The House GOP health plan would repeal, starting in 2018, two Medicare taxes in the Affordable Care Act (ACA) that fall only on high-income filers: the additional Hospital Insurance (HI) payroll tax on high earners and the Medicare tax on unearned income.[1] High-income taxpayers would no longer face Medicare taxes on all their income — unlike low- and moderate-income earners — and the disparity between the top tax rates on income from earnings and income from wealth would widen further. And, because the HI tax on high earners supports the HI trust fund, its repeal would weaken Medicare by accelerating depletion of the fund by three years.

The highest-income filers in the nation would be the overwhelming beneficiaries of repealing these two taxes:

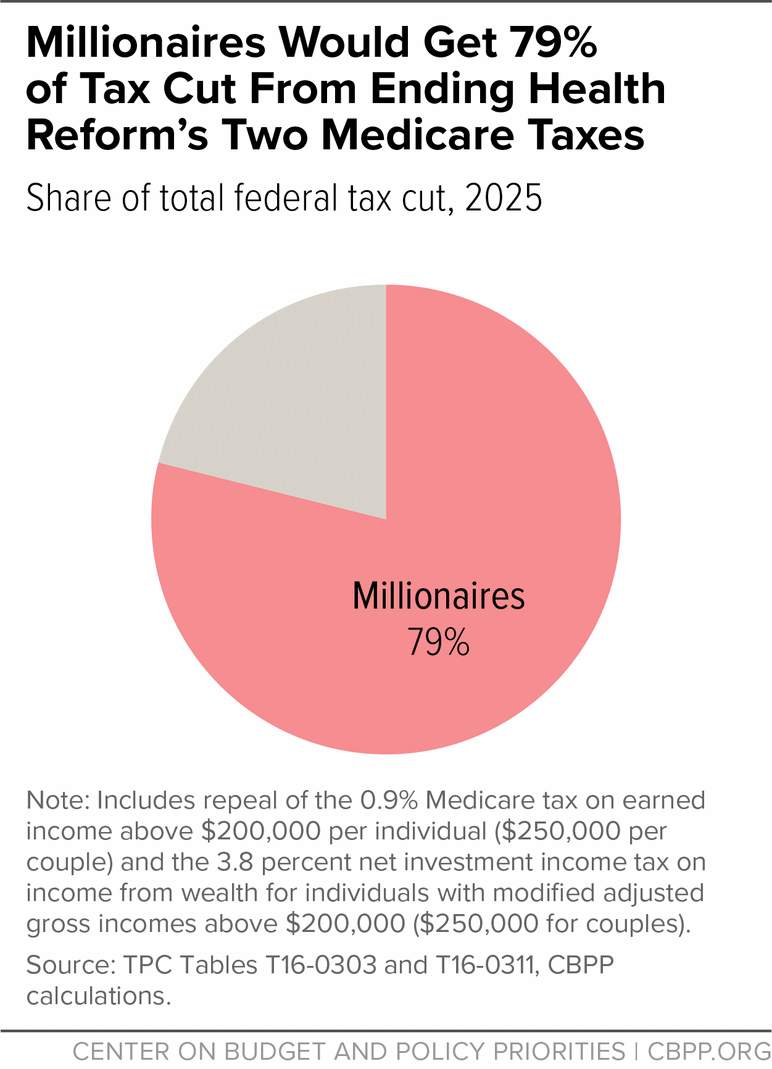

- Millionaires would reap 79 percent of the tax cut from repealing these two provisions in 2025, the Tax Policy Center (TPC) estimates.[2] (See Figure 1.)

