Under Donald Trump’s revised tax cut plan, the top 0.8 percent of Americans — those who make over $1 million a year — as a group would ultimately receive nearly three times as much in tax cuts as the bottom 80 percent of Americans, today’s new Tax Policy Center (TPC) analysis finds. In addition, those at the top would receive average tax cuts that, as a percentage of their incomes and in dollar terms, would vastly exceed the average tax cuts for low- and middle-income households, TPC estimates.[1] (These and other estimates generally come either from the TPC analysis or from simply multiplying TPC’s estimates of the share of tax cuts for each income group by TPC’s estimate of the tax cut’s total size.)

The Trump campaign has said that his tax cuts would be paid for so that they wouldn’t increase the deficit. If policymakers paid for the tax cuts with offsetting budget cuts, low- and middle-income households overall would likely face net losses because they receive the bulk of the benefits that federal programs provide.

TPC estimated the impacts of the Trump tax plan in 2017 and 2025 on people at different income levels. We focus here on 2025 because it better reflects the permanent effects of the tax cuts. TPC’s estimates show that, in 2025:[2]

- The tax cuts would raise after-tax income for the top 0.8 percent of Americans — those with annual incomes of over $1 million — by 14.3 percent, with those households receiving average tax cuts of $310,000.

- Moreover, the tax cuts would raise after-tax income for the top 0.1 percent of Americans — with annual incomes of over $4.8 million — by a similar 14.0 percent, with those households receiving average tax cuts of $1.2 million.

- By contrast, the tax cuts would raise after-tax income for those in the middle fifth of the income scale — with annual incomes from $52,300 to $89,300[3] — by just 1.5 percent, with those households receiving average tax cuts of $900.

- Moreover, the tax cuts would raise after-tax income for those in the bottom fifth — with annual incomes up to $26,900 — by just 0.7 percent, with those households receiving average tax cuts of $100.

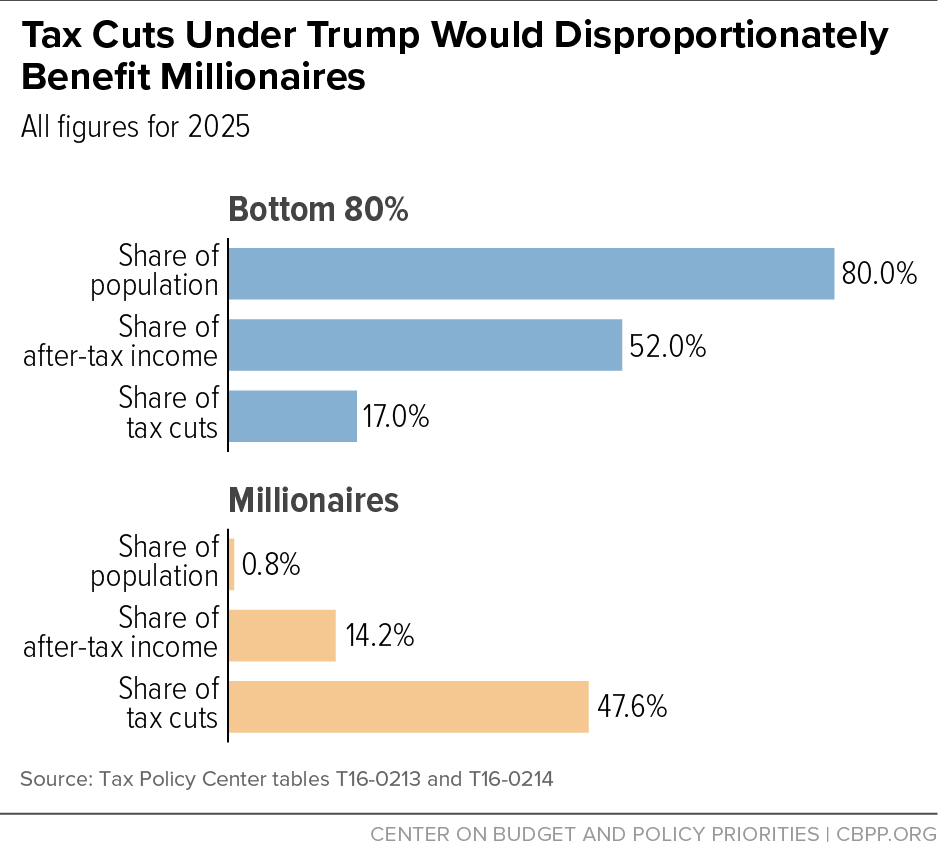

As a result, the TPC analysis shows, the top 0.8 percent, who make over $1 million a year — that is, 920,000 households with about 2.7 million people — would receive 48 percent of the tax cut in 2025. The rest of the top 20 percent of the population would receive 35 percent of the tax cut. And the bottom 80 percent, numbering an estimated 280 million people, would receive the remaining 17 percent of the total tax cut — that is, only a little more than one-third of what the top 0.8 percent would receive. (See Figure 1.)

