más allá de los números

TPC: 2017 Tax Law Could Leave Most Low- and Middle-Income Families Worse Off

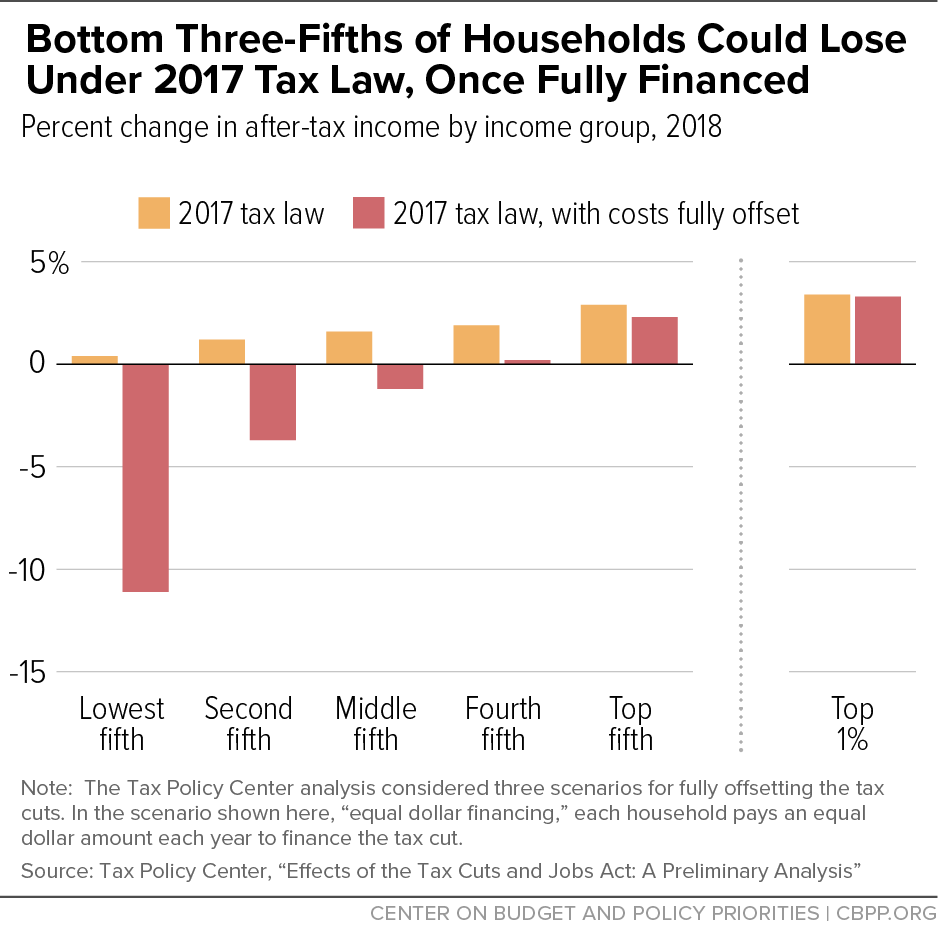

The new tax law could wind up harming the vast majority of low- and middle-income families, an updated Tax Policy Center (TPC) analysis shows. It considers several plausible ways to pay for the tax cuts and concludes, “when the notion that the tax cuts must be paid for is taken into account, many households are made worse off.” That’s because budget cuts enacted to pay for the tax cuts — which will cost $1.9 trillion over ten years — could reduce low- and middle-income families’ incomes by more than the tax cuts will increase them.

The vast majority of the bottom 60 percent of households would be net losers, TPC found, under a scenario for financing the tax cuts that “arguably . . . closely resembles recent Administration and Congressional budget proposals to cut entitlement spending.” (Like those proposals, the House Budget Committee’s new budget features cuts that would severely, and disproportionately, hit low- and moderate-income people.) High-income filers, on the other hand, would still be net winners (see chart).

Specifically, TPC found that households in:

- The bottom fifth, with incomes below $25,000, would lose about $1,560 each on average, lowering their after-tax incomes by 11.1 percent. Essentially every household would lose.

- The middle fifth, with incomes between $48,600 and $86,100, would lose about $690 each on average, lowering their after-tax incomes by 1.2 percent. Eighty percent of households would lose.

- The bottom 60 percent, with incomes below $86,100, would lose about $1,210 each on average, lowering their after-tax incomes by 3.7 percent. Ninety-four percent of households would lose.

- The top 1 percent, with incomes above $732,800, would still gain about $49,530 each on average, raising their after-tax incomes by 3.3 percent. Only 11 percent of households would lose.

Moreover, these estimates don’t include the tax law’s direct harm to health coverage from its $314 billion cut to health care. To help pay for its corporate tax cuts, it permanently repealed the Affordable Care Act’s individual mandate, the requirement that most people get health insurance or pay a penalty. All of the savings from the repeal will come because fewer people will be insured, which will lower federal costs for Medicaid and for federal tax credits that help people buy insurance. Repeal will eventually cause millions more people to become uninsured and raise premiums by an average of 10 percent in the individual market, the Congressional Budget Office estimates.

That the 2017 tax law will generate pressure to cut programs that millions of low-income and middle-class families rely on only further highlights why it requires fundamental restructuring.