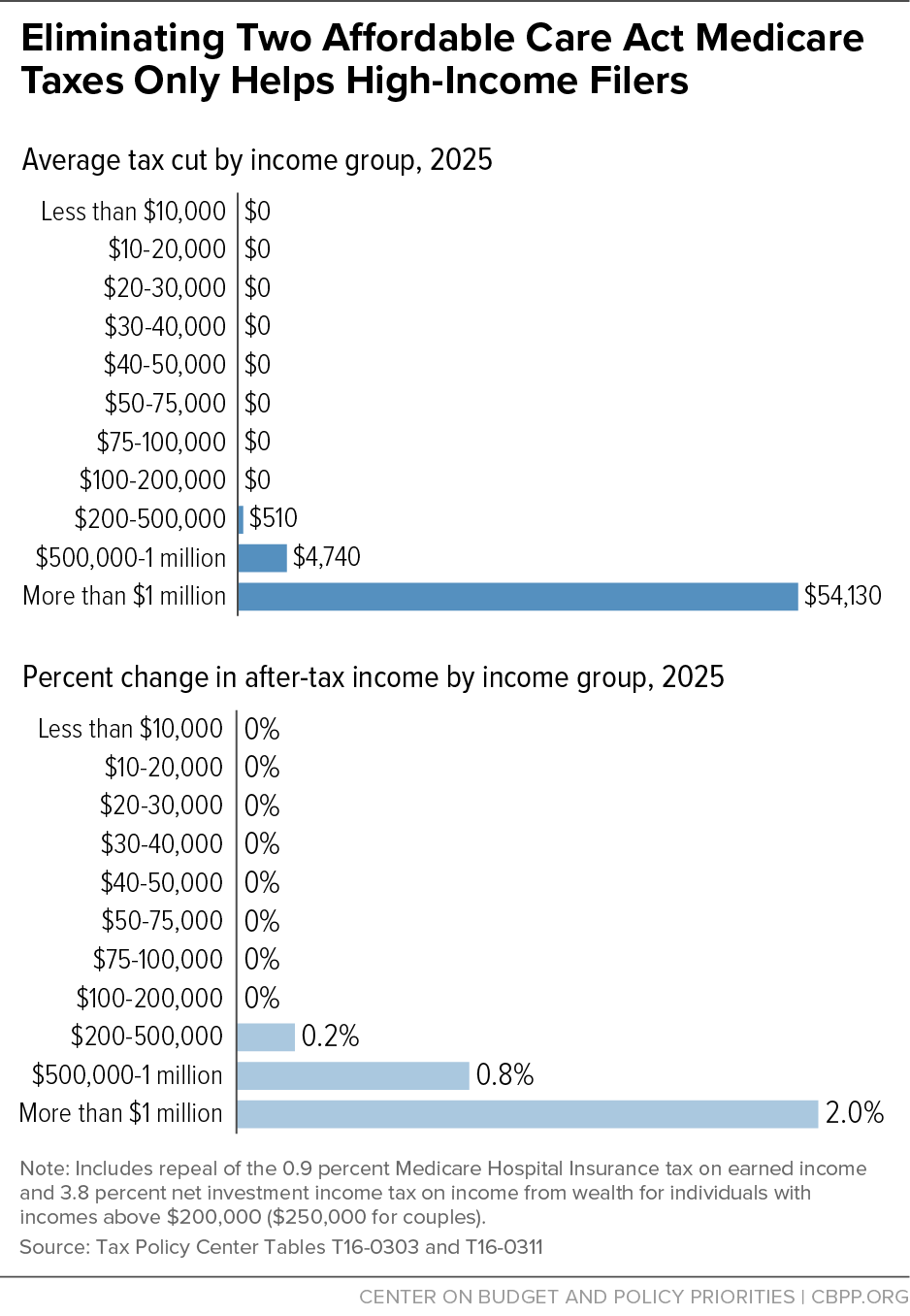

- Millionaire households would get tax cuts of more than $50,000 apiece (2.0 percent of after-tax income), on average in 2025, TPC estimates. (See Figure 2.) (Such households’ incomes average $4.1 million in 2025.)[3] The repeal of these two taxes represents the overwhelming bulk of the total tax cuts for millionaires from repealing the ACA, which average about $57,000 apiece.[4]

- Multi-millionaires would benefit even more. The top 0.1 percent of filers — those with incomes above $5.9 million (and incomes averaging about $15.8 million) — would receive tax cuts of more than $250,000 apiece on average in 2025, TPC estimates.[5]

- The 400 highest-income taxpayers would get annual tax cuts averaging about $7 million each, we estimate.[6] These taxpayers, whose annual incomes average more than $300 million, would receive tax cuts totaling about $2.8 billion a year.

The House bill would pay for these tax cuts with deep cuts to Medicaid and the tax credits that help low- and moderate-income families afford health coverage and care. The bill would cause 24 million people to become uninsured by 2026, the Congressional Budget Office (CBO) estimates.[7]

