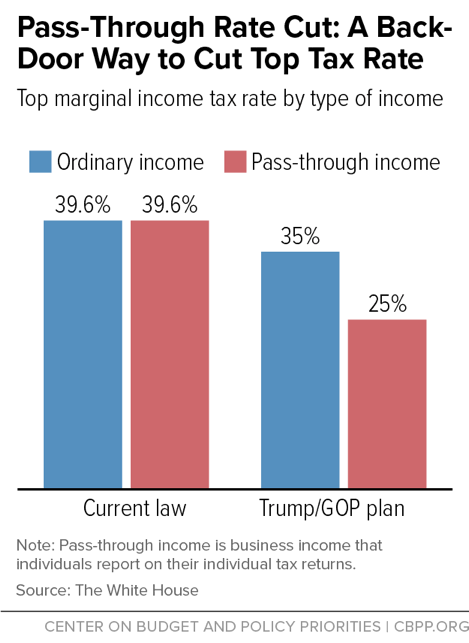

A key reason why the tax plan that the Trump Administration and congressional Republican leaders released in September is costly and heavily tilted to the wealthiest households is its special, much lower top rate for “pass-through” business income.[1] This is income from businesses such as partnerships, S corporations, and sole proprietorships claimed on individual tax returns — that is, it “passes through” to the business owners and is taxed at the owners’ individual tax rates (the same rates that apply to wages and salaries). These businesses already have the advantage of being exempt from the corporate tax on profits and taxes on dividends. Under the September Republican tax plan, pass-through income would be taxed at no more than 25 percent — far below the 39.6 percent top individual income tax rate that now applies to pass-through income, or the 35 percent top rate that would apply to individual income under the GOP plan. This would provide a massive windfall to the very wealthy and has sometimes been referred to as the “Trump loophole” because Donald Trump exemplifies the type of business owner whom it would most benefit. (See Box 1.)

The GOP tax plan as a whole would cost well over $2.4 trillion over a decade and would cut millionaires’ taxes by $200,000 in 2018, on average. The pass-through provision is a prime driver of that cost and regressive tilt. Tax Policy Center (TPC) analyses[2] of plans to reduce the pass-through rate to 25 percent show:

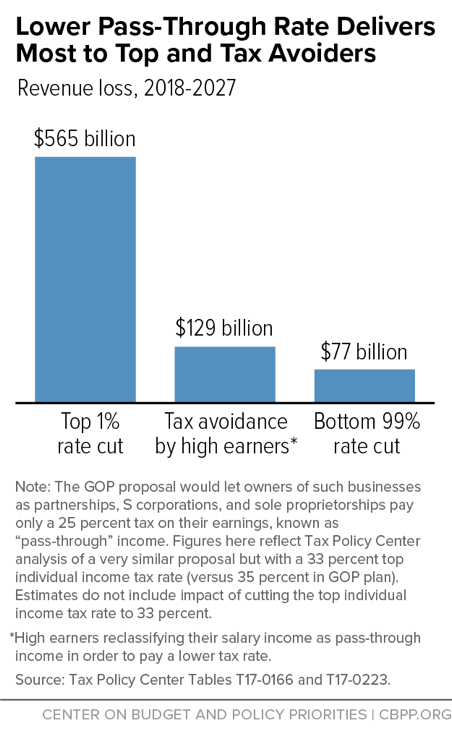

- The pass-through rate cut would cost about $770 billion over ten years, accounting for a significant share of the overall tax plan’s cost.

