- Home

- State Budget And Tax

- For States, Inclusive Approach To Unauth...

For States, Inclusive Approach to Unauthorized Immigrants Can Help Build Better Economies

In the coming year, a number of states will debate proposed policies that would affect unauthorized immigrants. By taking a pragmatic, inclusive approach to these proposals, state policymakers can produce a more educated workforce, ensure that more employers pay workers fairly, and help pay for the schools and other public services that form a strong foundation for broadly shared prosperity.

Unauthorized immigrants contribute to state economies and finances. (See Appendix.) They work, pay many taxes — in fact, they pay a larger share of their income in state and local taxes than the top 1 percent of taxpayers do — and buy goods and services from businesses across a state. But because they operate in the shadows of the labor market, employers can exploit them and they are cut off from many opportunities to earn more and contribute more to a state’s economy and tax base.

Their status in the shadows harms state economies. Currently, for example, some employers exploit unauthorized immigrants by paying them less than the minimum wage (or not at all) and subjecting them to poor working conditions. If employers could no longer do that, wages and working conditions would improve for a broader swath of workers. That’s because exploitative employers would have to compete with more responsible firms on a level playing field, encouraging higher quality jobs rather than a “race to the bottom.” In addition, if unauthorized workers could improve their skills more easily and obtain jobs that better match those skills, they’d earn higher wages, spend more in the economy, and contribute more to the tax base from which states fund schools and other investments that are critical to a strong economy.

Unauthorized immigrants, of course, are in the shadows because the federal government hasn’t given them permission to work in the United States. States can’t change that, but they can take steps to maximize the contributions of all state residents, including unauthorized immigrants. Rather than pursue immigration enforcement measures that are better left to the federal government, such as mandating immigration status checks during law enforcement stops, states should look to policies that better integrate immigrants into the mainstream economy. In the coming year, inclusive state-level proposals may gather momentum if the courts uphold President Obama’s executive actions that allow many unauthorized immigrants to work legally in the United States.

Strong Implementation of Executive Actions Would Benefit State Economies

In the absence of comprehensive immigration reform legislation, President Obama took executive action in 2012 to authorize work and deprioritize deportation for aspiring citizens who came to America before they were 16. He expanded this action, known as DACA (Deferred Action for Childhood Arrivals), by applying it to immigrants regardless of their current age (the previous age limit was 31). He also created a second program authorizing work and deprioritizing deportation for the parents of U.S. citizens and lawful permanent residents, known as DAPA (Deferred Action for Parents of Americans and Lawful Permanent Residents).1 The orders authorize eligible immigrants to work legally in America for three years. A federal district court in Texas, however, has temporarily blocked the Administration from implementing both the DACA expansion and DAPA.

