BEYOND THE NUMBERS

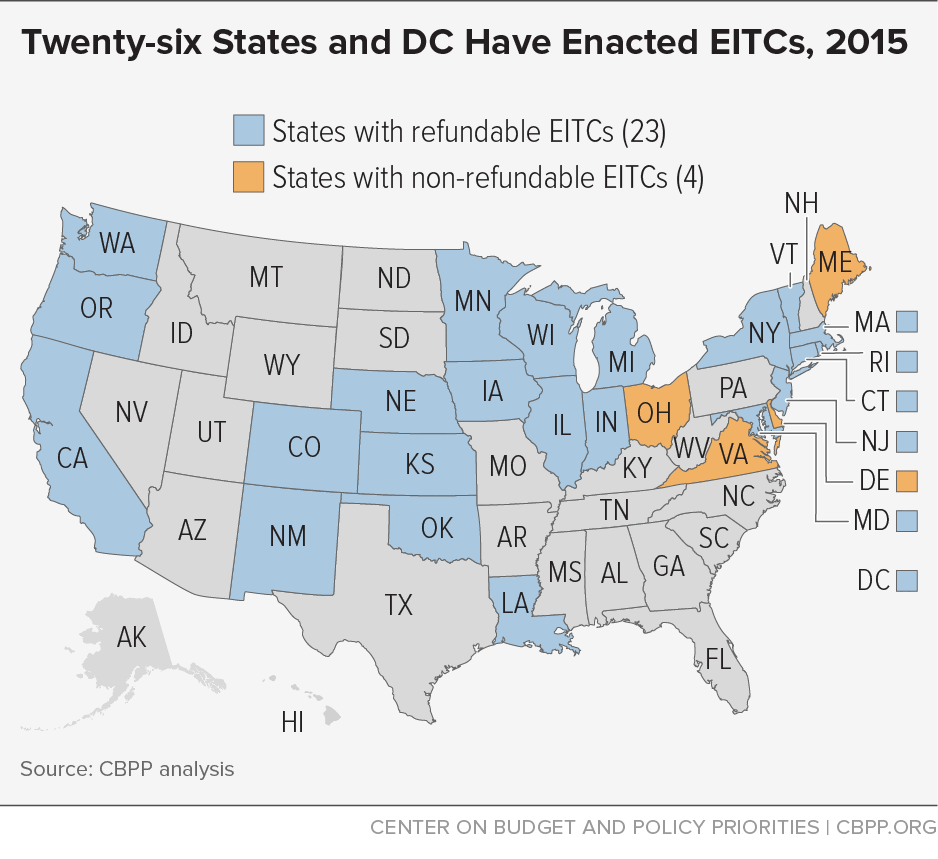

California just became the 26th state (and 27th jurisdiction, counting the District of Columbia) to adopt a state Earned Income Tax Credit (EITC). Governor Jerry Brown signed the state’s 2016 budget yesterday, thereby enacting a credit that will provide $380 million to up to 2 million very poor Californians in over 800,000 working households.

As our previous post explained, the credit will help workers earning up to $6,580 for individuals without dependents and $13,870 for married-couple families with three or more children. It will average $460 per recipient household, but some working families can get up to $2,600 to help them meet basic needs in one of the nation's most expensive states.

California’s new EITC will build on the federal credit to help families provide for their children, ease poverty and hardship, and brighten the outlook for kids who are otherwise getting a rough start in life. The 24 states without EITCs should follow suit and take advantage of one of the nation’s most effective tools for boosting working families.