In fact, even the top 0.1 percent of Americans — numbering about 350,000 people — would receive substantially more in tax cuts than the bottom 280 million people.

Over the decade, we estimate, based on the TPC data, that those who make over $1 million a year would receive $2.8 trillion of the $6.2 trillion in total tax cuts, or 45 percent of the total.[4]

The revised Trump plan, while less costly than his original tax plan, actually is more tilted to those at the top. In an earlier analysis, TPC found that millionaires would receive 38 percent of the tax cuts in 2025 under the original Trump plan, compared to the 48 percent they would secure under the revised plan.

While people in all income categories would receive a tax cut on average, the TPC analysis indicates that some households would face tax increases. “Repealing personal exemptions and the head of household filing status,” as the revised Trump tax plan would do, “would cause many large families and single parents to face tax increases,” the analysis notes. The TPC estimates show that individual filers with dependents (mostly single parents with children) with cash incomes between $20,000 and $200,000 would on average face net tax increases that reduce their after-tax income by almost 1 percent ($460).[5] Other analyses indicate that the number of people in households facing tax increases could run into the tens of millions.[6]

Also, the revised Trump plan would offer substantial new opportunities for businesses and high-income households to avoid taxes. Its proposal to sharply cut the top tax rate on certain “pass-through” income (business income claimed on individual tax returns) to 15 percent would cost $1.5 trillion in lost federal revenue over ten years, TPC estimates — and $649 billion of that cost would come from high-income earners using tax avoidance strategies to report their wage and salary income as “business” income in order to claim the 15 percent rate (rather than the 33 percent top tax rate they would otherwise face on wage and salary income under the Trump plan).[7] In addition, as TPC notes, the plan’s provision to allow certain businesses to deduct the full cost of certain investments in the year they are made (rather than over time, as the new plants or equipment lose value) would likely lead some firms to engage in complex avoidance arrangements to take advantage of this provision.[8]

Low- and Middle-Income Families Would Likely Be Net Losers, Due to Offsetting Budget Cuts

As noted, the Trump campaign has said that his tax cut plan would be paid for so that it doesn’t increase the deficit. Assuming at least a substantial share of the offsets came through federal spending cuts (rather than tax increases), low- and middle-income households would likely face net losses as they’d likely lose significantly more from the budget cuts than they would gain from the tax cuts. Only a very small fraction of spending cuts could come from program spending that benefits millionaire households, given how few such households there are.

Mr. Trump has proposed one specific spending cut to help offset the tax cuts: to cut total funding for non-defense programs funded through the annual appropriations process by 1 percent each year below the prior year’s level. While only offsetting $900 billion of the Trump tax plan, this proposal would reduce non-defense discretionary funding by 2026 by 29 percent, after adjusting for inflation. This category of spending — which covers a wide range of services such as veterans’ medical care, scientific and medical research, education, child care, environmental protection, and infrastructure — has been the hardest-hit part of the budget in recent years. These additional cuts would shrink non-defense discretionary spending to 2.0 percent of gross domestic product by 2026, which would be one-third below the lowest level on record, with data back to 1962.[9]

| TABLE 1 |

|---|

| Expanded cash income* percentile |

Percent change in

after-tax income |

Share of total

federal tax change |

Average federal tax change (in 2016$)** |

|---|

| Lowest quintile |

0.7% |

0.8% |

-$100 |

| Second quintile |

0.9 |

2.2 |

-320 |

| Middle quintile |

1.5 |

5.4 |

-880 |

| Fourth quintile |

1.8 |

8.6 |

-1,710 |

| Top quintile |

7.3 |

82.8 |

-19,740 |

| All |

4.3 |

100.0 |

-3,250 |

| |

|

|

|

| Addendum |

|

|

|

| 80-90 |

1.9 |

6.0 |

-2,730 |

| 90-95 |

2.9 |

5.9 |

-5,790 |

| 95-99 |

8.0 |

20.1 |

-25,540 |

| Top 1 percent |

14.1 |

50.8 |

-256,170 |

| |

|

|

|

| Top 0.8 percent (millionaires) |

14.3 |

47.6 |

-313,130 |

| Top 0.1 percent |

14.0 |

24.5 |

-1,179,250 |