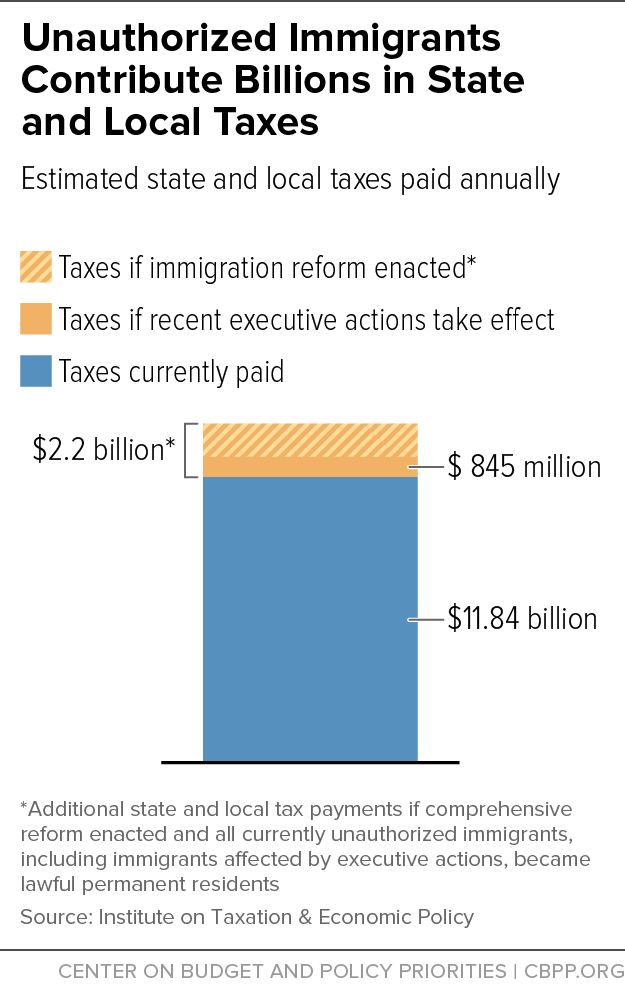

Should the court let implementation move forward, these executive actions would likely improve state economies and state finances, yielding an estimated $845 million in new state and local tax revenue nationally.2 The revenue increase would result from more immigrants paying income taxes and earning higher wages. Numerous studies show that comprehensive immigration reform or other avenues to legal work status for unauthorized immigrants would allow aspiring citizens to take higher paying jobs that better match their skills and experience, while also protecting them from exploitation and wage theft.3

Comprehensive immigration reform, which ultimately would extend permanent legal work status to nearly all currently unauthorized workers, would bring even greater economic and fiscal benefits to states than the temporary legal status available to some of them under DACA and DAPA. Permanent legal status for all unauthorized workers would boost state and local tax revenue by $2.2 billion nationally, according to one estimate. (See Appendix for estimates by state.)

States can help ensure that eligible unauthorized immigrants take advantage of DACA and DAPA by funding outreach efforts in immigrant communities, application assistance, and legal services. California, for example, has dedicated $15 million to a new Immigration Assistance Program within its Department of Social Services to contract with legal services organizations to assist with DACA, DAPA, and naturalization applications. States can also prepare to expand any public programs or services that would be open to DACA or DAPA participants.4

Many states are considering three such policies:

-

Strengthening labor law enforcement to ensure that all workers are paid what they earn, leveling the playing field for both businesses and workers in the state.

- Allowing unauthorized immigrants to pay in-state tuition at public colleges and universities and to obtain financial aid, which over time would boost the skills and wages of the state workforce.

- Giving unauthorized immigrants access to driver’s licenses, which would help them not only get jobs but potentially find jobs that better suit their and employers’ needs.

Some critics fear that policies to bring unauthorized immigrants out of the shadows would reduce incomes and employment for native workers by making unauthorized workers more competitive in the labor market. These fears are largely unfounded, however. In general, U.S.-born workers would benefit if unauthorized workers could fully use or improve their skills and if states enforced labor standards for them.

Three Policies That Benefit Immigrants and Help Build Better State Economies

Immigrants who lack legal status already contribute significantly to state economies and finances. They work, earn, and spend, and they pay a range of taxes. Social Security Administration estimates show, for example, that unauthorized workers contributed a net $12 billion to Social Security trust funds in 2010.[1] In addition, they paid nearly $12 billion in state and local taxes in 2012. (See Figure 1.) They even pay a greater share of their income in state and local taxes than the richest 1 percent of households nationally.[2] Their tax dollars help finance public services and programs that help state residents generally, though many such programs are unavailable to unauthorized immigrant taxpayers.

States are considering some prudent policies that can boost the economic contributions and tax payments of unauthorized immigrants:

1) Strengthened labor law enforcement. Labor laws are critical to ensuring that workers receive the wages they are legally owed and that they can contribute to the economy and state finances to the best of their ability. These laws also help put businesses and workers on a more level playing field. Businesses hiring unauthorized workers have a competitive advantage over businesses that don’t, partly because some businesses hire them at below-market wages (often below the minimum wage) and sometimes steal their wages altogether. Employers who pay workers off the books or incorrectly pay them as independent contractors also skirt requirements to contribute to state unemployment insurance and worker’s compensation funds, thereby boosting payments for the employers that properly report their employees.[3] All of this encourages a “race to the bottom” by low-wage employers rather than encouraging them to provide higher paying, better quality jobs. When, by contrast, minimum wage and other labor laws protect all workers, one set of employers and workers can’t undercut another.