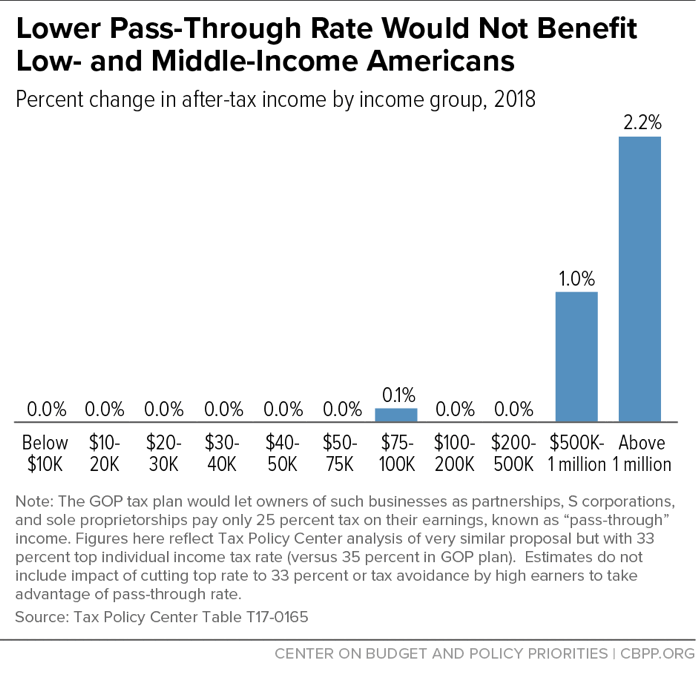

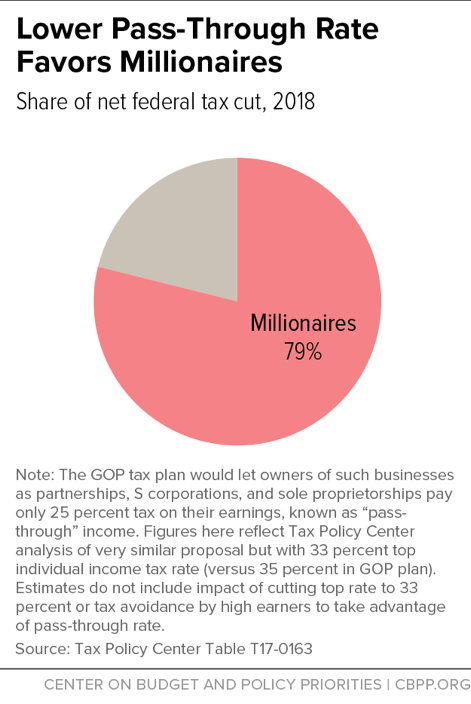

- About 80 percent of the tax cut on existing pass-through income would flow to households with incomes over $1 million. Their tax cuts would average roughly $50,000 apiece in 2018, boosting their after-tax incomes by more than 2 percent.[3] This extreme tilt reflects the fact that the bulk of pass-through income flows to high-income households and that they would get a larger tax break on each dollar of pass-through income (because they are in higher income tax brackets).

- The provision would create major new opportunities for tax avoidance. An estimated $130 billion of the $770 billion total cost would come from high earners reclassifying their non-business wage and salary income as pass-through income to take advantage of the lower rate, according to TPC.[4] In fact, the revenue losses due to tax avoidance would easily exceed the provision’s total tax cuts for the bottom 99 percent of the population.

Republicans have recently floated keeping the top tax rate at 39.6 percent. While this would somewhat reduce the overall plan’s tax cut to the wealthy, it would actually increase the risk of pass-through-related avoidance since the difference between the two rates would be even larger.

