The tax-cut proposals from Republican presidential candidates Donald Trump and Ted Cruz, in conjunction with their calls for balancing the budget, would dictate low levels of government spending not seen since about 1950. Programs that receive support across the political spectrum and are important to the well-being of most Americans would dramatically shrink or disappear altogether. Even if policymakers did not achieve budget balance under their tax-cut plans but simply offset the costs of the plans themselves, the consequences to essential programs — and to low- and middle-income Americans — would be severe.

These conclusions emerge from an analysis of the Urban-Brookings Tax Policy Center’s (TPC) revenue estimates of the Trump and Cruz tax plans[1] — which would reduce revenues by $9.5 trillion and $8.7 trillion over the next ten years, respectively, according to TPC[2] — and CBPP estimates of what such revenue levels imply for government spending. This analysis examines only the Trump and Cruz plans because TPC has not analyzed John Kasich’s proposals and because the proposals of Democratic candidates Hillary Clinton and Bernie Sanders would raise revenues, not reduce them. The specific findings include:

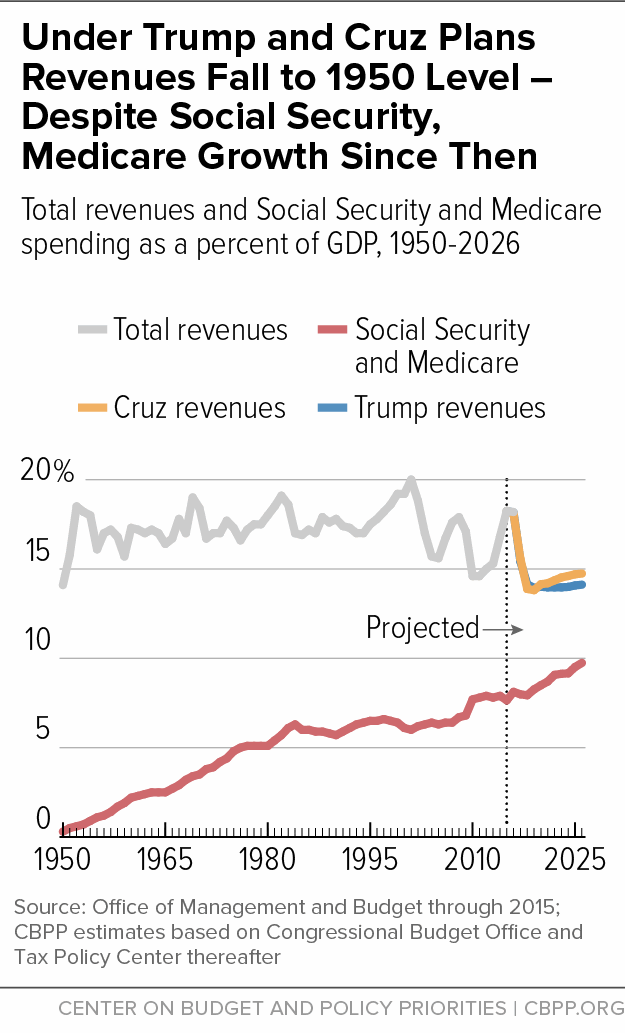

- Measured as a percent of the economy (gross domestic product or GDP), revenues would fall to their lowest level since 1950 under the Trump tax cuts and to their third-lowest level since 1950 under the Cruz tax cuts. Social Security spending was just 0.3 percent of GDP in 1950 and Medicare did not exist. Social Security and Medicare spending now amounts to 8.1 percent of GDP and continues to rise, primarily due to the aging of the population. The 1950 revenue base is inadequate for today’s needs.

- Offsetting the cost of the Trump or Cruz tax cuts would require cuts in government programs that far exceed the painfully deep reductions in the budget plan the Republican majority on the House Budget Committee recently approved. Offsetting the costs of the tax cuts and balancing the budget, as both candidates support doing, would require spending cuts about two and one-half times the size of the Budget Committee cuts.