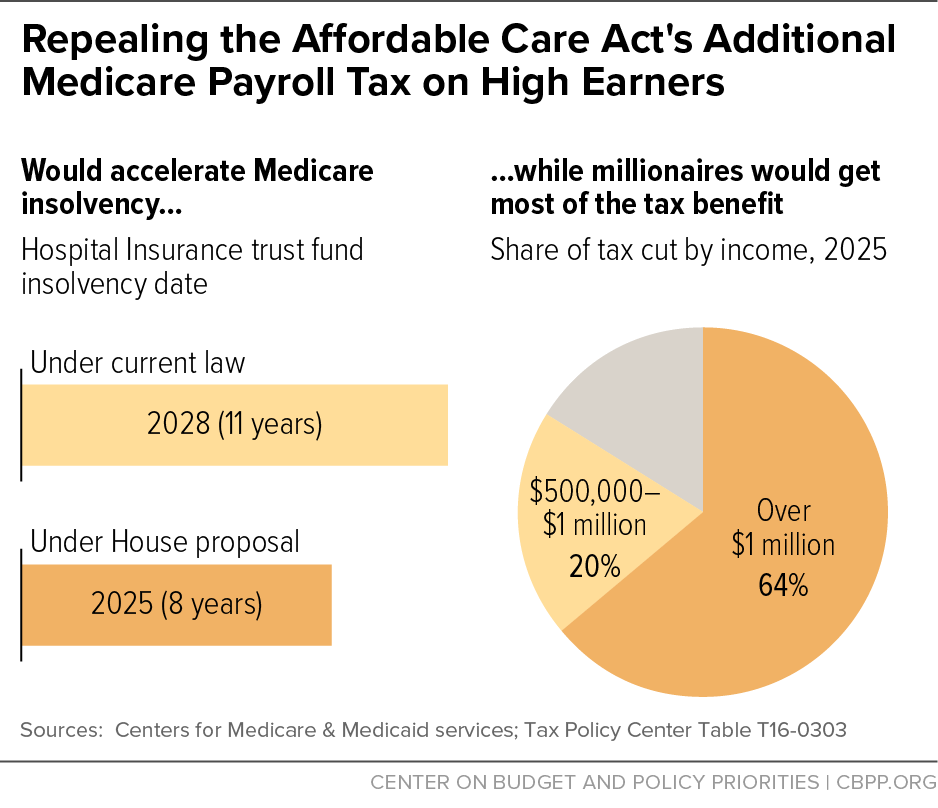

Only individuals with earnings over $200,000 — or $250,000 for couples — face the 0.9 percent tax on their earnings above those amounts, which raises their employee share of their Medicare tax rate on earnings from 1.45 to 2.35 percent. Repealing the payroll tax add-on would reduce federal revenues by $117 billion over the 2017-2026 period, according to the Joint Committee on Taxation (JCT).[8] This would undermine Medicare’s financing while providing a windfall to high earners. (See Figure 3.)

Medicare’s chief actuary estimates that repealing the additional payroll tax would harm Medicare’s financing in both the near and long term. It would advance the date of the HI trust fund’s insolvency by three years, from 2028 to 2025.[9] In doing so, it would reverse some of the progress driven by the ACA, which extended HI solvency by about 11 years.[10] Repeal would also increase HI’s 75-year deficit by more than half — from 0.73 percent to 1.12 percent of payroll subject to tax.[11]

Undercutting Medicare’s finances would further expose it to benefit cuts. Speaker Paul Ryan and other House Republican leaders have proposed converting Medicare to a “premium support” system, which would provide beneficiaries with vouchers whose purchasing power wouldn’t keep pace with health care costs. They’ve also proposed raising Medicare’s eligibility age from 65 to 67. Ryan has falsely claimed that Medicare is “going broke” and that these radical changes are necessary to “save” the program. By accelerating HI’s insolvency date, the House bill would only fuel these bogus charges and put Medicare coverage for seniors and persons with disabilities at greater risk.

Repealing this tax would also be highly regressive. Nearly two-thirds of the benefits would go to millionaires, who would get tax cuts of $13,700 each, on average, in 2025 (0.5 percent of after-tax income), TPC estimates.[12]

Before health reform, Medicare taxes applied only to wage and salary and self-employment income; they did not apply to unearned income from wealth such as capital gains, dividends, taxable interest, and royalties. For low- and moderate-income working families, which have little in the way of unearned income, this meant that Medicare taxes applied to virtually all of their income. In contrast, the wealthiest taxpayers owed no Medicare taxes on the unearned income derived from their wealth — a significant share of their income.[13]

The ACA addressed this inequity by ensuring that individuals with incomes above $200,000 and couples with incomes above $250,000 would face a 3.8 percent tax rate on their net investment income above those levels.[14] The 3.8 percent rate is equal to the 2.9 percent combined employee and employer Medicare payroll tax rate faced by all earners, plus the 0.9 percent high-earner Medicare rate on wage and salary income. The tax is referred to as the “unearned income Medicare contribution” or the “net investment income tax.” The revenues are not deposited in a Medicare trust fund, although President Obama proposed to do so.[15]

Repealing this provision would increase the gap between the tax rates that middle-income workers face on their earnings and those that the wealthy face on their investment income (see box, below). As before the ACA, middle-income filers would face Medicare taxes on virtually all their income, while wealthy filers would face no Medicare taxes on their large income from wealth.

The unearned income Medicare contribution also somewhat improves economic efficiency. The current gap between the overall tax rate applied to ordinary income and the much lower rate applied to capital gains encourages inefficient tax-sheltering activities; it creates large tax incentives for wealthy individuals to engage in financial engineering schemes to convert ordinary income into capital gains. By modestly reducing the differential between the tax rates on ordinary income and capital gains, the ACA’s unearned income contribution takes a step toward reducing these tax-shelter incentives. Eliminating the tax would increase this distortion and make tax sheltering more attractive.