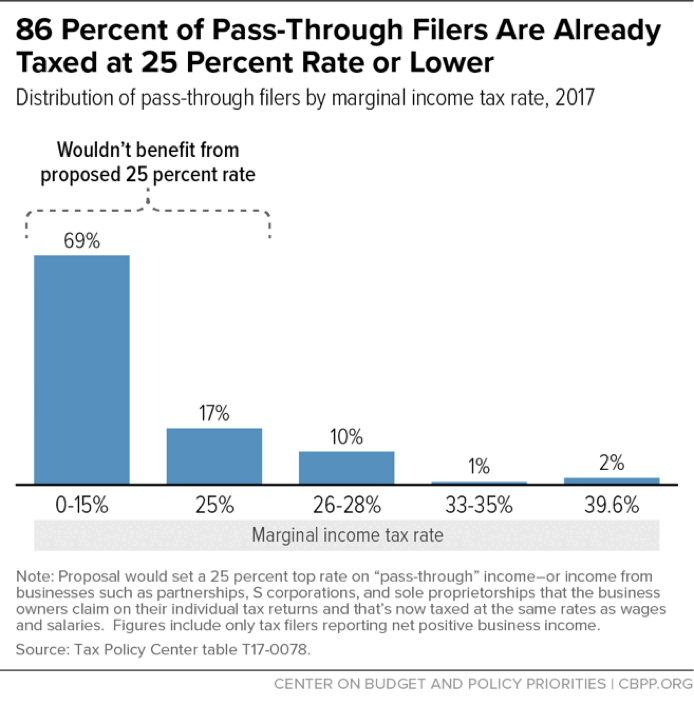

President Trump said during the campaign that “small businesses will benefit the most” from his plan to cut the pass-through rate,[5] but neither the pass-through rate cut in his campaign plan nor the one in the latest GOP plan would help many “Mom-and-Pop” small businesses. Most small businesses are, in fact, small, and their owners don’t make as much as wealthy investors or face top tax rates. Some 86 percent of taxpayers who now have pass-through income already pay a top rate of 25 percent or less on such income,[6] so they wouldn’t benefit from a new 25 percent pass-through rate. Indeed, TPC estimates that only about 2 percent of households with incomes below $100,000 would get any tax cut, and that low- and middle-income owners of pass-through businesses would receive effectively no benefit. (See Figure 1.) Furthermore, the $130 billion of the GOP proposal’s cost that comes from wealthy individuals reclassifying their non-business income would do nothing for actual businesses, small or large.

Proponents of the low pass-through rate frequently argue that pass-through businesses need a rate cut if C corporations’ tax rates are cut in order to maintain “parity” between the different types of businesses. But comparing the top rate on pass-through income with the corporate rate is misleading. While pass-through income faces only the individual income tax, C corporation profits may face both the corporate income tax and, when they are distributed to shareholders, the tax on dividends. Pass-throughs are, in fact, currently taxed at lower rates on average than C corporations are, according to Treasury Department estimates.

The concept underlying the GOP tax proposal has already been tested on a smaller scale. Kansas adopted an aggressive set of tax cuts in 2012, including exempting pass-through income from all state income taxes. Since these tax cuts were implemented, the state’s economy has performed poorly and its finances have been thrown sharply out of balance, in significant part due to the revenue loss from the pass-through exemption. The Kansas House and Senate voted in June on a bipartisan basis to reverse the tax cuts, overriding Governor Sam Brownback’s veto. As Republican State Senator John Doll said in support of the bill, “The right thing is to get out of this mess.”[7] Federal policymakers should learn from Kansas’ example and avoid the mess in the first place. (See Box 2.)

During the presidential campaign, Donald Trump said that his tax plan “reduces or eliminates most … deductions and loopholes available to special interests, and to the very rich. In other words, it’s going to cost me a fortune, which is actually true.”a But the Trump pass-through proposal would enlarge a tax break and tax avoidance opportunity that wealthy investors like him are best placed to take advantage of.

President Trump holds many of his businesses in pass-throughs. His attorneys wrote last year:b

[Y]ou hold interests as the sole or principal owner in approximately 500 separate entities. These entities are collectively referred to and do business as The Trump Organization. . . . Because you operate these businesses almost exclusively through sole proprietorships and/or closely held partnerships, your personal federal income tax returns are inordinately large and complex for an individual.

President Trump has not released his tax returns, so it’s impossible know how much he would benefit from the proposal to sharply reduce the tax rate on pass-through income.

A number of tax experts — including former IRS Commissioner Fred Goldberg and former Treasury tax official Michael Graetz (both of whom served in the George H.W. Bush Administration), former TPC Director Len Burman, and former Joint Committee on Taxation counsel Steven Rosenthal — have observed that President Trump may already have made use of tax-avoidance techniques involving pass-throughs that would become still more lucrative and widespread under the pass-through proposal.c

a Donald Trump, “Presidential Candidate Donald Trump News Conference on Tax Policy,” C-SPAN, September 28, 2015, https://www.c-span.org/video/?328396-1/donald-trump-news-conference-tax-policy.

b Sheri A. Dillon and William F. Nelson, “Re: Status of U.S. federal income tax returns,” Morgan, Lewis & Bockius LLP, March 7, 2016, https://assets.donaldjtrump.com/Tax_Doc.pdf.

c Len Burman, “Trump Is Proposing A Huge Tax Loophole, And He's Already Shown How Wealthy Americans Would Exploit It,” Forbes.com, November 5, 2016, http://www.forbes.com/sites/beltway/2016/11/05/trumps-guide-to-exploiting-his-proposed-loophole/#3cd06df86c69 ; Steven Rosenthal, “Did Donald Trump take advantage of the Gingrich-Edwards payroll tax loophole?” TaxVox, October 7, 2016, http://www.taxpolicycenter.org/taxvox/did-donald-trump-take-advantage-gingrich-edwards-payroll-tax-loophole; Fred T. Goldberg and Michael J. Graetz, “Trump Probably Avoided His Medicare Taxes, Too,” New York Times, November 2, 2016, https://www.nytimes.com/2016/11/03/opinion/trump-probably-avoided-his-medicare-taxes-too.html.

