BEYOND THE NUMBERS

Unauthorized Immigrants Pay More of Income in State and Local Taxes Than Nation’s Top Earners

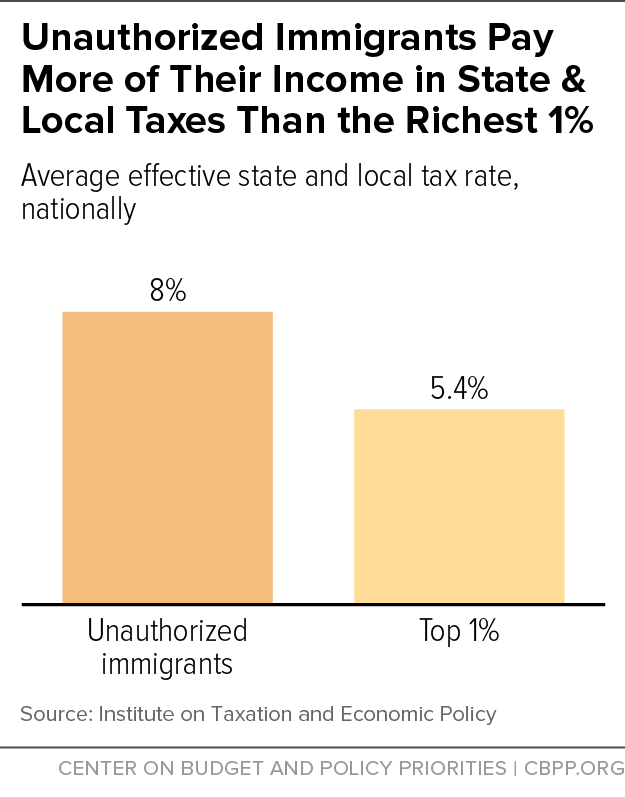

Unauthorized immigrants pay a larger share of their income in state and local taxes than the nation’s top earners, and immigration reform would improve state and local finances across the country, a new report from the Institute on Taxation and Economic Policy (ITEP) shows.

Unauthorized immigrants pay sales taxes when they buy goods and services; property taxes (mostly passed along through their rent); and income taxes from withholding through their paychecks — even those who don’t file income tax returns, although as many as three-quarters do.

Among the report’s key findings:

- Unauthorized immigrants paid about $11.6 billion in state and local taxes in 2013.

-

They pay about 8 percent of their income, on average, in state and local taxes, significantly higher than the 5.4 percent that the average taxpayer in the top 1 percent pays. (See chart.)

-

President Obama’s executive actions providing a temporary reprieve from deportation and a three-year, renewable work permit to some unauthorized immigrants would boost state and local tax revenues by as much as $805 million a year if fully implemented, and would raise the effective state and local tax rate that this group of unauthorized immigrants pay to 8.6 percent from about 8 percent. That’s mainly because the temporary reprieve and work permits both raise these immigrants’ wages, on average, and increase the share who file income taxes. (Texas has legally challenged the President’s actions, and the case is pending before the Supreme Court.)

-

Comprehensive immigration reform would further boost the state and local taxes that these immigrants pay, because more of them would be out of the shadows and working. ITEP estimates that granting lawful permanent residence to all unauthorized immigrants now in the country would lift state and local tax collections by about $2.1 billion a year.