más allá de los números

Ahead of Tax Day, Highlighting Progress and Next Steps for a Rebuilding IRS

This tax season, millions of taxpayers are benefiting from a better-funded IRS that’s answering more taxpayer questions, processing returns timelier, and issuing refunds to families around the country. Last week the IRS released its ten-year plan for using funds it’s gotten to rebuild a system to best serve honest taxpayers and focus enforcement on high-end tax evasion — a transformative effort that will also need consistent and sufficient funding from federal policymakers.

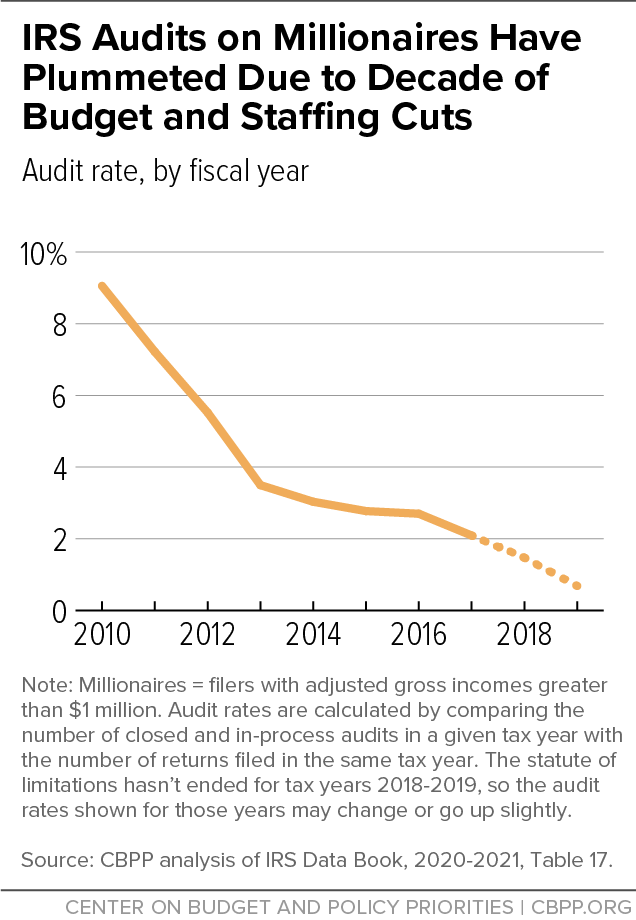

Before this tax season’s improvements, a decade of steep budget cuts left the IRS unable to provide the customer service that taxpayers deserve or to adequately enforce the nation’s tax laws. As many as 9 in 10 taxpayer phone calls to the IRS went unanswered, while audits plummeted for millionaires (see chart) and corporations, contributing to the half-a-trillion-dollar annual tax gap.

To reverse this decade-long decline, last year’s Inflation Reduction Act included nearly $80 billion in supplementary, long-term mandatory funding for the IRS. And the agency has started delivering on its goals — hiring 5,000 new customer service employees, answering around 90 percent of all phone calls from taxpayers, and processing returns much more quickly than in recent years. Adding to the momentum, the IRS has a newly confirmed IRS commissioner, Danny Werfel, who will lead it through its historic, multi-year rebuilding effort.

Last week’s release of a ten-year strategic plan for the IRS was another important step. The plan outlines initiatives to transform how taxpayers interact with the IRS, modernize outdated technology and ensure responsiveness to taxpayer needs, and increase compliance of high-income households and businesses with complex returns, which today are rarely audited.

A few highlights from the IRS plan:

A customer service focus, to vastly improve taxpayers’ experience with the IRS. In addition to fully staffing its customer service operations — such as its call centers and in-person taxpayer assistance centers — the agency plans to introduce new services that will speed processing times and more quickly identify mistakes and fix issues.

For example, in the next few years it plans to start providing real-time updates on refund processing and audit statuses. It will also explore the cost and feasibility of letting taxpayers directly file tax returns electronically with the IRS, instead of using outside tax preparation software. These and other customer service improvements will increase transparency, reduce burdens on taxpayers, and help people resolve issues more quickly.