Some lawmakers claim that the GOP tax plan carries less tax-avoidance risk than the Kansas plan did because the federal pass-through rate wouldn’t be cut to zero (and the corporate tax rate would be at a similar level). But the tax-avoidance incentive comes from the gap between the top tax rate on salaries and the lower pass-through rate. So the tax-avoidance incentives would be greater under the GOP tax plan because the tax savings from re-classifying income would be 10 percent of income under that plan, or more than double the gain from tax avoidance under the Kansas tax cuts, which equaled 4.6 percent of an individual’s income.[8]

Pass-through income is business income claimed on individual tax returns. Instead of facing the corporate income tax, it “passes through” the business to the business owners and is taxed at their individual tax rates — the same rates that apply to their wage and salary income. The types of businesses that can choose to be taxed as pass-through entities include partnerships (such as law firms or financial services firms), sole proprietorships, limited liability companies (LLCs), and S corporations (which are similar to companies that face the corporate tax rate but have 100 or fewer shareholders and elect to be taxed as a pass-through).

President Trump and the Republican leaders propose a 25 percent top rate for pass-through income — far below the top rate of 35 percent they propose for wages and salaries, and even further below the current 39.6 percent top rate that applies to both wage and salary and pass-through income. (See Figure 2.)

The pass-through tax cut in the GOP proposal would cost about $770 billion from 2018 to 2027, TPC estimates — making it one of the costliest provisions in the tax plan as a whole.[9] There are two reasons why the tax cut would be so expensive:

- It would deliver a large tax break to high-income filers by sharply cutting the rate on income they already report as pass-through business income. TPC estimates that $640 billion of the cost of the proposal would come from cutting taxes on income that would mostly have been reported as pass-through income anyway. This high cost reflects the fact that most of that income would otherwise have fallen in the top tax rate brackets.

- It would spur large-scale tax avoidance by high earners. The GOP tax plan sets the pass-through rate 10 percentage points below its proposed 35 percent top rate on salaries and wages. This big rate difference would create a huge new incentive for high-earning employees — such as highly compensated business executives, consultants, and other professionals — to become “businesses” for tax purposes to cut the tax rate on the income from their labor. For example, a law firm partner who reclassified her $1 million salary as business income from the law firm would save $100,000 in taxes by doing so.

President Trump and congressional Republican leaders have not proposed any rules or enforcement mechanisms to prevent such gaming.[10] TPC estimates that $130 billion of the proposal’s cost would come from high earners avoiding taxes by claiming that more of their income is from pass-through businesses.

Indeed, much smaller tax differentials under current law already lead to significant income reclassification. For example, many S corporation shareholders receive both wages from the company and a share of the company’s profits, but they pay payroll tax only on their wages. This gives them an incentive to underreport the share of their income that comes from wages and overstate the share that is pass-through business income in order to avoid the Medicare payroll tax that would otherwise apply.[11] This tax avoidance strategy received attention when former lawmakers John Edwards and Newt Gingrich were found to be using it to shrink their payroll tax liabilities.[12]

The GOP pass-through proposal would expand this type of tax avoidance. As TPC notes, “Current-law rules are difficult to enforce, leading to significant avoidance of payroll taxes; with the much larger rate differential under the revised Trump plan, avoidance would be much more prevalent.” [13]

The tax plan presented by the White House and GOP leaders left open the possibility of a top rate higher than 35 percent, and some Republican policymakers are reportedly considering holding the top tax rate at the current 39.6 percent. While this should somewhat reduce the plan’s cost and tilt to the top, much of that would be offset by the increased incentive for high-income workers to take advantage of the special 25 percent pass-through rate to reduce their taxes. The incentive to reclassify wage and salary income as pass-through income would grow by about 50 percent, as the difference between the two rates would grow from 10 percentage points (25 percent versus 35 percent) to 14.6 percentage points (25 percent versus 39.6 percent).