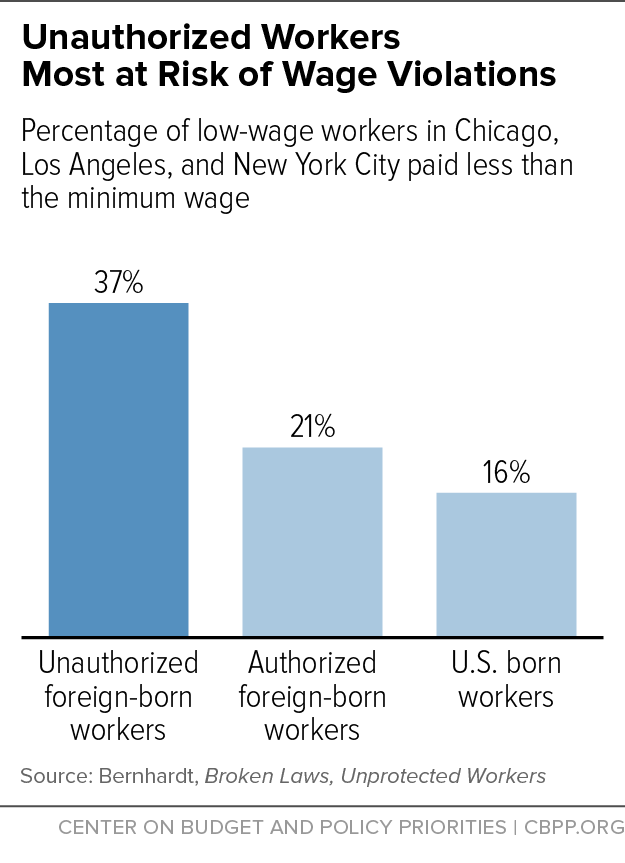

States play a major role in enforcing labor laws and would benefit by ensuring proper funding and staffing to enforce those laws. Wage violations, for example, substantially diminish workers’ earnings and leave them with less to spend in the economy. Pay-based labor law violations ― from denying overtime to denying pay outright ― cost low-wage workers in Chicago, Los Angeles, and New York City 15 percent of their earnings, on average, generating a total wage loss for workers in the three cities of $56 million per week, according to one major study.[4] While all workers surveyed in the study were at risk, unauthorized workers were the most likely to experience wage violations. Specifically, 37 percent of unauthorized foreign-born workers were paid less than the minimum wage, compared to 21 percent of authorized foreign-born workers and 16 percent of U.S.-born workers. (See Figure 2.) These lost wages hurt workers and their families, and they may be lost to the economy in the near term since lower-wage workers tend to spend most of what they earn. Wage violations also increase poverty and, thus, public assistance, while reducing income tax revenues.[5]

States can do more to address wage theft and other labor law violations. They can, for instance, hire more wage law enforcement agents. A 2010 survey of 43 states found that fewer than 700 state investigators were responsible for enforcing labor laws covering almost 100 million private sector workers (nearly 90 percent of the nation’s private sector workforce).[6] That’s roughly one investigator for every 146,000 private sector workers — and for many of the investigators, labor law enforcement wasn’t their sole responsibility. States also can stiffen penalties for violations and scrap outdated rules that exclude certain categories of workers from full protection, such as domestic workers.[7]

2) In-state resident tuition and financial assistance. States guarantee all children, no matter their immigration status, a place in their K-12 education systems — a wise choice that helps children reach their potential, giving the economy the educated workers of tomorrow. Similarly, states should give all resident college-bound youth access to their higher education systems at in-state tuition rates. By doing otherwise, states are now largely wasting their substantial investments in many resident children by putting the cost of college out of reach for them. States that maximize the share of their residents with a college education will be better positioned to compete for high-wage jobs in the future.

In-state tuition for resident immigrants not only increases the likelihood that more students will attend a state’s colleges and universities,[8] but also may increase the share of immigrant students who graduate from high school by offering them a powerful incentive to stay in school. The high school dropout rate for foreign-born, non-citizen Mexican students fell by an average of 7 to 11 percentage points in states that adopted an in-state resident tuition policy, without any apparent negative effects on the academic achievement of U.S.-born students, according to one study.[9]

