BEYOND THE NUMBERS

California could soon join the growing number of states with state earned income tax credits (EITCs). Governor Jerry Brown proposed one in his revised budget that he released yesterday, and California lawmakers have introduced several other EITC proposals this year to help ensure that low-paid working families benefit more fully from the economic recovery.

State EITCs leverage the federal EITC to help working families make ends meet, reduce hardship, and put kids in struggling families on a better path. Governor Brown’s plan would build on the federal credit for the state’s poorest working families, providing $380 million in tax year 2015 to some 825,000 households with 2 million Californians. The credit would average $460 per recipient household, but some working families would get up to $2,600 to help them afford the basics in one of the nation’s most expensive states.

The credit would help workers earning up to $6,580 for individuals without dependents and $13,870 for married-couple families with three or more children.

Other proposals before lawmakers would extend much higher up the income spectrum, as is more typical of state EITCs. A proposal from Assembly Member Mark Stone, for example, would reach the 3 million working households now eligible for the federal EITC and provide a collective income boost of about $1.5 billion.

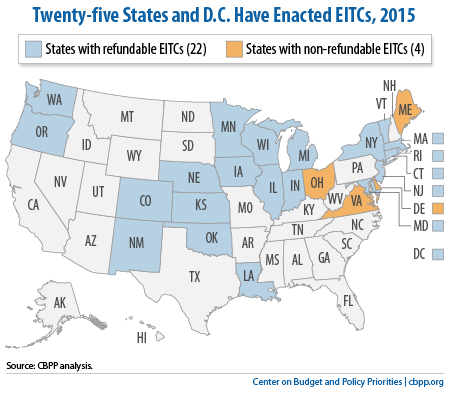

Regardless of which option wins out in coming budget negotiations, California looks poised to become the 26th state (and 27th jurisdiction, counting the District of Columbia) to give low-paid working families a much-needed income boost with a state EITC.