más allá de los números

SSA Needs More Funding to Support Essential Services

As policymakers turn to 2021 appropriations to fund the government, they should ensure that the Social Security Administration (SSA) has enough funds to meet daunting workloads that have become even more challenging during the COVID-19 crisis. While SSA received supplemental appropriations to fund its short-term response to the crisis, which included switching abruptly to teleservice and administering economic impact (“stimulus”) payments, that funding won’t likely be enough for the agency, which was already severely under-resourced, to deal with COVID-19’s long-term fallout.

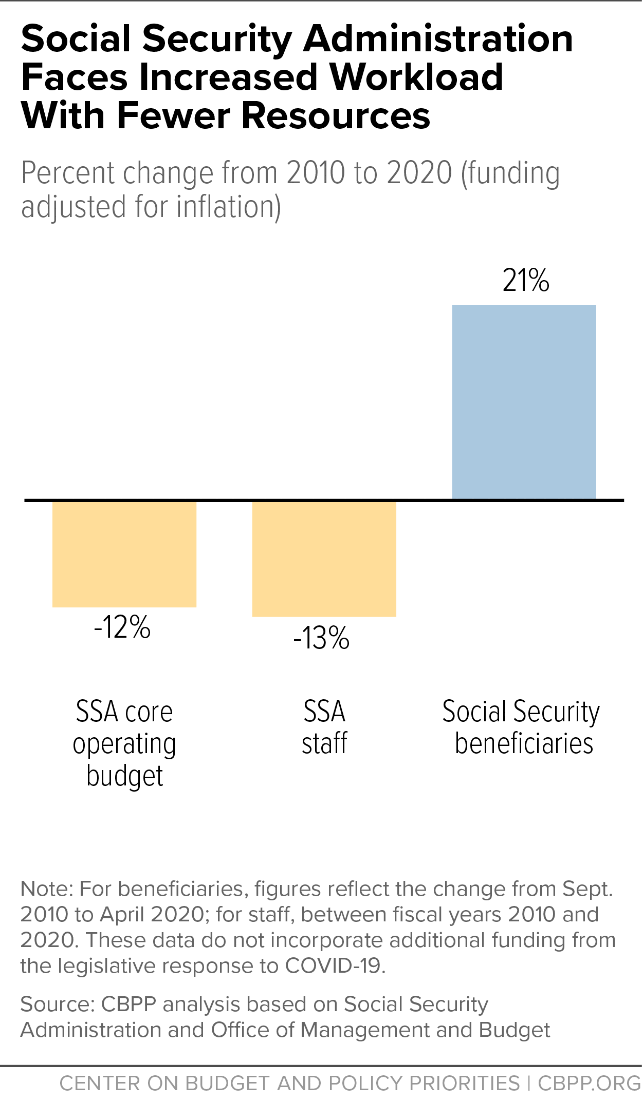

Even before the pandemic, SSA’s customer service suffered from over a decade of underinvestment. From 2010 to 2020, the agency’s operating budget fell 12 percent in inflation-adjusted terms — even as the number of Social Security beneficiaries grew by 21 percent. (See chart.)

These cuts have hampered the agency’s ability to perform its essential services, such as determining eligibility in a timely manner for retirement, survivor, and disability benefits; paying benefits accurately and on time; responding to questions from the public; and updating benefits promptly when circumstances change. Since 2010, for example, SSA’s national 800 number staff shrank by 12 percent even as call volume grew 6 percent, resulting in more busy signals, more hang-ups, longer waits, and fewer calls answered, the SSA Inspector General found just before the pandemic. Busy rates tripled from 4.6 percent to 14.1 percent, while wait times increased six-fold from 3.4 to 20.4 minutes from 2010 to 2019.

SSA’s ability to serve the public is more important now than ever, as it has been helping with economic impact payments, preparing for an influx of benefit applications related to COVID-19, dramatically adjusting business practices to serve a population of high-risk elderly and disabled Americans, and facing new customer service backlogs resulting from service disruptions during the crisis. Along with its usual workloads, here’s what SSA must tackle:

- COVID-19 has already claimed over 113,000 American lives and will likely claim many more. Many who have died left behind family members who will apply for Social Security survivor benefits.

- COVID-19 will likely have long-term disabling effects on many who contract it, including lung scarring, heart damage, and neurological and mental health effects. SSA will need to process these new disability claims and possibly adjust its medical listings for these new cases.

- Though Social Security Disability Insurance (SSDI) enrollment has shrunk significantly in recent years, disability applications tend to rise during a recession, which the economy has now entered. Even though SSDI’s already high denial rate rises in recessions, SSA must process every claim and every appeal, which is labor-intensive and expensive.

- After a years-long trend in older workers delaying their Social Security retirement claims, today’s skyrocketing unemployment will likely prompt more people to apply for early retirement benefits.

- SSA serves mainly older and disabled Americans, most of whom are at high risk for complications and even death if they contract the virus. To protect them and its workforce, the agency shifted abruptly to teleservice in March and will likely continue to have significant service and workplace disruptions well into the next fiscal year. Relocating the work of more than 1,200 field offices, 23 teleservice centers, disability determination services in every state, and more has required more equipment and software and an overhaul of business practices.

- SSA has necessarily suspended some non-essential work, like continuing disability reviews (CDRs). But CDRs are required on a certain schedule, so the agency will accrue a CDR backlog. SSA has only recently reduced a previous CDR backlog with additional program integrity funding. If another backlog accrues, the agency will likely need another funding boost.

- If policymakers provide another round of stimulus checks, SSA will be required to share data and provide technical assistance to its beneficiaries.

In his independent budget request, which was published before the pandemic, SSA’s new commissioner requested an 8 percent increase, of $935 million, for 2021. That would be the largest single-year increase in SSA’s operating budget since 2010. But even with that increase, SSA’s total appropriation for 2021 would be less than that of 2010 in inflation-adjusted terms, and it wouldn’t account for SSA’s pandemic-driven increased workloads. The agency will need more funding to deal with the continuing crisis.

The President and Congress should provide sufficient funding in the 2021 Labor, Health and Human Services, and Education appropriations bill to cover SSA’s essential services.