- Home

- Federal Budget

- Trump “Penny Plan” Would Mean Large Cut ...

Trump “Penny Plan” Would Mean Large Cut in Non-Defense Spending

To help pay for his tax cut plan, Republican presidential nominee Donald Trump is proposing to cut total funding for non-defense programs funded through the annual appropriations process by 1 percent below the previous year’s total each year. The cumulative cut would be very substantial.While this may sound modest, the cumulative cut would be very substantial. By the tenth year (2026), non-defense appropriations would be about 29 percent below current levels, after accounting for inflation.

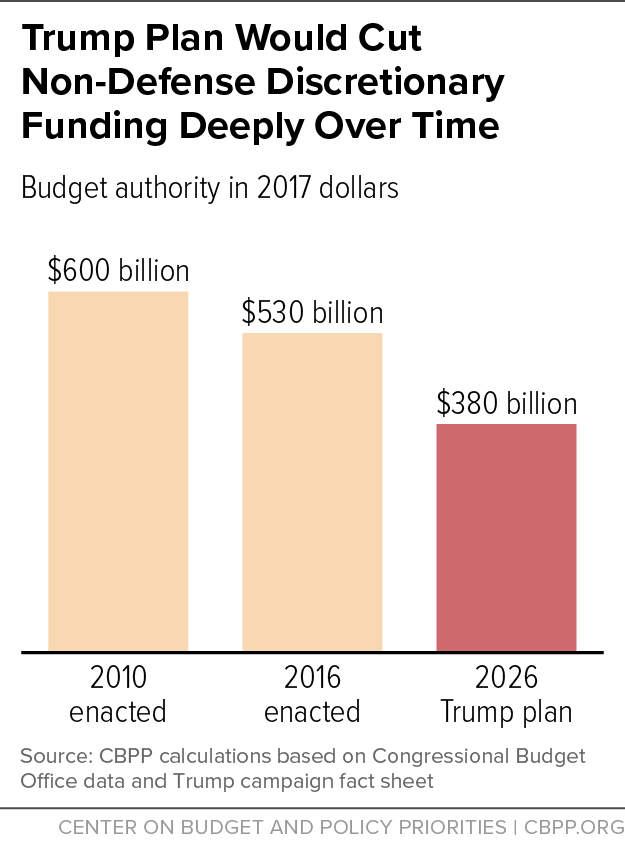

Moreover, the cuts would come on top of cuts over the past six years due to the 2011 Budget Control Act and sequestration. By 2026, non-defense discretionary funding would be 37 percent below the 2010 level, adjusted for inflation (see Figure 1) — and one-third below the previous record low as a share of the economy, as explained below.

The category of funding targeted by the Trump plan covers a wide range of basic services, from veterans’ medical care to scientific and medical research, border enforcement, education, child care, national parks, air traffic control, housing assistance for low-income families, and maintenance of harbors, dams, and waterways.

If policymakers exempted any of these or other items from cuts, they would have to cut everything else even more.

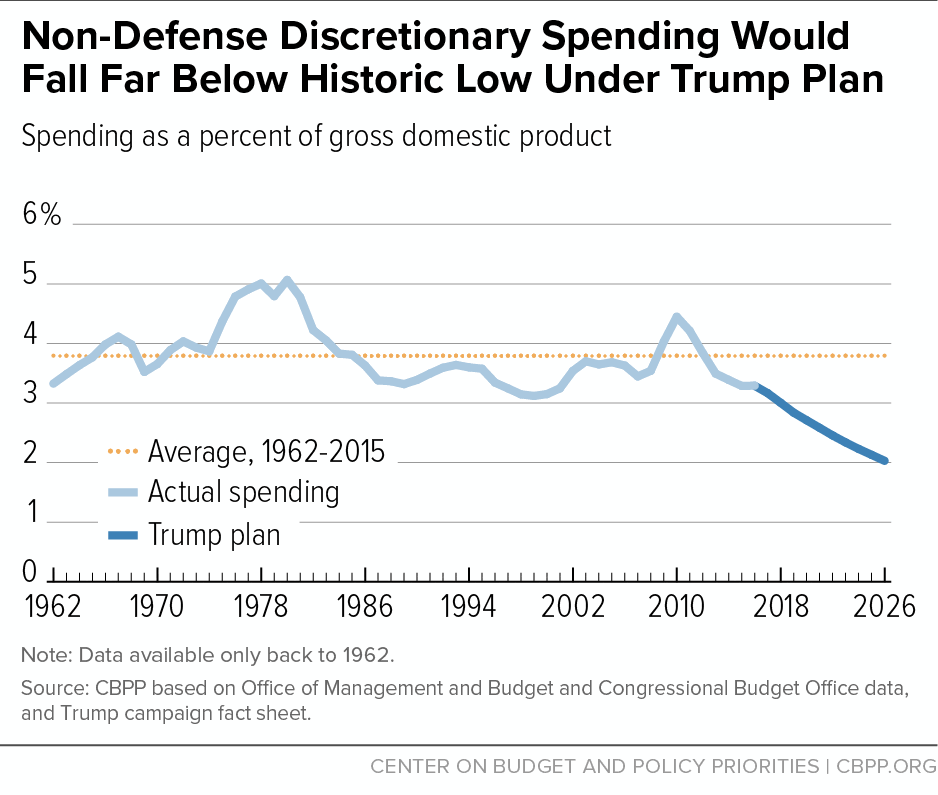

Relative to the size of the economy (gross domestic product or GDP), non-defense discretionary funding is already headed to record lows, but the Trump plan would greatly accelerate that decline. Total funding for these programs now equals about 3.3 percent of GDP — just 0.2 percentage points above the record low, with data going back to 1962. Under the Trump plan, it would reach a new record low in 2018 and keep on falling. By 2026, it would fall to about 2.0 percent of GDP — fully one-third below the previous low point (see Figure 2). For perspective, the lows under Presidents George W. Bush and Reagan were 3.4 percent and 3.3 percent of GDP, respectively.

Mr. Trump proposes to use these spending cuts to pay for about one-fifth of his $4.4 trillion tax cut plan. He says the remaining four-fifths would be offset by the higher economic growth (and resulting revenues) he contends his tax plan and regulatory reforms would produce. If these growth assumptions — which should be treated with considerable skepticism[1] — fail to materialize, even larger spending cuts would be needed to offset the tax cuts, or the tax cuts would substantially increase the deficit.

Trump Campaign’s “Dynamic Scoring” of Revised Tax Plan Should Be Taken With More Than a Grain of Salt

End Notes

[1] Chad Stone and Chye-Ching Huang, “Trump Campaign’s ‘Dynamic Scoring’ of Revised Tax Plan Should Be Taken With More Than a Grain of Salt,” Center on Budget and Policy Priorities, September 15, 2016, https://www.cbpp.org/research/federal-tax/trump-campaigns-dynamic-scoring-of-revised-tax-plan-should-be-taken-with-more.

More from the Authors