BEYOND THE NUMBERS

Big Stakes for Millennials Over Pro-Work Tax Credits

Our new report explains why upcoming decisions in Washington over the future of the Earned Income Tax Credit and Child Tax Credit will have a major impact on millions of millennial workers and their families. Here’s the opening:

Roughly 14 million millennial workers (workers ages 18-34) earn the Earned Income Tax Credit (EITC) or low-income component of the Child Tax Credit (CTC), two tax credits for low- and moderate-income working households. Research shows that the EITC and CTC encourage and reward work. A growing body of research also suggests that children in families receiving the credits have improved health, perform better in school, are likelier to attend college, and can be expected to work and earn more as adults. Policymakers concerned with helping millennials succeed should make permanent critical EITC and CTC provisions set to expire at the end of 2017 and plug a glaring hole in the EITC for childless adults and non-custodial parents.

- Working-family tax credits make a major difference to the economic security of millions of millennials and their families. Some 13.9 million working millennials — more than one in five — receive the EITC, the low-income portion of the CTC, or both.

- Millions of millennial workers will lose some or all of their credits if lawmakers fail to act. Key EITC and CTC provisions are set to expire at the end of 2017. If lawmakers don’t save these provisions by making them permanent, 6.3 million millennial workers will lose some or all of their credits.

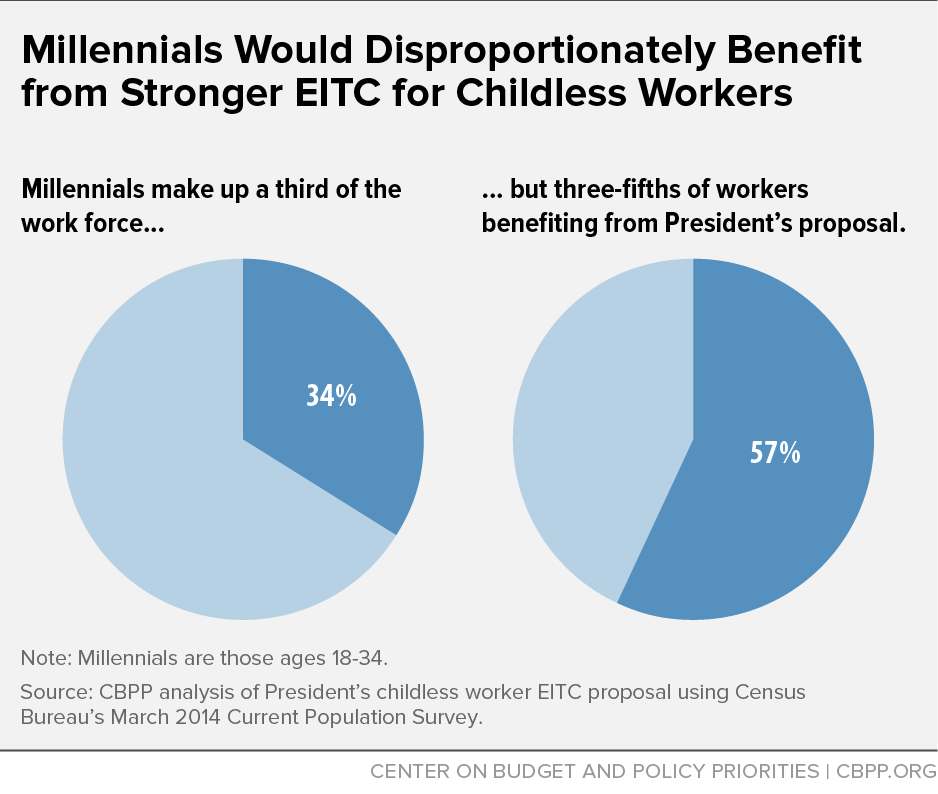

- Closing the large gap in the EITC for childless adults and non-custodial parents is also critical for millennials. The federal tax system taxes 4.1 millennial “childless workers” (workers who don’t claim dependent children for tax purposes) into or deeper into poverty, in part because childless workers receive little or no EITC. President Obama and House Ways and Means Committee Chairman Paul Ryan have offered nearly identical proposals to boost the EITC for childless workers, including making workers aged 21 to 25 eligible; 8.6 millennial workers would benefit. In fact, the President’s proposal would disproportionately help millennial workers, who make up 34 percent of all workers but 57 percent of the workers who would benefit.