BEYOND THE NUMBERS

Trump, Cruz Tax-Cut Plans Would Force Historically Dramatic Cuts

The tax-cut proposals from Republican presidential candidates Donald Trump and Ted Cruz, in conjunction with their calls for balancing the budget, would dictate low levels of government spending not seen since about 1950, as we explain in a new paper. Programs that receive support across the political spectrum and are important to the well-being of most Americans would dramatically shrink or disappear altogether. Even if policymakers didn’t achieve budget balance under their tax-cut plans but simply offset the costs of the plans themselves, the consequences to essential programs — and to low- and middle-income Americans — would be severe.

These conclusions emerge from an analysis of the Urban-Brookings Tax Policy Center’s (TPC) revenue estimates of the Trump and Cruz tax plans — which would reduce revenues by $9.5 trillion and $8.7 trillion over the next ten years, respectively, according to TPC — and CBPP estimates of what such revenue levels imply for government spending. This analysis examines only the Trump and Cruz plans because TPC has not analyzed John Kasich’s proposals and because the proposals of Democratic candidates Hillary Clinton and Bernie Sanders would raise revenues, not reduce them. The specific findings include:

-

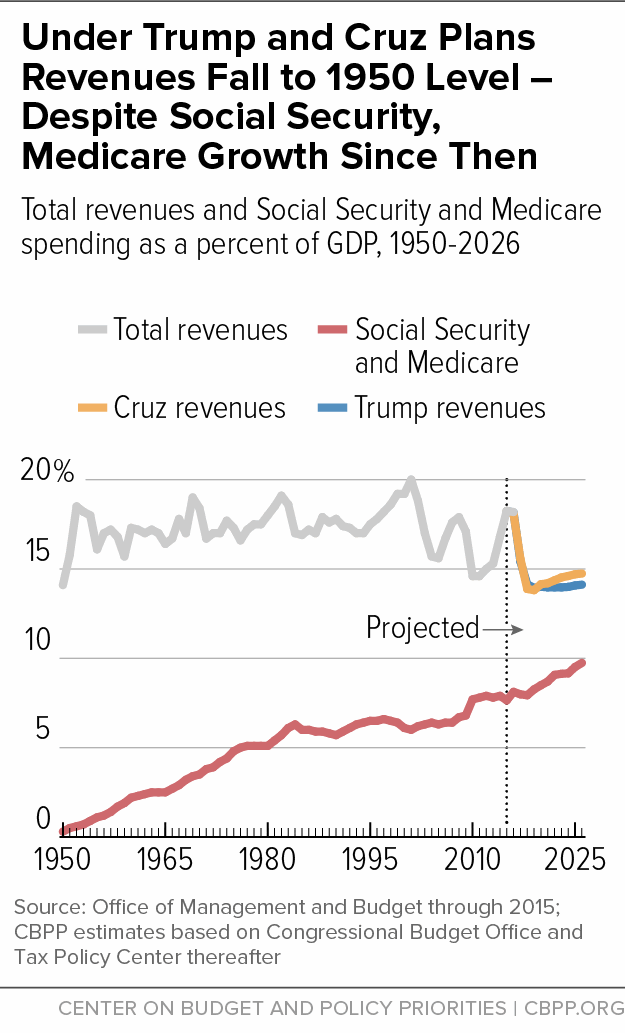

Measured as a percent of the economy (gross domestic product or GDP), revenues would fall to their lowest level since 1950 under the Trump tax cuts and to their third-lowest level since 1950 under the Cruz tax cuts. Social Security spending was just 0.3 percent of GDP in 1950 and Medicare did not exist. Social Security and Medicare spending now amounts to 8.1 percent of GDP and continues to rise, primarily due to the aging of the population. The 1950 revenue base is inadequate for today’s needs (see chart).

-

Offsetting the cost of the Trump or Cruz tax cuts would require cuts in government programs that far exceed the painfully deep reductions in the budget plan the Republican majority on the House Budget Committee recently approved. Offsetting the costs of the tax cuts and balancing the budget, as both candidates support doing, would require spending cuts about two and one-half times the size of the Budget Committee cuts.

-

Under both the Trump and Cruz plans, balancing the budget in 2026 would require cutting program spending (i.e., federal spending for everything except interest payments on the debt) to its lowest level as a percent of the economy since the Truman administration — to the lowest since 1948 under the Trump plan and since 1951 under the Cruz plan.

-

Under both plans, balancing the budget in 2026 would require cutting all government programs — including Social Security, Medicare and defense — by about two-fifths if all programs were cut by the same percentage. Balancing the budget without cutting Social Security, Medicare, and defense would require eliminating essentially the rest of government under both plans.

-

If spending were reduced enough to pay for the tax cuts but not to balance the budget — and Social Security, Medicare, and defense were not cut — all other programs would need to be cut by 45 percent under the Cruz plan and by 53 percent under Trump’s.

As dramatic as these figures are, they understate the pressure that the two candidates’ proposals would place on many government programs. Both have proposed large spending increases in certain areas, including Senator Cruz’s proposal to increase defense spending by $2.7 trillion over the next decade and Mr. Trump’s proposal to increase spending on veterans by $500 billion to $1 trillion over this period. Offsetting the cost of such increases, as well as the tax cuts, would require even deeper cuts to other programs.

Such large tax cuts, of course, would also put pressure on the nation’s fiscal situation, which already appears unsustainable over the long term. Under its current path, the budget deficit is expected to rise from 2.9 percent of GDP in 2016 to 4.8 percent in 2026, and the debt is expected to rise from 75 percent to 85 percent of GDP. If the tax cuts are not offset at all, under both plans the annual budget deficit would rise to about 10 percent of GDP in 2026. The debt would jump to 121 percent of GDP in 2026 under Cruz and 124 percent under Trump. Quite simply, failing to pay for tax cuts of this magnitude would be fiscally and economically irresponsible.