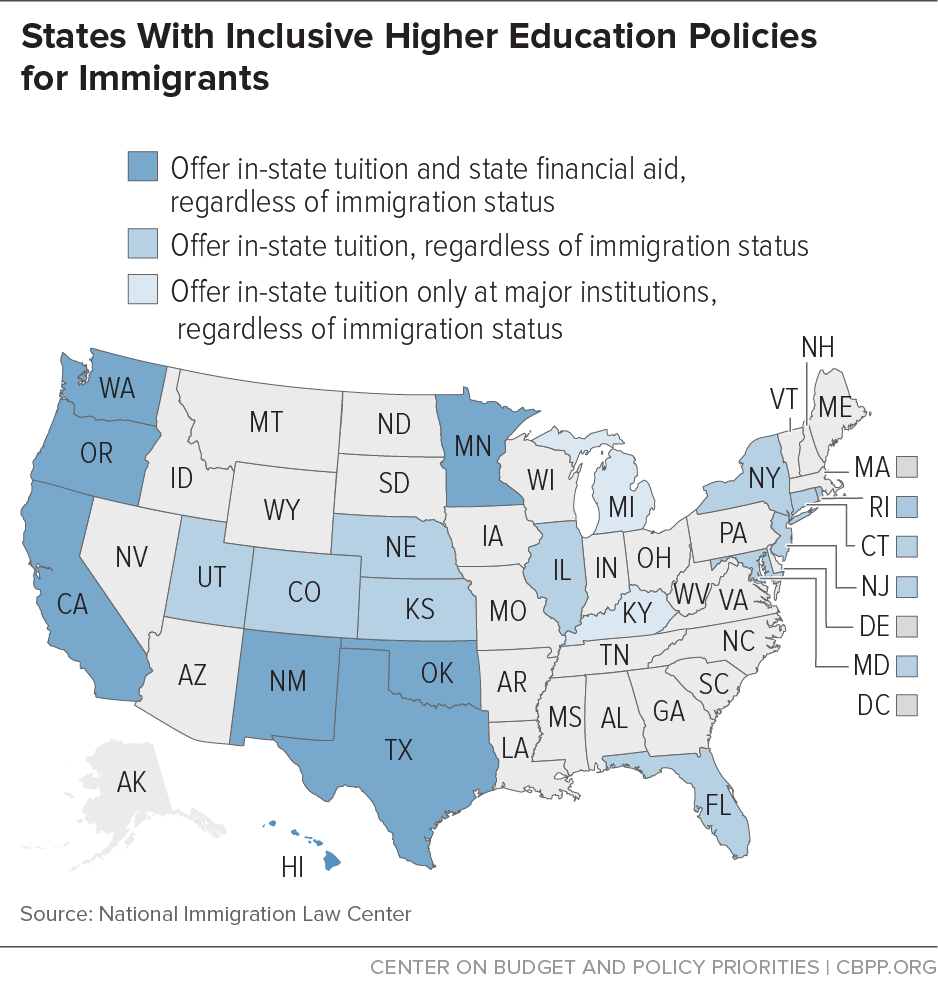

In addition, more education means higher earnings, whether for unauthorized youth or anyone else. On average, college graduates earn $12,000 more a year than their peers without college degrees.[10] Higher earnings mean more money circulating through local stores and businesses and more public revenue for state investments and services that benefit everyone, like safe roads and public schools. Twenty-one states have adopted “tuition equity” laws or policies that enable students who meet certain criteria, regardless of immigration status, to pay in-state tuition rates at some or all public universities and colleges. (See Figure 3.) Eight of these states also offer state financial aid to unauthorized students who can’t afford in-state tuition in its entirety.[11]

