS). Focus more on the extended baseline because it represents a continuation of current laws and policies while the AFS includes lots of new and costly policies. Second, while the long-term picture remains challenging, it’s far better than it was five years ago.

The AFS is like a worst-case scenario, and you should think of it that way. Historically, it has relied upon some key and costly assumptions that do not reflect current budget law or policy. Last year, for example, CBO’s AFS assumed that:

- Policymakers would enact enough additional, continual tax cuts to freeze federal revenues at 18 percent of gross domestic product (GDP), even though the graduated income tax means that revenues naturally grow as the nation gets richer. Under CBO’s extended baseline scenario of last summer, revenues are expected to grow gradually to 19.5 percent of GDP in 2040.

- The “tax extenders” — so named because policymakers routinely extend these tax breaks for only a year or two at a time — would continue permanently without any measures to offset the costs.

- The sequestration budget cuts that are currently reducing annually appropriated spending would end immediately.

- All of the recent restraint in spending outside Social Security and health care would effectively end starting at the end of the decade, and spending on these programs would be nearly 50 percent higher in 2040 than in CBO’s extended baseline.

To be sure, some of the AFS assumptions would make for good policy — lifting sequestration and adequately funding discretionary programs, for example. But policymakers would have to change policy in order to devote more resources to these areas. And they would have to decide how best to pay for those additional resources. Most generally, no one should point to the AFS, as some likely will, and say “we cannot continue on the path we are currently on,” because the AFS does not represent the current path.

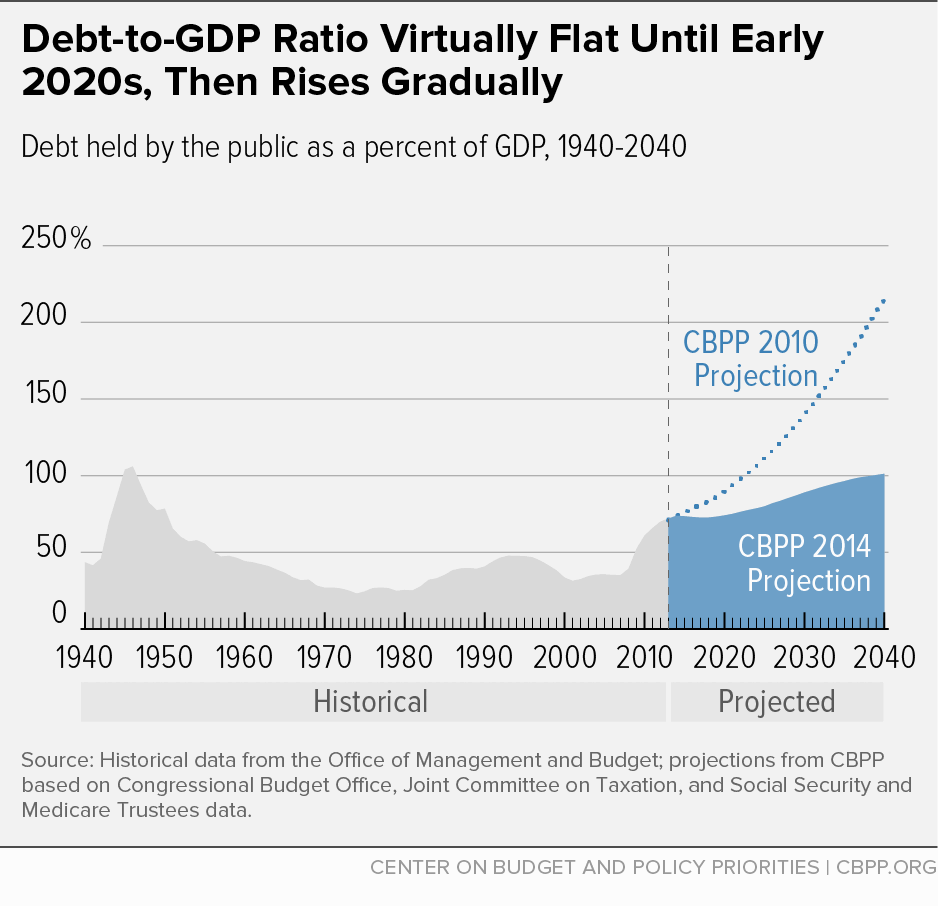

Overall, the federal budget situation has improved significantly in recent years. That’s true by every measure, including CBPP’s own forecasts. For instance, CBPP projected in 2010 that debt held by the public would reach 218 percent of GDP in 2040. By last summer, we were projecting that it would reach only 101 percent in that year, as the chart shows.

In part, the substantial improvement came from deficit-reducing legislation that policymakers have enacted:

- The Budget Control Act (2011) imposed tight caps on annual appropriations and further reduced them, and some entitlement costs, through sequestration.

- The American Taxpayer Relief Act (2012) reversed most of the 2001 and 2003 tax cuts for the wealthiest households.

- Health reform, which policymakers enacted in 2010, created new revenues and reduced Medicare payments to providers and plans by more than it cost to increase health insurance coverage for tens of millions of people.

Beyond the direct effects of legislative changes, the fiscal picture has also brightened because projections of health care costs have improved since 2010; health reform likely contributes here, as well.