The benefit of eliminating the unearned income Medicare contribution tax would be extremely tilted to the highest-income and wealthiest individuals, given the concentration of wealth among the highest-income filers. In 2025, millionaire households would receive a tax cut averaging $40,430 apiece (1.5 percent of after-tax income), TPC estimates show. Millionaires would receive a full 85 percent of the tax cut.[16]

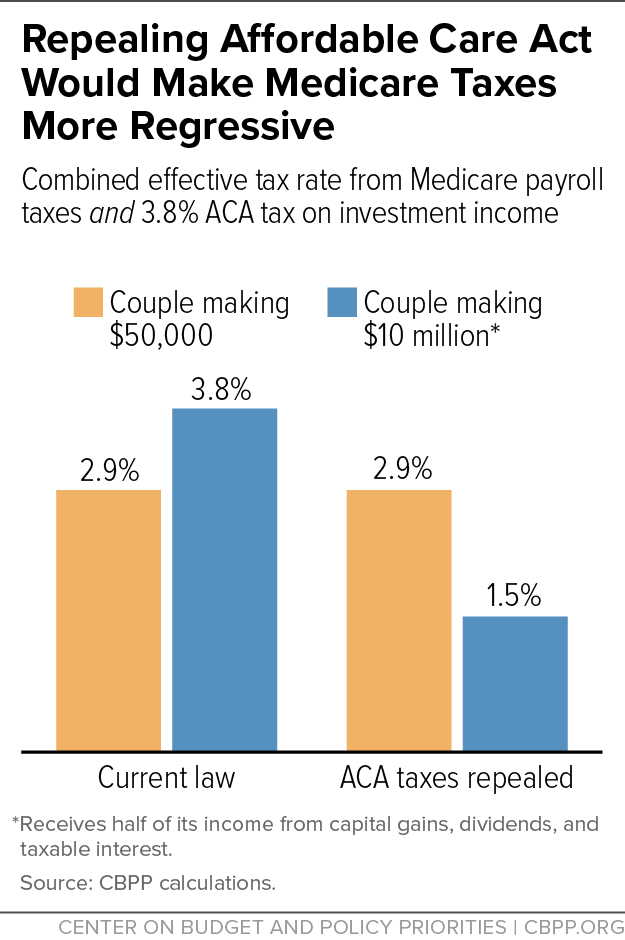

A middle-income family whose income comes entirely from wages currently faces the full 2.9 percent Medicare tax, and would continue to do so if the two ACA Medicare taxes are repealed because the taxes do not affect households with incomes below $200,000 per individual or $250,000 per couple.

But while capital gains, dividends, and taxable interest account for only a tiny share of the income of low- and middle-income families, a millionaire household is much more likely to have a significant share of its income from “unearned” income from investments, such as capital gains, dividends, and taxable interest.a As an illustrative example, consider a couple making $10 million a year that receives half of its income from capital gains, dividends, and taxable interest and the other half from earnings. Under the ACA Medicare tax provisions, the couple currently faces Medicare taxes totaling about 3.8 percent of their income, regardless of whether the income comes from wages or investments. The 3.8 percent rate they face from these taxes is modestly higher than the 2.9 percent rate faced by a middle-income couple making $50,000.b

If the ACA Medicare taxes were repealed, however, the middle-income family would continue to face a Medicare tax rate of 2.9 percent, while the multi-millionaire couple would pay only 1.5 percent of its income in Medicare tax, reinstating a significant disparity between low-and middle-income wage earners and wealthy households at the top.

a Net capital gains, dividends, and taxable interest made up an average of 59 percent of the income of people who make more than $10 million in 2014. By contrast, these sources of income only made up about 3 percent of the income of people who made between $50,000 and $75,000. (Source: CBPP calculations from IRS 2014 Statistics of Income Table 1.4, https://www.irs.gov/pub/irs-soi/14in14ar.xls).

b The rate would be lower than 3.8 percent if part of the couple’s $10 million income consisted of active Subchapter S corporation income, which is exempt from Medicare tax.

JCT estimates that eliminating this provision alone starting in 2018 would cost $158 billion over 2017 to 2026.[17]

While Wealthy Benefit, Millions Stand to Lose Health Care

Repealing the two ACA Medicare taxes together starting in 2018 would cost $275 billion over ten years, JCT estimates. The House GOP bill would pay for these tax cuts — along with the bill’s large tax cuts for medical industries — by slashing federal Medicaid funding and deeply cutting tax credits to help low- and moderate-income filers afford health insurance and care.[18] CBO estimates that the bill would cause 24 million people to become uninsured by 2026.