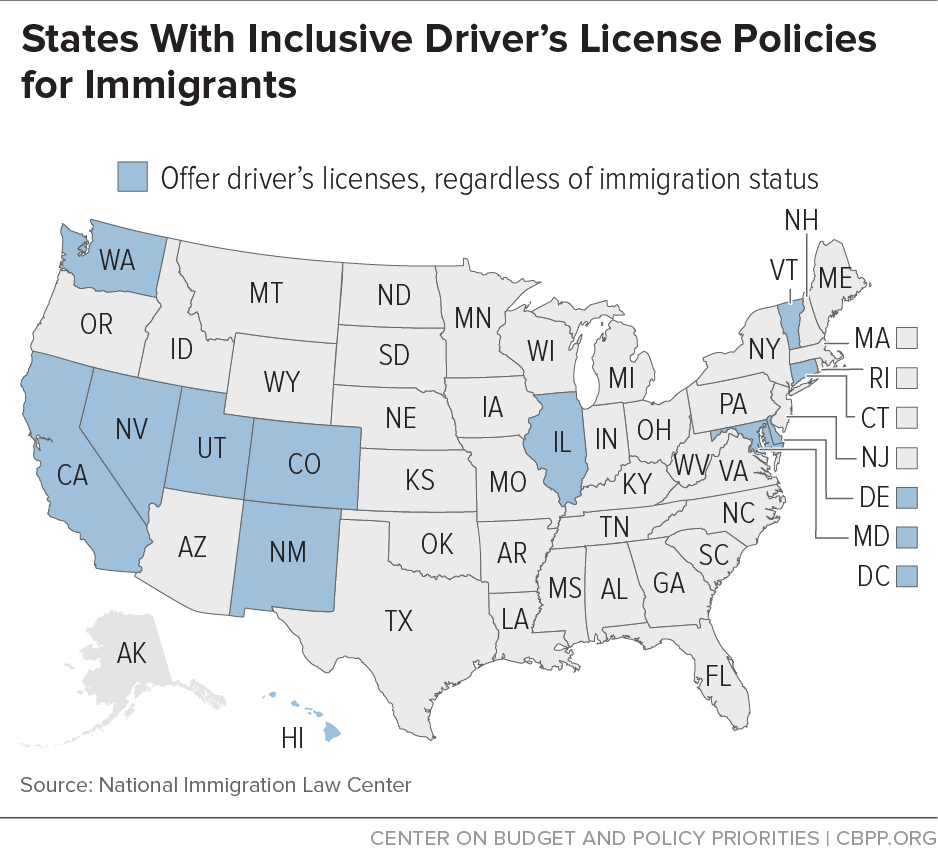

3) Access to driver’s licenses. Giving all immigrants access to driver’s licenses would help maximize the contributions of unauthorized immigrants to state economies and finances. With a license, immigrants can more easily get to work, shop, and drive their children to the doctor.[12] In addition, licenses for immigrants would help employers who need workers to operate vehicles in order to conduct their business. And if a license gives unauthorized workers access to a wider array of jobs to choose from, they may be able to better avoid exploitative employers and find jobs that better match their skills, boosting their wages and more fully using their talents.

States also may enjoy a modest revenue increase through licensing fees.[13] And, to the extent that allowing licenses for immigrant workers improves public safety — because law enforcement can focus on more pressing public safety issues rather than processing unlicensed drivers through local jails and courts — states can spend their tax dollars more efficiently. Currently, just 12 states and the District of Columbia allow unauthorized immigrants to get driver’s licenses.[14] (See Figure 4.)

Policies Benefitting Unauthorized Immigrants Will Likely Help U.S. Workers Overall

By improving the earning prospects of unauthorized immigrants who already live in the United States, policymakers would likely improve conditions for U.S.-born workers as well. If employers can’t skirt the law by paying some workers below their fair wages, that’s good for all workers. If people now working in low-wage jobs go to college and then get higher-level jobs, that’s good for the economy.

Critics often ask, however, what happens to U.S.-born workers when more immigrants join the economy — that is, not just when those already in the labor market have full rights, but when new people are added to it, as comprehensive federal immigration reform almost surely would bring. Most economic research shows that added immigrant labor has close to zero, if not slightly positive, effects on the wages of native-born workers overall.1

While that may seem counterintuitive, it stems from an often overlooked aspect of immigration. More immigration doesn’t simply add labor supply, which could diminish the employment and earnings prospects of native-born workers. It also increases demand for goods and services. That is, immigrants add to both the number of workers and the number of consumers. More consumer demand can spur more production and hiring.

In addition, immigrant workers often complement, rather than substitute for, native-born workers in the workforce, bringing different skills to certain sectors or filling roles that native-born workers do not. That can even happen when native-born and immigrant workers have similar education and skill levels. For example, a firm that typically hires low-skilled, less educated workers may choose to shift its U.S.-born workers into more public-facing jobs and other higher-level positions that require more facility with English, while hiring immigrant workers to fill roles that require less customer interaction.2

Nevertheless, while the typical native-born worker may not face more competition for jobs or lower wages due to immigration, certain subgroups of workers sometimes do. For example, from 1994 through 2007, U.S.-born men with a high school degree or less in places like California, Florida, New York, and Texas — where the immigrant labor supply is particularly large — experienced wage declines even as immigration contributed positively to wages for native-born workers overall in those states, according to one major study.3 And, a number of studies have highlighted a modest negative impact on black men with a high school education or less. Policymakers should focus on ways to improve conditions for these workers directly rather than pursue restrictive immigration policies that would hurt the economy as a whole. While native-born workers with high school degrees or less face the problem of immigrant competition, their prospects would be constrained by their education level even without such competition.