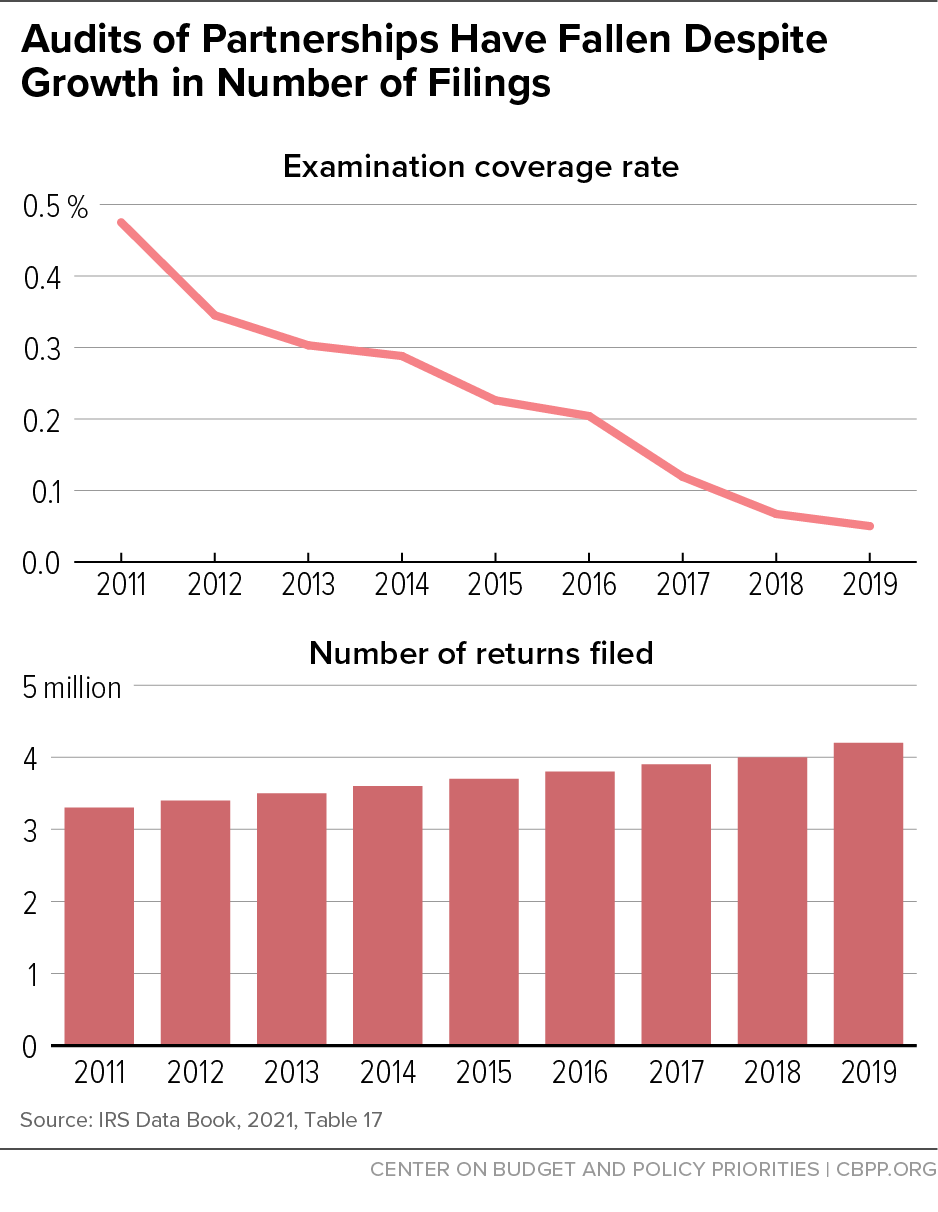

Compliance efforts targeted at high-end tax evasion. An estimated 28 percent of the tax gap — and possibly much more — comes from the top 1 percent not paying what they legally owe. The IRS’ enhanced enforcement efforts will focus on evasion by wealthy people and large businesses, including those with complex partnership structures and those who hide money offshore.

The income of partnerships (like most investment funds and real estate businesses), for example, is heavily concentrated among those with top incomes and is especially hard to trace to specific individuals because of complicated, multi-layered ownership structures. Since 2011, the audit rate for partnerships has declined by almost 90 percent, with less than 0.05 percent of partnerships audited in 2019. (See second chart.)

According to Treasury Secretary Janet Yellen, “these additional resources will help us peel back complex structures and large taxpaying entities and make sure they pay what they owe.”

- 21st century technology. Much of the IRS’ technology dates back to the Kennedy Administration. Modernizing it is fundamental to both improved customer service — such as by enabling more online interactions with the IRS and faster return processing — and for making enforcement activities more targeted and effective. For instance, with better data analytic capabilities, the IRS can better identify tax evasion in complex tax returns of high-income individuals and large businesses.

The Inflation Reduction Act funding offers some certainty that will help the agency make these long-term investments in improving its customer service and better detecting tax cheating. But the ultimate success of this effort requires Congress to do its part by adequately funding the regular IRS budget through annual appropriations. The Inflation Reduction Act funds are designed to supplement and not to supplant the agency’s regular budget.

The Biden budget takes the next step, calling for $14.1 billion in base funding for 2024. This 15 percent increase over 2023 is needed to help get base funding back on track, to account for inflation, and to make up for the 2 percent cut in 2023.

In upcoming budget negotiations, policymakers should set funding as close to the Administration’s request as possible. This would allow the IRS to fully implement its rebuilding plan, resulting in a more user-friendly and responsive tax system, and the agency will be far better equipped to fairly enforce the nation’s tax laws and deliver the services honest taxpayers and businesses deserve.