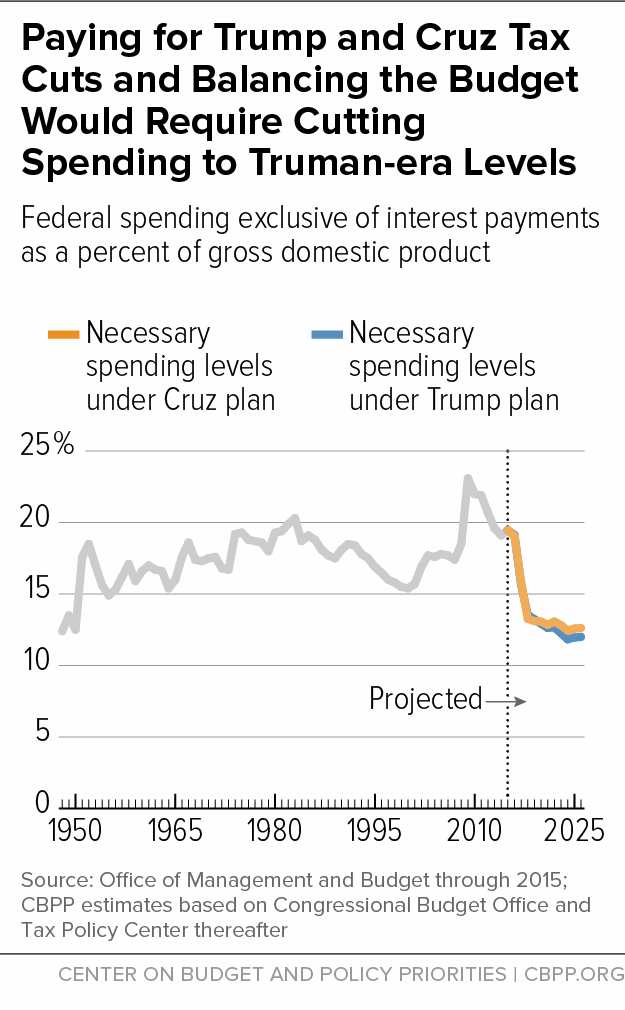

- Under both the Trump and Cruz plans, balancing the budget in 2026[3] would require cutting program spending (i.e., federal spending for everything except interest payments on the debt) to its lowest level as a percent of the economy since the Truman administration — to the lowest since 1948 under the Trump plan and since 1951 under the Cruz plan.

- Under both plans, balancing the budget in 2026 would require cutting all government programs — including Social Security, Medicare and defense — by about two-fifths if all programs were cut by the same percentage. Balancing the budget without cutting Social Security, Medicare, and defense would require eliminating essentially the rest of government under both plans.

- If spending were reduced enough to pay for the tax cuts but not to balance the budget — and Social Security, Medicare, and defense were not cut — all other programs would need to be cut by 45 percent under the Cruz plan and by 53 percent under Trump’s.

As dramatic as these figures are, they understate the pressure that the two candidates’ proposals would place on many government programs. Both have proposed large spending increases in certain areas, including Senator Cruz’s proposal to increase defense spending by $2.7 trillion over the next decade and Mr. Trump’s proposal to increase spending on veterans by $500 billion to $1 trillion over this period. Offsetting the cost of such increases, as well as the tax cuts, would require even deeper cuts to other programs.

Such large tax cuts, of course, would also put pressure on the nation’s fiscal situation, which already appears unsustainable over the long term. Under its current path, the budget deficit is expected to rise from 2.9 percent of GDP in 2016 to 4.8 percent in 2026, and the debt is expected to rise from 75 percent to 85 percent of GDP. If the tax cuts are not offset at all, under both plans the annual budget deficit would rise to about 10 percent of GDP in 2026.[4] The debt would jump to 121 percent of GDP in 2026 under Cruz and 124 percent under Trump. Quite simply, failing to pay for tax cuts of this magnitude would be fiscally and economically irresponsible.

Claims that tax cuts can boost economic growth sufficiently to pay for themselves lack foundation, as discussed in the Appendix. The Appendix also discusses other available estimates of the costs of the tax cuts. TPC’s estimate of the costs of the Trump tax cuts is lower than the other available estimates, while its estimate of the costs of the Cruz tax cuts is in the middle of available estimates.

In all likelihood, most Americans would lose on balance from the combination of the proposed tax cuts and the spending cuts needed to pay for them. The Trump and Cruz tax cuts are heavily tilted to the top: TPC estimates that in 2026 the most affluent 1 percent of taxpayers would receive about two-fifths of the benefits from the Trump tax plan and half of the benefits from the Cruz plan, while the middle 20 percent of taxpayers would receive just 11 percent and 6 percent of the benefits, respectively. In short, dramatic reductions to much of government — which would have sweeping, adverse implications for most low- and middle-income Americans — would occur to offset tax cuts that primarily benefit the wealthiest among us.