Conclusion

Pragmatic, inclusive state immigration policies can help unauthorized immigrants participate more fully in state economies, thereby allowing states to harness more of their earning potential and purchasing power and also helping states avoid the unnecessary economic costs of leaving some of their residents out of mainstream economic life. States would be wise to leave immigration enforcement to the federal government and focus on how to maximize the contributions of all of their residents.

End Notes

[1] Stephen Goss et al., “Effects of Unauthorized Immigration on the Actuarial Status of the Social Security Trust Funds,” Social Security Administration, April 2013, http://www.ssa.gov/oact/NOTES/pdf_notes/note151.pdf.

[2] Gardner et al.

[3] See discussion in David Kallick, “Three Ways Immigration Reform Would Make the Economy More Productive,” Fiscal Policy Institute, June 2013, http://fiscalpolicy.org/wp-content/uploads/2014/11/3-Ways-Reform-improves-productivity.pdf.

[4] Annette Bernhardt et al., “Broken Laws, Unprotected Workers: Violations of Employment and Labor Laws in America’s Cities,” 2009, http://www.nelp.org/content/uploads/2015/03/BrokenLawsReport2009.pdf?nocdn=1.

[5] “The Social and Economic Effects of Wage Violations,” prepared by Eastern Research Group, Inc. for the U.S. Department of Labor, December 2014, http://www.dol.gov/asp/evaluation/completed-studies/WageViolationsReportDecember2014.pdf.

[6] Zach Schiller and Sarah DeCarlo, “Investigating Wage Theft: A Survey of the States,” Policy Matters Ohio, November 2010, http://www.policymattersohio.org/wp-content/uploads/2011/10/InvestigatingWageTheft20101.pdf. The U.S. Department of Labor also has several hundred investigators tasked with enforcing the Fair Labor Standards Act, which establishes wage and overtime protections. As at the state level, these investigators are responsible for enforcing other laws as well.

[7] Bernhardt et al.

[8] Neeraj Kaushal, “In-State Tuition for the Unauthorized: Education Effects on Mexican Young Adults,” Journal of Policy Analysis and Management, 2008, https://www.dartmouth.edu/~ethang/Lectures/Class17/Kaushal2008.pdf. This study looked at college enrollment before and after the adoption of in-state tuition policies in CA, NY, TX and UT.

[9] Stephanie Potochnick, “How States Can Reduce the Dropout Rate for Unauthorized Immigrant Youth: The Effects of In-State Resident Tuition Policies,” Department of Public Policy, University of North Caroline Chapel Hill, paper presented at PAA Conference, March 32-April 2, 2011, http://paa2011.princeton.edu/papers/110491. The study examined drop-out rates in TX, CA, UT, NY, WA, OK, IL, KS, NM, and NE before and after the passage of in-state tuition policies.

[10] Michael Greenstone and Adam Looney, “Regardless of the Cost, College Still Matters,” Hamilton Project, October 5, 2012, http://www.brookings.edu/blogs/jobs/posts/2012/10/05-jobs-greenstone-looney.

[11] National Immigration Law Center, “Current State Laws & Policies on Access to Higher Education for Immigrants,” April 2015, http://www.nilc.org/eduaccesstoolkit2.html#maps.

[12] See, for example, Mary C. King et al., “Assessment of the Socio-economic Impacts of SB 1080 on Immigrant Groups,” Oregon Department of Transportation Research Section, June 2011, http://www.oregon.gov/ODOT/TD/TP_RES/docs/reports/2011/sb1080.pdf.

[13] States may lose revenues from fines assessed for not having a license, but that likely won’t outweigh the benefits of licensing fees that everyone would pay, since not everyone gets caught for driving without a license.

[14] National Immigration Law Center, “State Laws on Driver’s Licenses for Immigrants,” May 2015, http://www.nilc.org/driverlicensemap.html. States include: CA, CO, CT, DE, HI, IL, MD, NM, NV, UT, VT, and WA, as well as Washington, D.C. and Puerto Rico.

More from the Authors

Areas of Expertise