BEYOND THE NUMBERS

As the New York Times writes today, President-elect Trump argues that the federal government can raise the wages of low-income workers by cutting taxes for the wealthy and corporations, spending more on infrastructure, and renegotiating trade deals. “But another, more direct, approach is possible, one aimed at turbocharging the wages of people who have lost out on the economic gains of the last few decades,” the Times’ Neil Irwin explains at the “Upshot” blog. “That could be done by expanding a tax credit that is already in place and enjoys bipartisan support” — namely, the Earned Income Tax Credit (EITC).

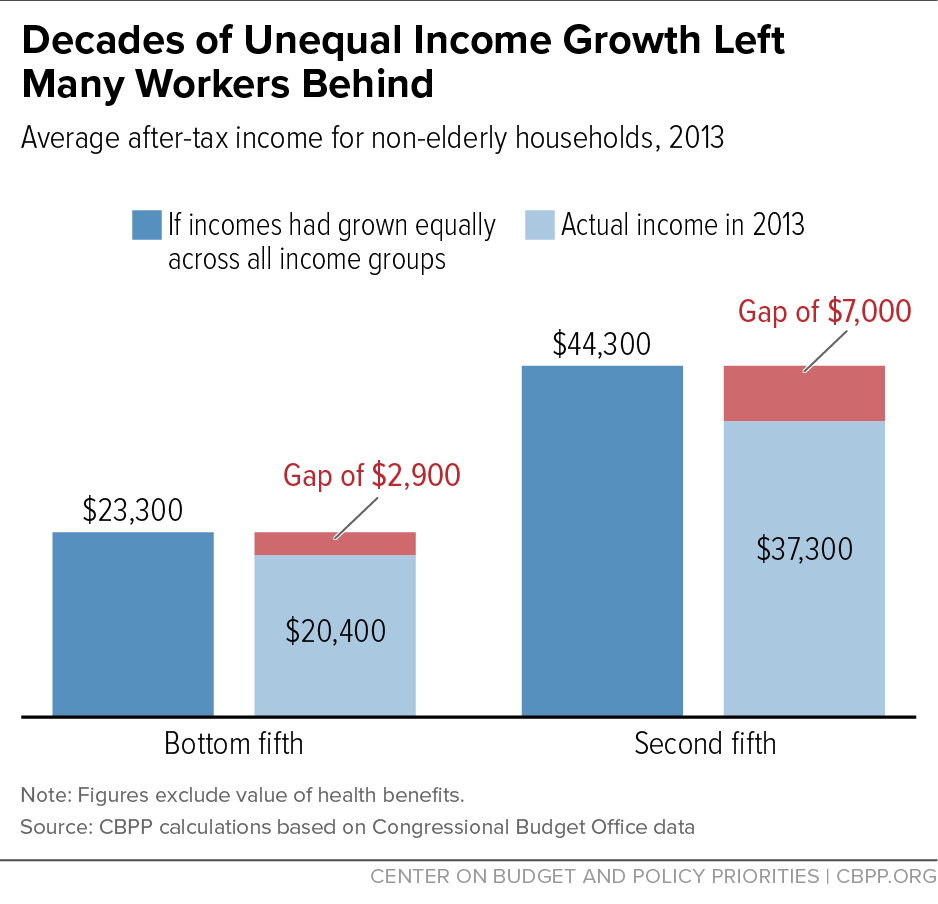

Irwin highlights an EITC expansion that CBPP developed to eliminate the $2,900 gap between the actual income of households in the bottom fifth of the income scale and what their incomes would be if they had shared equally in the income gains across society since 1979 (see graph).

The proposal would also close most of the $7,000 income gap for the next fifth of families. A family with two kids making $40,000 would receive at least $6,000 a year from an expanded EITC, up from the current maximum of $2,100.

Our proposal would cost $1 trillion over the next decade, the Tax Policy Center estimates.

But, as Irwin points out, “Mr. Trump’s campaign tax plan already implies a far greater reduction in federal revenue than this idea does” — as much as an estimated $6 trillion over ten years — and “carving out $1 trillion for workers who haven’t seen large raises in years may just pay some dividends.”

The harsh economic reality facing many workers received considerable public attention in recent months, with Mr. Trump promising to address their needs, and an expanded EITC of the kind described above surely would help him do so.