In 2026, revenues would amount to 14.1 percent of GDP under the Trump plan and 14.7 percent under the Cruz plan — far below projected revenues of 18.2 percent under current law and even further below projected spending that year of 23.1 percent of GDP. In 2026, revenues would be $1.1 trillion lower than under current law under the Trump plan and close to $1 trillion lower under the Cruz plan.

Under both plans, revenues would drop to a much smaller share of the economy than has typified the post-World War II era. Going forward, moreover, revenues will need to exceed their historical levels to help pay for the rise in government costs as the baby-boom generation retires.

Under the Trump plan, revenues as a percent of GDP would fall to their lowest level since 1950. As noted, in 1950 Medicare had not yet been created and Social Security spending amounted to just 0.3 percent of GDP. Medicare and Social Security spending now totals 8.1 percent of GDP and is projected to rise to 9.7 percent of GDP in 2026. In other words, the enhanced national commitment to assisting the elderly necessitates a much larger revenue base than existed more than six decades ago.

Under the Cruz plan, revenues would fall to their third-lowest percent of GDP since 1950 — only a tick higher than in 2009 and 2010, when revenues plummeted to 14.6 percent of GDP largely due to the Great Recession.

The budget that the House Budget Committee adopted March 16 illustrates the potential nature and magnitude of the cuts needed under the Trump and Cruz tax plans. The Committee’s plan, which the full House could vote on in April, would balance the budget over the next decade through $6 trillion of cuts to non-defense programs. The plan would be revenue neutral; that is, its net effect would be to neither cut nor raise taxes. The plan’s basic structure — it includes no cuts in defense, essentially no cuts to Social Security, and moderate cuts to Medicare — is virtually the same as other congressional Republican budgets of recent years.

Our analysis[5] found that 62 percent of the plan’s spending cuts would come from programs targeted for low- and moderate-income Americans; those programs would be cut by $3.7 trillion over ten years. By 2026, more than two of every five dollars (42 percent) now projected to go to these programs would be withdrawn. If implemented, the budget would eliminate health coverage for more than 20 million people and drive millions of people into, or deeper into, poverty. In addition, due to the plan’s deep reductions in non-defense discretionary programs — which would be cut about $1 trillion below the sequestration levels over the coming decade — investments in scientific and medical research, education, infrastructure, law enforcement, environmental protection, and other national priorities could be cut sharply.

While the House GOP plan calls for $6 trillion in spending cuts over ten years, TPC estimates that the Trump and Cruz plans cut taxes by $9.5 trillion and $8.7 trillion over ten years, respectively. As noted, the calculations in this paper use slightly lower figures — $9.2 trillion for Trump and $8.5 trillion for Cruz — that reflect more recent Congressional Budget Office (CBO) economic projections.[6] Thus, as Table 1 shows:

- Paying for the tax cuts in the Trump and Cruz plans (without balancing the budget) would require spending cuts much deeper than what the House GOP budget plan would require.

- To also balance the budget under the Trump and Cruz plans would require spending cuts of roughly two and one-half times the size of those in the House GOP budget plan.

| TABLE 1 |

|---|

| Offsetting Candidate Tax Plans Would Require Much Larger Spending Cuts than in GOP Budget Plan |

|---|

| |

Spending cuts required to offset tax cuts |

Approximate spending cuts required to offset tax cuts and balance the budget |

|---|

| Under the Trump plan |

| Dollar amount, 2017-2016 |

$9.2 trillion |

$15.2 trillion |

| Size compared to House GOP spending cuts of $6 trillion |

1.5x |

2.5x |

| Under the Cruz plan |

| Dollar amount, 2017-2016 |

$8.5 trillion |

$14.5 trillion |

| Size compared to House GOP spending cuts of $6 trillion |

1.4x |

2.4x |

The Trump and Cruz campaigns provide little information about how they would cut programs to pay for their tax cuts,[7] let alone to balance the budget. So, to further illustrate their potential impact, this analysis examines two hypothetical approaches to reducing spending: one in which all spending programs are cut by the same percentage and one in which combined spending on defense, Social Security and Medicare is not reduced, requiring deeper cuts in other programs. The second scenario reflects the fact that both candidates have proposed to increase defense spending and neither they nor congressional Republican budget plans have expressed an appetite for deep cuts over the coming decade in the two key programs assisting the elderly.

To pay for the tax cuts themselves:

- If all government programs were cut by the same percentage, offsetting the cost of the tax cuts in 2026 would require cutting all programs by 17 percent under the Cruz plan and 20 percent under the Trump plan.

