BEYOND THE NUMBERS

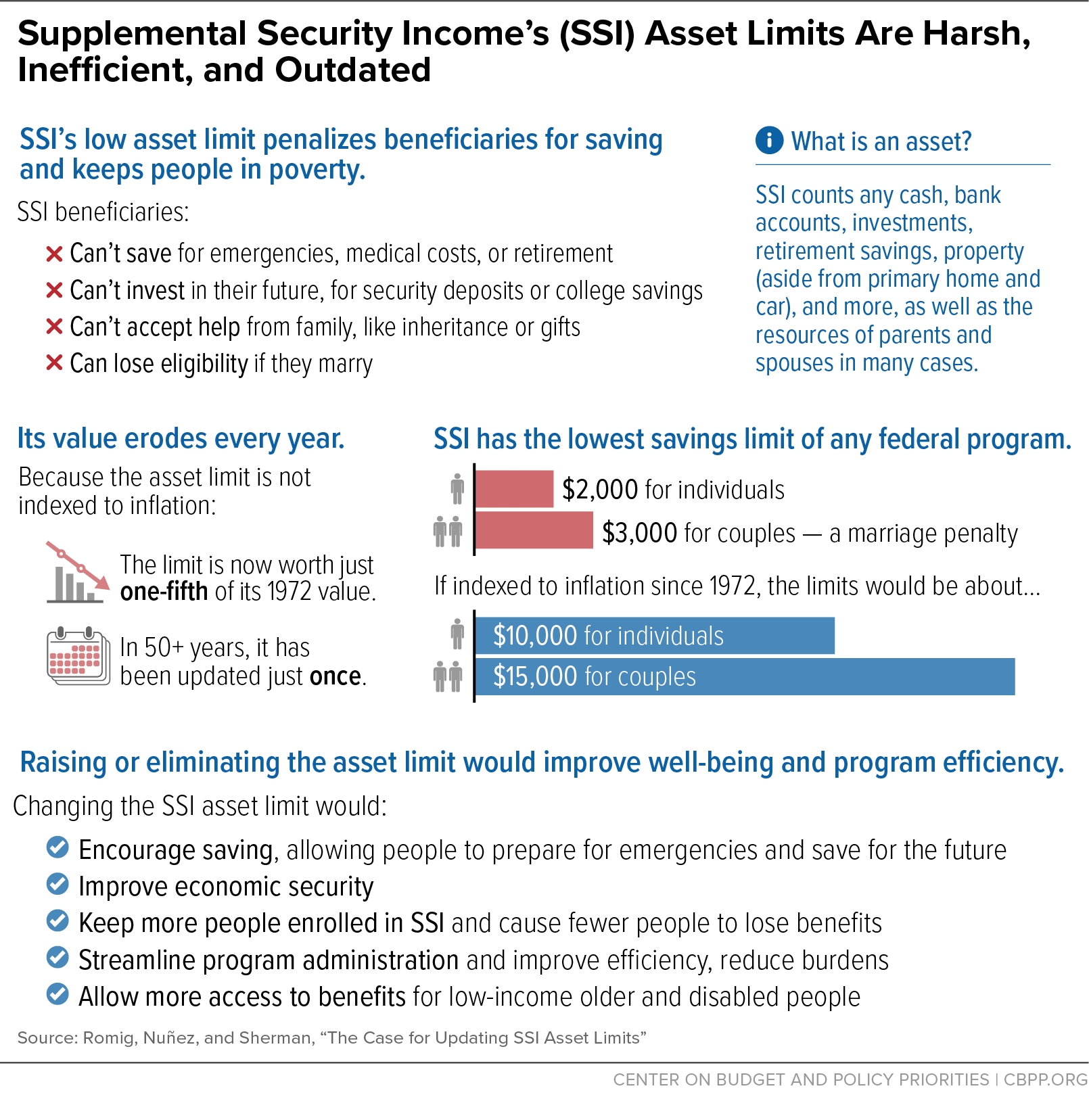

A newly reintroduced bill would provide relief for low-income older and disabled beneficiaries of Supplemental Security Income (SSI), who face the strictest savings limits of any federal program. At no more than $2,000 for individuals (and $3,000 for couples, essentially a marriage penalty), those asset limits aren’t enough to weather an emergency, let alone provide stability or save for the future.

The bipartisan bill, from Sens. Sherrod Brown and Bill Cassidy and Reps. Brian Higgins and Brian Fitzpatrick, would raise the limits to $10,000 for individuals and $20,000 for couples, improving beneficiaries’ well-being. The bill would also improve program administration, reducing churn and strain on an underfunded Social Security Administration (SSA).

Because the current limits aren’t indexed to inflation and have been updated only once in over 50 years, their value erodes each year. They now stand at only one-fifth of their 1972 value. (See infographic.)

Over the last four decades, we’ve learned a lot about the value of savings — especially for people living with a disability. People with little to no savings are more likely to have subprime credit scores, struggle to pay bills, and have lower financial well-being. What’s more, living with a disability — as at least 85 percent of SSI beneficiaries do — imposes additional costs that are often high and require savings to cover, such as customized wheelchairs, home and automobile modifications, and other medical equipment not covered by Medicaid.

Higher asset limits would encourage saving instead of penalizing it, and would allow people to retain savings to use when they really need those resources. More very low-income older people and people with disabilities could get the income support they need to afford the basics and not be forced to first deplete modest savings, or face harsh penalties for going just over the limits. Beneficiaries who exceed the limit typically rack up thousands of dollars in overpayments that are extremely difficult to repay from their meager benefits.

Research shows that having a financial cushion leads to greater economic security. Policymakers have recognized the case for allowing greater savings and have increased or eliminated resource limits in other economic security programs, including the Supplemental Nutrition Assistance Program (SNAP) and Medicaid.

Raising the asset limits would also simplify program administration and reduce churn. The limits are the leading cause of erroneous payments. And they lead to churn because beneficiaries who go even slightly over the outdated limit are suspended and then terminated. More than 100,000 SSI beneficiaries exceed the program’s low limits each year.

SSA staff must administer these complex and inefficient rules amid a customer service crisis due to underfunding.

Raising SSI’s asset limits also would not dramatically increase program costs or participation. SSA’s actuaries have estimated that increasing the limits to $10,000 for individuals and $20,000 for couples — as the bill would do — would increase SSI costs by about $8 billion over ten years, or about 1 percent of program costs over that period.

We estimate that SSI participation would increase less than 3 percent. The change would have modest impacts on costs and participation because few older or disabled people who meet SSI’s very low-income criteria have much in savings.

Policymakers could and should go much further, even eliminating the asset limits altogether, all without dramatically increasing costs or participation. Raising or indeed eliminating SSI’s asset limits would improve beneficiaries’ well-being and the program’s efficiency, at a modest cost. Policymakers should make this long overdue change to this important program, and the reintroduced bill is a good first step.