As part of an aggressive set of tax cuts, in 2012 Kansas exempted pass-through income from all state income taxes. Analysts across the political spectrum (including CBPP)a flagged the risk; the Tax Foundation’s Joseph Henchman, for example, warned that excluding pass-through income from taxation would act as “an incentive to game the tax system without doing anything productive for the economy.”b

Since enacting the tax cuts, Kansas’ private-sector job growth, GDP growth, and growth in small business formation have all lagged well behind the country as a whole, and the pass-through exemption has failed to spur the growth of the kinds of pass-through businesses most likely to create jobs (other than for the firms’ owners) — S corporations, LLCs, and partnerships. The state’s own data show that the annual rate of growth in these types of businesses actually slowed in the first two years in which the exemption was in effect.c And, the large difference between the top Kansas income tax rates on pass-through income (0 percent) and salaries (4.6 percent) led thousands of salaried individuals in Kansas to reorganize themselves as pass-throughs in order to avoid state income tax.d

Further, the tax cuts have wreaked havoc on the state’s budget, with the pass-through exemption alone costing $472 million in 2014, a substantial portion of the cost of the cost of the Kansas package. To balance its budget, Kansas turned to budget gimmicks such as delaying a payment to schools into the next fiscal year (which caused some schools to close early), delayed road projects, cut services, and nearly drained the funds it had set aside to prepare for the next recession. Two bond rating agencies downgraded the state due to its budget problems.

In June 2017, the Kansas House and Senate — on a bipartisan basis — overrode Governor Brownback’s veto to pass a tax package to close what had become known in Kansas as the “LLC loophole.”e

a Nicholas Johnson and Michael Mazerov, “Proposed Kansas Tax Break for ‘Pass-Through’ Profits Is Poorly Targeted and Will Not Create Jobs,” CBPP, revised March 26, 2012, https://www.cbpp.org/research/proposed-kansas-tax-break-for-pass-through-profits-is-poorly-targeted-and-will-not-create.

b Joseph Henchman, “Kansas May Drop Pass-Through Exclusion After Revenue Projections Miss Mark Again,” Tax Foundation, April 30, 2015, http://taxfoundation.org/blog/kansas-may-drop-pass-through-exclusion-after-revenue-projections-miss-mark-again.

c Kansas Department of Revenue, “Governor’s Consensus Revenue Estimating Working Group Final Recommendations,” October 4, 2016, Table 3, p. 9, http://budget.ks.gov/files/FY2017/cre_workgroup_report.pdf.

d Jim Tankersley, “Kansas Tried a Tax Plan Similar to Trump’s. It Failed.” New York Times, October 10, 2017, https://www.nytimes.com/2017/10/10/us/politics/kansas-tried-a-tax-plan-similar-to-trumps-it-failed.html?_r=0.

e Hunter Woodall, “Legislature overrides Brownback’s veto of bill that rolls back his 2012 tax cuts,” Kansas City Star, June 2017, www.kansascity.com/news/politics-government/article154691724.html.

The proposal to set a special low rate for pass-through income would provide massive benefits for the highest-income households. TPC estimates that about 80 percent of the tax cut on existing pass-through income would flow to households with incomes above $1 million — roughly the top 0.4 percent of Americans. (See Figure 3.) Millionaires would receive a $50,000 average tax cut from this provision, boosting their after-tax income by more than 2 percent in 2018.

A key reason for this extreme tilt is that pass-through income is concentrated among the wealthiest. In 2017, 45 percent of pass-through income will flow to millionaire households, TPC estimates.[14] Only about 22 percent will flow to the bottom 90 percent of households.

But, as the TPC estimates show, the benefits of the tax cut are even more skewed than pass-through income. A key reason is that the highest-income filers facing the top income tax rate would receive the largest rate reduction for pass-through income. Filers in brackets below the top would receive less of a rate cut, and filers in the 25 percent bracket or below would get nothing from the special rate.[15] For example, under the GOP tax plan, a couple with income of $1 million would receive a $1,000 tax cut (relative to the tax brackets in the GOP tax plan) on each $10,000 of pass-through income that would otherwise be in the top tax bracket, compared to $0 for a couple with income below $75,000.[16]

The estimates above are limited to income that would have been reported as pass-through income in the absence of the Trump/GOP proposal for a special, lower pass-through rate. So, they do not reflect the benefits of any tax avoidance savings that high earners would reap by reclassifying their salaries and wages as pass-through income. These tax avoidance savings would also be concentrated on high-income households.