- If spending on defense, Social Security, and Medicare remained unchanged, offsetting the cost of the tax cuts in 2026 would require cutting all other programs by 45 percent under the Cruz plan and 53 percent under the Trump plan.

Cruz and Trump both support balancing the budget.[8] To accomplish that goal, spending cuts would need both to eliminate currently projected deficits and to offset the tax cuts’ costs. If the budget were balanced in 2026, interest payments would amount to about 2.1 percent of GDP that year. With revenues of 14.1 percent of GDP under the Trump plan and 14.7 percent under the Cruz plan, that leaves 12.0 percent of GDP under the Trump plan — and 12.6 percent of GDP under the Cruz plan — available for all federal programs and activities outside of interest payments. To achieve budget balance:

- Federal spending (exclusive of interest payments) as a percent of GDP would have to fall to its lowest level since 1948 under the Trump plan and its lowest level since 1951 under the Cruz plan.

- If all government programs were cut by the same percentage, budget balance would require cutting all programs by 37 percent under the Cruz plan in 2026 and by 40 percent under the Trump plan. Among other things, this means that about two of every five dollars in basic Social Security benefits would be withdrawn.

- Spending on Social Security, Medicare, and defense is currently projected to equal 12.2 percent of GDP in 2026. This is slightly more than the revenues available for all federal spending under the Trump plan (12 percent of GDP) and just slightly less than the revenues available for all federal spending under the Cruz plan (12.6 percent of GDP). Thus if Social Security, Medicare, and defense spending were unchanged, all other programs would essentially need to be eliminated entirely to achieve budget balance.[9]

Other spending-reduction scenarios are possible, of course. But under any scenario, balancing the budget over the next decade while enacting the proposed tax cuts would entail hollowing out government in an unprecedented and potentially disastrous manner. The essential role that Social Security and Medicare play for tens of millions of Americans could be compromised. Spending on infrastructure, education, the judicial system and domestic security, scientific research, and basic food, housing, and health assistance to the poor could all be eviscerated. Such changes could fundamentally alter the nature of middle-class life and retirement security while also increasing poverty.

Proposals to Expand Certain Programs Would Increase Pressure on Others

Furthermore, Cruz and Trump have also proposed some significant program expansions. Both, for instance, have said they would increase spending on the military, [10] with Senator Cruz laying out the more specific plan.

Cruz has proposed raising defense spending substantially and then stabilizing it at 4 percent of GDP. This would increase defense spending by $2.7 trillion over the next decade, according to CBPP calculations. Offsetting both these defense increases and Cruz’s $8.5 trillion tax cut would require $11.2 trillion in spending reductions between now and 2026, and thus necessitate even sharper cuts in domestic programs than described above.

While Mr. Trump has not made explicit how much he would raise defense spending, he has proposed a fairly specific plan to expand assistance to veterans. The Committee for a Responsible Federal Budget estimates the plan would cost $500 billion to $1 trillion over a decade.[11] This proposal would similarly necessitate larger reductions in other programs than those described above.

If such expansions — or increases in areas such as infrastructure, which Mr. Trump has discussed[12] — were enacted in addition to their tax-cut proposals, the squeeze on other programs would become even more intense.

Low- and Middle-Income Households Likely Net Losers From Tax and Budget Changes

In 2025, the latest year for which TPC analyzed the distribution of benefits of the Trump and Cruz tax cuts:

- The highest-income 1 percent of households (those with incomes exceeding $847,000) would receive about two-fifths of the tax cuts under the Trump plan and half of the tax cuts under the Cruz plan. They would gain an average of $330,000 each under the Trump plan and $397,000 apiece under the Cruz plan, on average. (These figures are adjusted for projected inflation and expressed in 2016 dollars.) The tax cuts would increase their after-tax incomes by 18 percent and 21 percent, respectively.

- The middle 20 percent of households would receive 6 percent of the tax cuts under the Cruz plan and 11 percent of the tax cuts under the Trump plan, gaining $1,150 or $2,900 on average. Even before considering the effects of the benefit reductions that would result from program cuts to offset the cost of the tax cuts, their percentage gains in after-tax income would be far smaller than such gains among high-income taxpayers.

- The bottom 20 percent of households would gain little from the Trump tax cuts and even less from the Cruz tax cuts. Their average after-tax income would rise by 1.1 percent ($170) under the Trump plan and by 0.3 percent ($45) under Cruz’s, before the effects on the needed budget cuts were taken into account.

