off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Richer Americans live longer than poorer Americans, and the gap is widening. While many people will live significantly longer than their parents and grandparents, some groups have seen no gains, and others (such as poorer women) may have lost years of life. This troubling development makes Social Security less progressive, as discussed below — and some widely discussed changes, like raising the full retirement age, could make things worse.

Here are the basic facts:

- Average American lifespans have grown over time. For example, an average 65-year-old man in 2015 can expect to live nearly six years longer than his counterpart 50 years earlier; for an average woman, the gain is over three years. But these average figures mask significant differences among Americans at different rungs of the socioeconomic ladder.

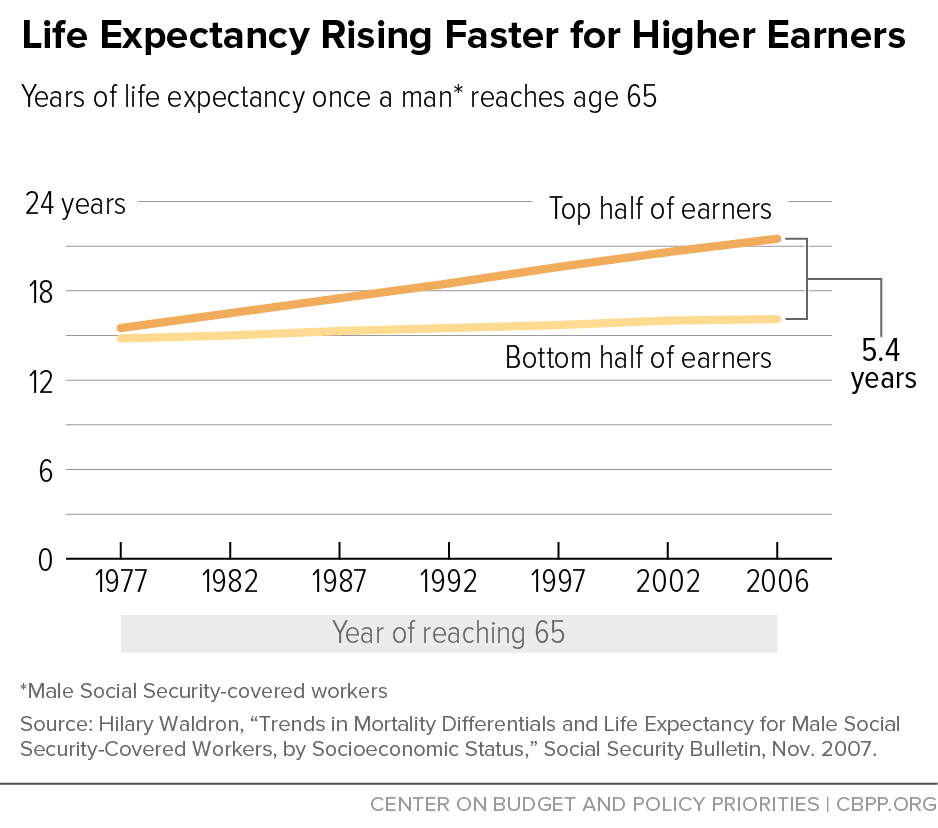

- Richer people live longer — and the gap is growing. The higher a person’s socioeconomic status — whether measured in earnings, income, or education — the longer his or her life expectancy. As the chart shows, for example, higher-earning men can expect to outlive lower-earning men by more than five years. Moreover, the gap between the lifespans of rich and poor has grown significantly, an abundance of research shows, and this trend is accelerating.

- Meanwhile, poorer women’s lifespans have actually shrunk, some studies show. Some groups of Americans are living shorter lives than their parents. This disturbing phenomenon is concentrated among women: the poorest 40 percent of women have lower life expectancies than the previous generation, one study found. Higher death rates among white women seem to drive this trend.

- The growing longevity gap makes Social Security less progressive. Social Security is designed to replace a larger share of pre-retirement earnings for lower earners than higher earners. But lower earners receive retirement benefits for fewer years before dying. As the longevity gap between lower and higher earners grows, the share of retirement benefits going to needy households shrinks.

- Some proposed changes to Social Security could make things worse. Changes such as raising the full retirement age or tightening eligibility for disability benefits would cut benefits even for people whose lifespans are stagnant or shorter than the previous generation. This could cause severe hardship for people who cannot realistically work and who rely heavily on Social Security in retirement.

Topics:

Commentary

The Realities of Work for Individuals with Disabilities: Impact of Age, Education, and Work Experience

November 20, 2015

Stay up to date

Receive the latest news and reports from the Center