There are several reasons why. First, people facing the 35 percent top marginal tax rate under the GOP tax plan would have the biggest incentive to reclassify their salaries as pass-through income in order to benefit from the 25 percent pass-through rate. Second, they would have larger amounts of earnings to reclassify. Third, they could best afford tax lawyers and accountants to help them reclassify their income and would have greater flexibility to negotiate with their employers to be paid as a pass-through business “contractor.”

In fact, the revenue loss just from tax avoidance easily exceeds the total tax cuts on actual business income for the bottom 99 percent of the population. (See Figure 4.)

Small Business and Parity Arguments Don’t Withstand Scrutiny

President Trump and Republican leaders have presented their pass-through proposal as helping small businesses, while others have argued that the rate cut is needed to provide parity between pass-throughs and corporations. In reality, most small businesses wouldn’t benefit at all from the rate cut, and many large businesses elect to be taxed as pass-throughs because of the tax advantages that gives them, relative to being taxed as corporations, under current law.

Cutting the marginal tax rate for pass-through income would not benefit the vast majority of small business owners. Most small businesses are in fact “small.” And most small-business owners have moderate incomes and hence would not benefit from proposals to cut the tax rates that only high-income filers face.

The pass-through income of most low- and middle-income income filers already is taxed at lower rates than they would pay under the GOP proposal. TPC estimates that some 86 percent of filers with pass-through income are currently taxed at a statutory marginal income tax rate at 25 percent or lower. (See Figure 5.) So under the GOP proposal to set the top rate on pass-through income at 25 percent, most taxpayers with pass-through income would not benefit.[17] TPC estimates that only about 2 percent of households with incomes below $100,000 would receive any tax cut, while 58 percent of millionaire households would.

Much of the pass-through income of wealthy filers has nothing to do with “small businesses.”[18] As TPC notes, the bulk of pass-through income taxed at high rates goes to lawyers, consultants, and other professionals and, for the very highest earners, to partners in hedge funds or other investment firms.[19] Income that could qualify for the lower pass-through rate includes:

- The $37 million in average net income from S corporations and partnerships that the 400 highest-income filers reported in 2014.[20] Conservatively, the lower pass-through rate under the GOP tax plan would give the 400 highest-income households a tax break of about $5.5 million each compared to their current tax rates, or about $3.7 million each compared to the 35 percent top rate on ordinary income they would otherwise face under the Trump tax plan.[21]

- Income for finance, holding company, and professional services firms that flows through the firm to its partners, which makes up 76 percent of the partnership income reported by the highest-income 1 percent of filers.[22]

- Income reaped by owners of extremely large pass-throughs. In 2012, only 0.4 percent of S corporations had receipts over $50 million, but they earned 40 percent of all S corporation income. Similarly, just 0.3 percent of partnerships had receipts over $50 million, but they earned more than 70 percent of partnership income.[23] Much of the income of these very large businesses could qualify for the pass-through rate cut.

Proponents of a special pass-through rate also argue that giving a rate cut to C corporations and not pass-throughs would undermine their goal of achieving “parity” between pass-throughs and C corporations. This argument glosses over the fact that, on average, pass-through entities already face lower marginal tax rates on new investment than C corporations do, as a Treasury analysis has found.[24]

Pass-throughs and C corporations are taxed differently. Where pass-throughs pay only individual tax, C corporation profits may face the corporate income tax and, when distributed to shareholders, the tax on dividends. Arguments that pass-throughs need a rate cut based on a comparison between the top pass-through rate and the corporate tax ignore the additional taxes paid at the shareholder level when profits are distributed.

Many businesses choose to be taxed as pass-through entities instead of as corporations because it lowers their taxes. The relative tax benefits of choosing to be taxed as a pass-through rather than as a corporation depend on several factors, but high-income investors can often reduce their taxes by operating their businesses as pass-throughs (and can retain various legal protections afforded to corporate investors even while doing so).[25]