Because dramatic cuts to programs assisting low- and middle-income Americans would be needed to offset tax cuts that will be heavily tilted to the top, most Americans likely would lose on balance.[13]

This analysis assumes that, in enacting the Trump or Cruz tax cuts, policymakers would cut spending sufficiently to pay for them (and possibly also to balance the budget). It is possible that policymakers would enact the tax cuts without significant offsetting spending reductions, potentially turning the nation’s serious long-term deficit problem into a long-term deficit nightmare.

Revenues at 1950 levels as a share of the economy are simply too low. Such a revenue base would necessitate some combination of exploding deficits and extraordinarily severe cuts to programs vital to low- and middle-income Americans. Both candidates should provide specifics on how they would address this conundrum. Describing the benefits of their tax cuts without explaining whether or how to pay for them provides a highly incomplete — and hence misleading — picture of their true effects.

Appendix: Revenue Loss Estimates and Dynamic Scoring

This analysis relies almost exclusively on revenue and distribution estimates from TPC, as CBPP frequently does in our reports on federal tax policies. Citizens for Tax Justice and the Tax Foundation have also released estimates of the revenue losses the Trump and Cruz plans would generate. (A separate Citizens for Tax Justice report takes an alternative approach to assessing the net impact of the tax cut proposals, accounting for the necessary offsets; see footnote 13.)

TPC’s estimate of the cost of the Trump plan is lower than the estimates from Citizens for Tax Justice and the Tax Foundation. Using the TPC estimate for this analysis thus suggests smaller offsetting spending reductions than if we had used the other estimates. Citizens for Tax Justice estimates the Trump plan would reduce revenues by $12 trillion over ten years; the corresponding Tax Foundation estimate is also $12 trillion. TPC estimates the revenue loss at $9.5 trillion, which we adjusted modestly downwards to $9.2 trillion for this analysis to take new GDP estimates from CBO into account.

TPC’s estimate of the cost of the Cruz plan is between the estimates from the other two organizations. TPC estimates that the Cruz plan would reduce revenues by $8.7 trillion over ten years (which we adjust to $8.5 trillion), compared to a Citizens for Tax Justice estimate of $13.9 trillion[14] and a corresponding Tax Foundation estimate of $3.7 trillion. The largest difference between the TPC and Tax Foundation figures, TPC notes, is that the Tax Foundation estimates that Cruz’s new consumption tax would raise $6.2 trillion more over the decade than TPC does.

Dynamic Scores Should Be Treated With Skepticism and Caution

TPC and Citizens for Tax Justice do not estimate the plans’ potential impact on economic growth and thus on tax revenues. Considering such changes is now commonly referred to as “dynamic scoring.” The Tax Foundation, in contrast, produces both estimates that don’t take macroeconomic effects into account (which are those discussed above) and dynamic estimates that attempt to take such effects into account. Its dynamic score of the Trump plan still finds greater revenue losses than those found by TPC, while its dynamic score of the Cruz plan produces the highly implausible result that the increased growth stimulated by the plan would reduce the tax cuts’ cost by nearly 80 percent.[15]

TPC’s analyses of the Cruz and Trump plans include discussions of assessing the macroeconomic impact of the tax cuts, which suggest that estimates showing very large positive effects are off-base. As TPC explains, a wide range of studies find that tax reforms in this country, as well as changes in the marginal tax rates faced by high-income people in a range of other countries, have little effect on economic growth:[16]

- “Examination of particular historical examples of tax reform — including shifts between the pre– and post–World War II periods, and the tax changes that occurred in 1981, 1986, 2001, and 2003 — suggests that taxes have little impact on growth.”

- “Cross-country comparisons of changes in output and changes in top marginal tax rates suggest that taxes have little or no impact on growth.”

A second reason to exercise caution in using dynamic scores of tax cuts is that there is no settled methodology for doing so. As a 2014 CBPP report observed, different modeling approaches based on different assumptions can produce widely varying economic growth effects. In some cases, one set of assumptions can yield estimates that economic growth will fall while another set of assumptions can yield estimates that growth will rise.[17]

A third reason for hesitation is that modeling macroeconomic effects is particularly difficult to undertake when critical details concerning any policies to offset the cost of the tax cuts — which themselves could have economic effects — are lacking. Such is the case with the Trump and Cruz plans.

In short, suggestions that tax cuts will substantially or completely “pay for themselves” by generating a far larger economy should be treated with deep skepticism. They are a risky basis on which to make major fiscal policy decisions.