BEYOND THE NUMBERS

Children eligible for Medicaid later earn more as adults and have fewer emergency-room visits and hospitalizations, two recent studies highlighted in this month’s National Bureau of Economic Research (NBER) Digest show — and the benefits grow with each year of childhood Medicaid eligibility. The studies are the latest in a growing body of research on the long-term benefits of health coverage for health and economic well-being.

The first study finds that, due to their higher earnings, people contributed $186 more in taxes through age 28 for each additional year they were likely Medicaid-eligible as children. Their earnings gains would continue and so by age 60, the authors estimate, the higher taxes recoup 56 cents of every dollar spent on Medicaid during childhood.

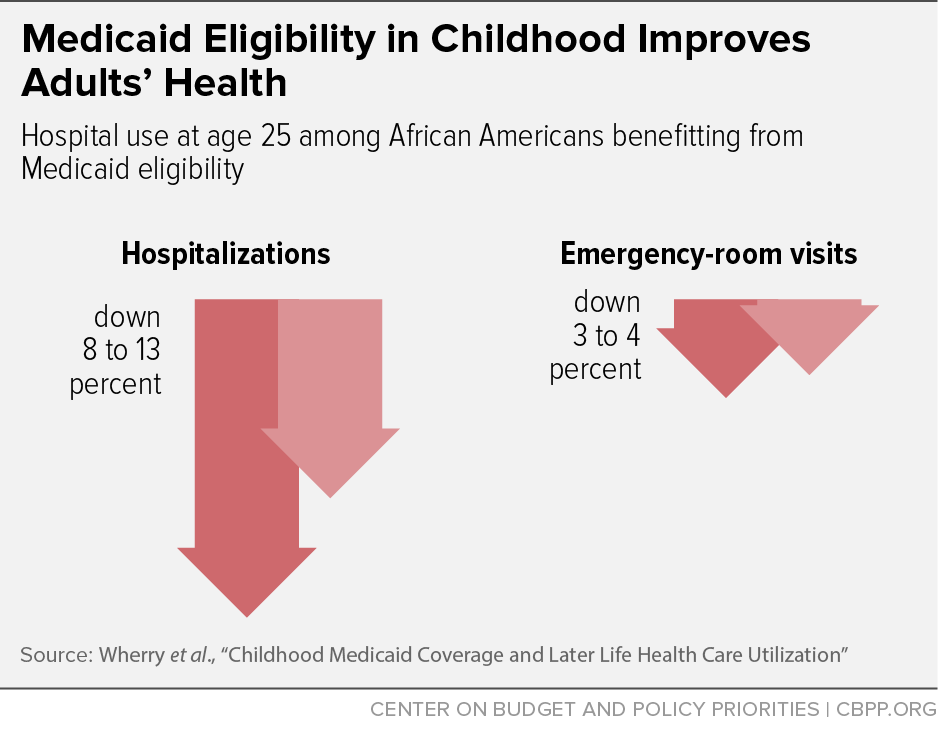

The second study finds that African Americans eligible for Medicaid for more of their childhood were hospitalized 8 to 13 percent less and visited the emergency room 3 to 4 percent less at age 25. (The analysts compared young adults born before and after a major expansion of federal Medicaid eligibility for children; the latter were Medicaid-eligible for five more years during childhood, on average.) The reductions were largest among people with chronic conditions, those living in low-income areas, and those living in states with less generous Medicaid coverage for children before the expansion.

The drop in hospitalizations and emergency-room visits generated savings of 3-5 percent of the Medicaid expansion’s cost, the authors estimate. And those savings are only for one year, when those studied were age 25; the savings would likely have been much greater if the study had evaluated more years of adulthood. Research shows that moving away from hospital and emergency-room settings to provide health care is an effective way to reduce health care costs.

Along with other recent research, the new studies suggest that we must look over longer time horizons to fully evaluate the impact of expanding health coverage. “[T]he health benefits of insurance may be cumulative and revealed only after a sustained period of insurance and regular use of medical care,” the second study notes.

More broadly, these results add to the robust evidence that safety net programs can open doors of opportunity for the people they serve. CBPP papers have highlighted the long-term benefits of programs like SNAP, the Earned Income Tax Credit and Child Tax Credit, and Pell Grants.